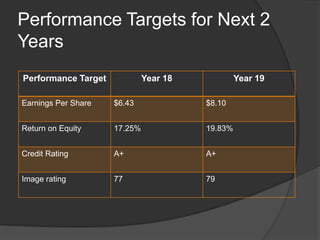

The document outlines the strategies and performance of "The A Team" shoe company. It discusses their strategic vision of being a low-cost industry leader to provide reasonably priced quality shoes. It also summarizes their targets for the next two years which include evolving their branded and private label competitive strategies through various measures like pricing, production capacity, and advertising. The document also discusses their production, workforce, and finance strategies and closest competitors in branded and private label footwear. It concludes with lessons learned like spending money to achieve higher profits and focusing on closest competitors.