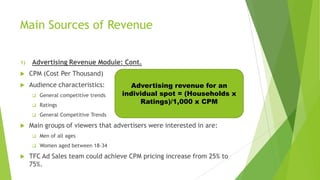

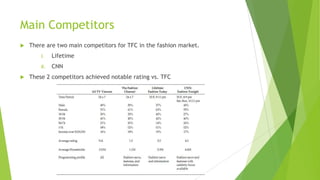

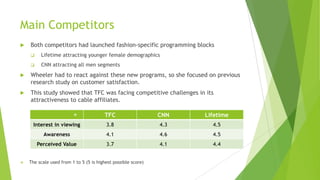

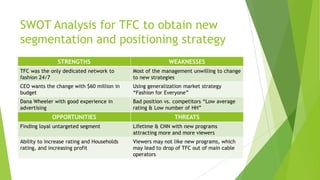

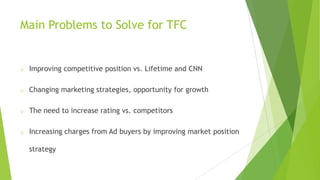

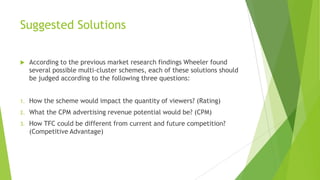

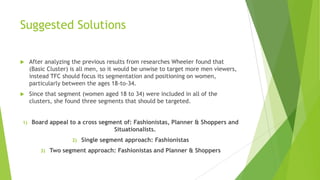

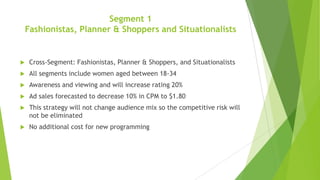

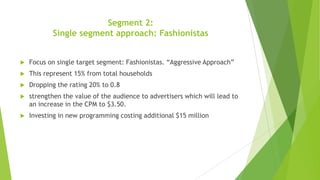

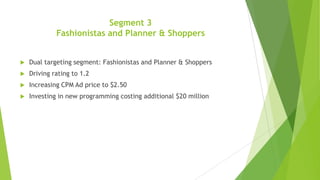

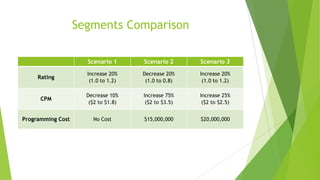

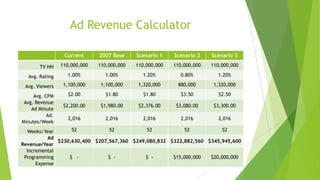

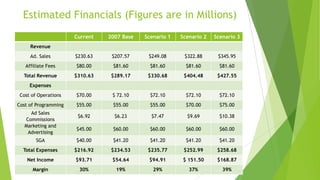

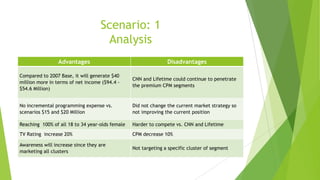

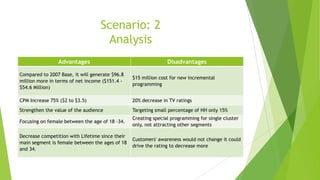

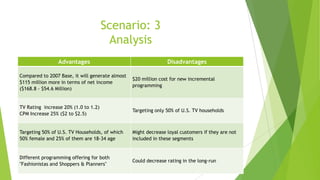

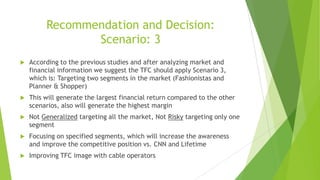

Dana Wheeler is preparing recommendations for The Fashion Channel's new segmentation and positioning strategy to strengthen its competitive position against main rivals Lifetime and CNN. Three scenarios are suggested: 1) Targeting multiple segments including Fashionistas, Planners & Shoppers and Situationalists with a 20% rating increase but 10% CPM decrease. 2) Targeting just Fashionistas with a 20% rating decrease but 75% CPM increase and $15M in new programming. 3) Targeting Fashionistas and Planners & Shoppers with a 20% rating increase and 25% CPM increase requiring $20M in new programming. Scenario 3 is estimated to generate the highest net income of $168.8M