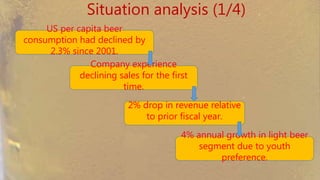

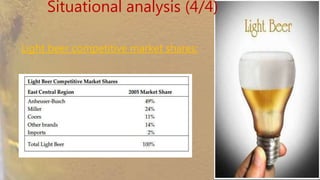

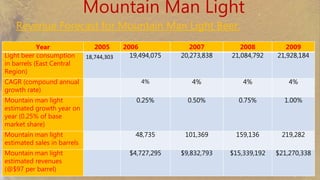

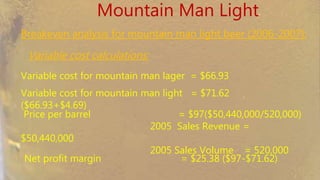

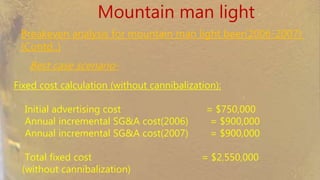

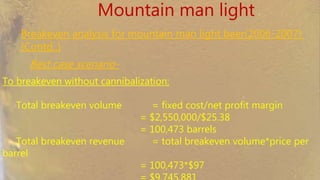

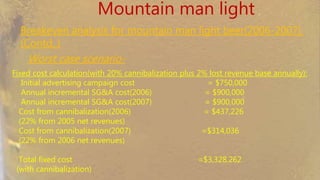

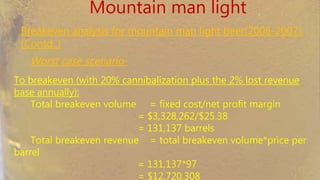

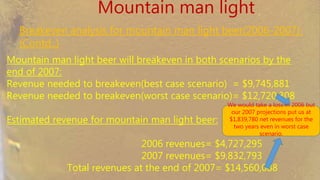

Mountain Man Brewing Company, founded in 1925 by Guntar Prangel in West Virginia, faces declining sales and seeks to tap into the growing light beer market amidst a 2% revenue drop. Chris Prangel, a recent MBA graduate, must evaluate the potential risks and benefits of launching Mountain Man Light, balancing production costs against projected revenues. Despite initial losses in 2006, the product is expected to become profitable by 2007 and enhance brand awareness.