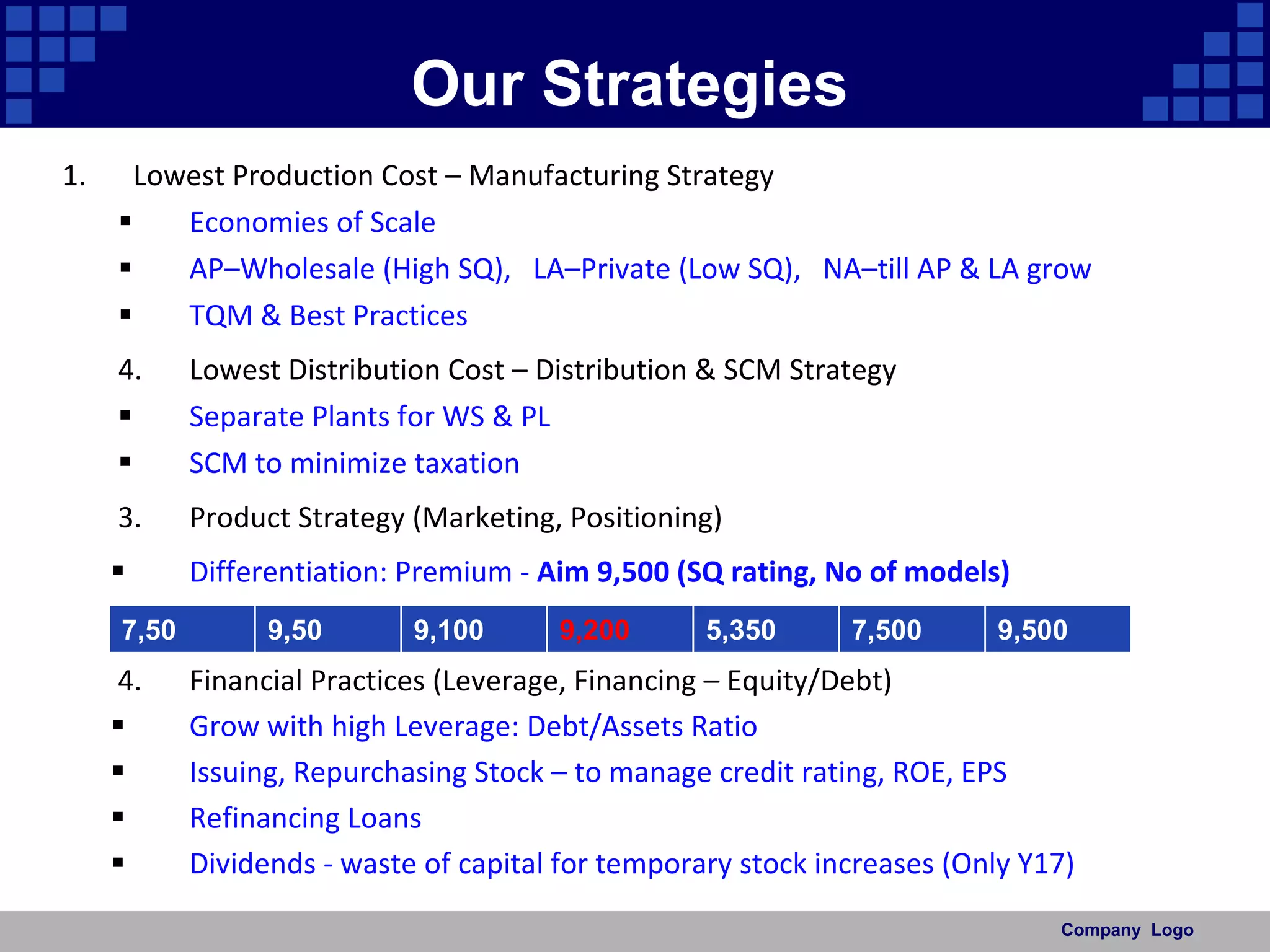

The document outlines strategies for a shoe manufacturing company to achieve the lowest production and distribution costs through economies of scale, best practices, and supply chain management. It recommends an aggressive approach of using high leverage through debt to grow quickly, corner the market through predatory pricing, and acquire excess manufacturing capacity from competitors to further lower costs and increase market share. Financially, it suggests managing equity, debt, stock purchases, and dividends to optimize returns while maintaining adequate credit ratings during the high growth phase.