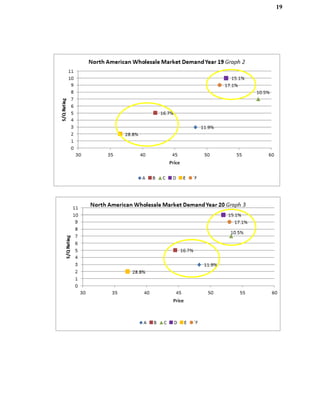

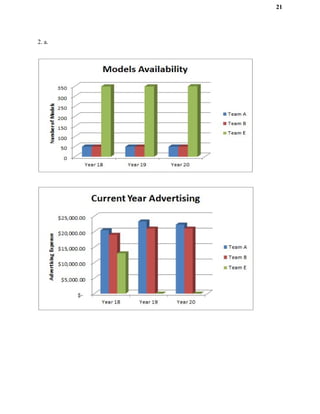

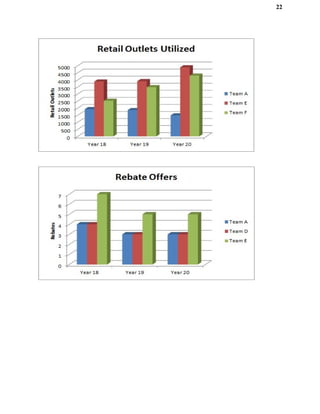

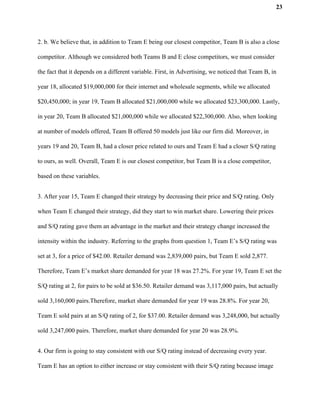

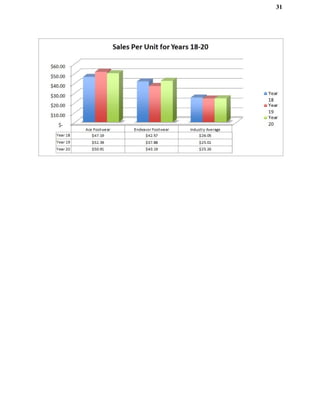

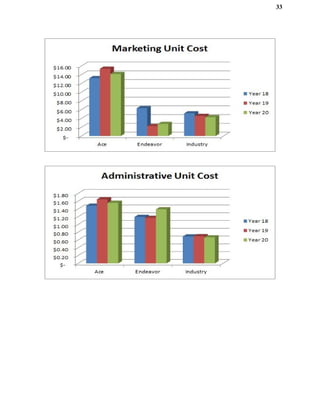

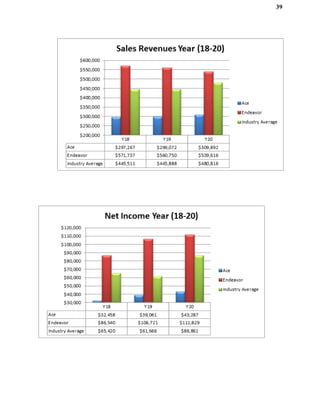

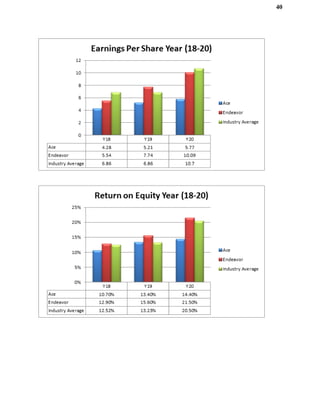

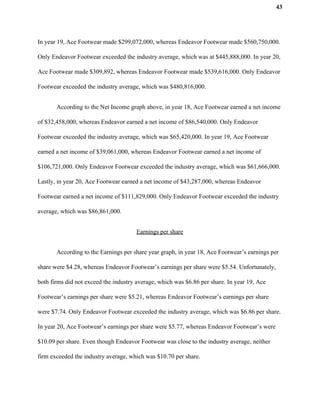

Ace Footwear is an athletic shoe company that operates globally. It aims to gain market share in multiple regions while maintaining financial goals like earnings per share and return on equity. Initially using a differentiation strategy, it later shifted to low-cost to be more competitive. Key competitive advantages include low retail price, quality rating, advertising expenditures, and delivery time. The company implements its strategy through plant upgrades, workforce training, marketing spending, and stock repurchases. It also engages in corporate social responsibility initiatives to improve its image rating. Globalization factors influence the company's production and sales decisions across different cultural markets.