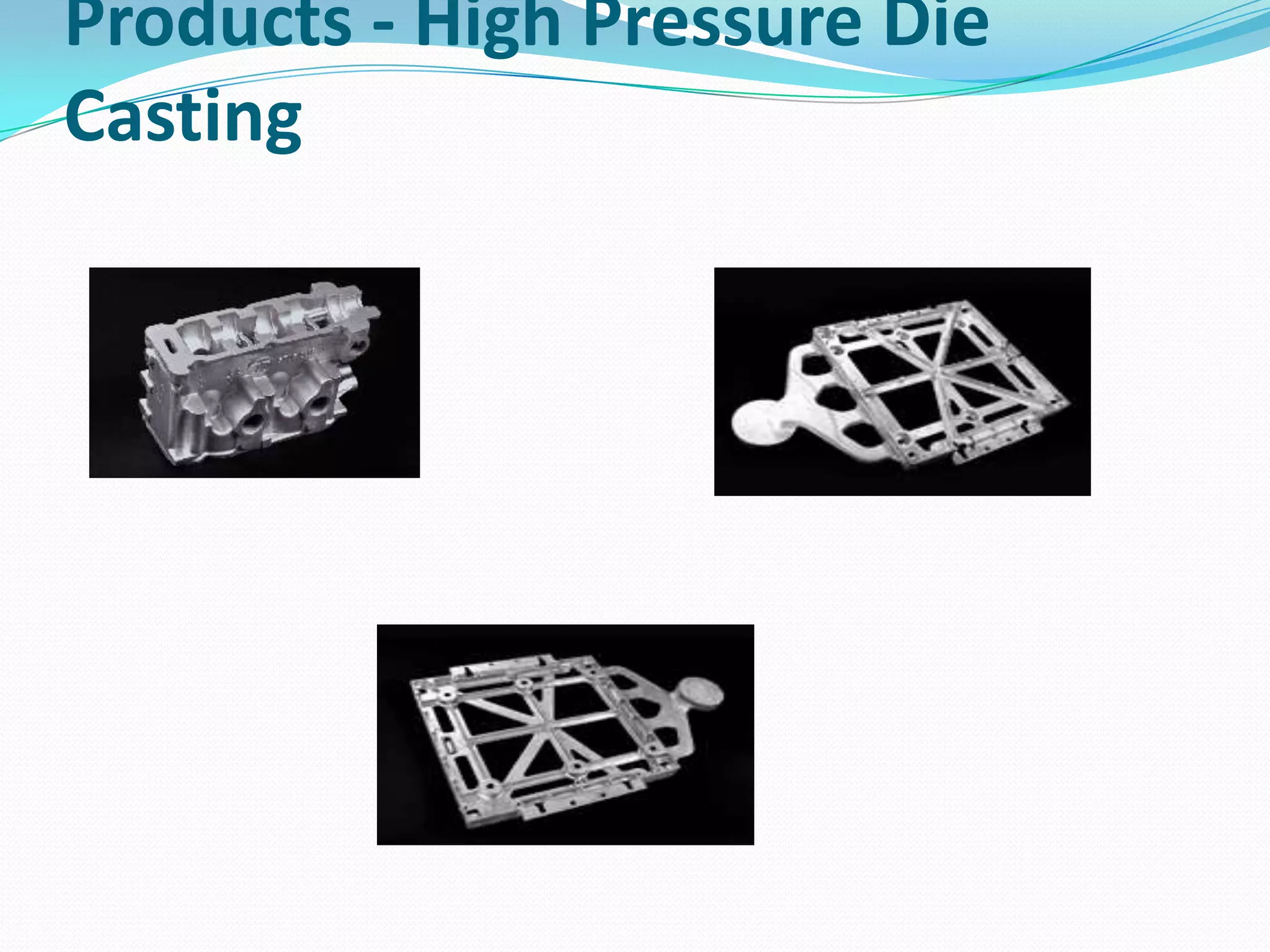

This document discusses value added tax (VAT) and provides details on composition schemes for smaller dealers under VAT. Small dealers with annual gross turnover not exceeding Rs. 50 lakh have the option to pay tax at a small percentage of gross turnover under the composition scheme. They will not be entitled to input tax credits but can pay simplified returns on a monthly or quarterly basis. The document also provides a case study of a company that manufactures high pressure die casting, low pressure die casting, sand core boxes, and ready-to-fit inserts as examples of goods subject to VAT.