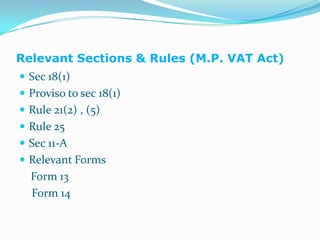

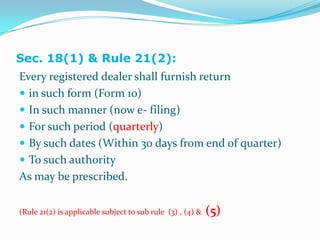

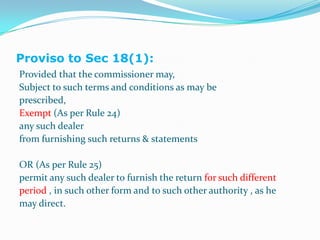

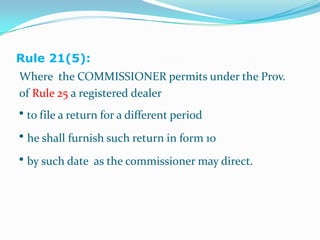

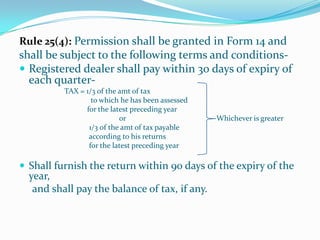

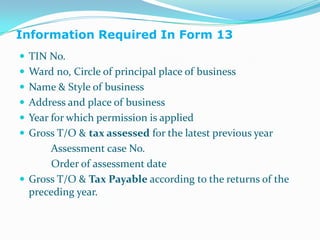

The document discusses the process for filing an annual VAT return instead of quarterly returns in Madhya Pradesh, India according to the relevant sections and rules of the M.P. VAT Act. It provides details on the application process including required forms and information, conditions for granting permission for annual filing, and payment requirements including paying 1/3 of the previous year's tax liability each quarter and paying any remaining balance after filing the annual return.

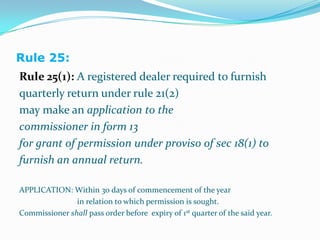

![FORM 13[See rule 25(1)]Application for grant of permission to submit annual returnTo,The Commercial Tax Officer.................................CircleI_____________________ Proprietor/Manager/Partner/Director of the businessknownas__________________________________________________________________________holding TIN ________________under the Madhya Pradesh Vat Act, 2002 whoseonly/*principal place of business within the jurisdiction of Commercial TaxOfficer______________________(circle) is situated at Municipal ward No _______town/village ____________ Tehsil ___________ District ___________ do herebyapply for permission to file an annual return under the proviso to sub-section (1) ofsection 18 of the said Act read with rule 25 of the Madhya Pradesh Vat Rules, 2006and for the said purpose I am furnishing the following particulars : (1) Particulars of business in respect of which permission is applied for ,- (i) Name and style of the business ___________________________ (ii) Address of the place of business __________________________ (iii) TIN . ________________________________________________ (2) Year for which permission is applied (From ____________ to ______________ ) (3) Gross turnover and tax assessed for the latest previous year. (i) year ___________________________ (ii) Gross turnover Rs.__________________ (iii) Tax assessed_________________ (iv) Assessment case No. _______, (v) order of assessment dated ________, (vi) passed by (Name & Designation of the officer) ___________________ (4) Gross turnover and tax payable according to the returns for the preceding year,- (i) Gross turnover Rs.______________________. (ii) Tax payable Rs.______________________ Tax paid Rs.__________________.Place..................... ..................................Date...................... Signature of the dealerI __________________________do hereby state that what is stated herein is true tothe best of my knowledge and belief.Place..................... ..................................Date...................... Signature of the dealer](https://image.slidesharecdn.com/forfilingannualvatreturn-13109883979269-phpapp01-110718062832-phpapp01/85/For-Filing-Annual-Vat-Return-10-320.jpg)

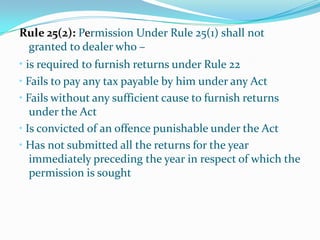

![FORM 14[See rule 25 (4)]Order permitting a dealer to furnish annual returnShri ____________who is carrying on the business known as ____________and is adealer holding TIN. _______ dated _________under the Madhya Pradesh Vat Act,2002. whose only/* principal place of business within the jurisdiction of theCommercial Tax Officer______________ is situated at__________Town/*Village______ District__________ Tehsil _______ Municipal wardNo.___________(for municipal area only) is hereby permitted under proviso tosub-section (l) of section 18 of the said Act and rule 25 of the Madhya Pradesh VatRules, 2006 to furnish an annual return in form 10 for the period from________to_________ on or before __________(date) in lieu of the quarterlyreturns under rule 21(2) of the said rules subject to the following conditions inrespect of the place(s) of business specified below:Place____________ TIN__________(l) The said dealer shall pay for the period specified in column (l) of the Scheduleappended hereto on or before the date specified in column (2) of the saidschedule the amount specified in column (3) thereof.S C H E D U L E Quarter for which tax isPayable Last date for payment of tax Amount of tax to be paid (1) (2) (3)2) For the last quarter, namely, for the period from _______to ______ thedealer shall pay as tax the difference between the amount of tax payableaccording to his annual return and the tax already paid for the first threequarters as mentioned in the above schedule.3) The dealer shall furnish along with the annual return copies of Challan inform 26 or e-Receipt in form 26 A for all the four quarters in respect ofwhich tax has been paid.264) This permission is liable to be cancelled at any time on account of anyinfringement of the conditions mentioned in sub-rule (4) of rule 25 of thesaid rules.Place______________ SignatureDate_______________ Designation*Strike out whichever is not applicable. ------------------------------------------------](https://image.slidesharecdn.com/forfilingannualvatreturn-13109883979269-phpapp01-110718062832-phpapp01/85/For-Filing-Annual-Vat-Return-11-320.jpg)