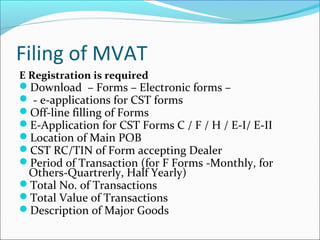

VAT (value added tax) has replaced sales tax in India, including in Maharashtra, to establish a uniform, transparent taxation system. VAT is collected from producers and sellers on the incremental value added at each stage of production and distribution. In Maharashtra, VAT is governed by the MVAT Act and applies to the sale of goods at rates from 1-20% according to schedules. Key VAT concepts include the definition of goods, dealers, importers, and sales/purchase prices. Manufacturers and businesses with over 1 lakh annual sales or 10,000 rupees of taxable purchases/sales annually must register and file VAT returns electronically monthly, quarterly, or half-yearly.