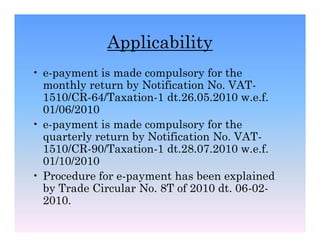

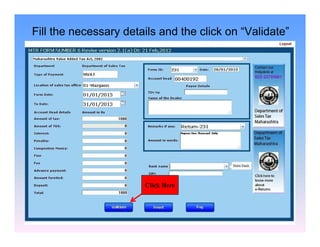

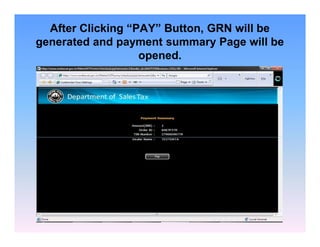

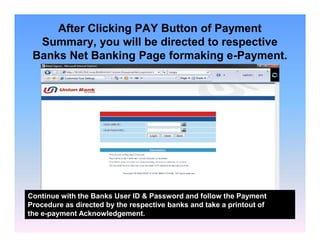

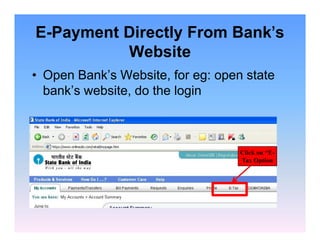

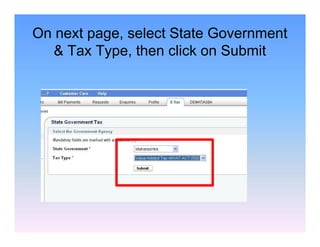

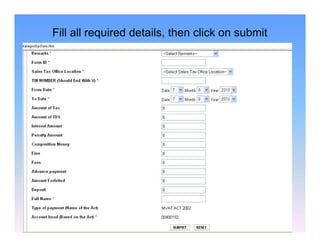

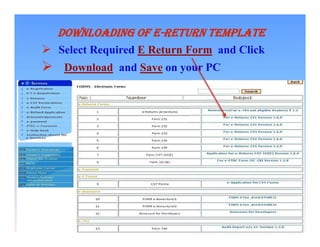

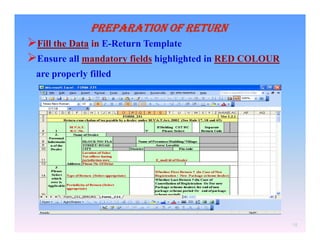

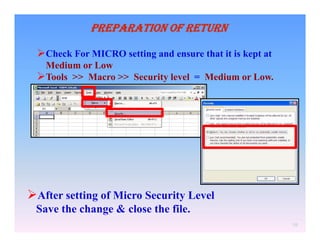

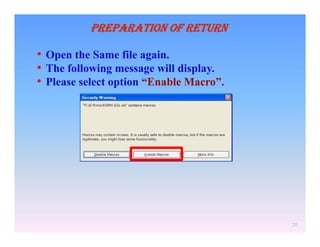

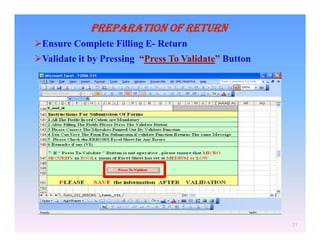

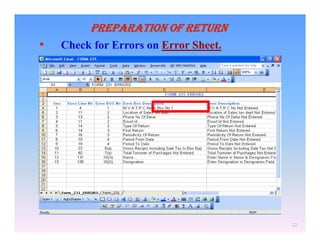

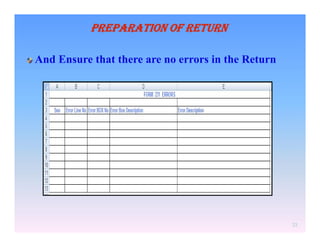

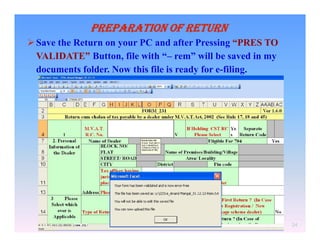

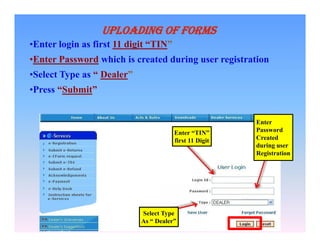

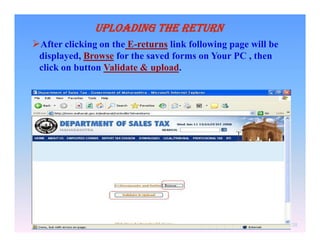

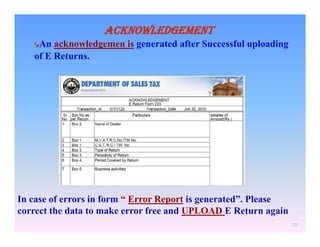

This document provides information and instructions for e-payment of VAT in India. It explains that e-payment is now mandatory for monthly and quarterly VAT returns. It outlines the procedure for e-payment through banks integrated with the MSTD website or directly from individual bank websites. Specific banks that allow direct e-payment are listed. Steps for e-filing of VAT returns through the MVAT website are also provided, including downloading and preparing the return form, uploading the completed form, and obtaining an acknowledgment.