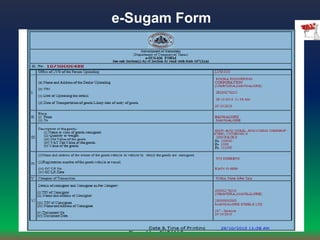

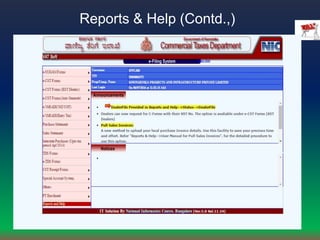

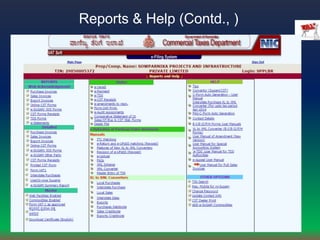

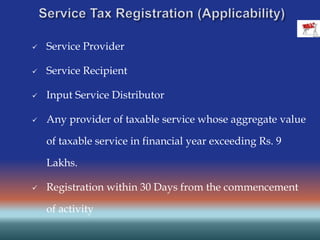

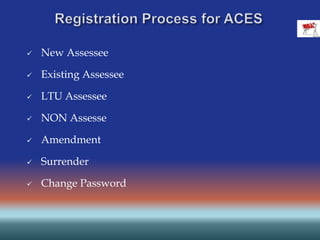

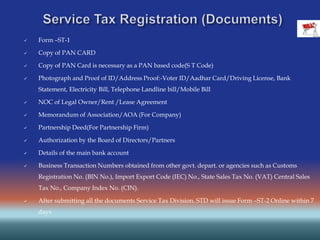

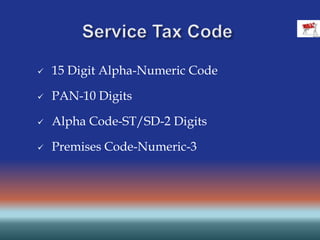

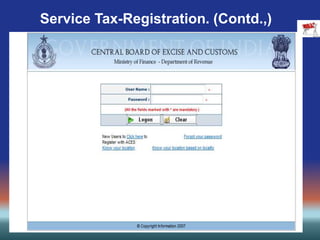

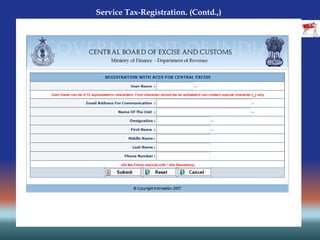

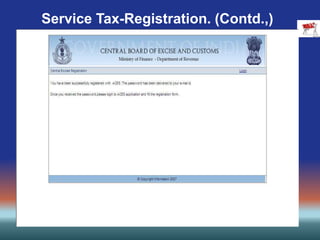

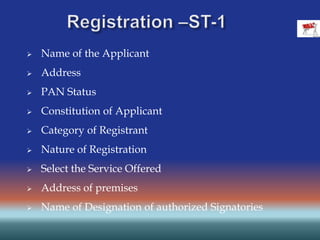

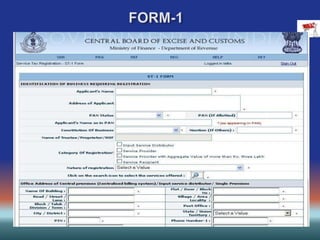

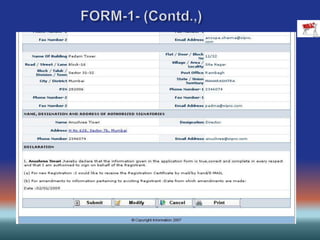

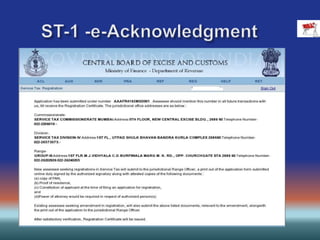

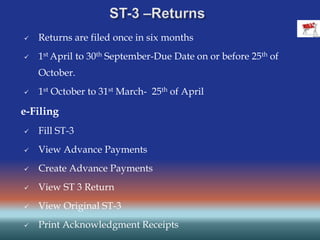

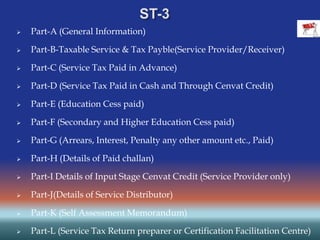

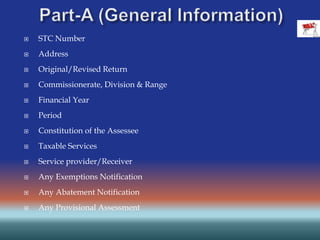

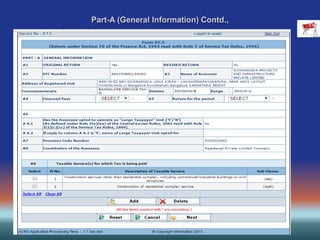

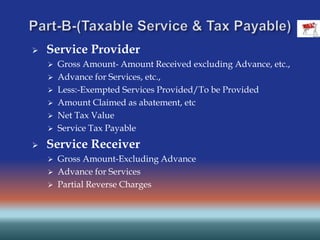

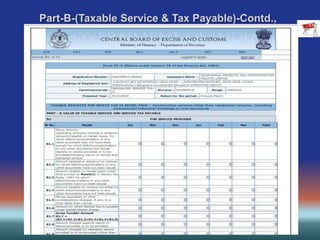

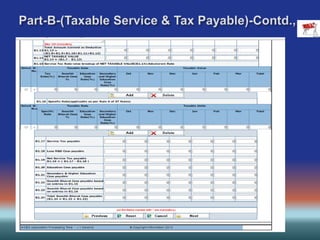

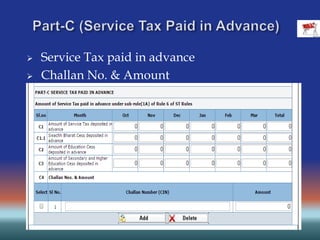

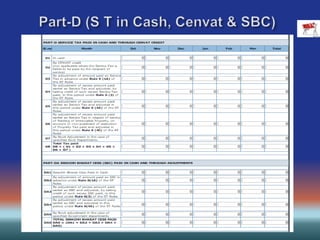

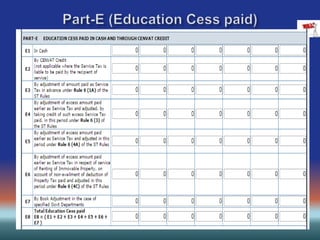

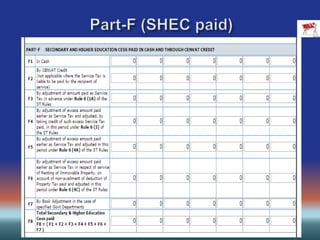

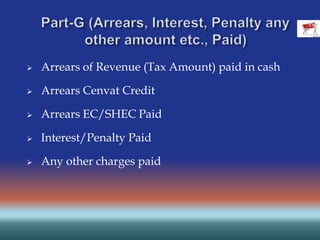

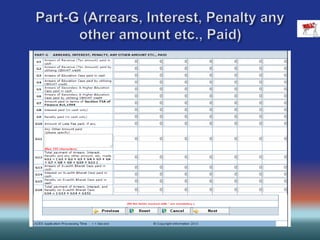

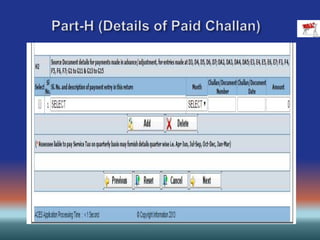

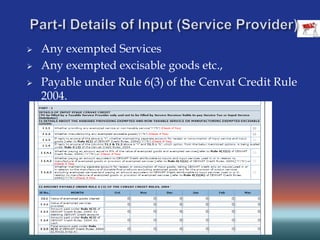

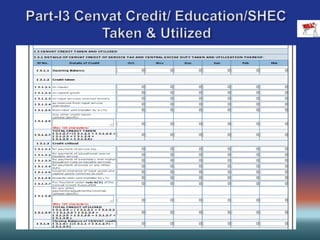

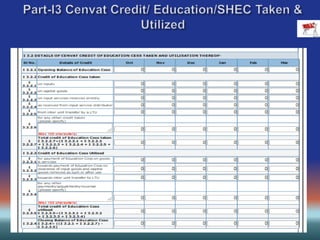

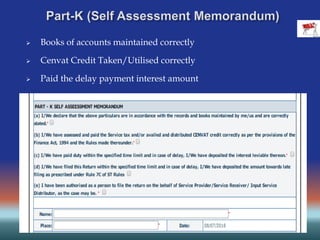

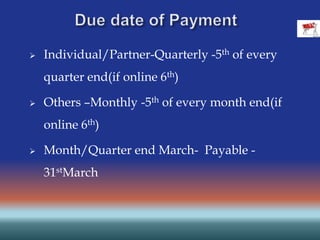

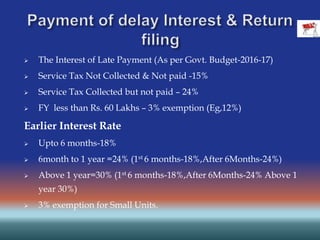

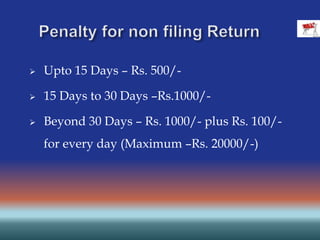

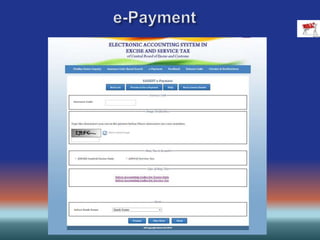

The document discusses various aspects of registration and e-filing procedures for service tax in India. It provides information on how to generate C forms automatically online, filing returns via form ST-3, registering for a service tax code, filing returns every six months, paying tax and interest for late payments. It also summarizes the various parts of form ST-3 and details around cenvat credit and input service distributors.