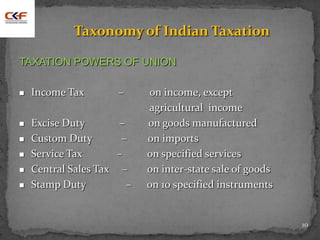

This document provides an overview and summary of a presentation on understanding recent changes to India's service tax law. The presentation covers:

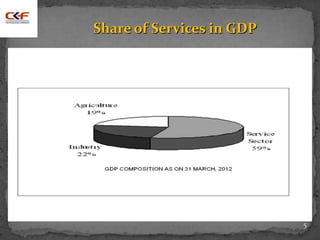

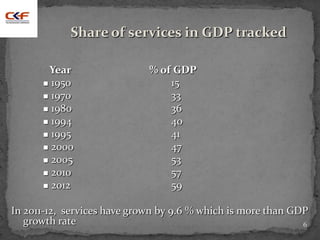

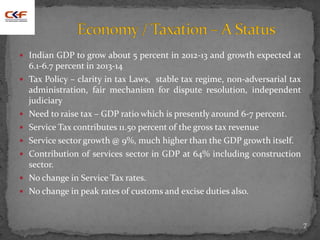

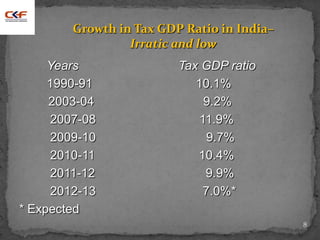

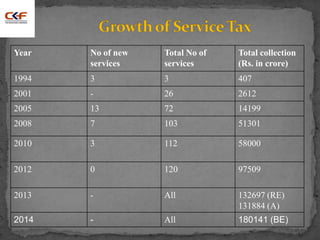

- An economic overview of India and the growing importance of the services sector.

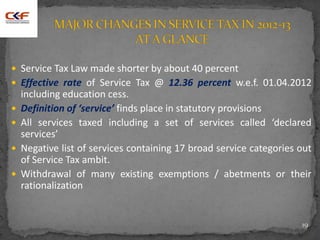

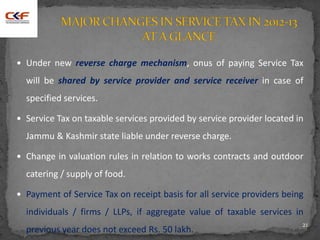

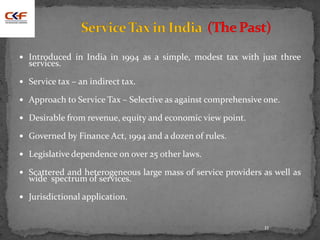

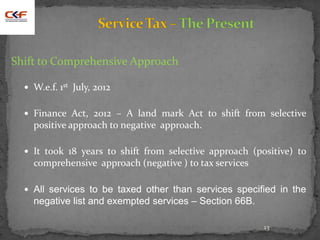

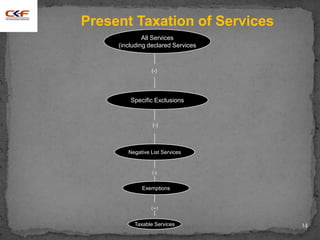

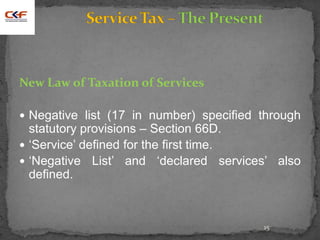

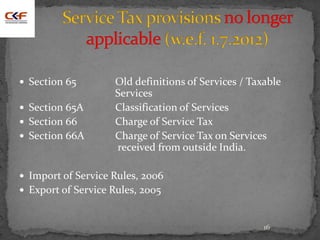

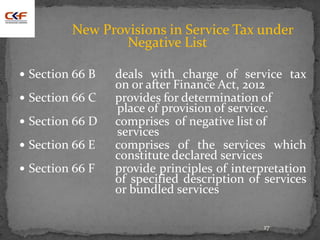

- An explanation of the shift in India's service tax law from a selective positive list approach to a comprehensive negative list approach implemented in July 2012.

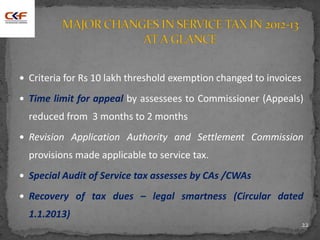

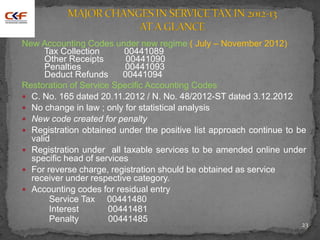

- A summary of the key changes introduced by the new negative list approach, including the definition of taxable services, rules for determining the place of provision, and new compliance requirements.

![12

Selective Approach to Service Tax

Taxation by choice

Service not defined but taxable service defined.

> 120 taxable services [section 65(105)]

Resulted in distortions / prejudice

Untapped tax potential

Economically unjustified

Issues – Classification, Illogical definitions,

Constitutional challenges, deemed services etc.](https://image.slidesharecdn.com/sessioni-130422051120-phpapp02/85/Mumbai-Presentation-17-4-2013-Session-i-12-320.jpg)

![18

All services Taxable

[section 65B (44)]

Declared services Taxable

(section 66E)

Services covered under Not Taxable

negative list of services

(section 66D)

Services exempt under Mega Exempted

Notification No. 25/2012-ST

dated 20.6.2012

Other specified Exemptions Exempted](https://image.slidesharecdn.com/sessioni-130422051120-phpapp02/85/Mumbai-Presentation-17-4-2013-Session-i-18-320.jpg)