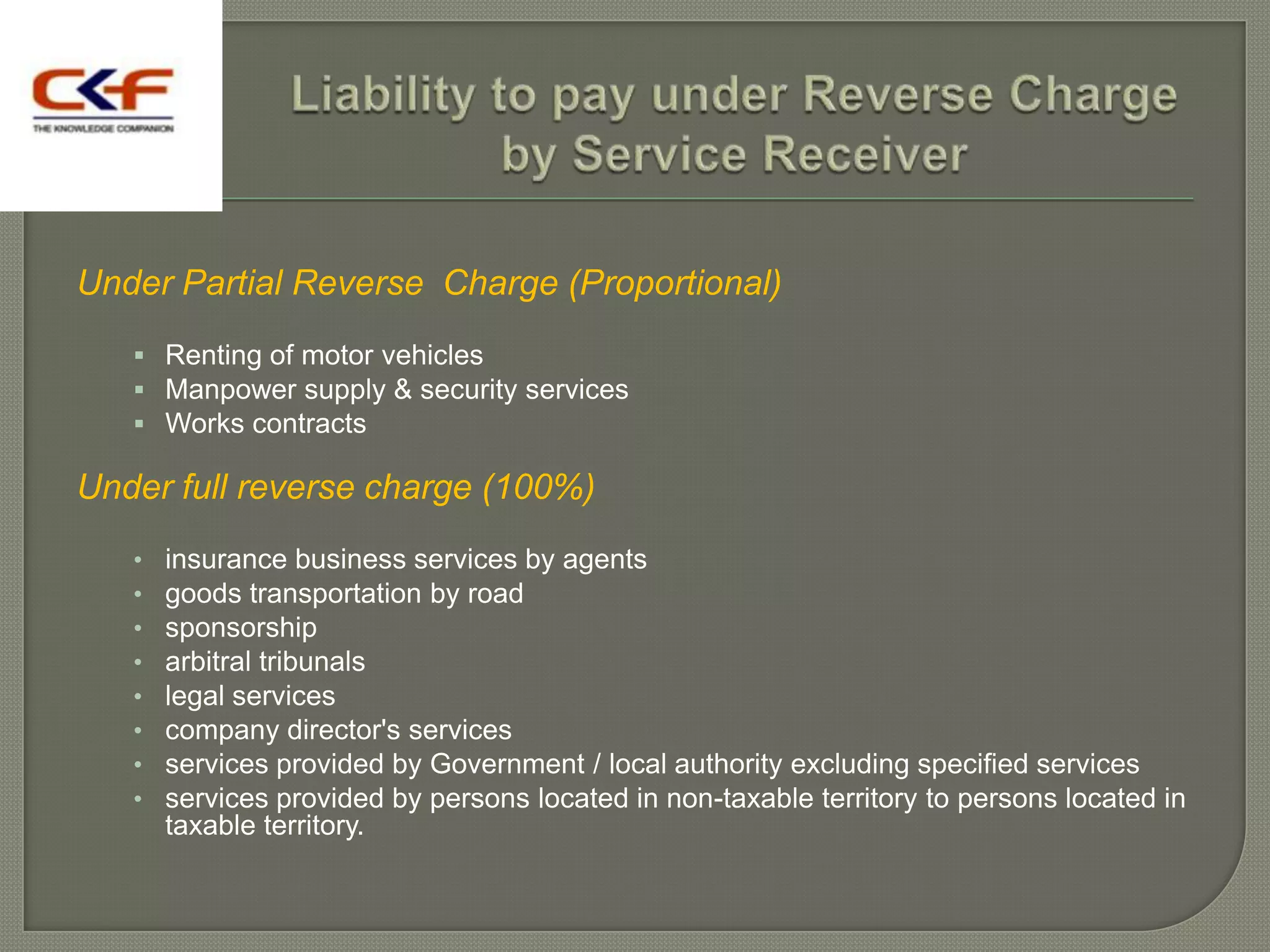

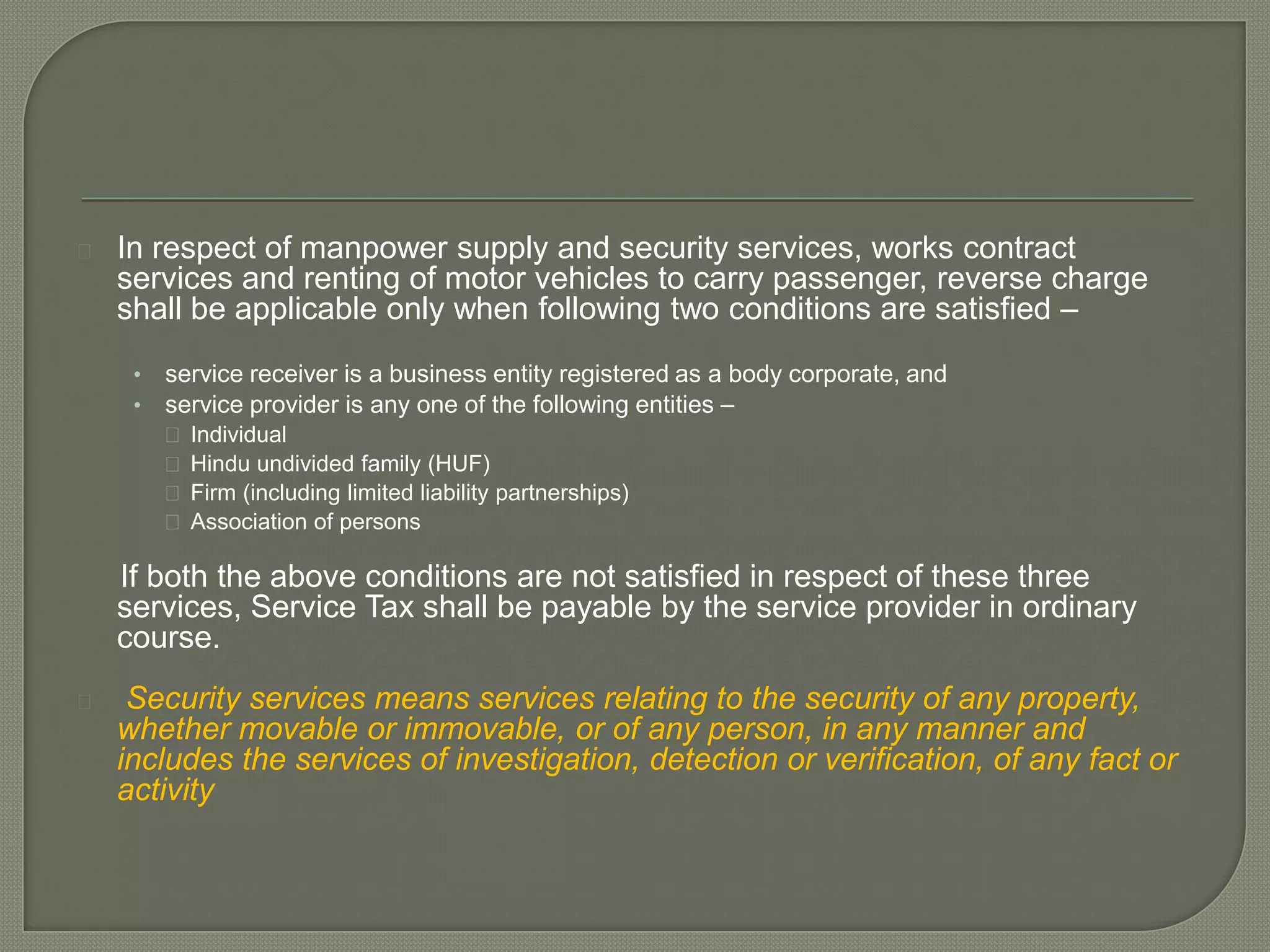

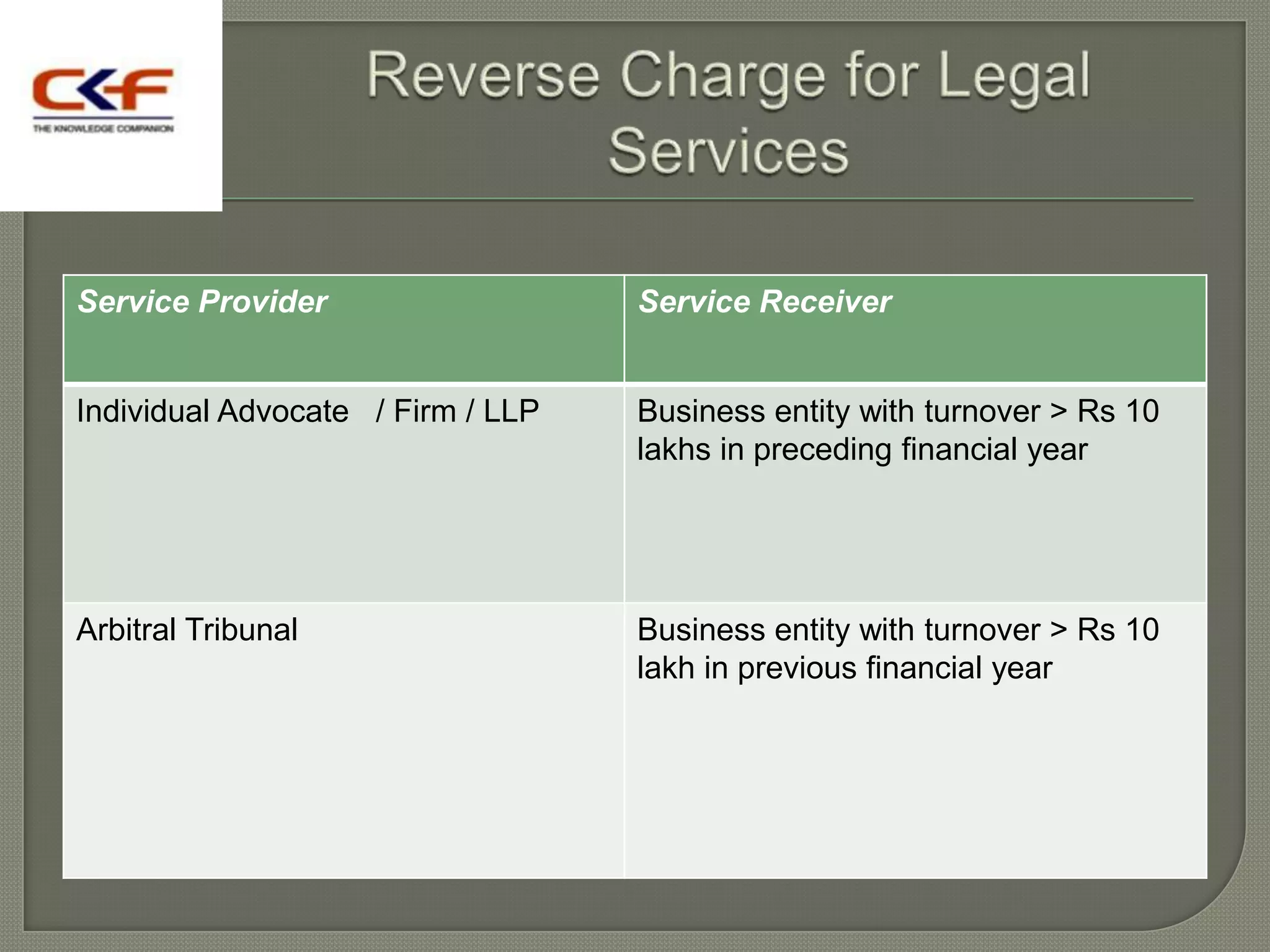

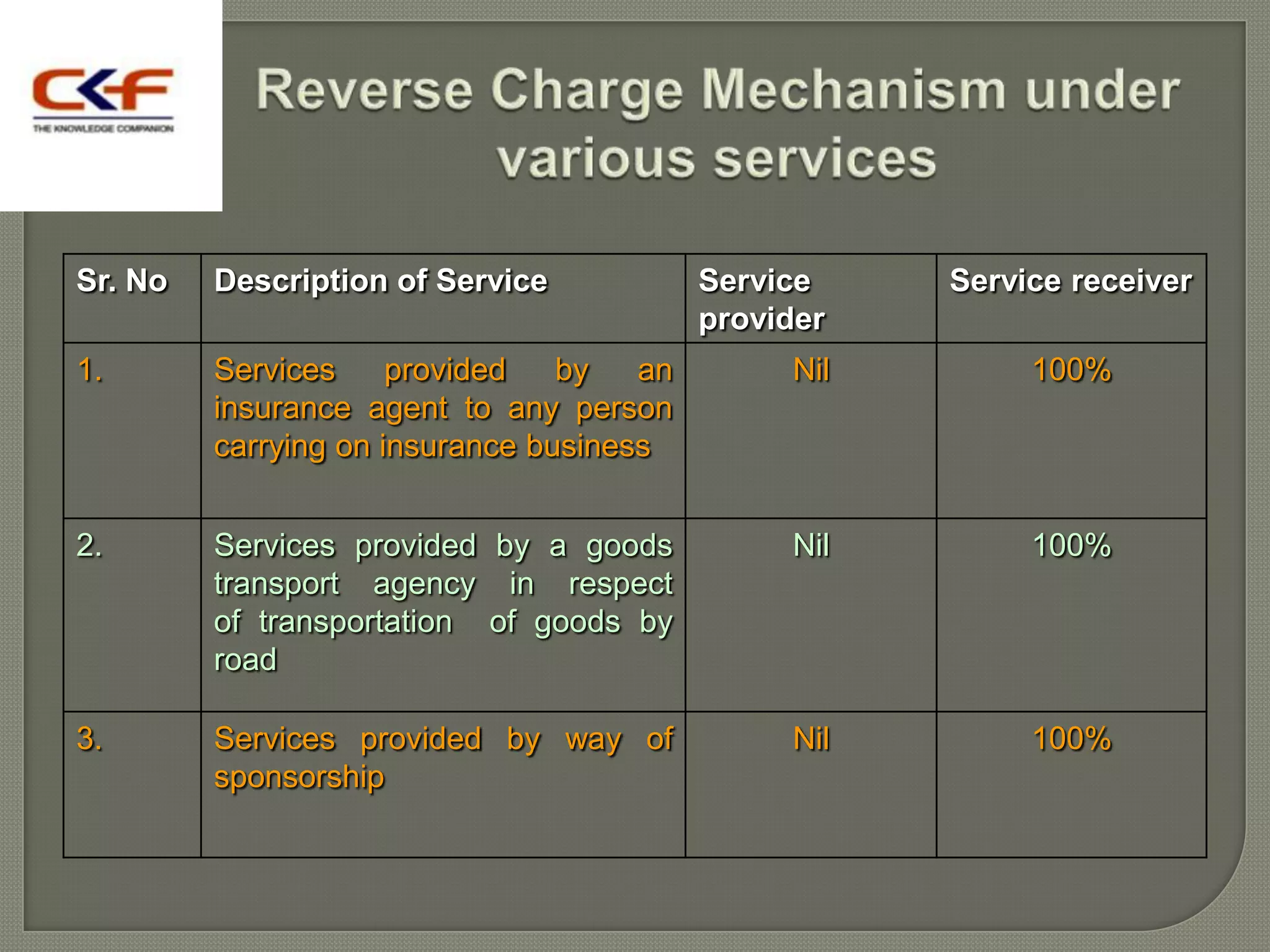

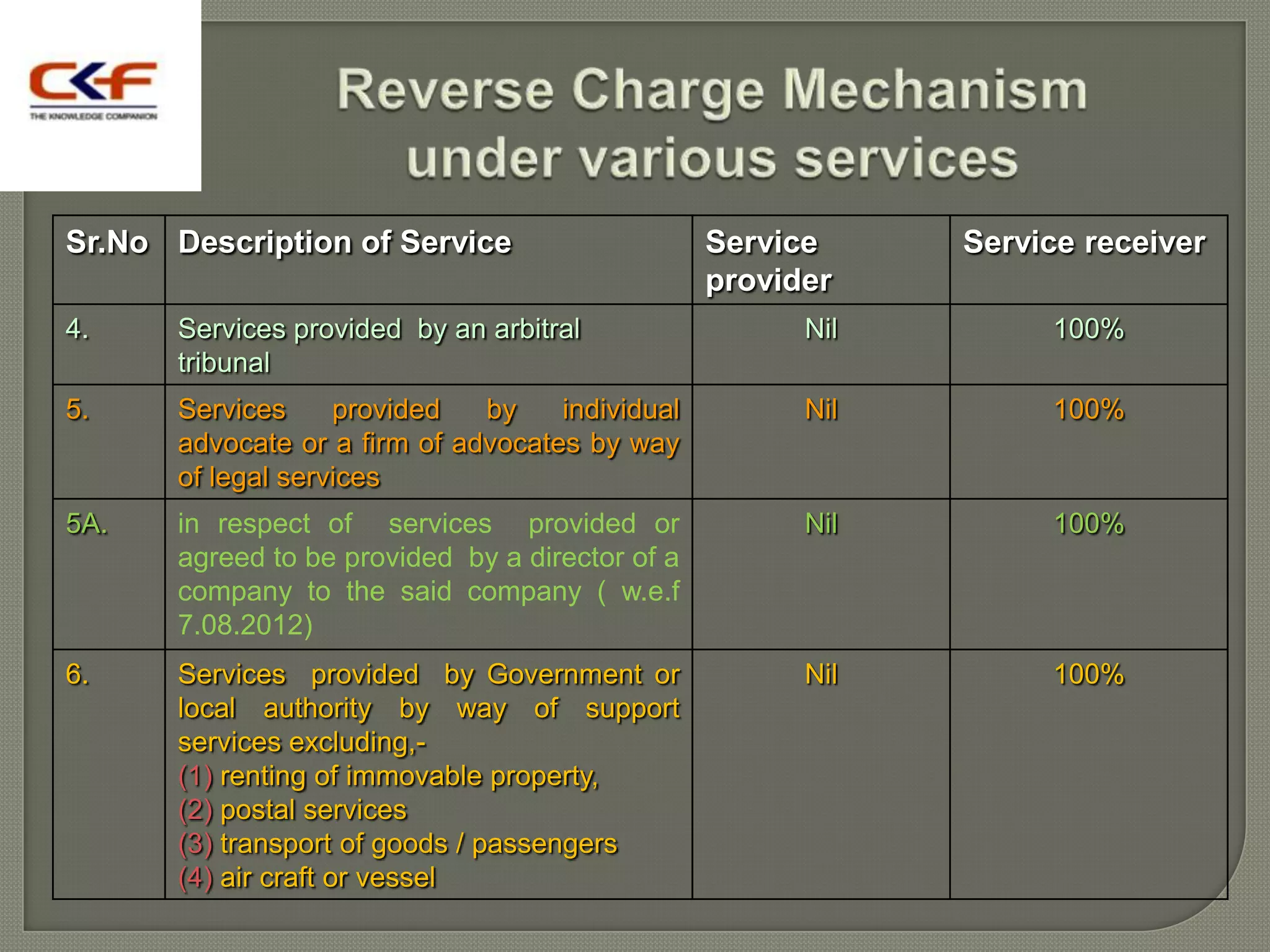

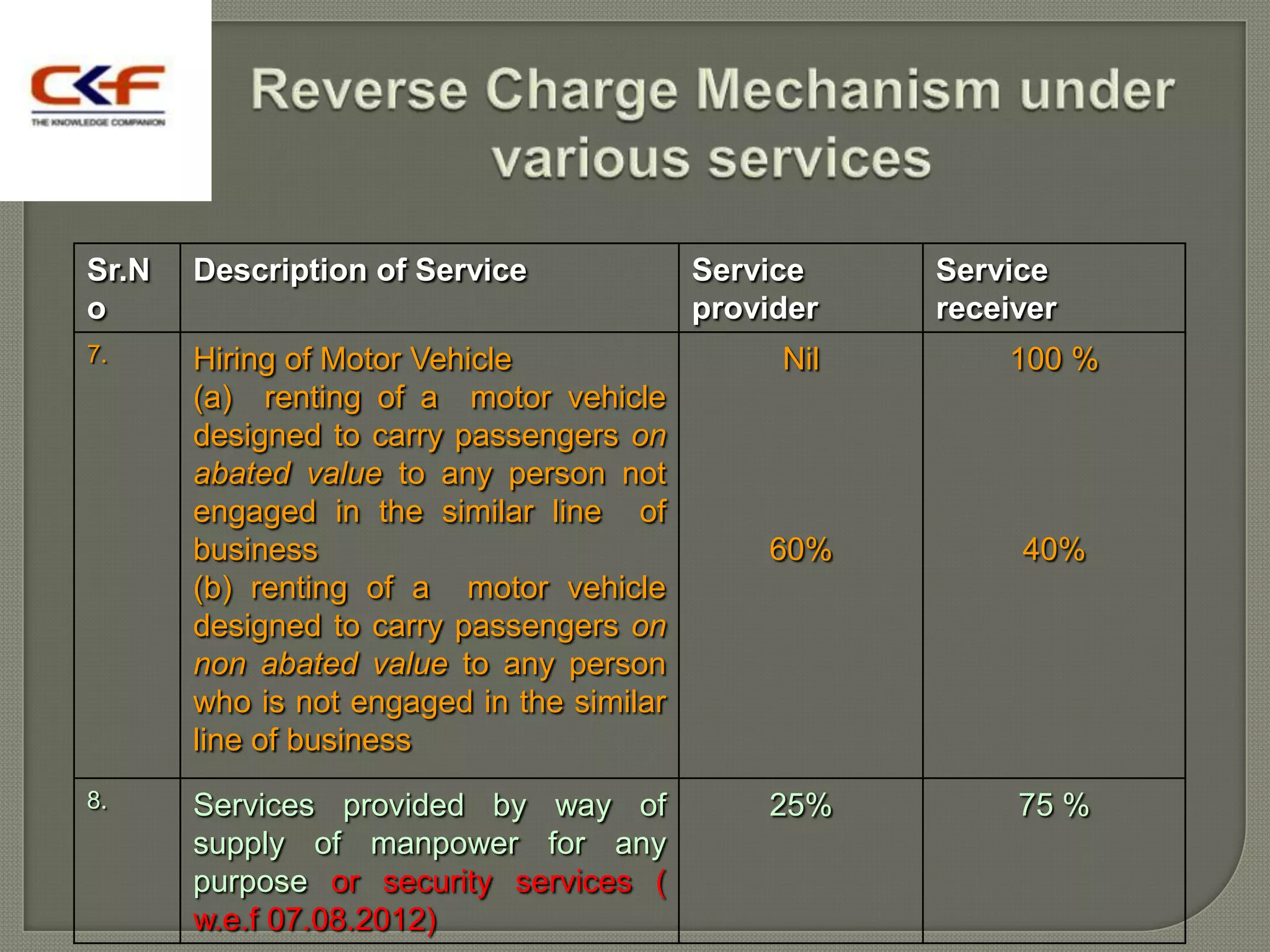

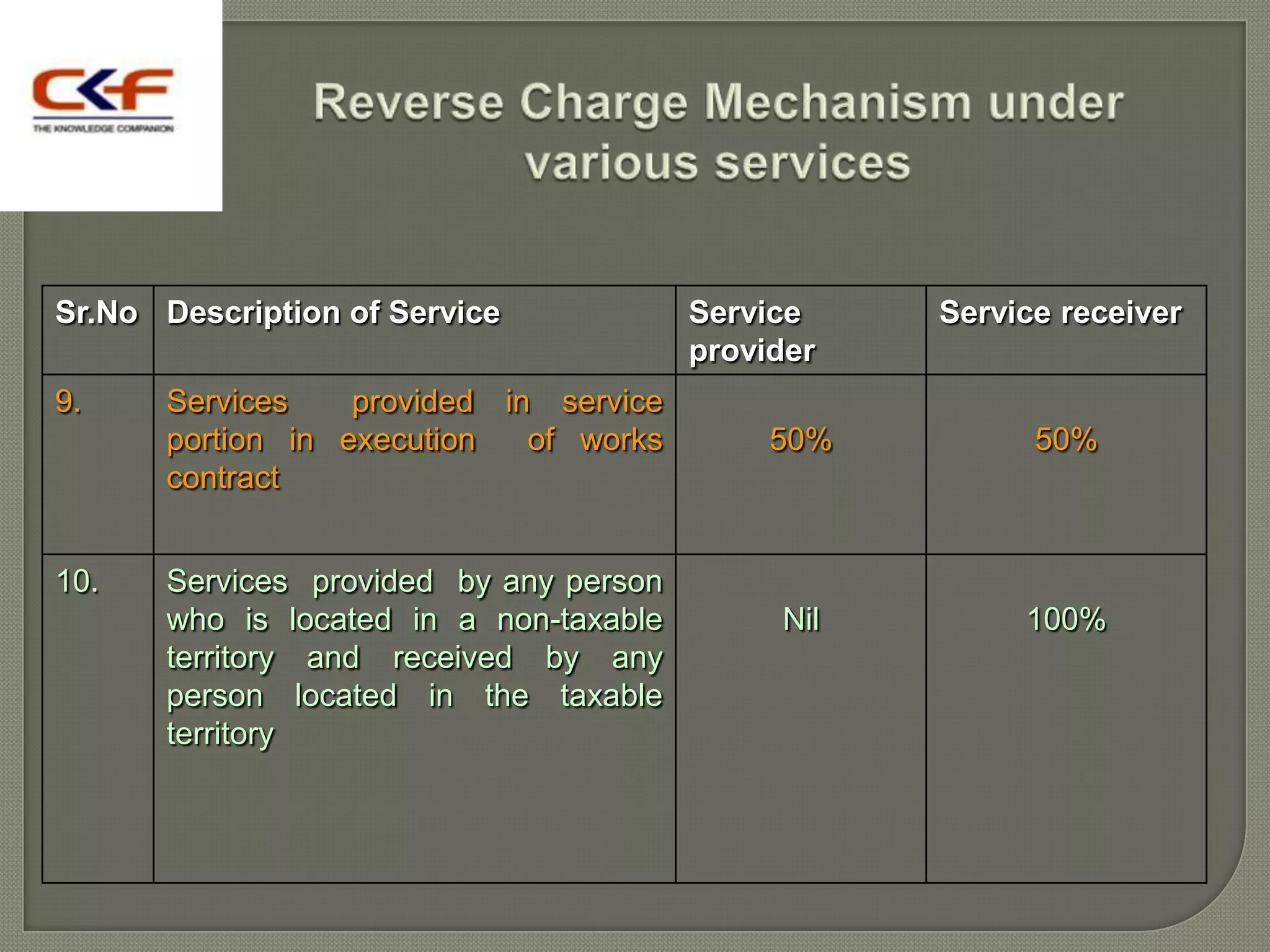

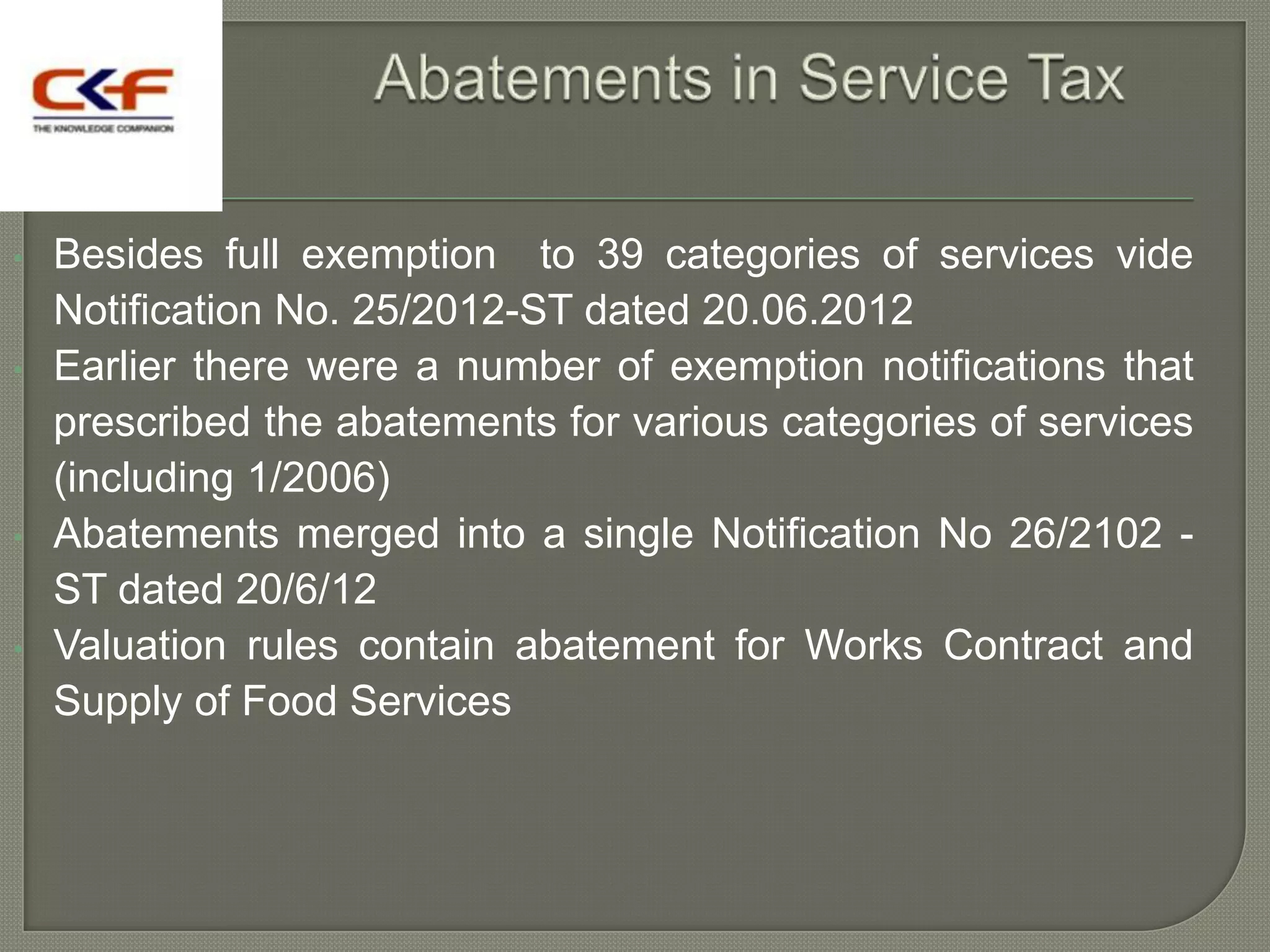

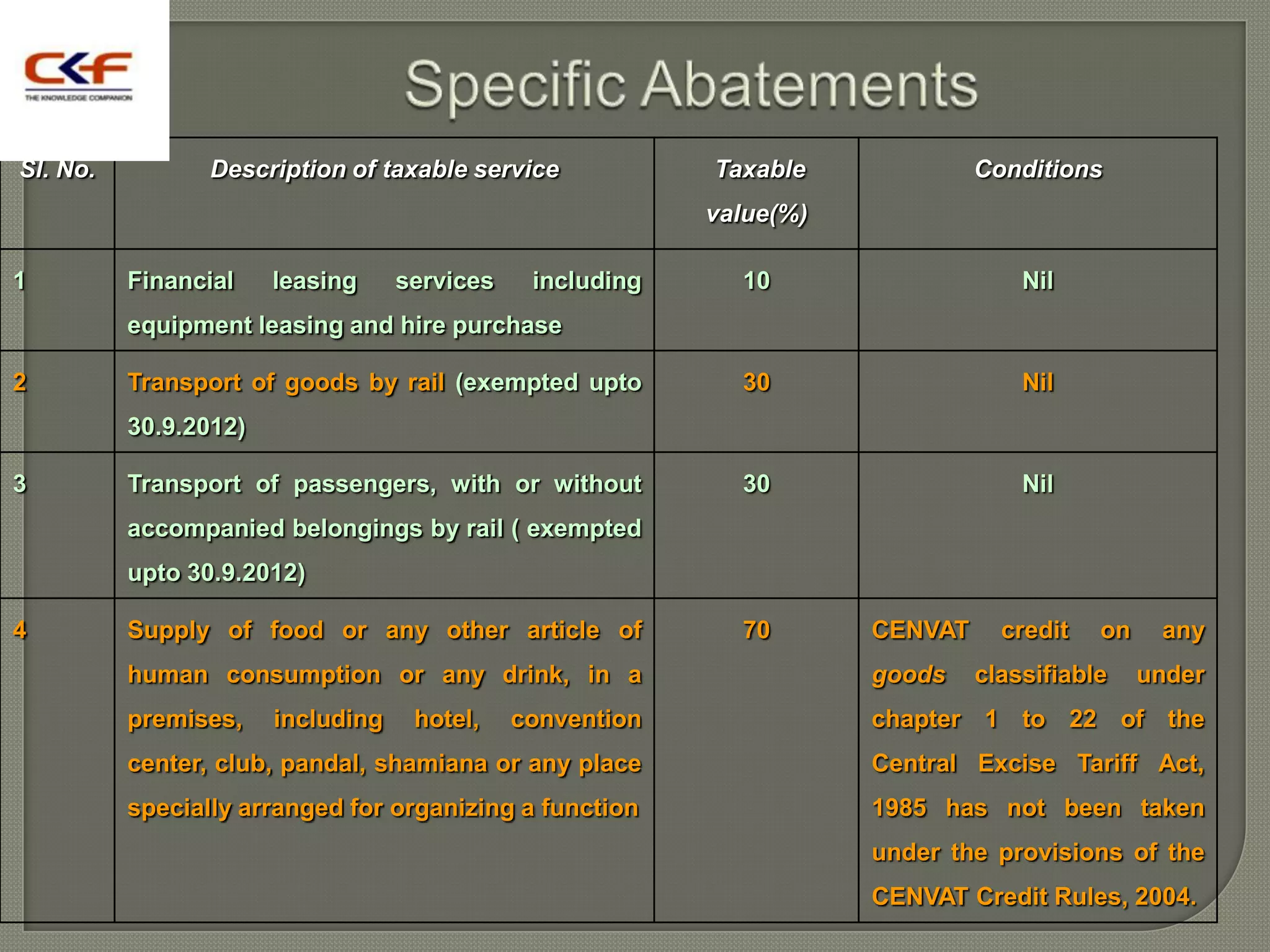

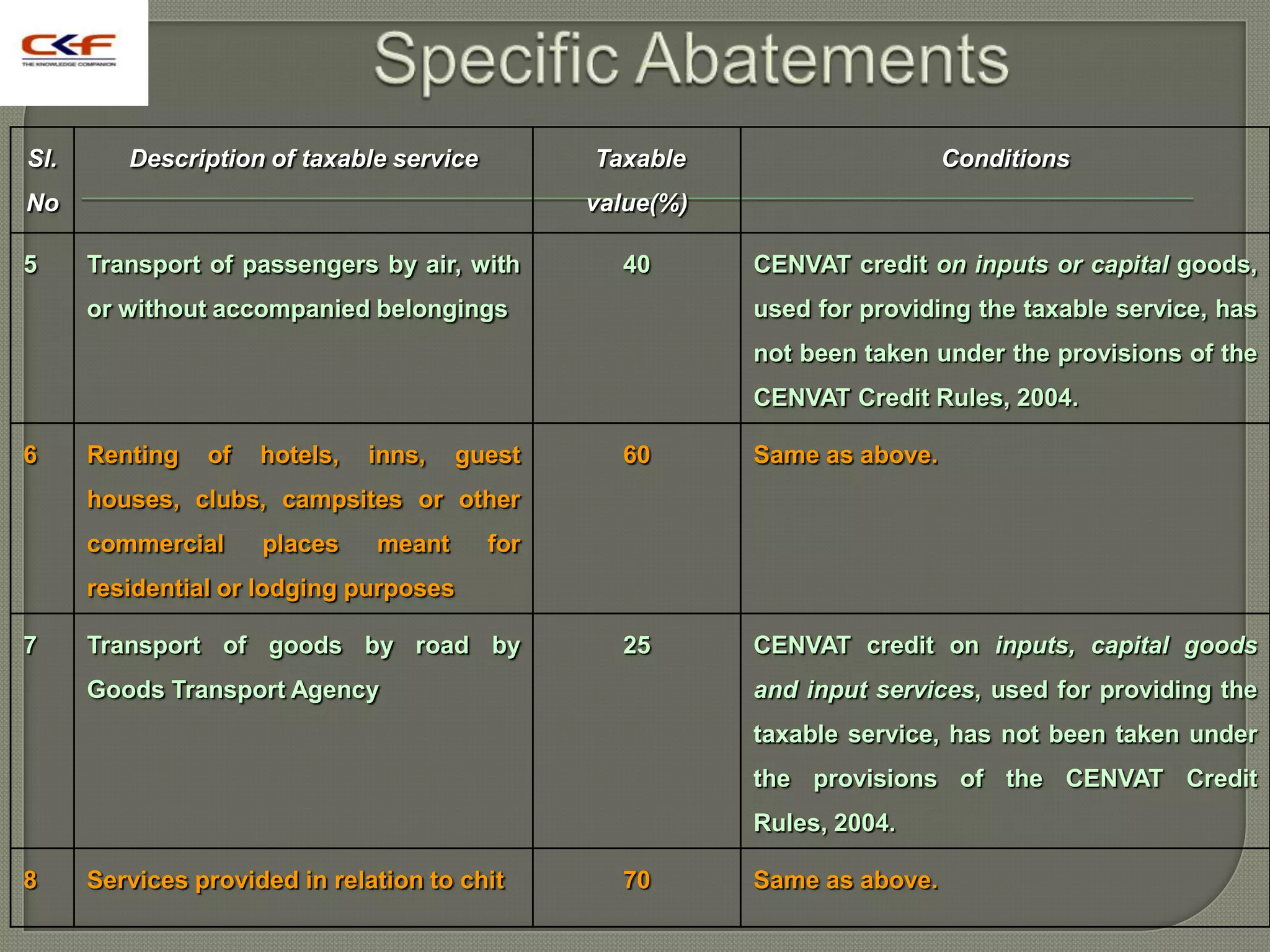

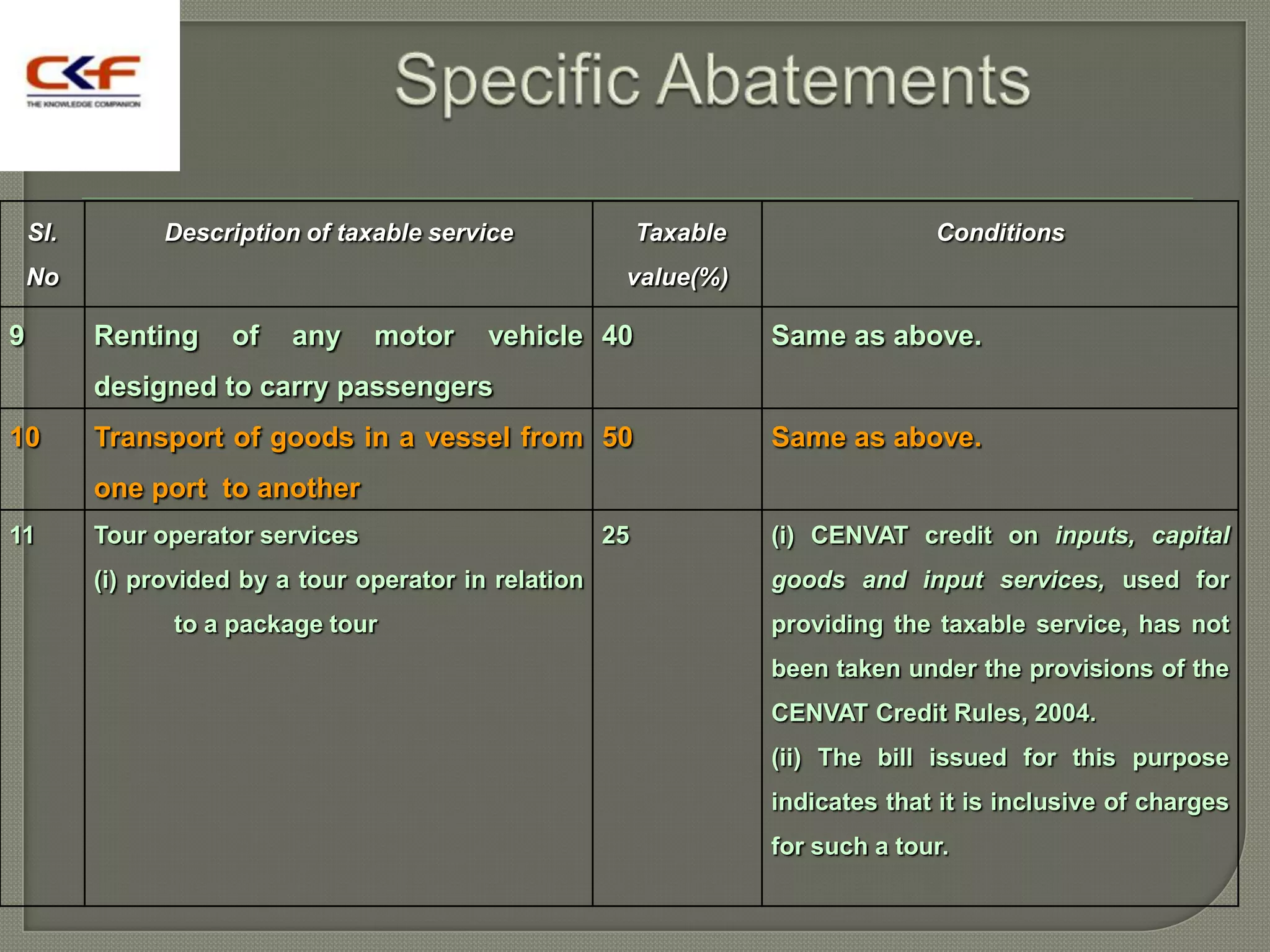

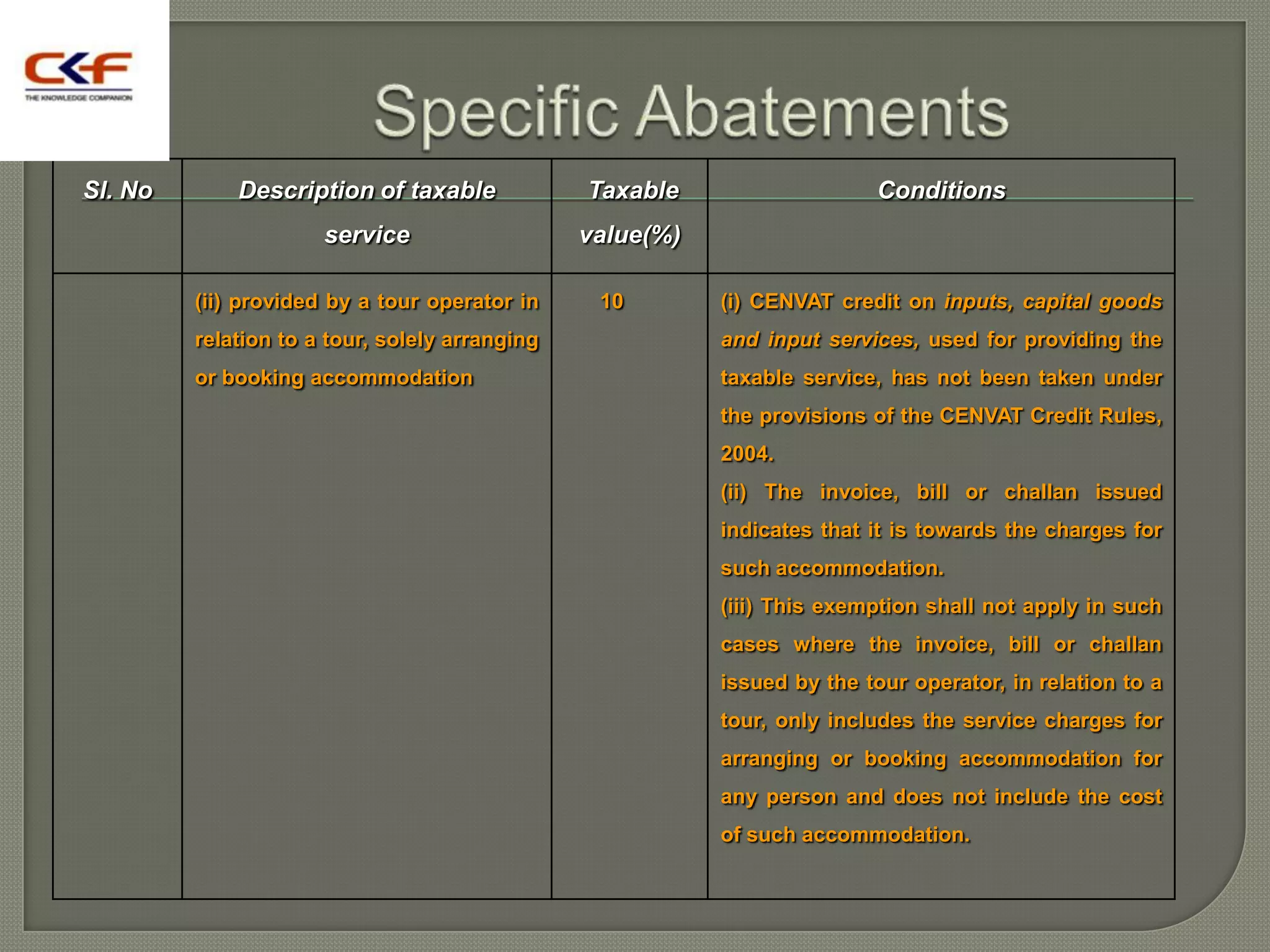

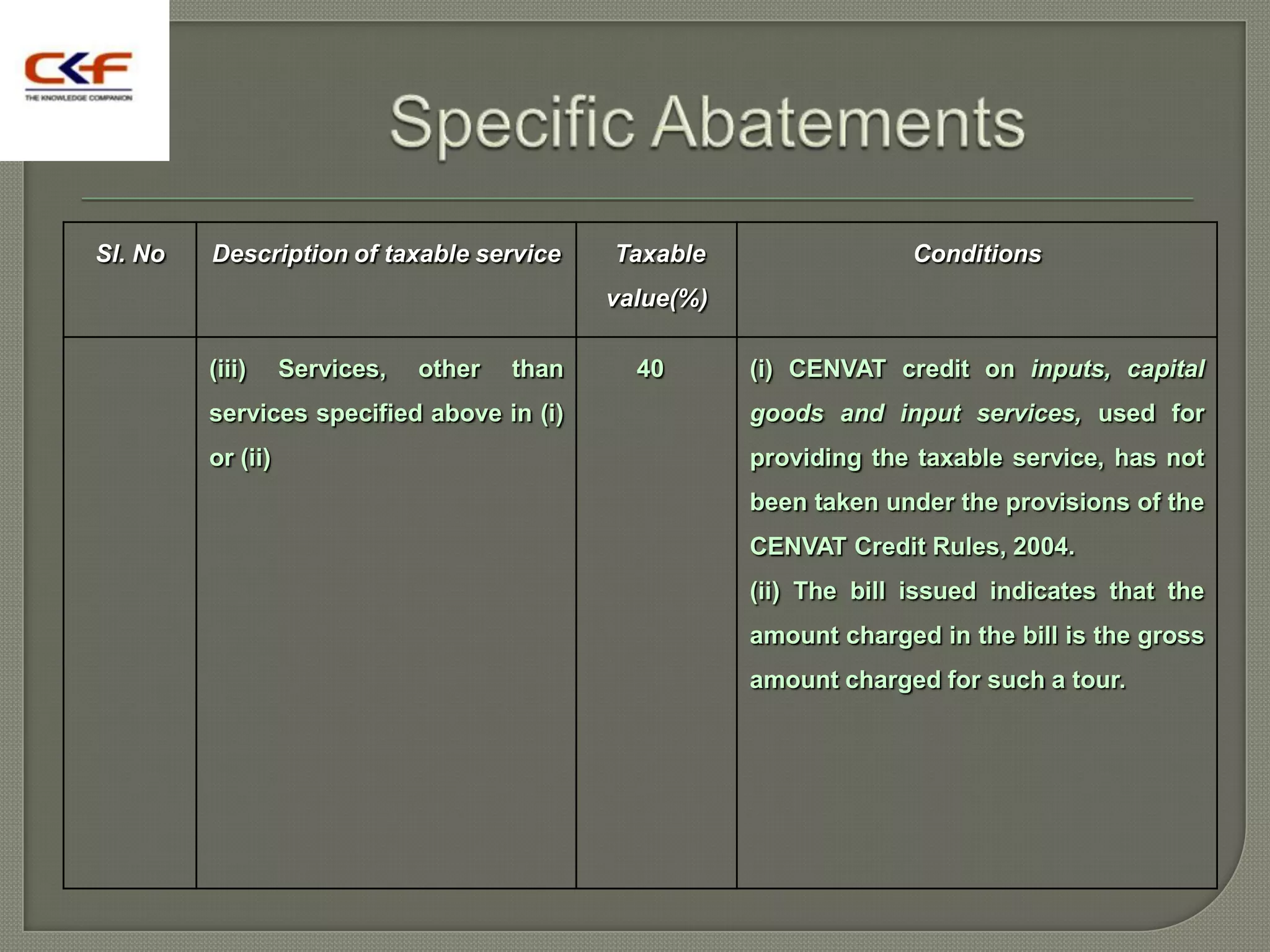

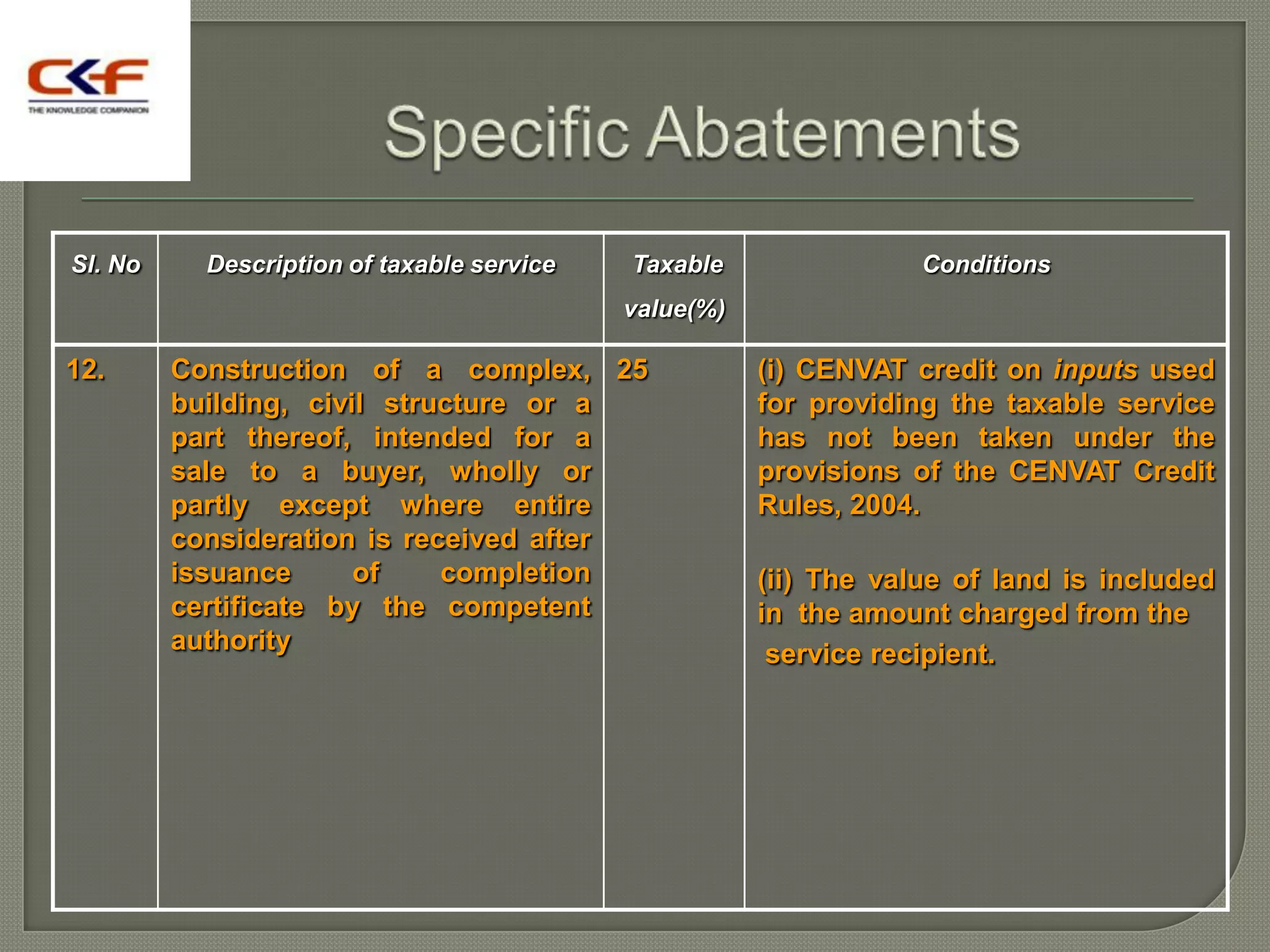

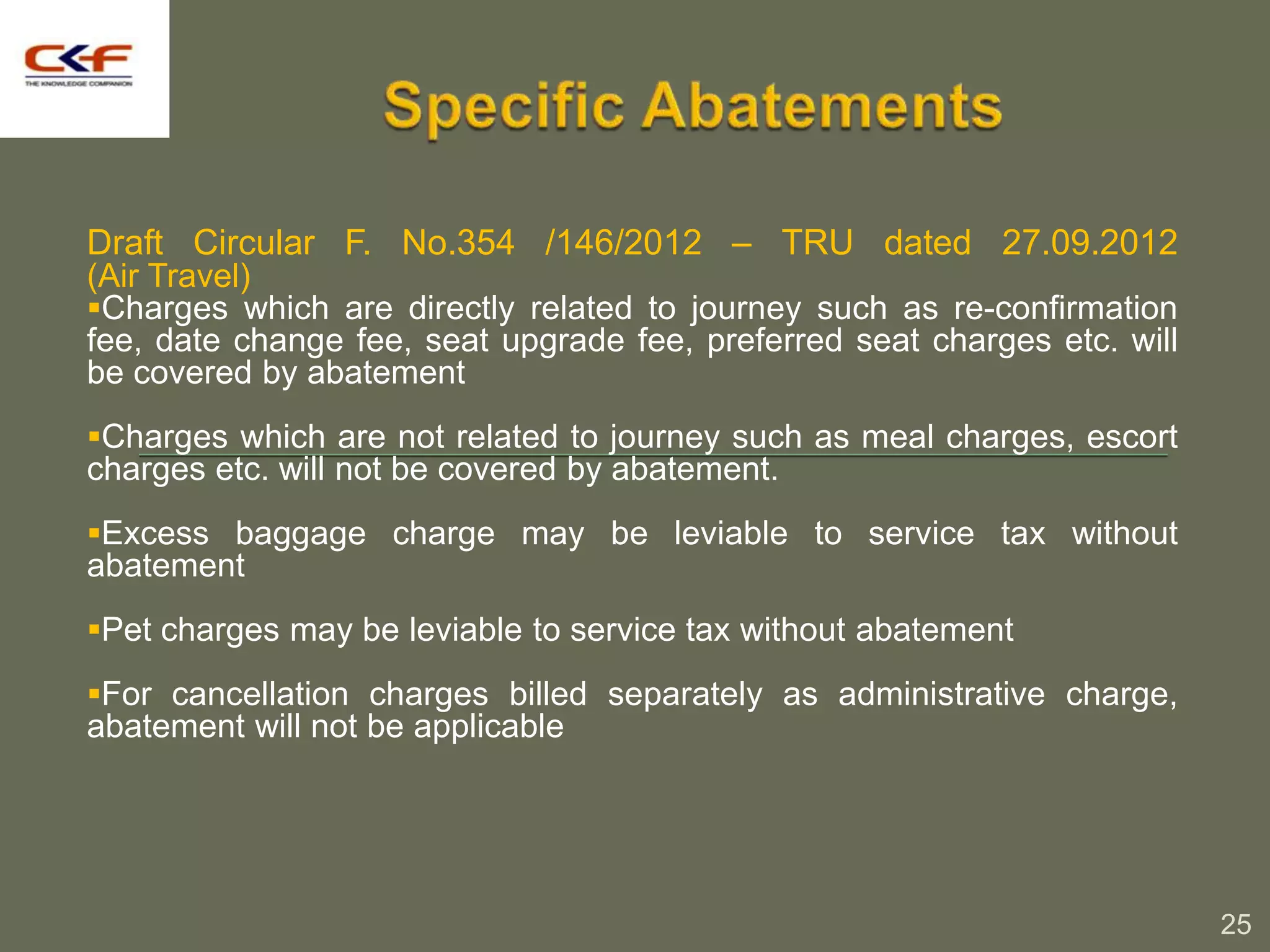

The document summarizes key aspects of reverse charge provisions and abatements under service tax in India per recent notifications. It discusses services where the liability to pay tax shifts fully or partially to the service recipient under reverse charge. It also outlines various taxable services and the abatement percentage allowed, such as 40% for transport of passengers by air and 70% for supply of food. Conditions for availing abatements include not claiming CENVAT credit on inputs by the service provider.

![SESSION – IV

Services under Reverse Charge [N. No.

30/2012-ST]

and

Abatements in Service Tax

[N. No. 26/2012-ST]

2](https://image.slidesharecdn.com/sessionivdated31-10-2012-130111012802-phpapp02/75/Session-iv-dated-31-10-2012-2-2048.jpg)