Embed presentation

Downloaded 11 times

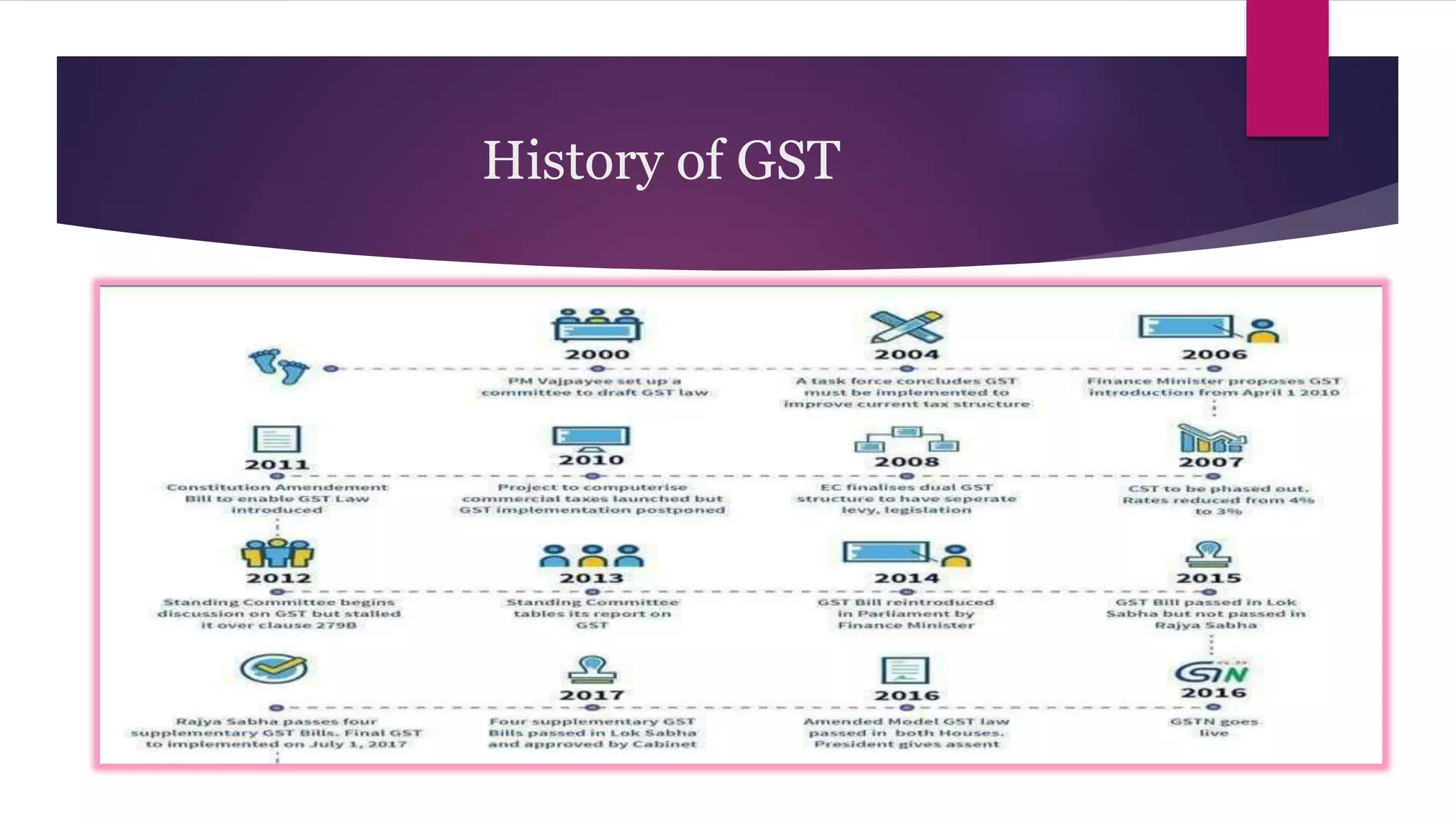

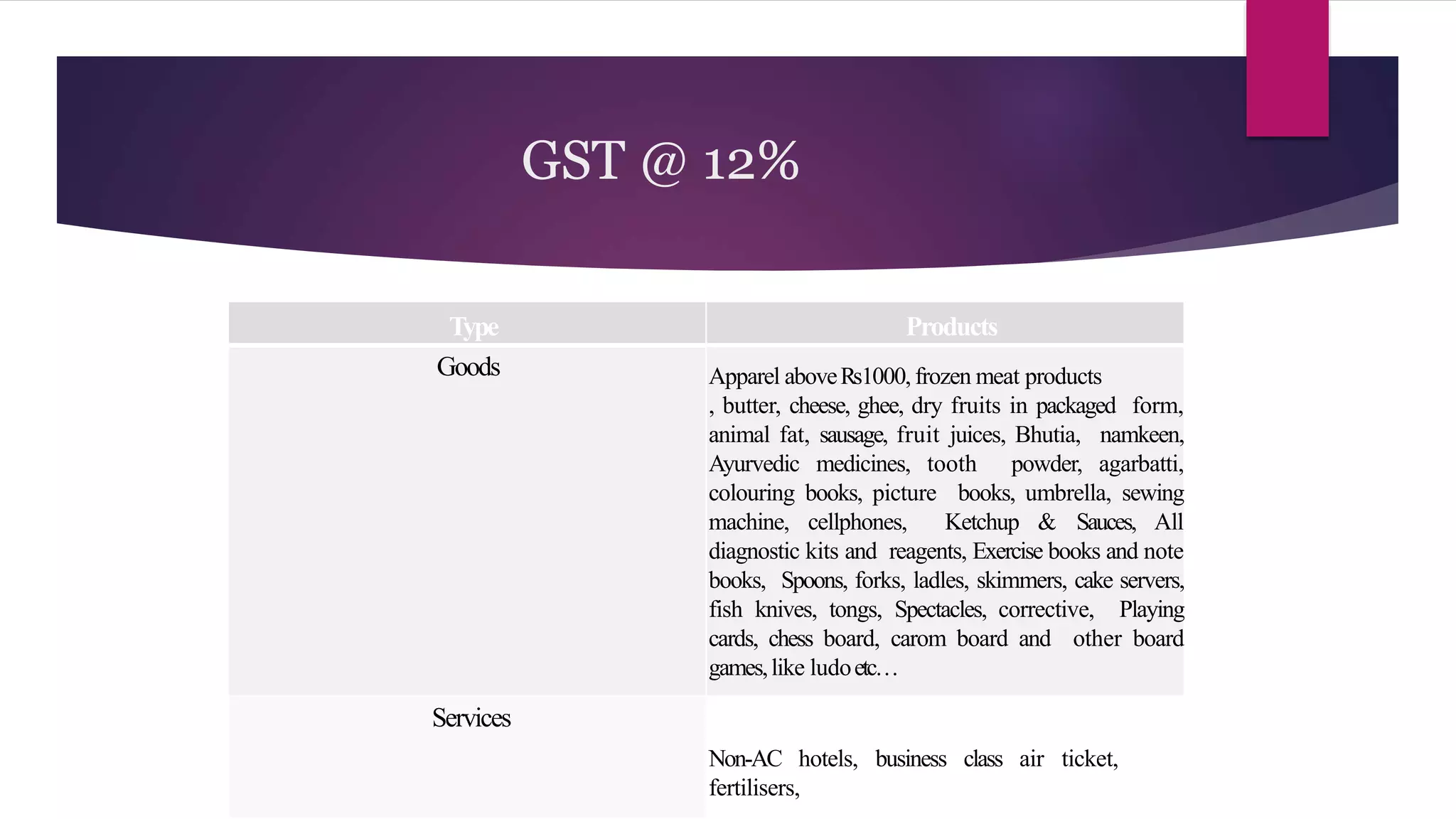

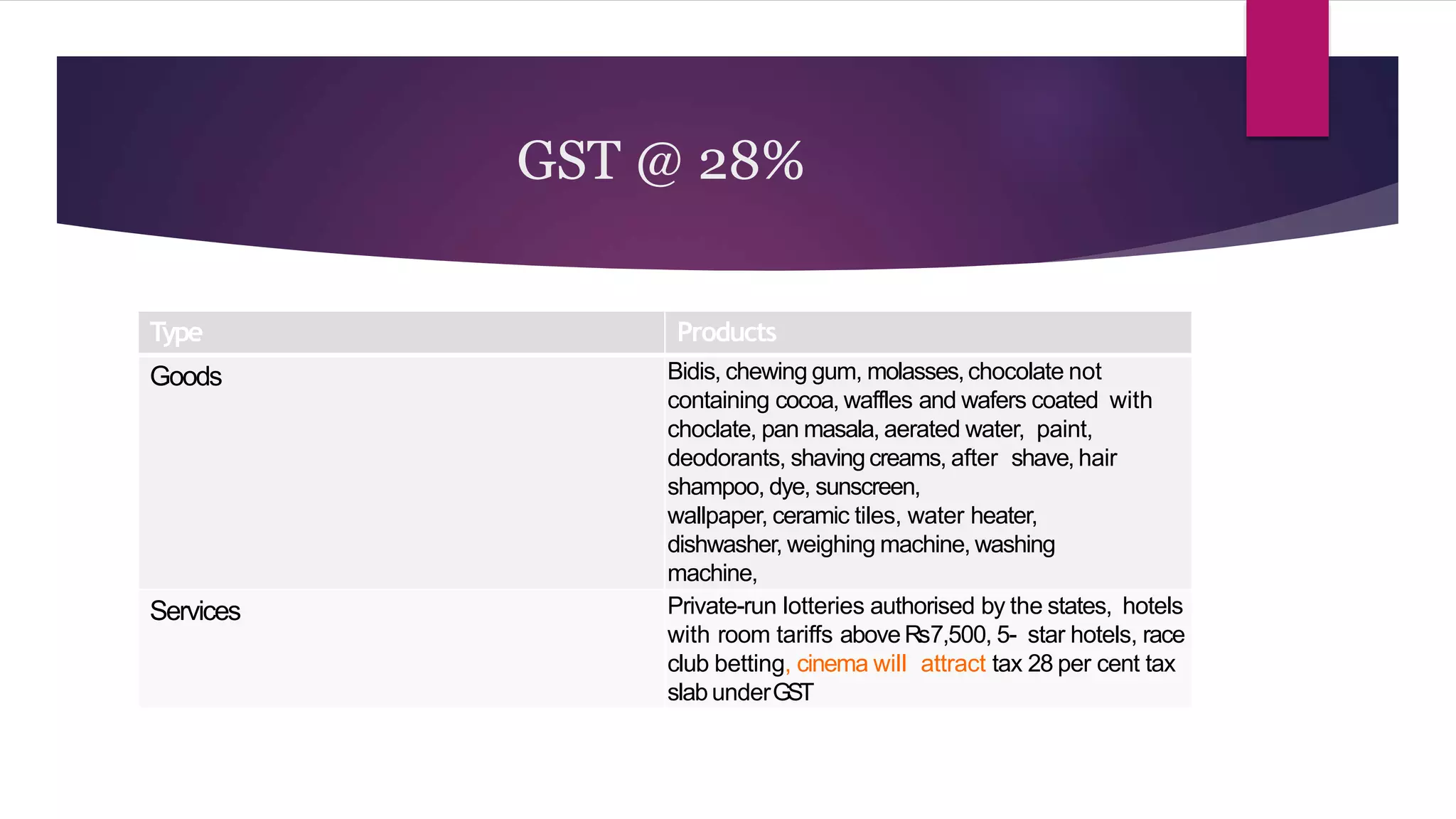

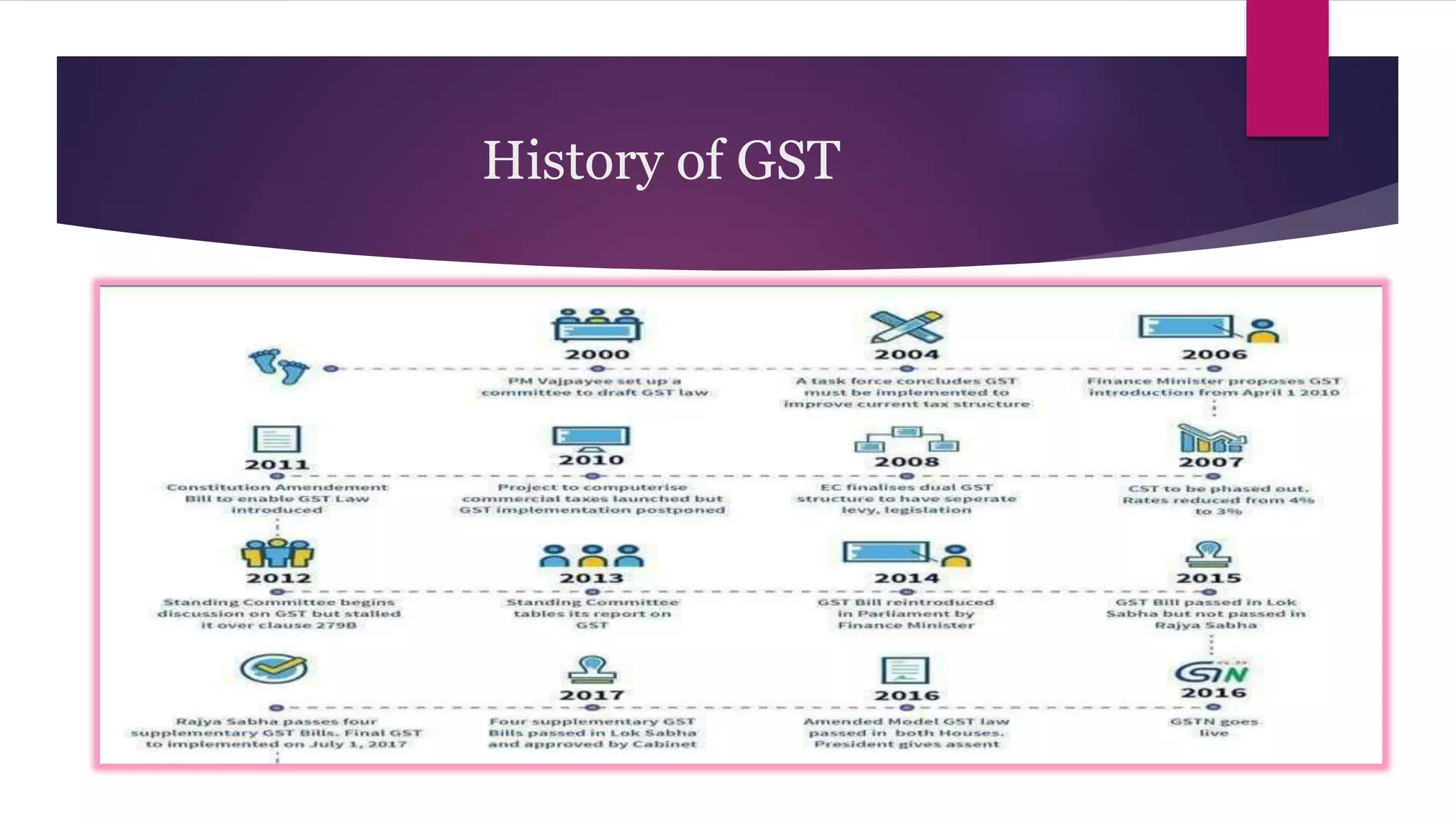

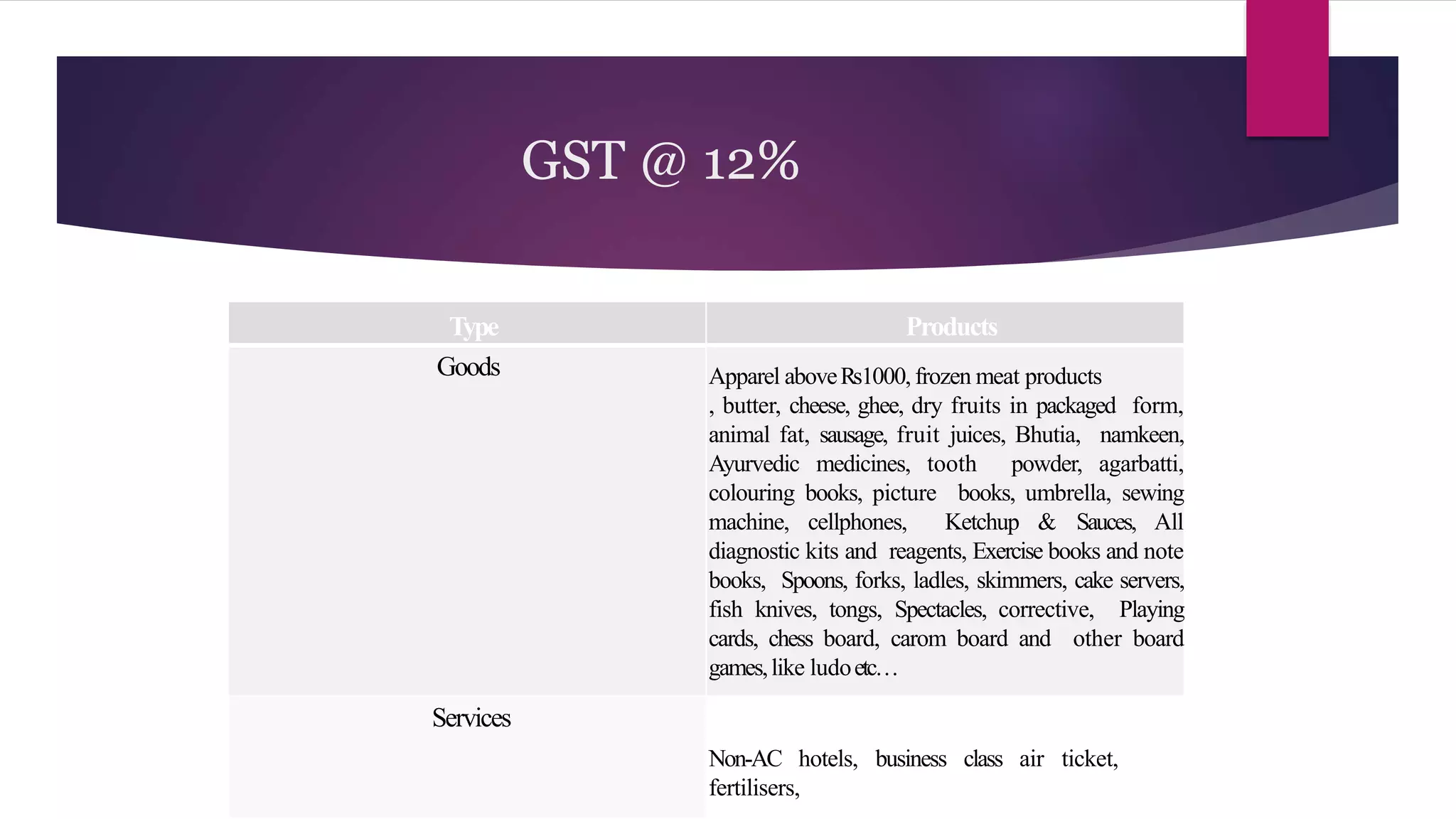

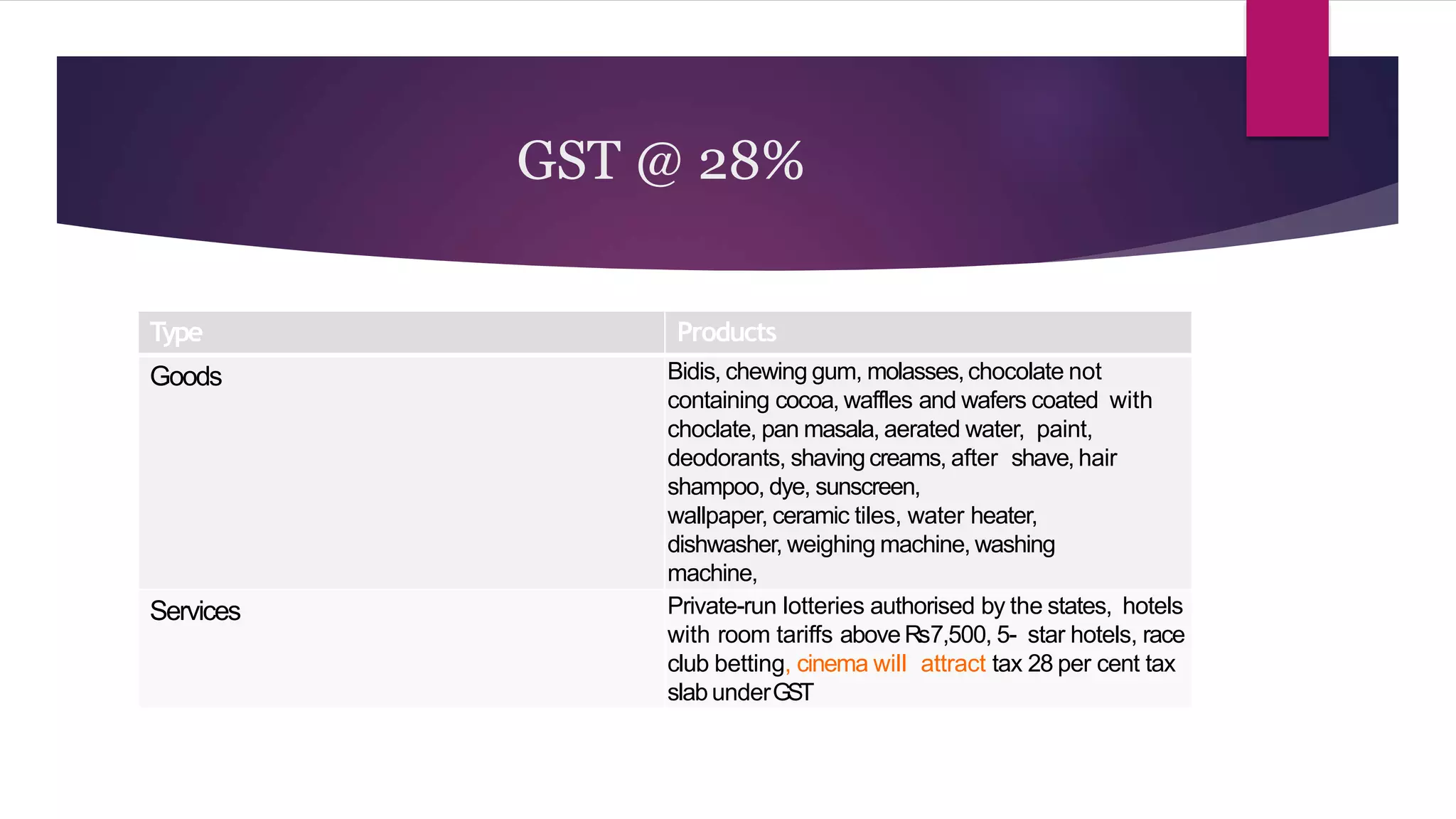

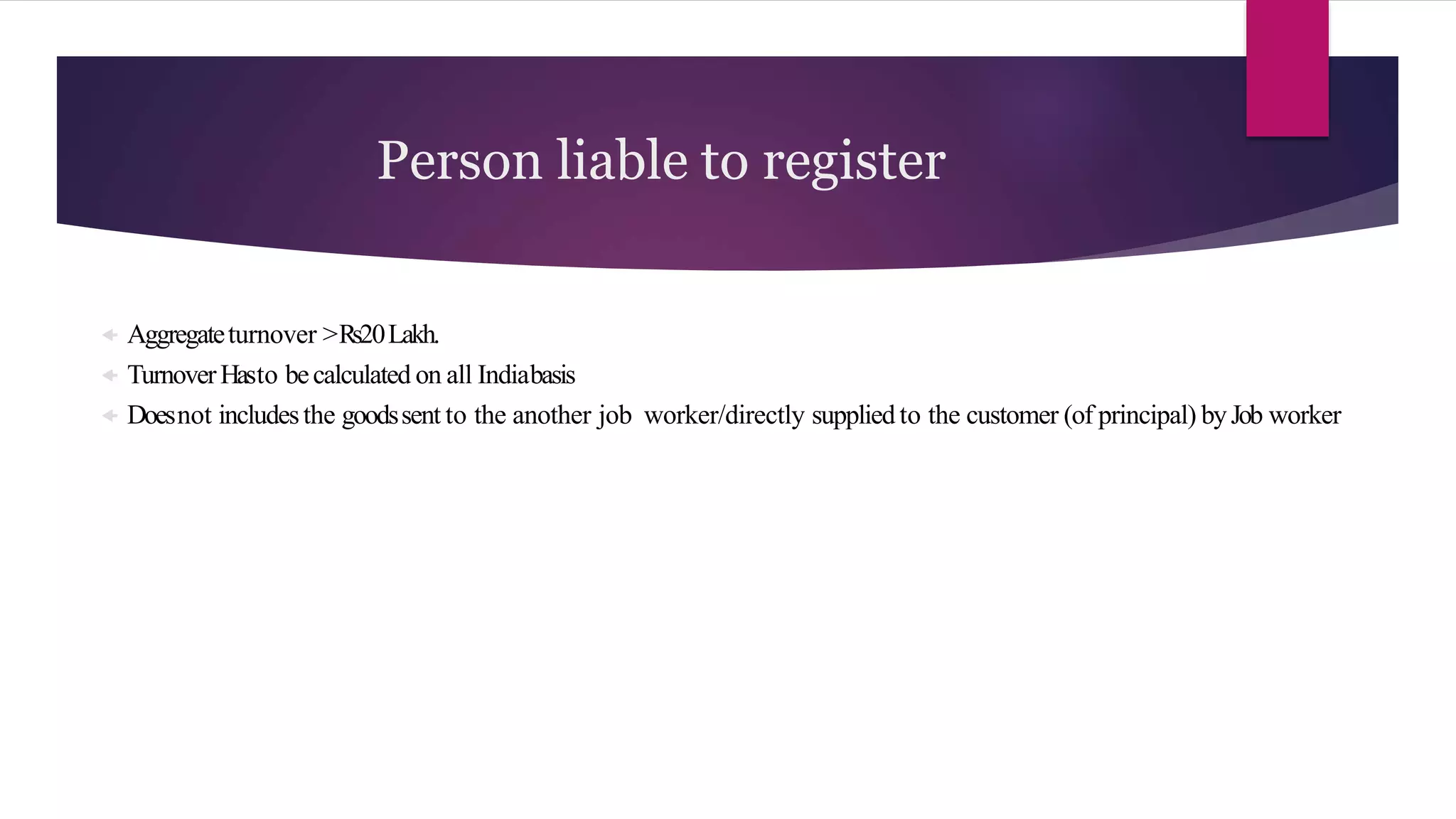

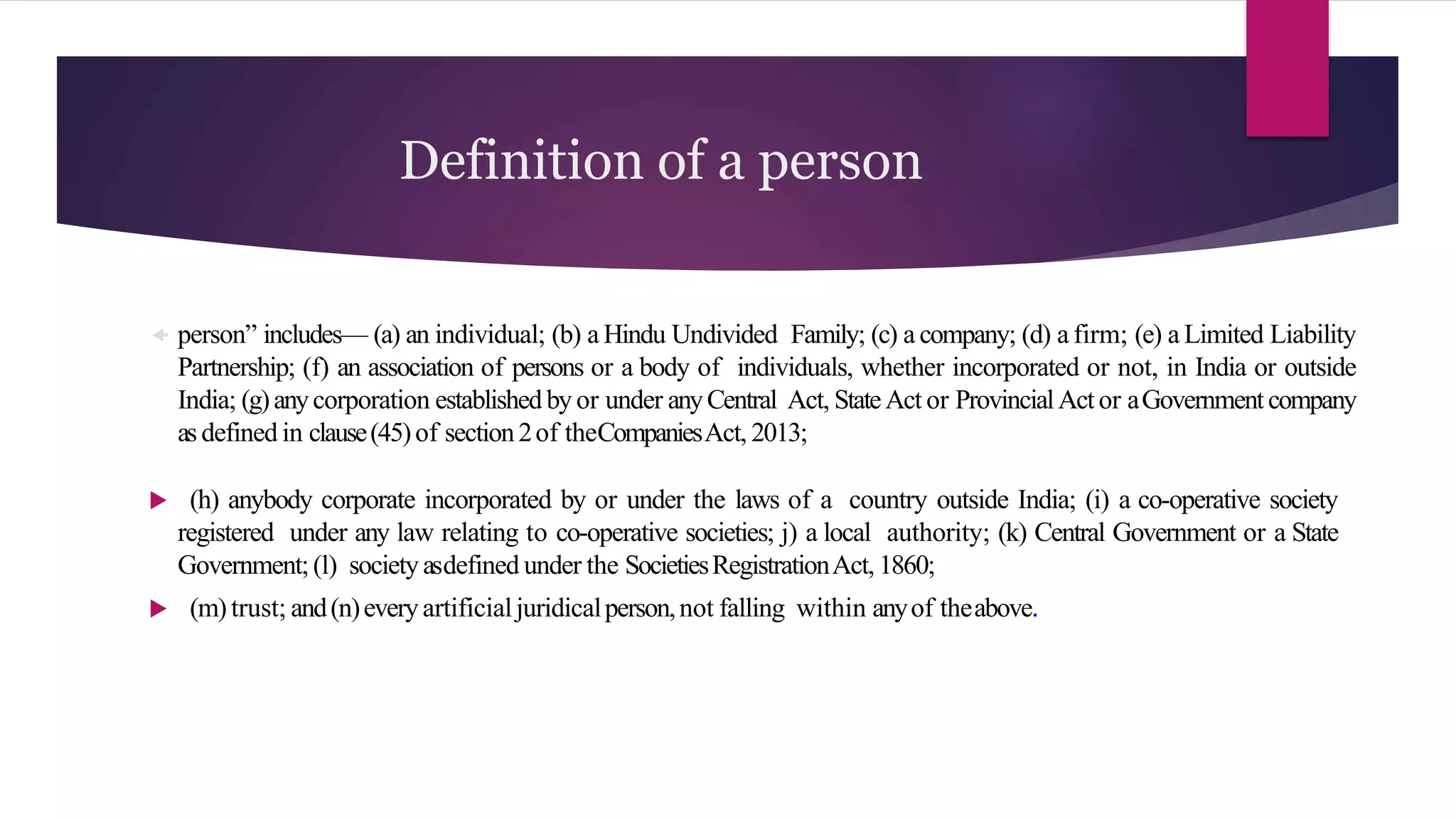

The document provides an overview of the Goods and Services Tax (GST) system implemented in India, including: 1. It defines what goods and services are covered under GST and lists some items that are not covered like alcohol and petroleum products. 2. It outlines the different GST tax slabs of 0%, 5%, 12%, 18%, and 28% and provides examples of product categories that fall under each rate. 3. It lists the registration process and requirements to register for GST, including having an aggregate turnover of over 20 lakhs and filling out an online application form with various details and documents.