This document provides an overview and summary of recent changes to Service Tax law in India. It covers:

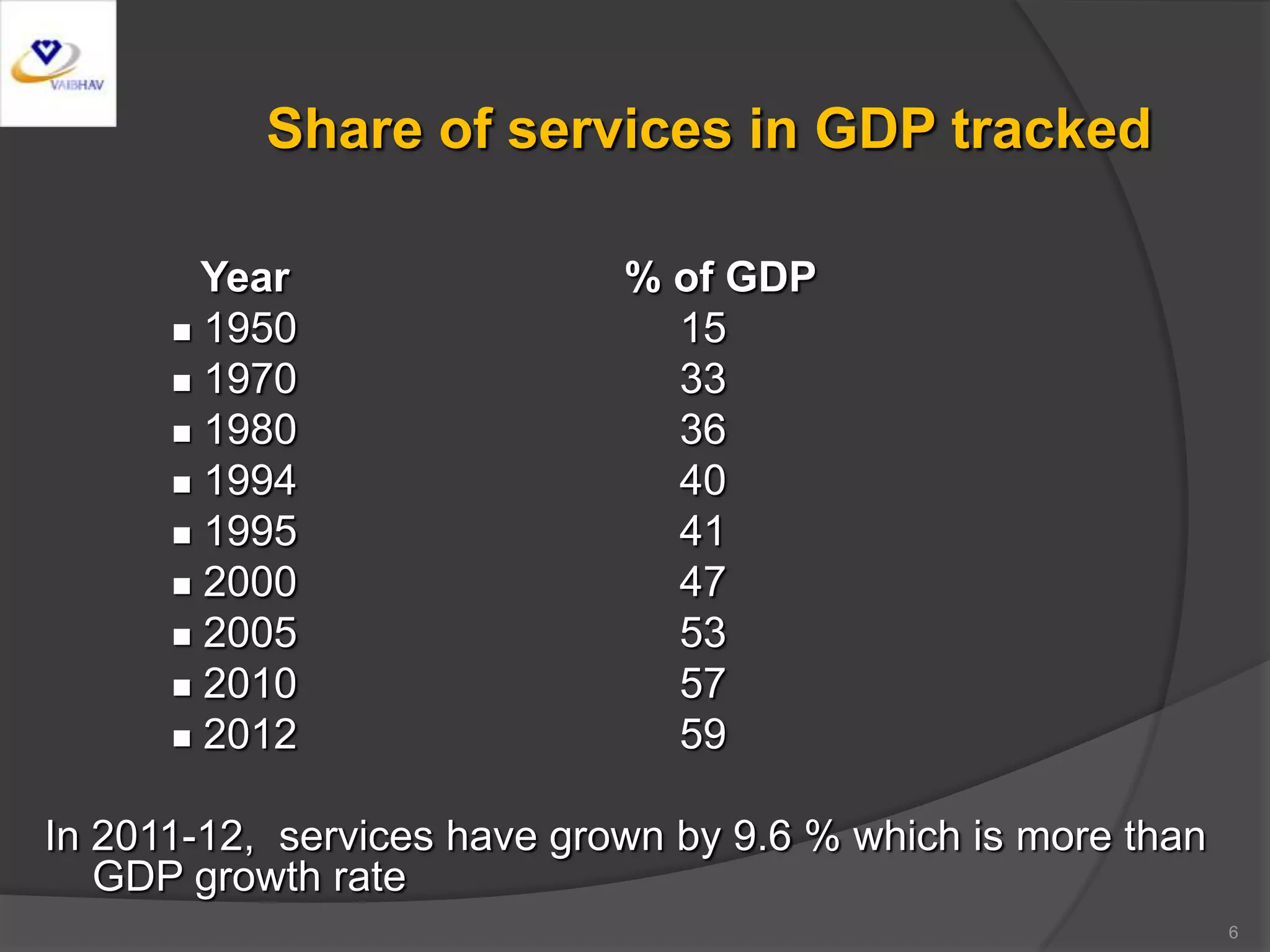

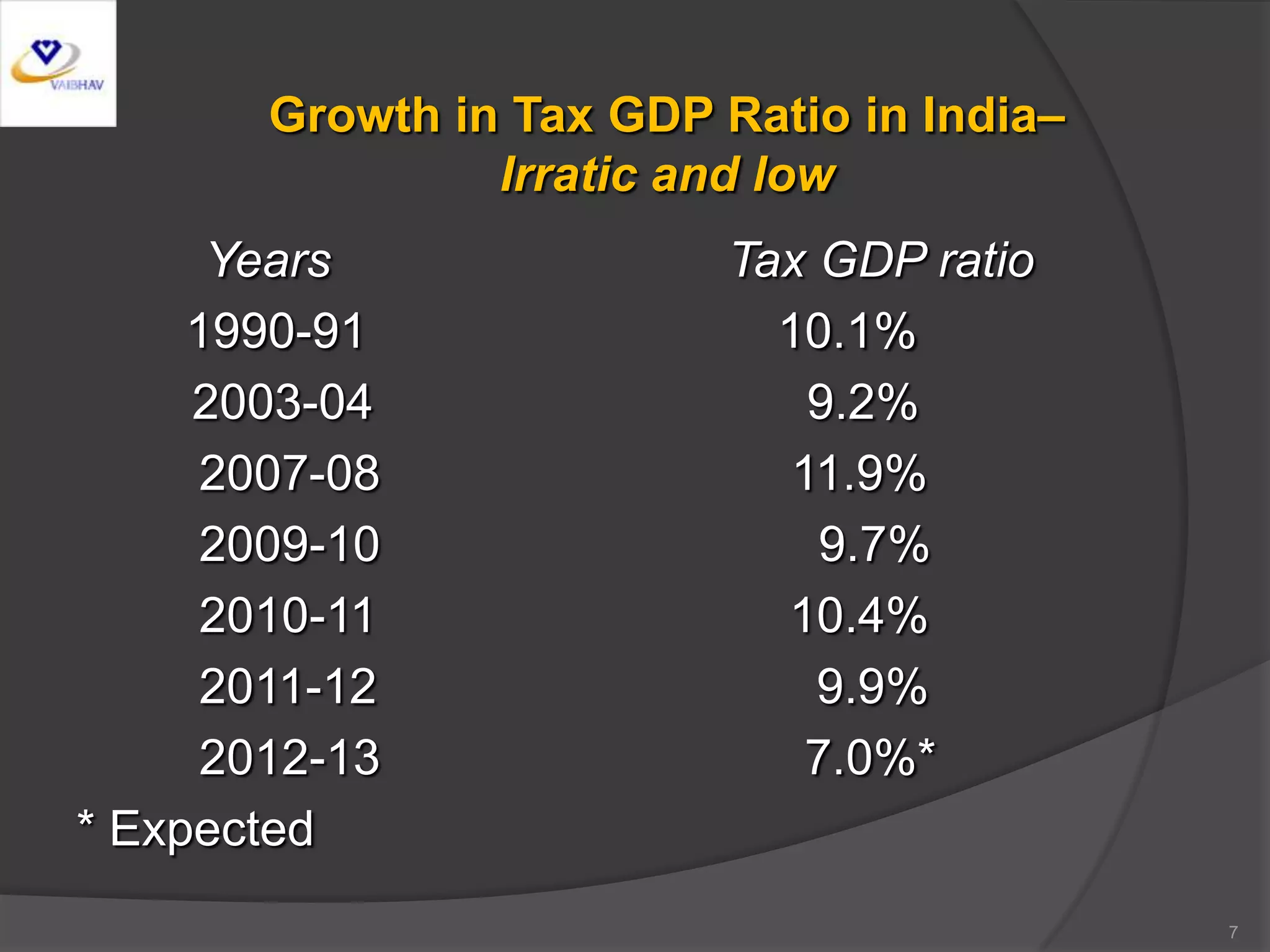

- An economic overview of the growing services sector in India and its contribution to GDP.

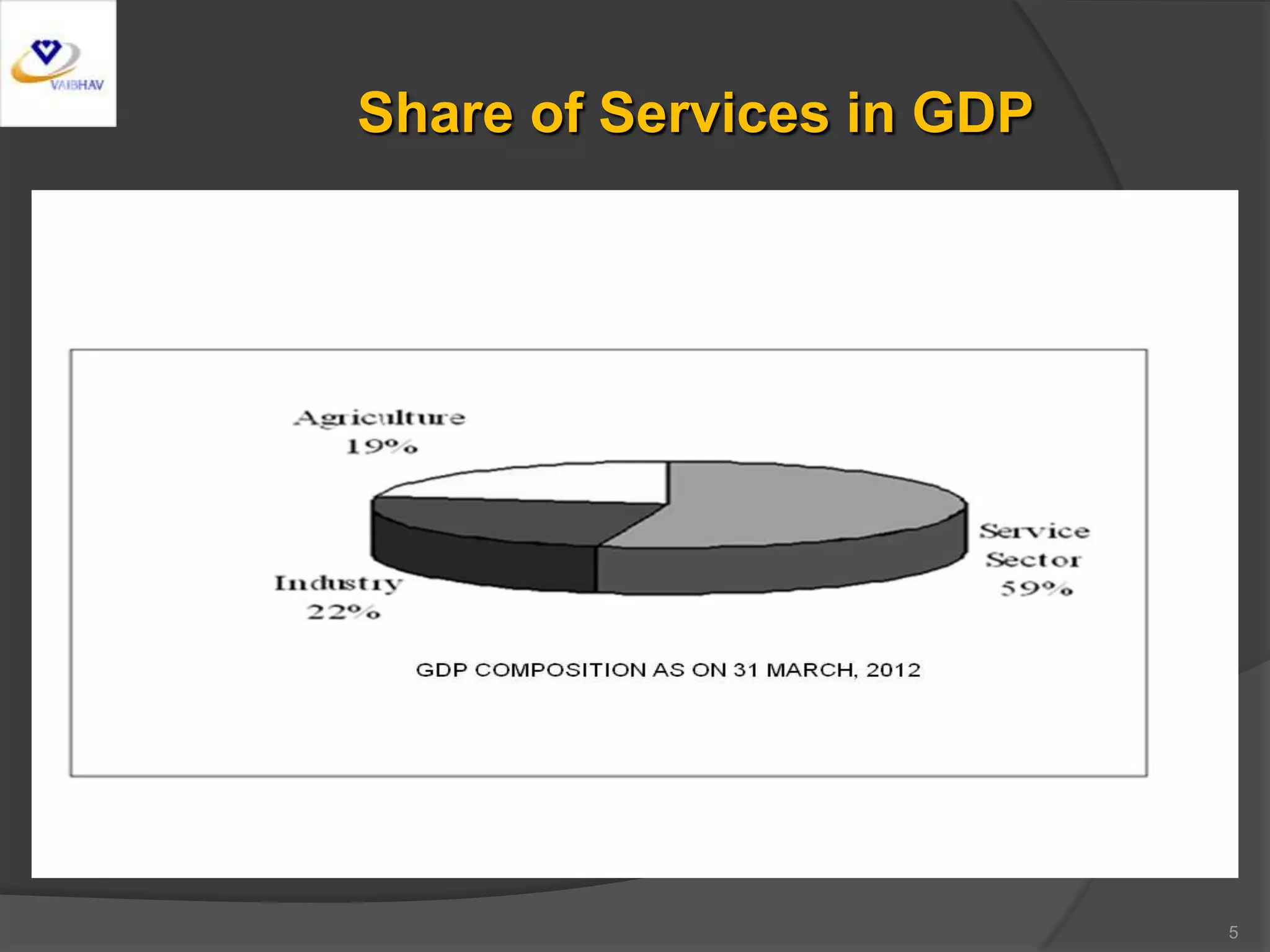

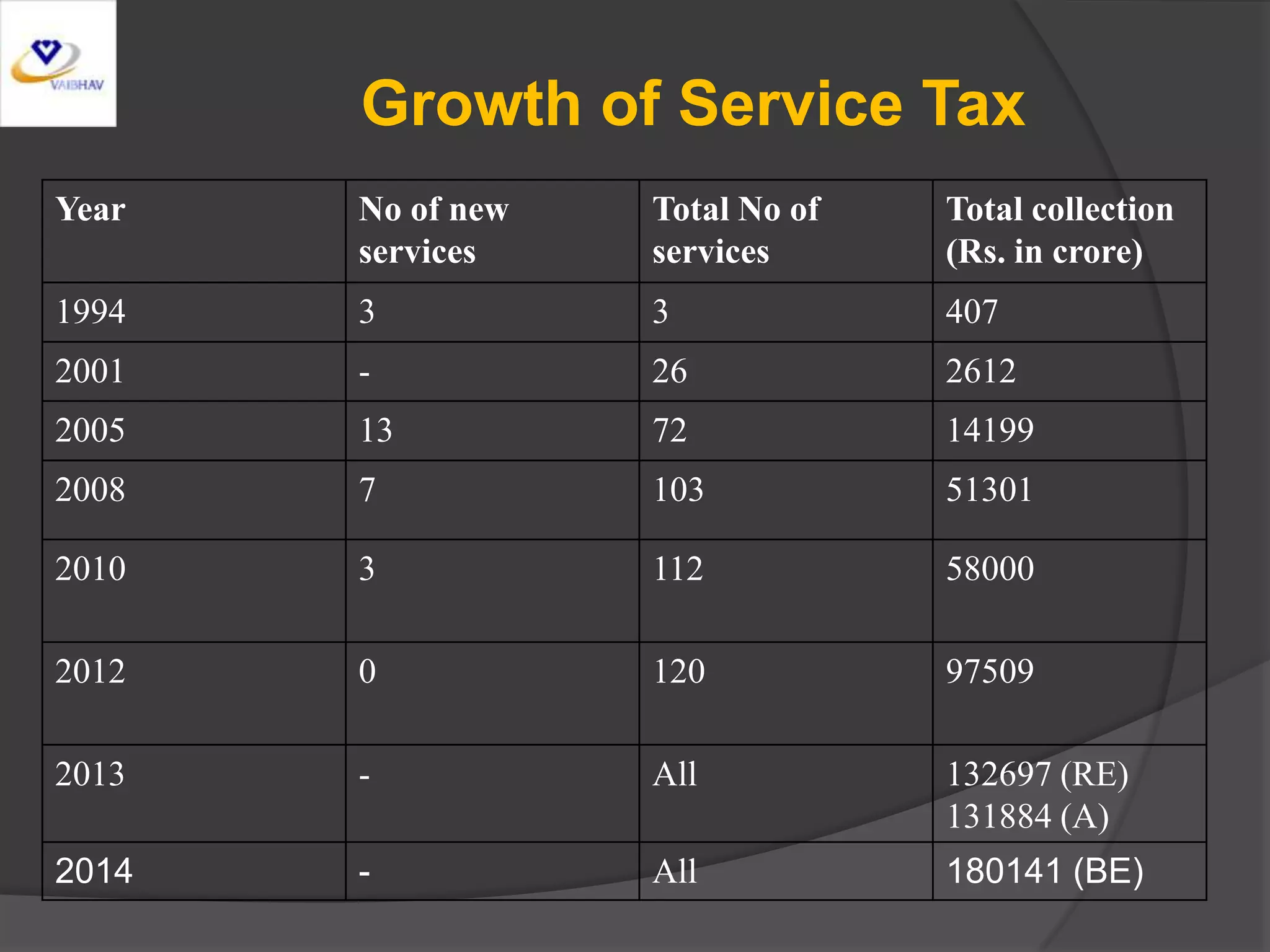

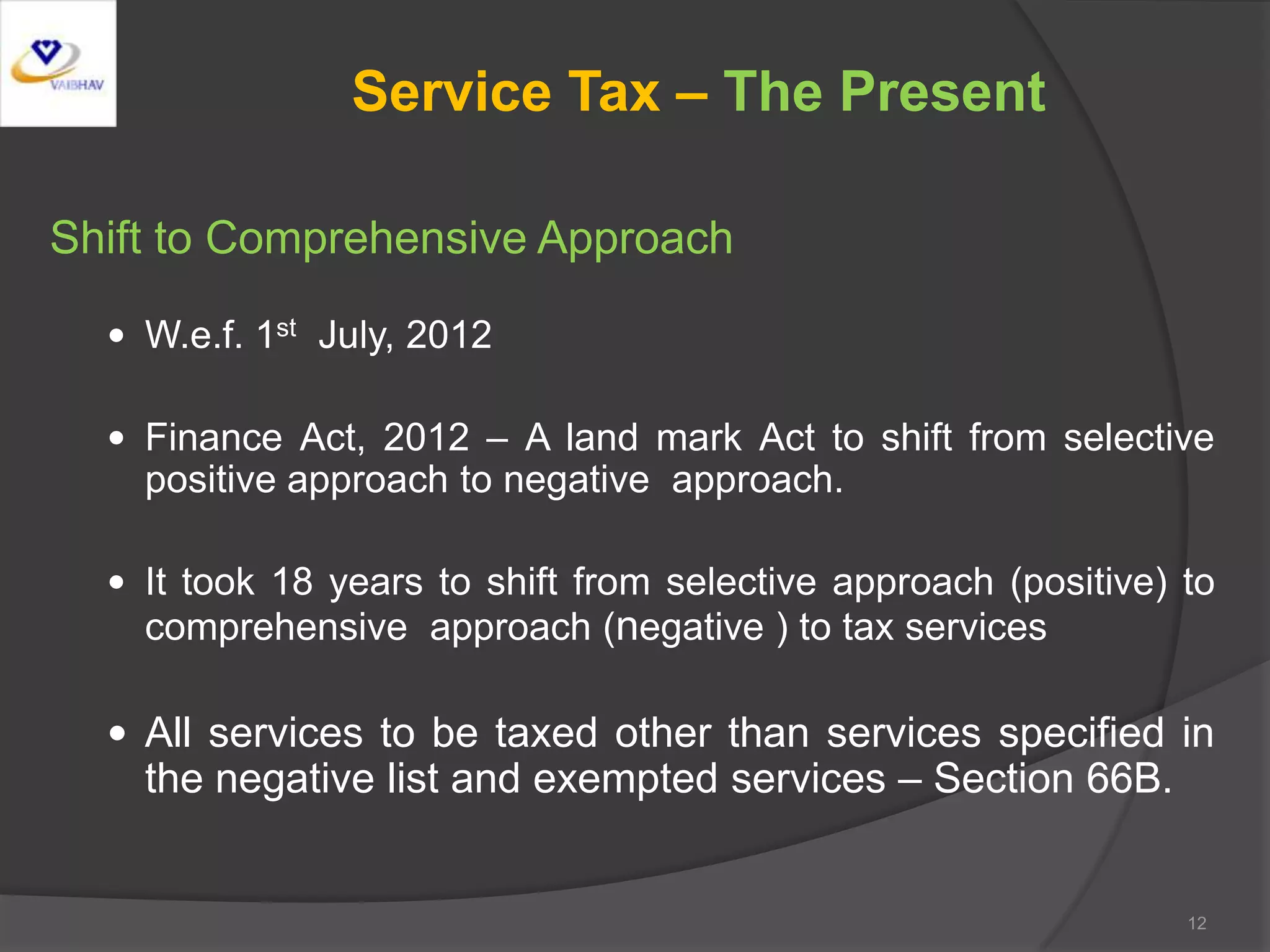

- A history of Service Tax in India, shifting from a selective to comprehensive approach in 2012.

- Major changes introduced in the 2012-2013 period, including defining 'service', introducing a negative list, new place of provision rules, and changes to exemptions.

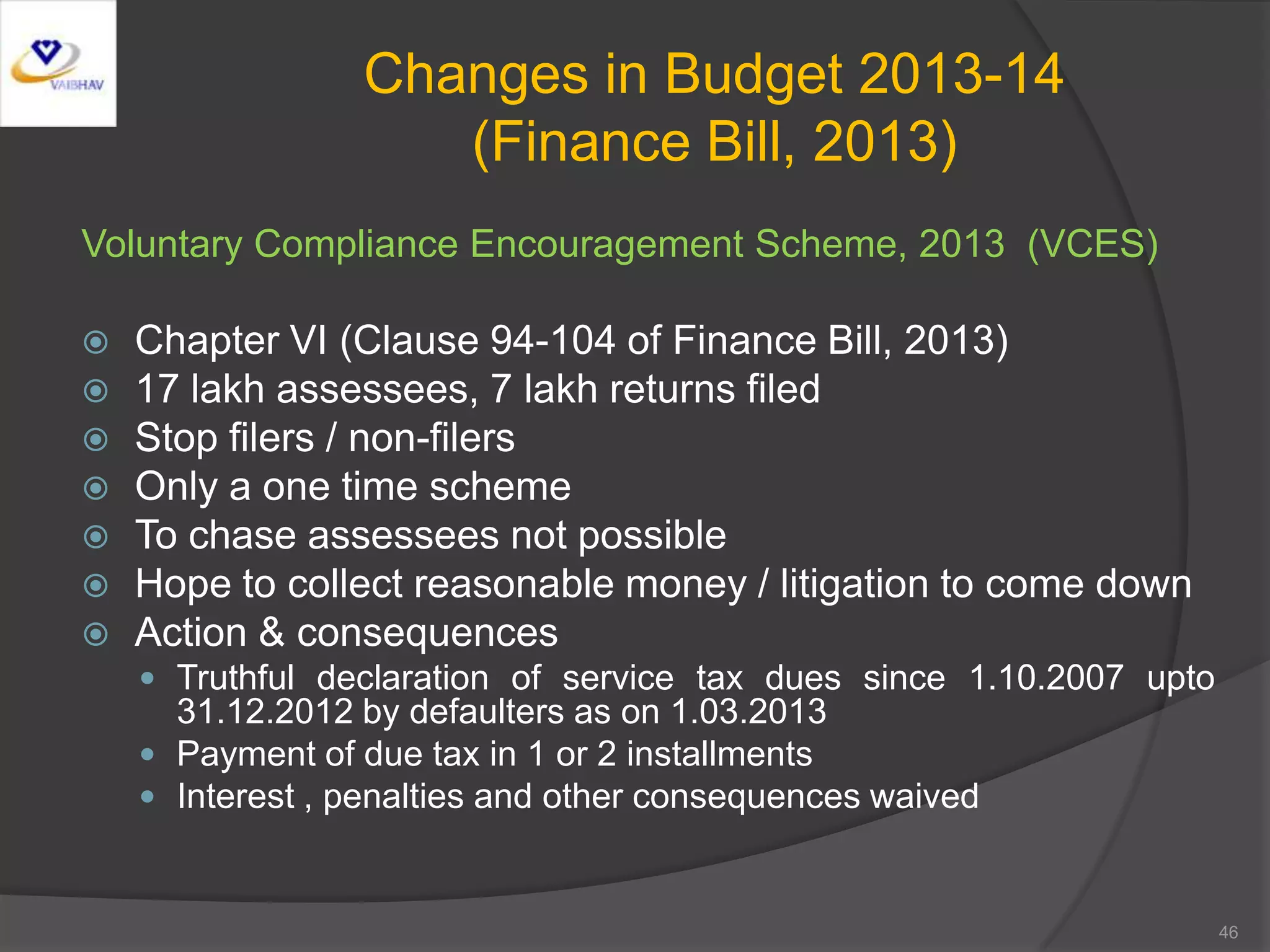

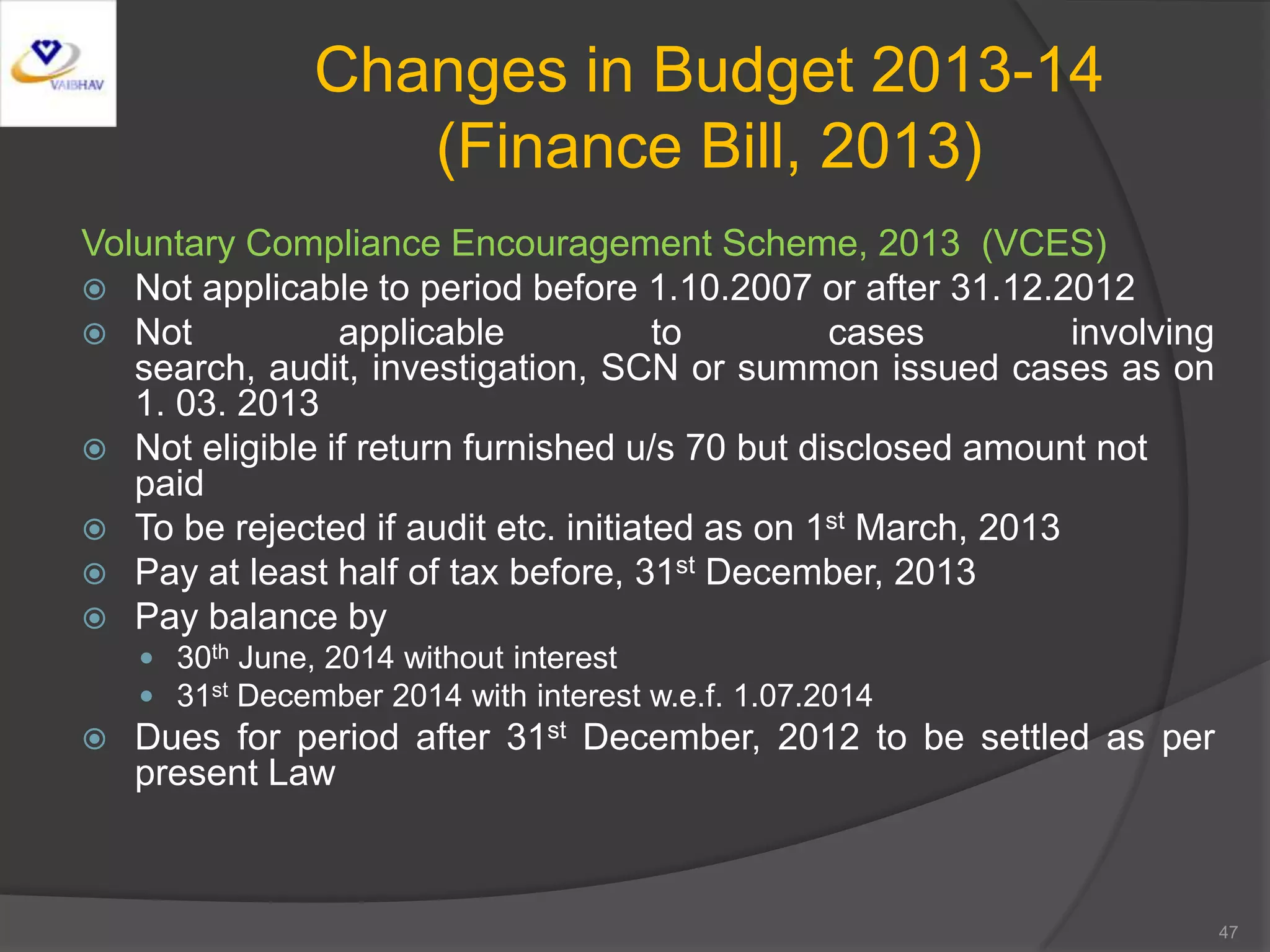

- Additional changes introduced in the 2013 budget, including some additions to the negative list and removal of exemptions.

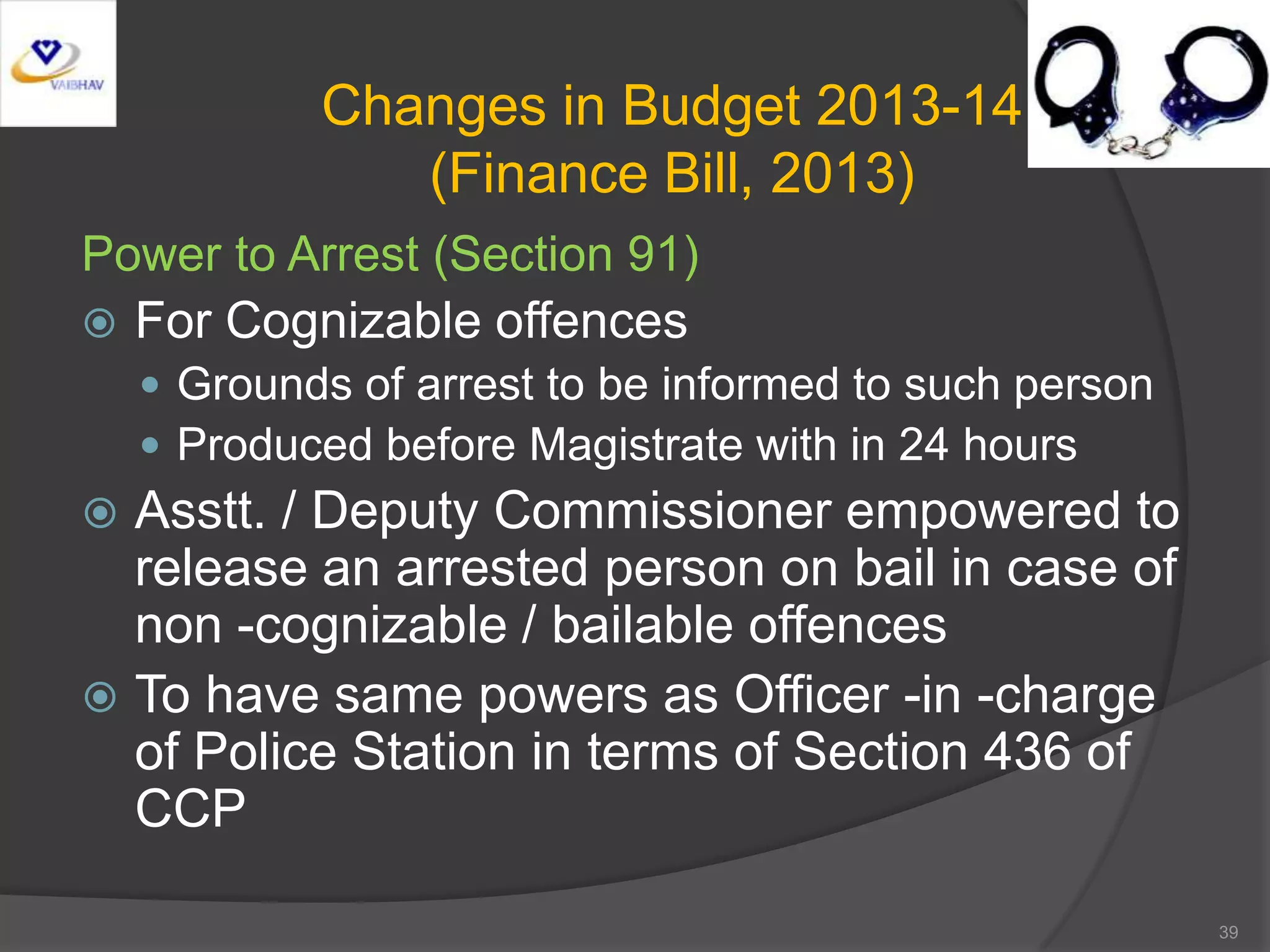

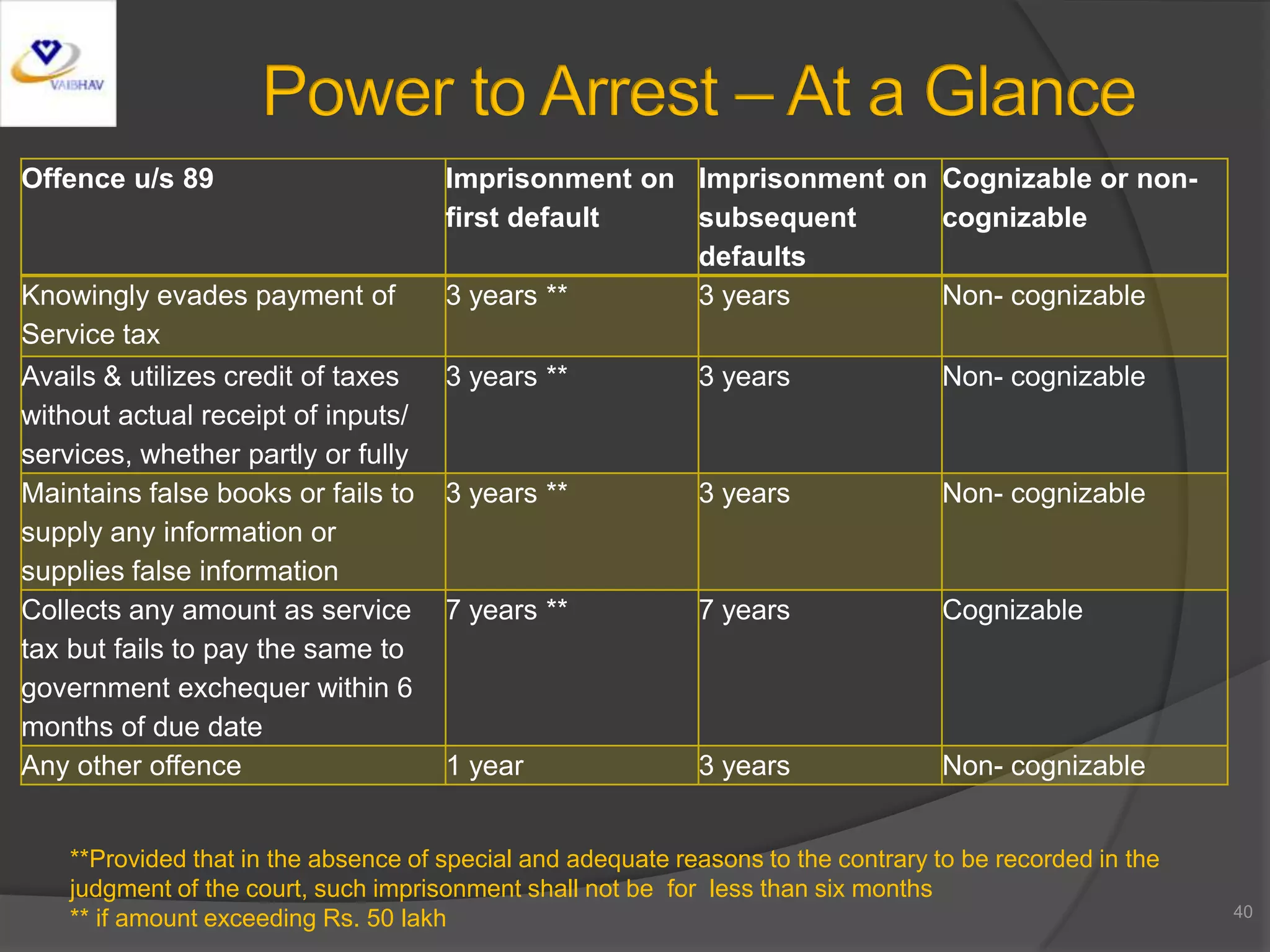

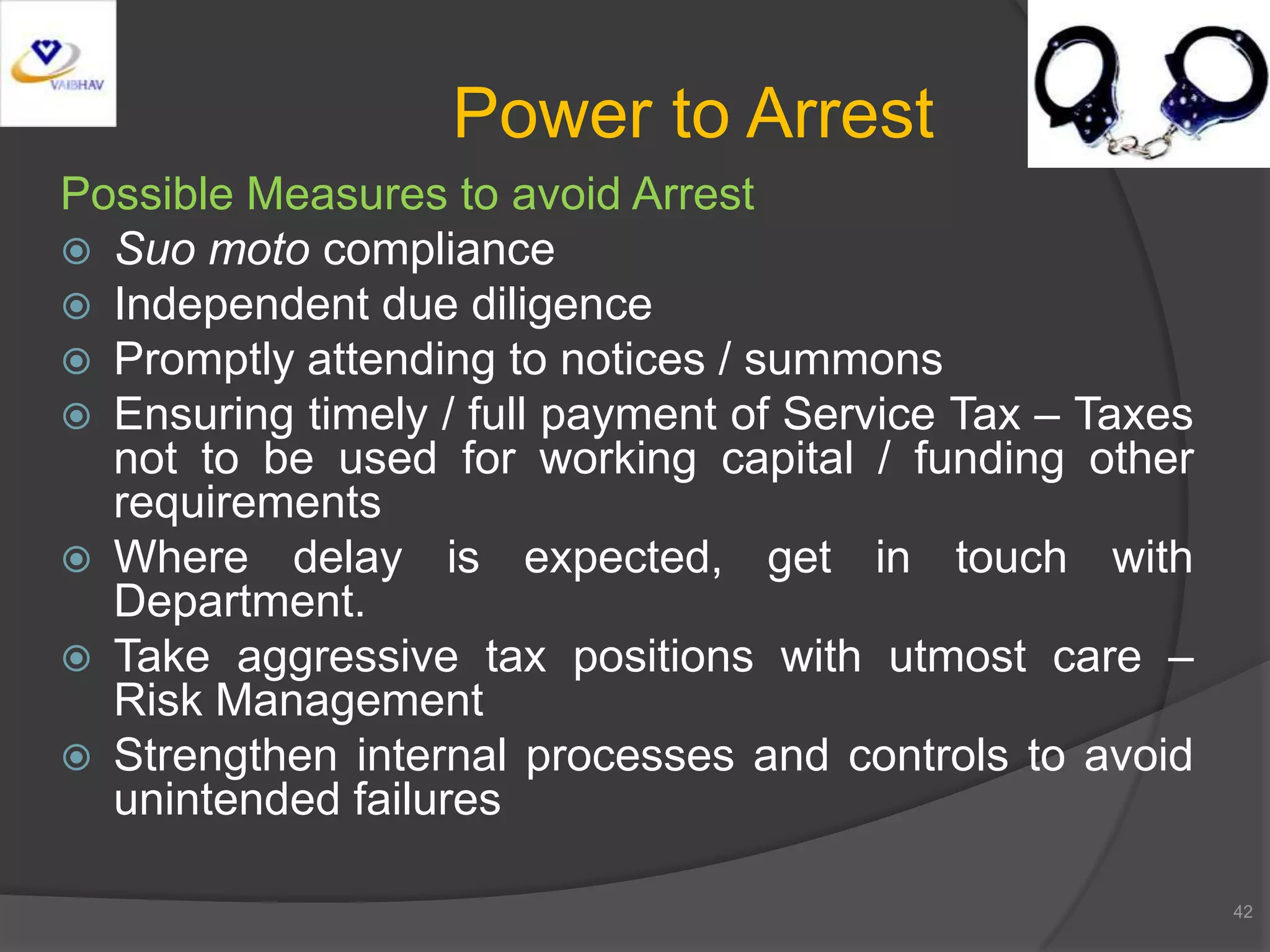

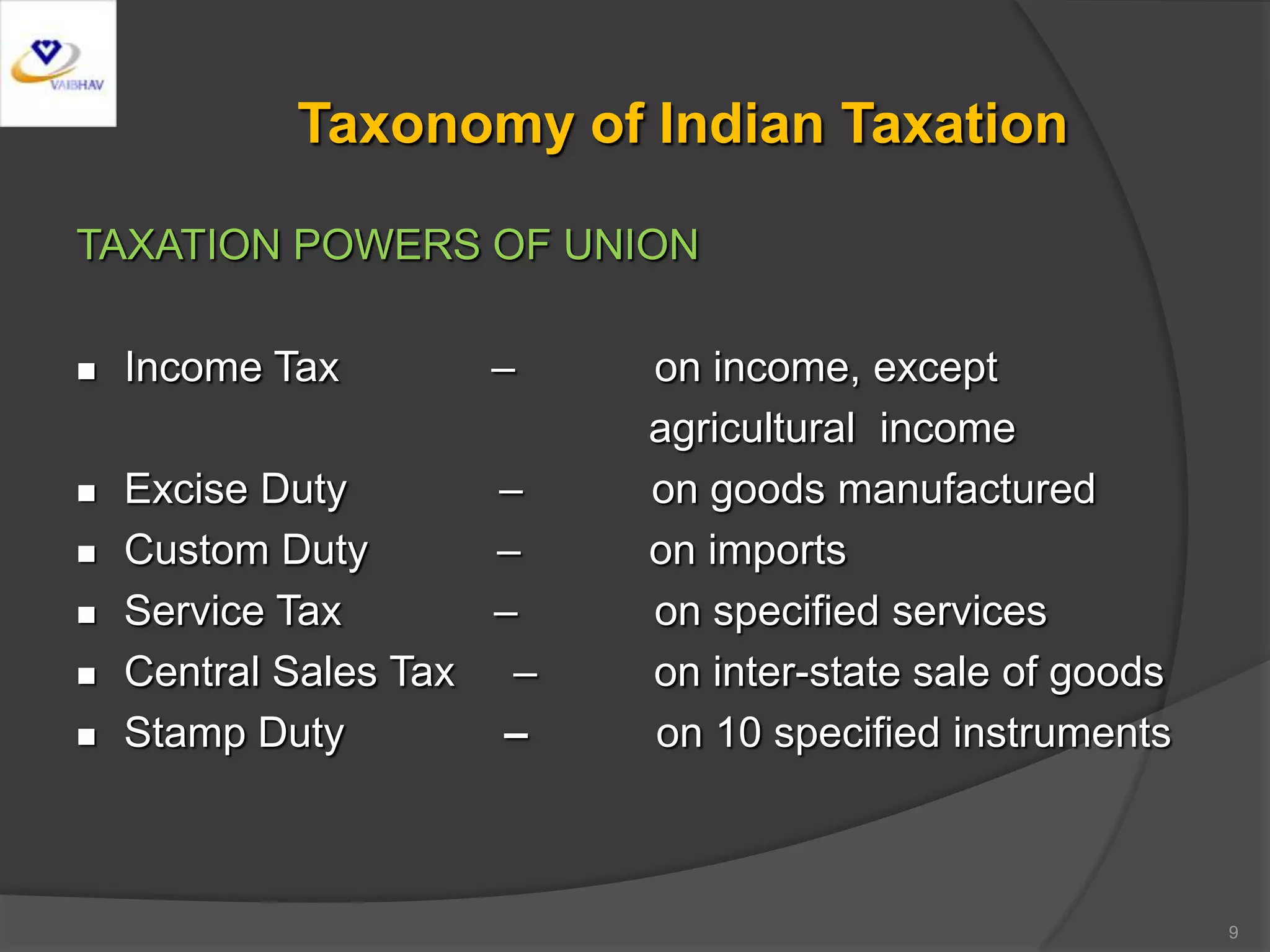

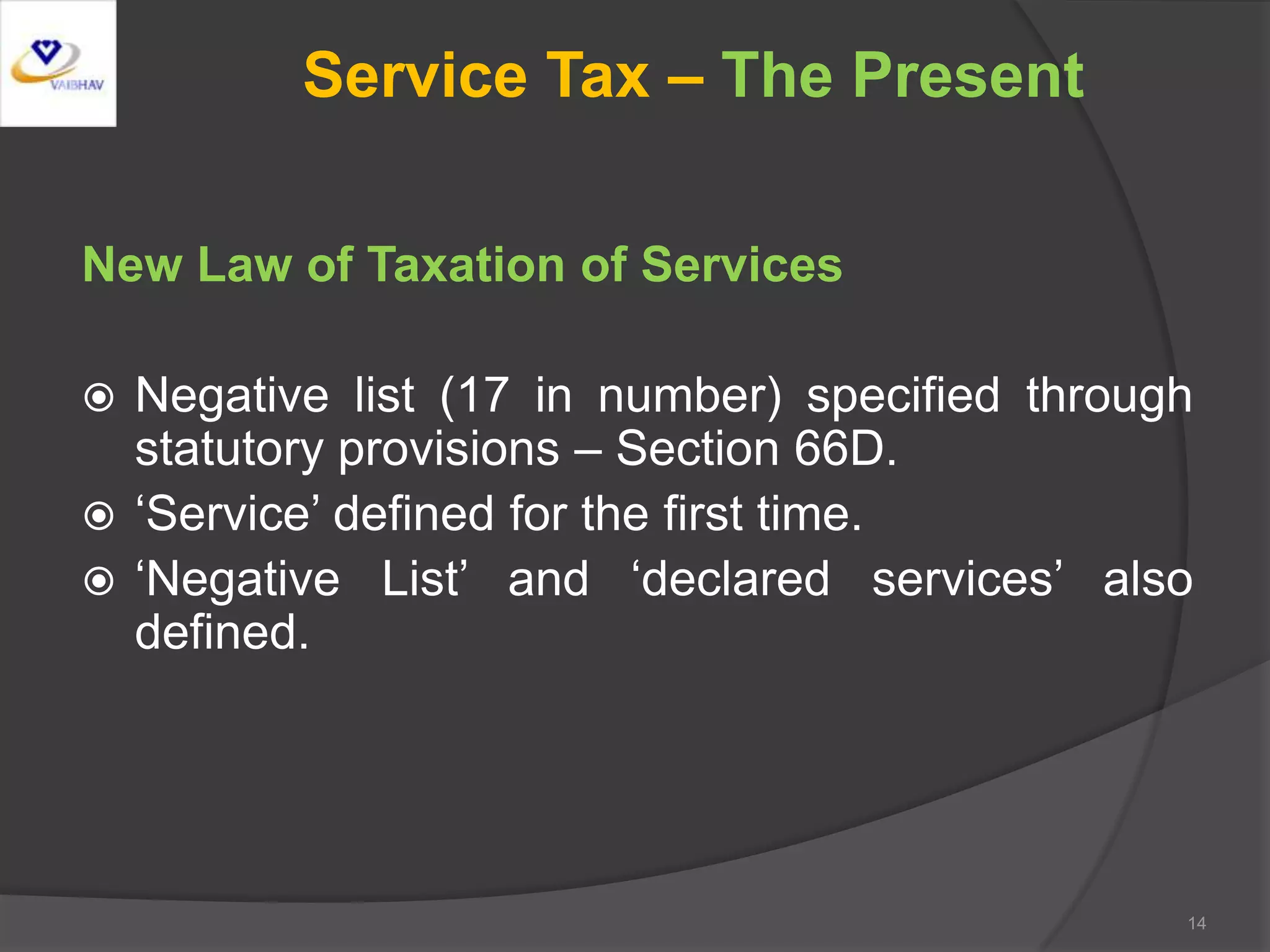

- New penal provisions introduced, including penalties for company officials and the power to arrest in certain cases of tax default.

![Service Tax in India (The Past)

Selective Approach to Service Tax

Taxation by choice

Service not defined but taxable service defined.

> 120 taxable services [section 65(105)]

Resulted in distortions / prejudice

Untapped tax potential

Economically unjustified

Issues – Classification, Illogical

definitions, Constitutional challenges, deemed

services etc.

11](https://image.slidesharecdn.com/sessioni-130422054113-phpapp01/75/Seminar-on-Service-Tax-at-Jaipur-on-20-4-2013-Session-i-11-2048.jpg)

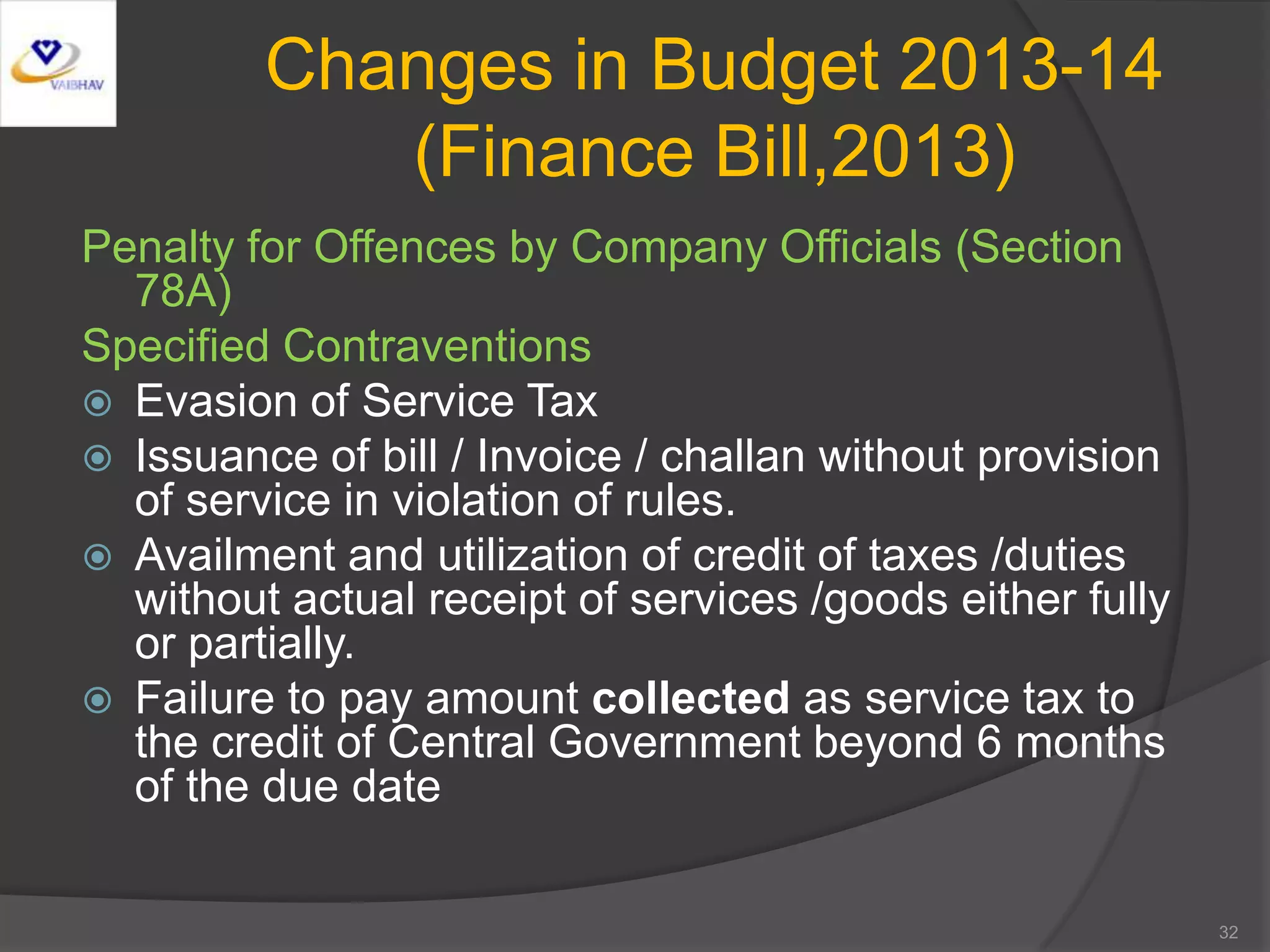

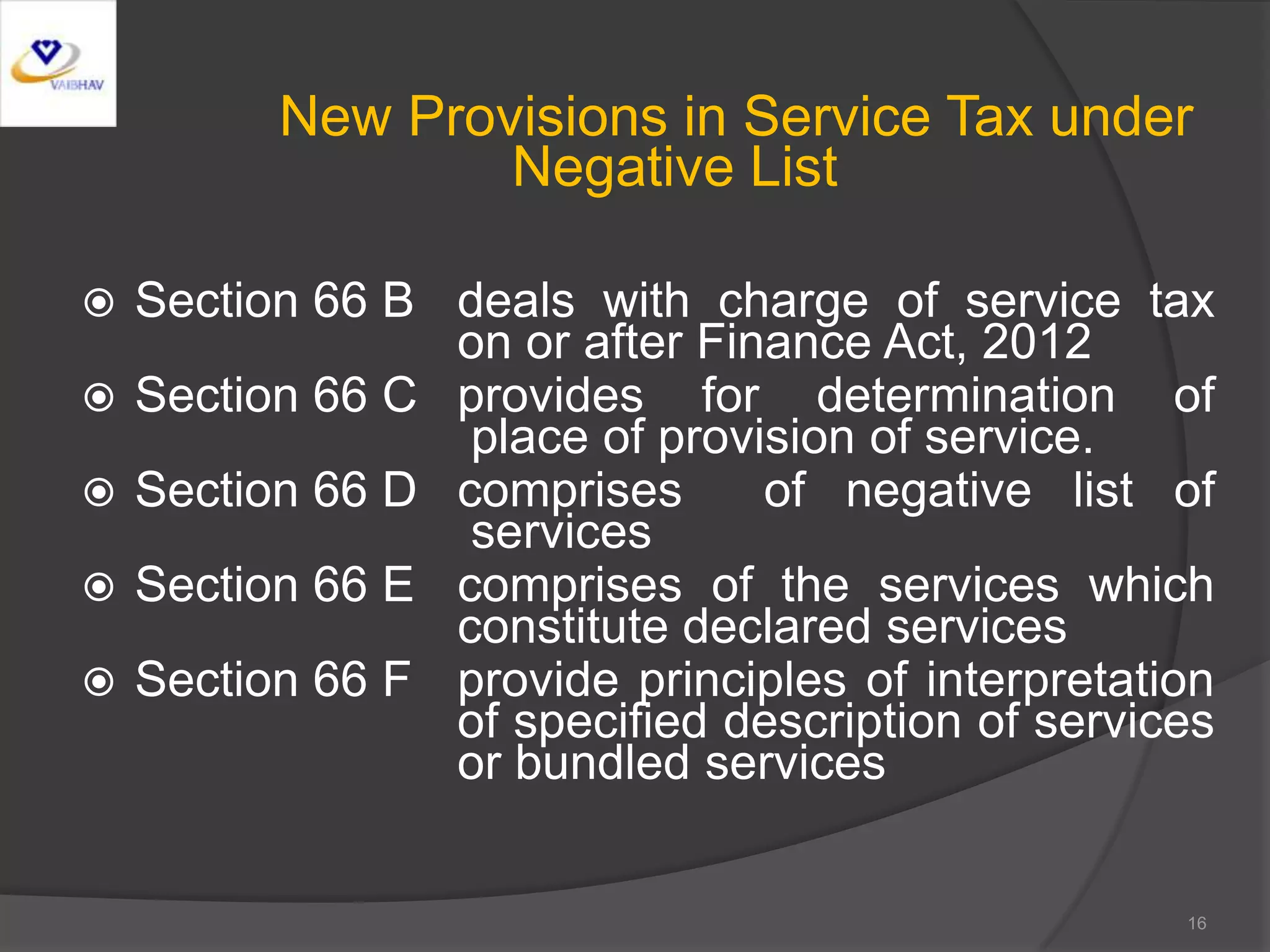

![Taxable Services w.e.f. 1.7.2012

All services Taxable

[section 65B (44)]

Declared services Taxable

(section 66E)

Services covered under Not Taxable

negative list of services

(section 66D)

Services exempt under Mega Exempted

Notification No. 25/2012-ST

dated 20.6.2012

Other specified Exemptions Exempted

17](https://image.slidesharecdn.com/sessioni-130422054113-phpapp01/75/Seminar-on-Service-Tax-at-Jaipur-on-20-4-2013-Session-i-17-2048.jpg)

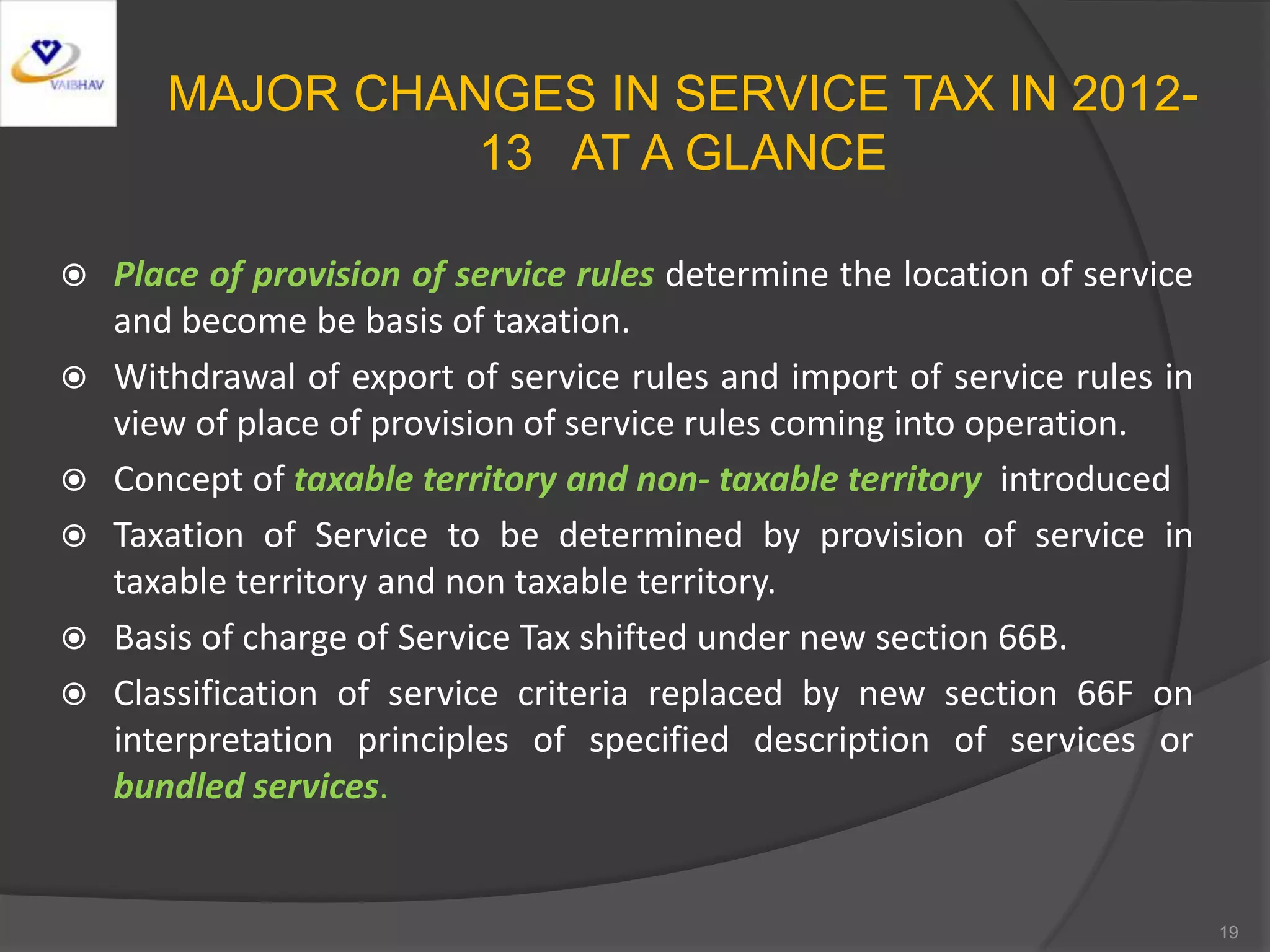

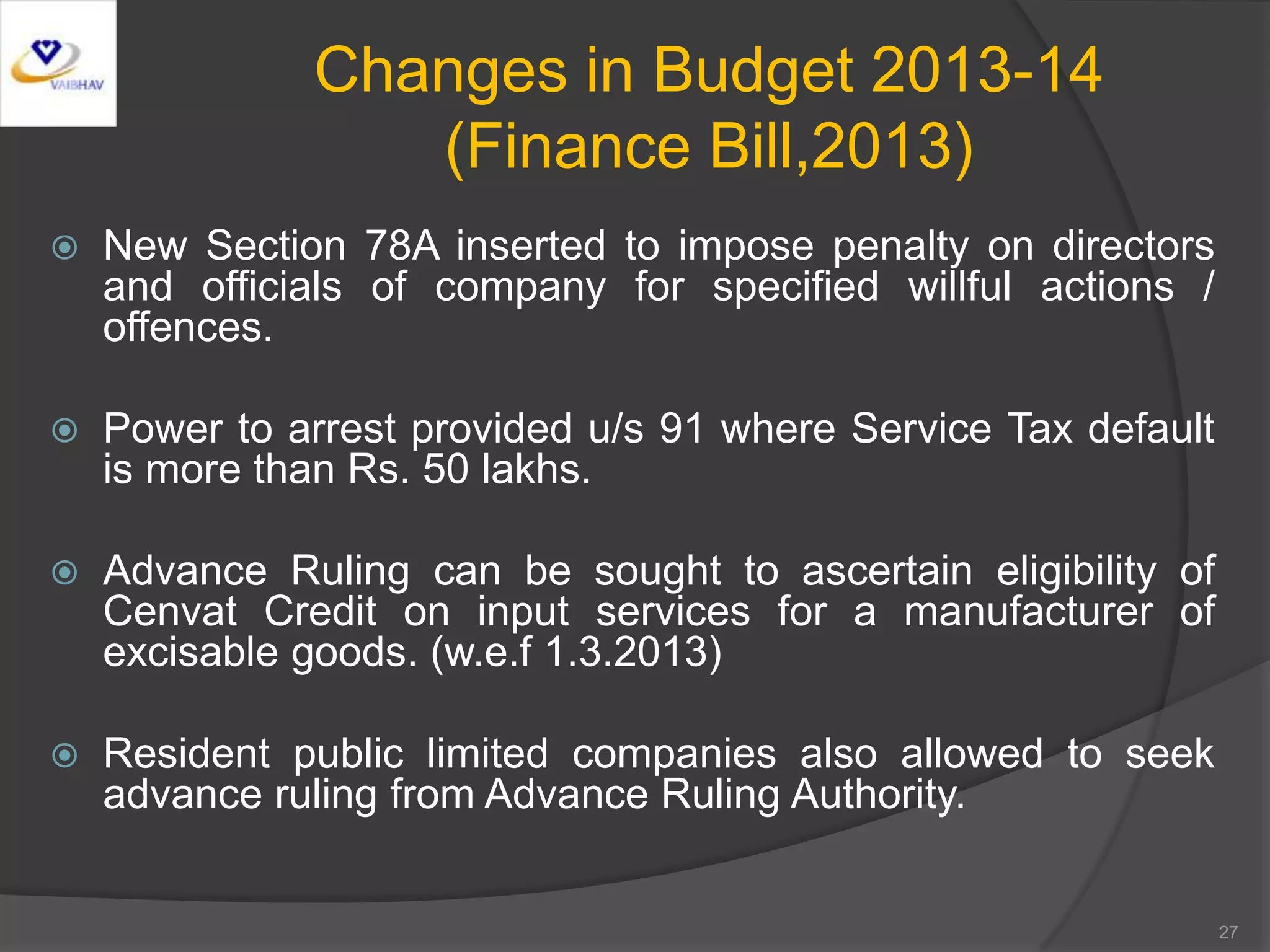

![Penalty for Non- registration

Penalty for failure to take registration (Section 77(1)(a)]

Now:

Penalty which may extend upto Rs. 10000 or Rs. 200 per

day during which default continues, whichever is

higher, starting from first day after due date till the date of

actual compliance

Proposed:

Penalty which may extend upto Rs. 10000

Penalty not to exceed Rs. 10000 in any case

For non payment, there are already strict penalties u/s 76

and 78

30

New Penal Provisions](https://image.slidesharecdn.com/sessioni-130422054113-phpapp01/75/Seminar-on-Service-Tax-at-Jaipur-on-20-4-2013-Session-i-30-2048.jpg)