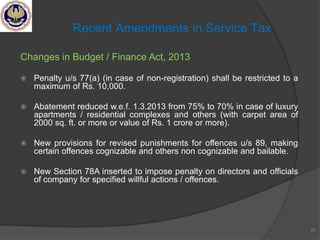

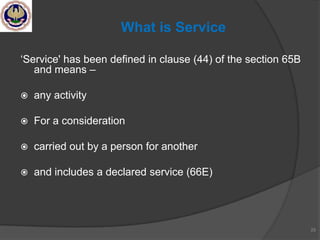

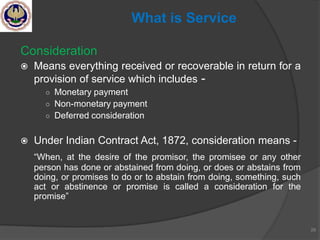

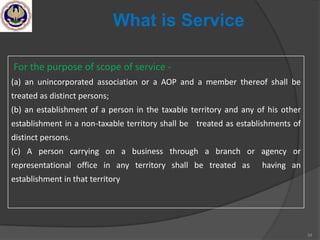

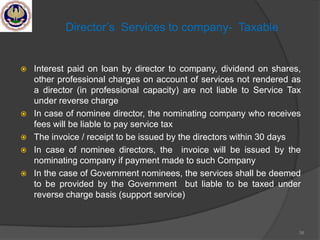

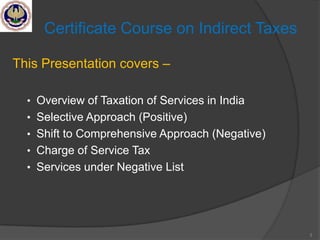

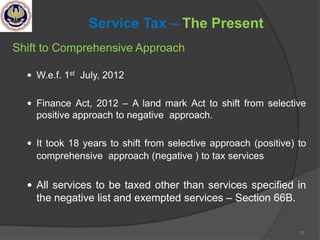

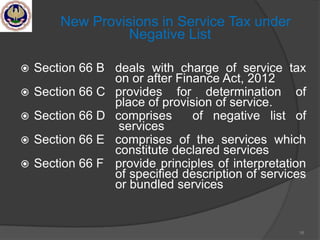

This document provides an overview of a presentation on service tax given on July 28th, 2013. The presentation covers the shift from India's previous selective approach to taxation of services to its current comprehensive negative list approach. Key points covered include definitions of service, consideration, and person. India's service sector has grown significantly as a percentage of GDP. Under the new negative list system, all services are taxable unless specifically excluded by the negative list or an exemption.

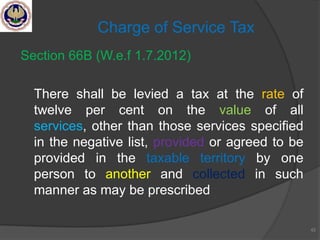

![11

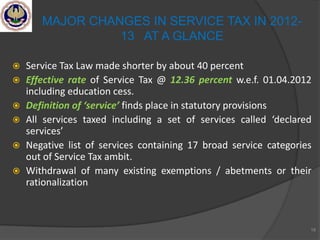

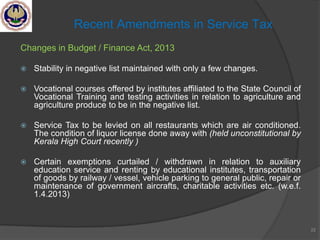

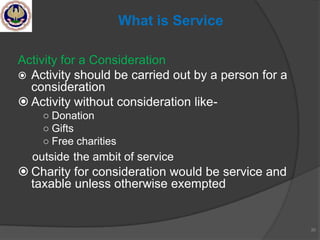

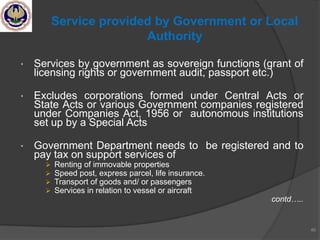

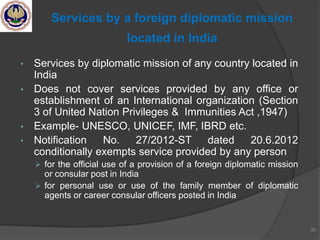

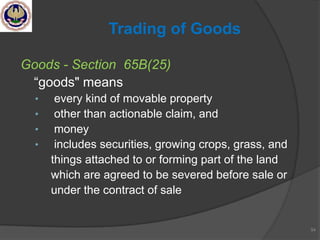

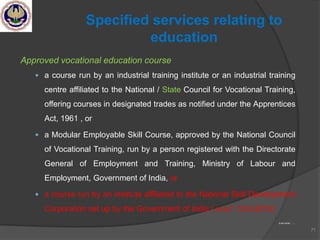

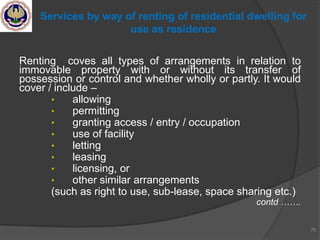

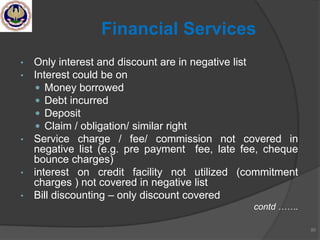

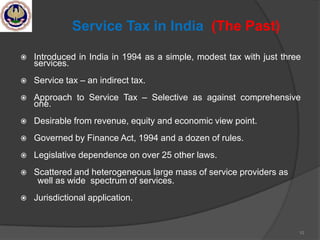

Service Tax in India (The Past)

Selective Approach to Service Tax

Taxation by choice

Service not defined but taxable service defined.

> 120 taxable services [section 65(105)]

Resulted in distortions / prejudice

Untapped tax potential

Economically unjustified

Issues – Classification, Illogical definitions,

Constitutional challenges, deemed services etc.](https://image.slidesharecdn.com/sessioni-130813041359-phpapp01/85/Presentation-on-Service-Tax-at-Ernakulam-dated-28-07-2013-11-320.jpg)

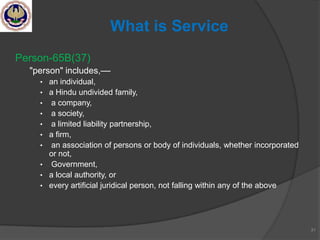

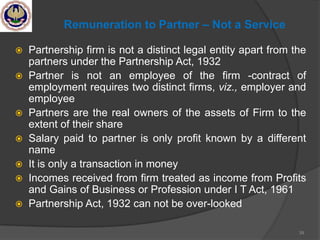

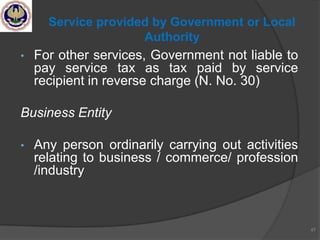

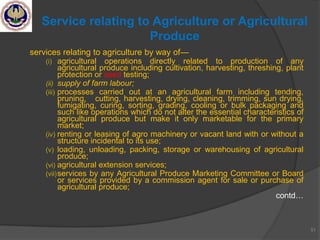

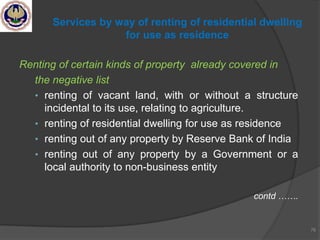

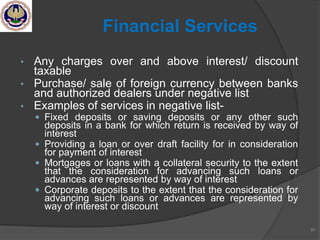

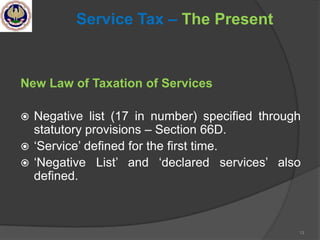

![17

Taxable Services w.e.f. 1.7.2012

All services Taxable

[section 65B (44)]

Declared services Taxable

(section 66E)

Services covered under Not Taxable

negative list of services

(section 66D)

Services exempt under Mega Exempted

Notification No. 25/2012-ST

dated 20.6.2012

Other specified Exemptions Exempted](https://image.slidesharecdn.com/sessioni-130813041359-phpapp01/85/Presentation-on-Service-Tax-at-Ernakulam-dated-28-07-2013-17-320.jpg)