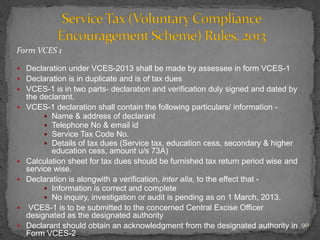

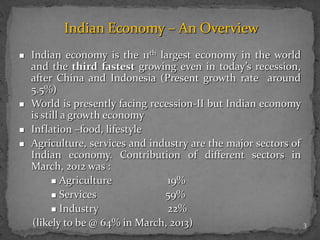

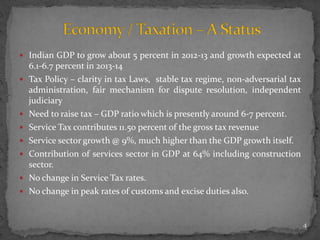

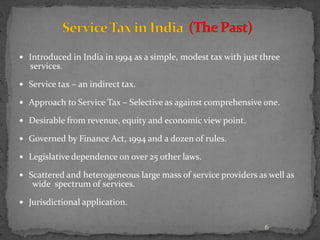

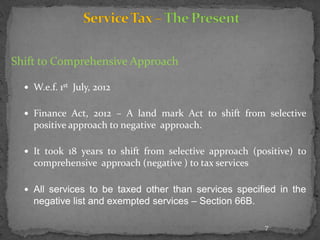

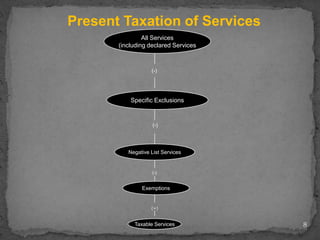

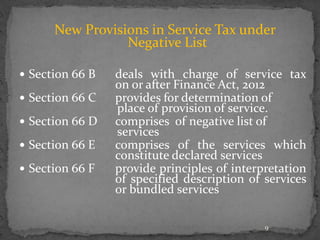

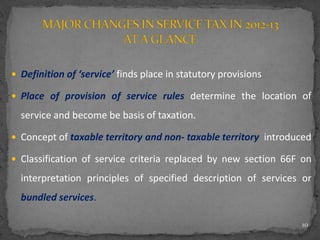

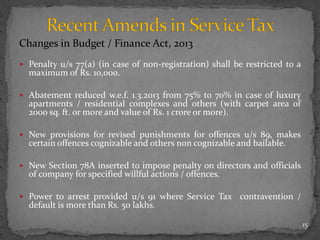

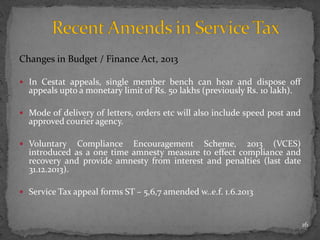

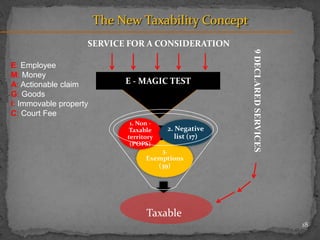

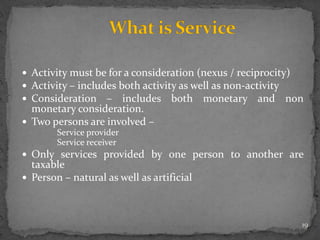

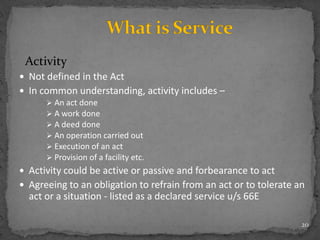

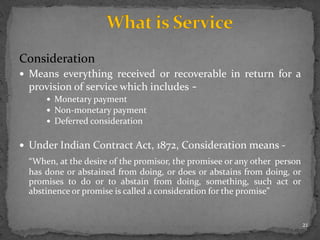

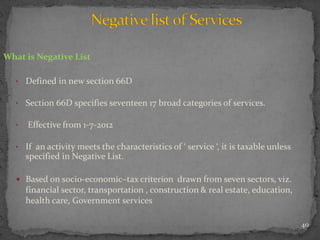

The document provides an overview of the Indian economy and service tax in India. It discusses the shift in 2012 to a negative list approach where all services are taxed unless specifically exempted. Key points include:

- Services now taxed unless in the negative list or exempted

- Definition of service broadened and place of supply rules introduced

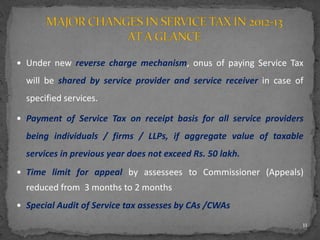

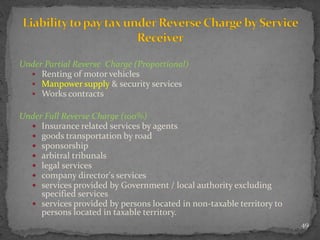

- Reverse charge and other compliance changes implemented

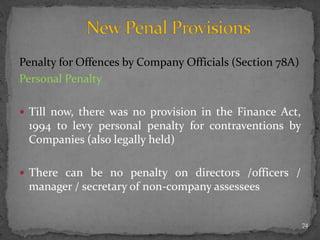

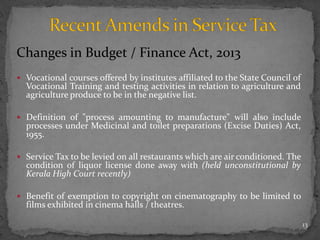

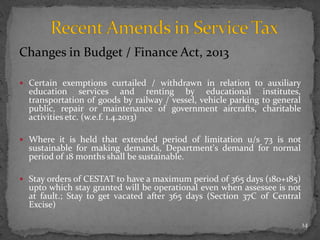

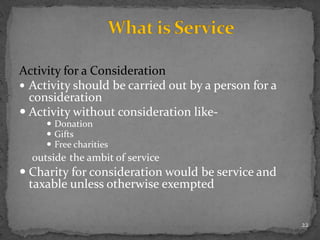

- Exemptions removed and penalties strengthened in the 2013 budget

- Voluntary compliance scheme introduced to boost tax collection

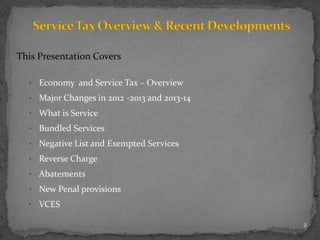

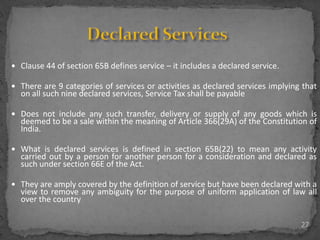

![Agreeing to an obligation to refrain from an Act / to tolerate Act or situation

/ to do an Act [section 66E(e)]

Following activities if carried out by a person for another for

consideration would be treated as provision of service -

Agreeing to an obligation to refrain from an act.

Agreeing to an obligation to tolerate an act or a situation.

Agreeing to an obligation to do an act.

30

Declared Services](https://image.slidesharecdn.com/presentationdated06-07-2013-130706032607-phpapp01/85/A-Presentation-on-Service-Tax-Overview-and-Recent-Developments-dated-06-07-2013-30-320.jpg)

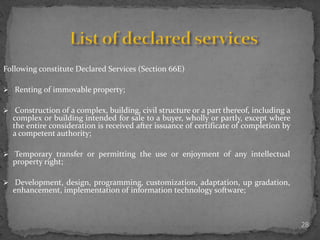

![32

Works Contract [65B(54)]

“Works Contract” means a contract wherein transfer of

property in goods involved in the execution of such contract is

leviable to tax as sale of goods and such contract is for the

purpose of carrying out construction, erection, commissioning,

installation, completion, fitting out, repair, maintenance,

renovation, alteration of any movable or immovable property

or for carrying out any other similar activity or a part thereof in

relation to such property.](https://image.slidesharecdn.com/presentationdated06-07-2013-130706032607-phpapp01/85/A-Presentation-on-Service-Tax-Overview-and-Recent-Developments-dated-06-07-2013-32-320.jpg)

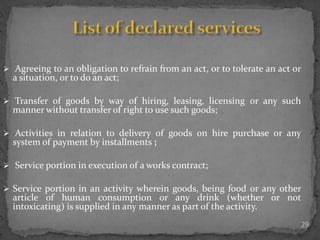

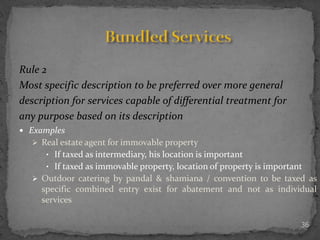

![34

Principles of Interpretation of specific description of services [section 66F]

Section 65A dealing with classification of taxable services omitted w.e.f.

1.7.2012

useful in deciding whether a service falls in negative list / exemptions /

declared services

composite v bundled service

bundled service –

collection of services / tied up services

more than one service

element of one service combined with element of provision of other

service (s).

Examples - Mailing done by RTI, Air traveling and catering therein

Earlier issue – which taxable service

Now – whether any activity is a ‘service’ or not a ‘service’.](https://image.slidesharecdn.com/presentationdated06-07-2013-130706032607-phpapp01/85/A-Presentation-on-Service-Tax-Overview-and-Recent-Developments-dated-06-07-2013-34-320.jpg)

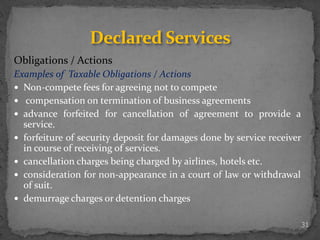

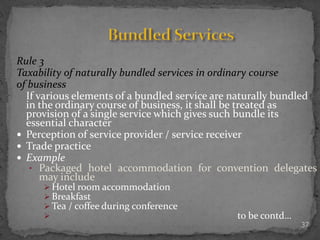

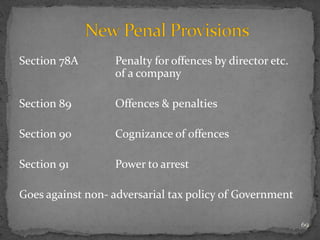

![Penalty for Non- registration

Penalty for failure to take registration (Section 77(1)(a)]

Earlier

Penalty which may extend upto Rs. 10000 or Rs. 200 per day

during which default continues, whichever is higher, starting

from first day after due date till the date of actual compliance

Now (w.e.f. 10.5.2013)

Penalty which may extend upto Rs. 10000

Penalty not to exceed Rs. 10000 in any case

For non payment, there are already strict penalties u/s 76 and 78

70](https://image.slidesharecdn.com/presentationdated06-07-2013-130706032607-phpapp01/85/A-Presentation-on-Service-Tax-Overview-and-Recent-Developments-dated-06-07-2013-70-320.jpg)