The document presents an overview of the key changes to India's service tax law as amended in 2014, including:

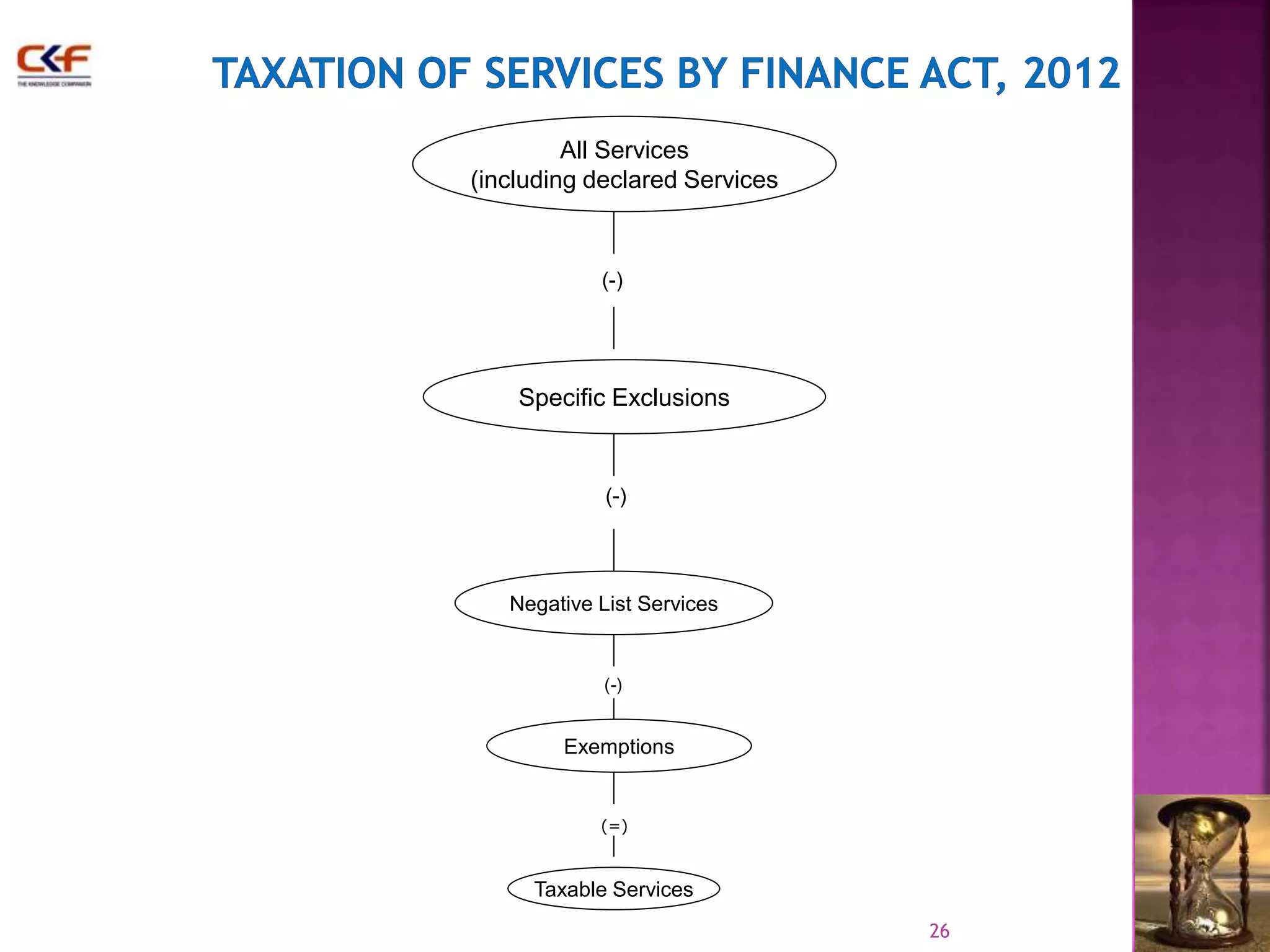

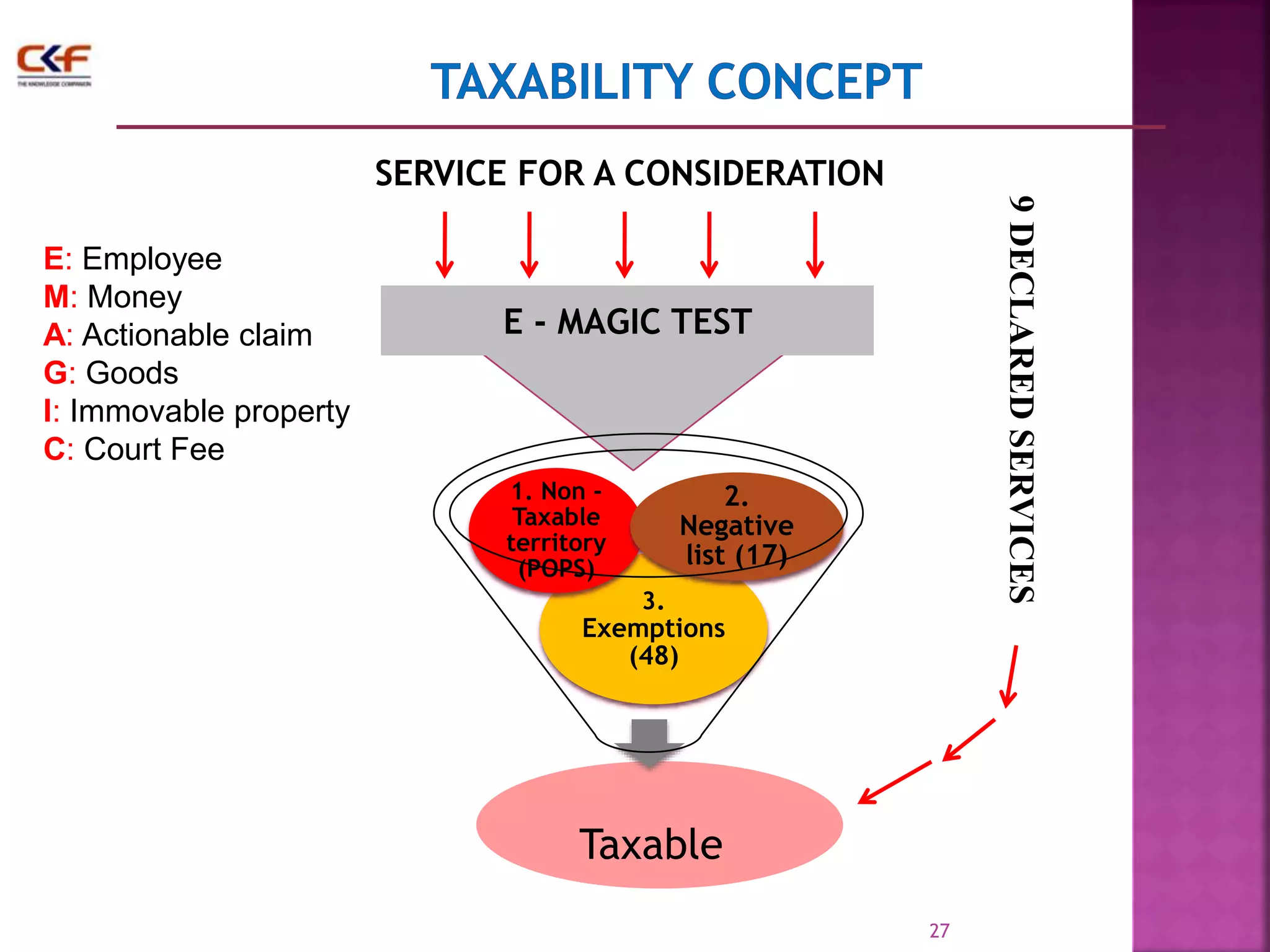

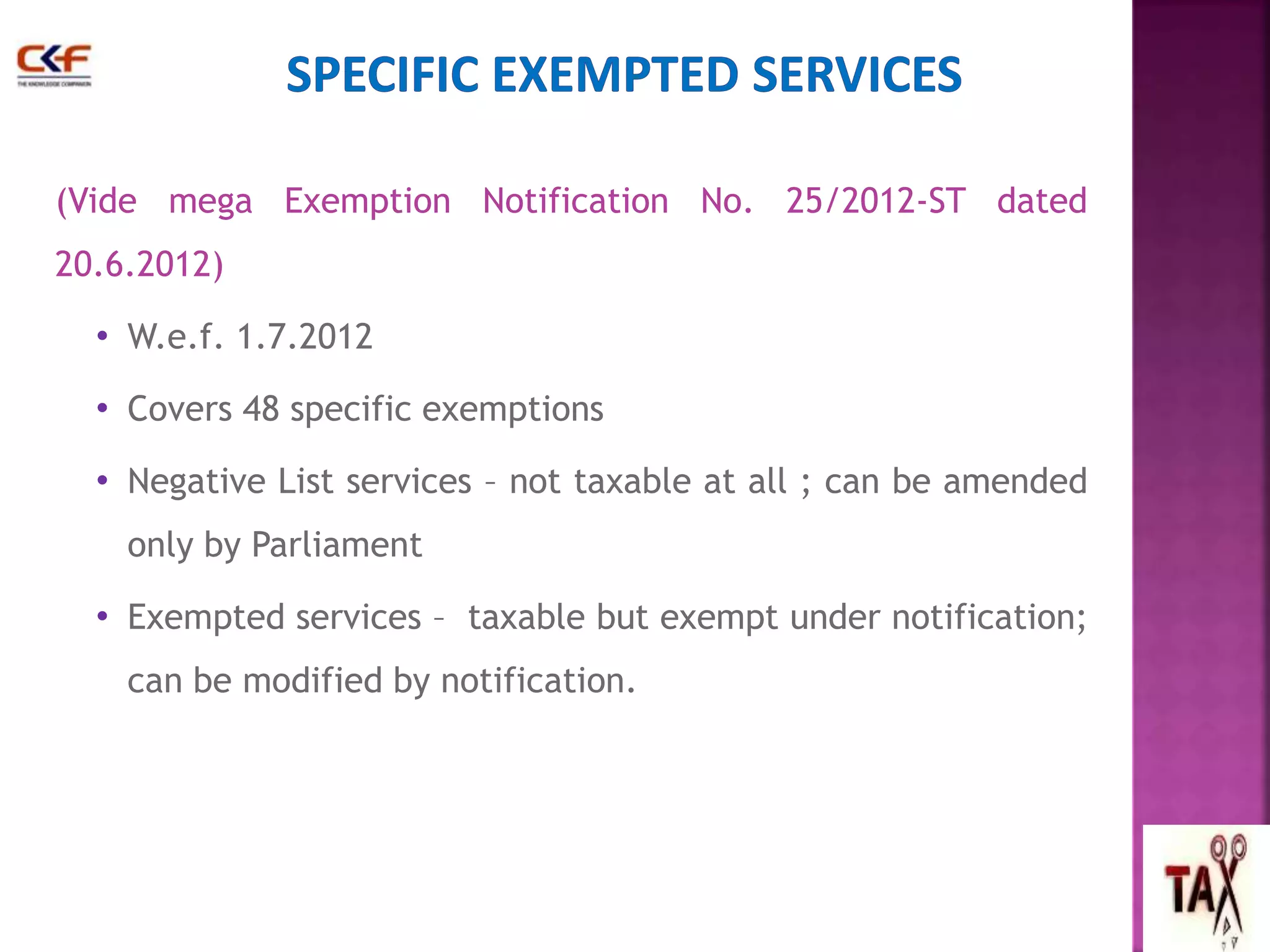

- Service tax now applies to all services by default, except those specified in the negative list or exempted. Previously only certain specified services were taxable.

- There are now 17 categories of services specified in the negative list that are not subject to service tax.

- Several other changes were made, such as directors' services to companies now being taxable under service tax.

The workshop aimed to educate participants on understanding the amended service tax law and highlighted major provisions around the definition of taxable services, the negative list approach, exemptions and other key changes introduced in the 2014 budget.

![• Chapter V, VA and VI of the Finance Act, 1994 (section 64 to 114) contains provision

of Service Tax.

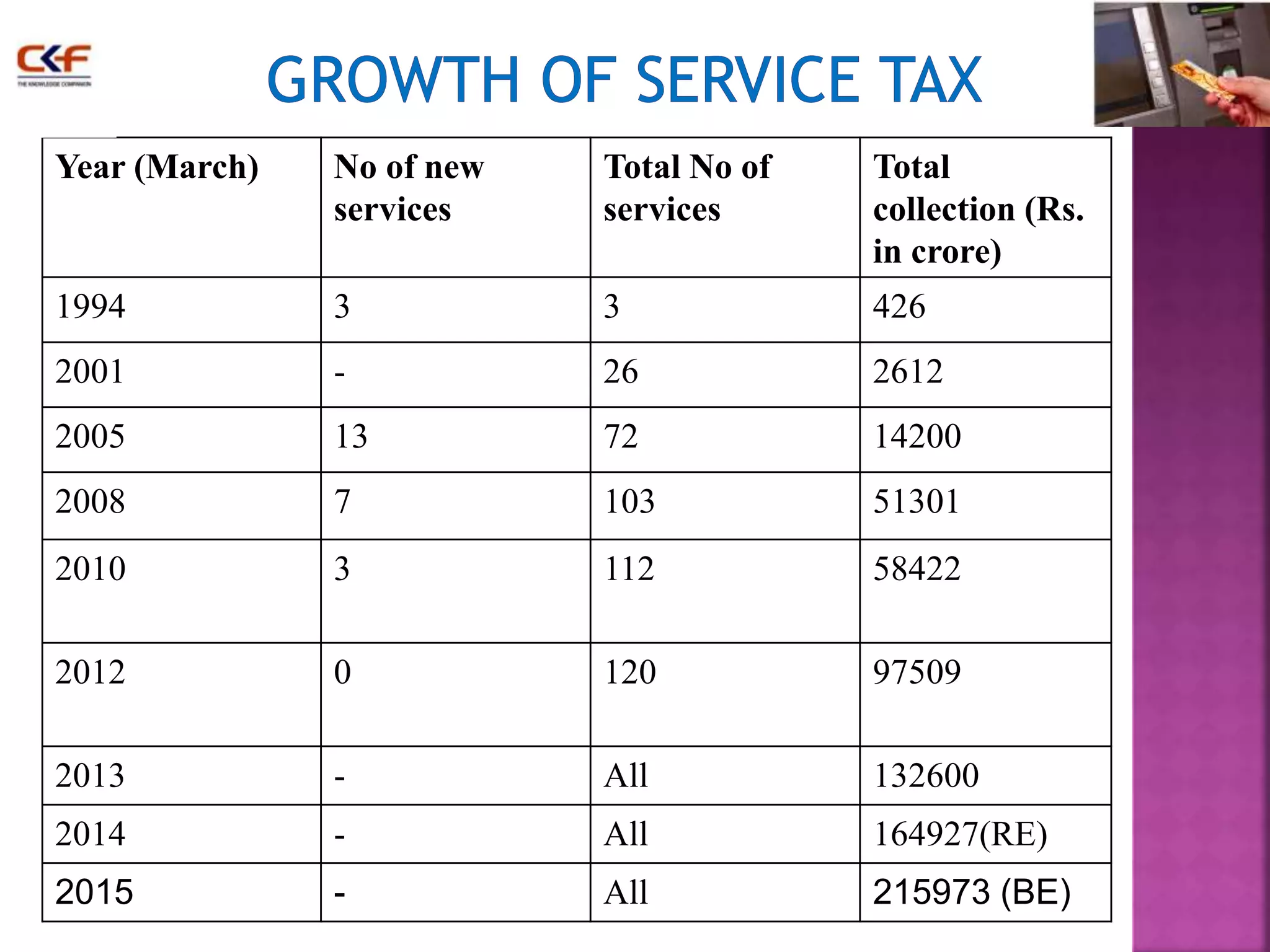

• In 1994, Service Tax was introduced by levy on only three services with selective

approach.

• Service Tax is an indirect tax leviable on the provision of service

• Destination based consumption tax recoverable from consumer / recipient.

• Desirable from revenue, equity and economic view point.

• Governed by Finance Act, 1994 and a dozen of rules.

• Legislative dependence on over 25 other laws.

• Selective approach has been shifted to comprehensive approach in 2012

• Upto 30.06.2012, > 120 taxable services [section 65(105)]

• W.e.f. 01.07.2012, all services other than services specified in negative list &

exempted services liable to service tax.

• Negative List (17 in number) specified through statutory provisions – section 66D](https://image.slidesharecdn.com/session1-140904044412-phpapp02/75/Workshop-on-Understanding-the-Amended-law-of-Service-Tax-dated-29-08-2014-Session-1-6-2048.jpg)

![• Service tax is a tax on activity and is a Value added tax. The value addition

is on account of activity which provides value addition. Service tax is a

value added consumption tax wherein the burden of tax is ultimately borne

by the final consumer and business does not bear the burden of tax. [All

India Federation of Tax Practitioners’ v Union of India (2007) 10 STT 166;

(2007) 7 STR 625 (SC)]

• Sale and service are two different and distinct transactions. The sale entails

transfer of property whereas in service, there is no transfer of property

[Ranchi Club Ltd. v Chief Commissioner of CE&ST, Ranchi (2012) 26 STR 401

(Jharkhand)]

• Service tax is a value added tax , which in turn is a destination based tax on

consumption in the sense that it is levied on commercial activities and it is

not a charge on business but on the consumer. [ Paul Merchants Ltd v CCE,

Chandigarh (2013) 29 STR 257 (Cestat, New Delhi)]](https://image.slidesharecdn.com/session1-140904044412-phpapp02/75/Workshop-on-Understanding-the-Amended-law-of-Service-Tax-dated-29-08-2014-Session-1-7-2048.jpg)

![• The term ‘service’ was not defined in erstwhile law

(upto 30.6.2012)

• The term ‘taxable service’ was defined under section

65(105)

• Each taxable service and definitions related to meaning

of service were defined [clause (a) to (zzzzw)]

• Around 120 definitions were in place

• W.e.f. 1.7.2012, ‘service’ has been defined in section

65B(44)

11](https://image.slidesharecdn.com/session1-140904044412-phpapp02/75/Workshop-on-Understanding-the-Amended-law-of-Service-Tax-dated-29-08-2014-Session-1-11-2048.jpg)

![Money- 65B(33)

“Money" means legal tender, cheques, promissory note, bill of exchange,

letter of credit, draft, pay order, traveller cheques, money order, postal or

electronic remittance or any similar instrument but shall not include any

currency that is held for its numismatic value

No service tax on Tax on Money Remittance (Circular No. 163 dated

10.7.2012)

Actionable Claim –Section 3 of Transfer of Property Act, 1882

Claim to unsecured debts

Claim to beneficial interest in movable property not in possession of claimant

Right to insurance claim

Arrears of rent

Service is an activity carried out by a person for another for consideration and

actionable claim is mere a transaction in money [ Delhi Chit Fund Association v

Union of India (2013) 30 STR 347 ; (2013) 39 STT955 (Delhi)]

17](https://image.slidesharecdn.com/session1-140904044412-phpapp02/75/Workshop-on-Understanding-the-Amended-law-of-Service-Tax-dated-29-08-2014-Session-1-17-2048.jpg)

!['Service' does not include -

• any activity that constitutes only a transfer in title of goods or

immovable property by way of sale, gift or in any other manner.

Sale of developed plots is a service [Narne Constructions Pvt.

Ltd. v Union of India 2013 (29)STR 3 (SC)]

• a transfer, delivery or supply of goods which is deemed to be a

sale of goods within the meaning of clause (29A) of article 366

of the Constitution

• a transaction only in money or actionable claim

• a service provided by an employee to an employer in the course

of the employment.

• fees payable to a court or a tribunal set up under a law for the

time being in force

19](https://image.slidesharecdn.com/session1-140904044412-phpapp02/75/Workshop-on-Understanding-the-Amended-law-of-Service-Tax-dated-29-08-2014-Session-1-19-2048.jpg)

![25

All services

[section 65B (44)]

Taxable

Declared services

(section 66E)

Taxable

Services covered under negative list of services

(section 66D)

Not Taxable

Services exempt under Mega Notification No.

25/2012-ST dated 20.6.2012

Exempted

Other specified Exemptions Exempted](https://image.slidesharecdn.com/session1-140904044412-phpapp02/75/Workshop-on-Understanding-the-Amended-law-of-Service-Tax-dated-29-08-2014-Session-1-25-2048.jpg)

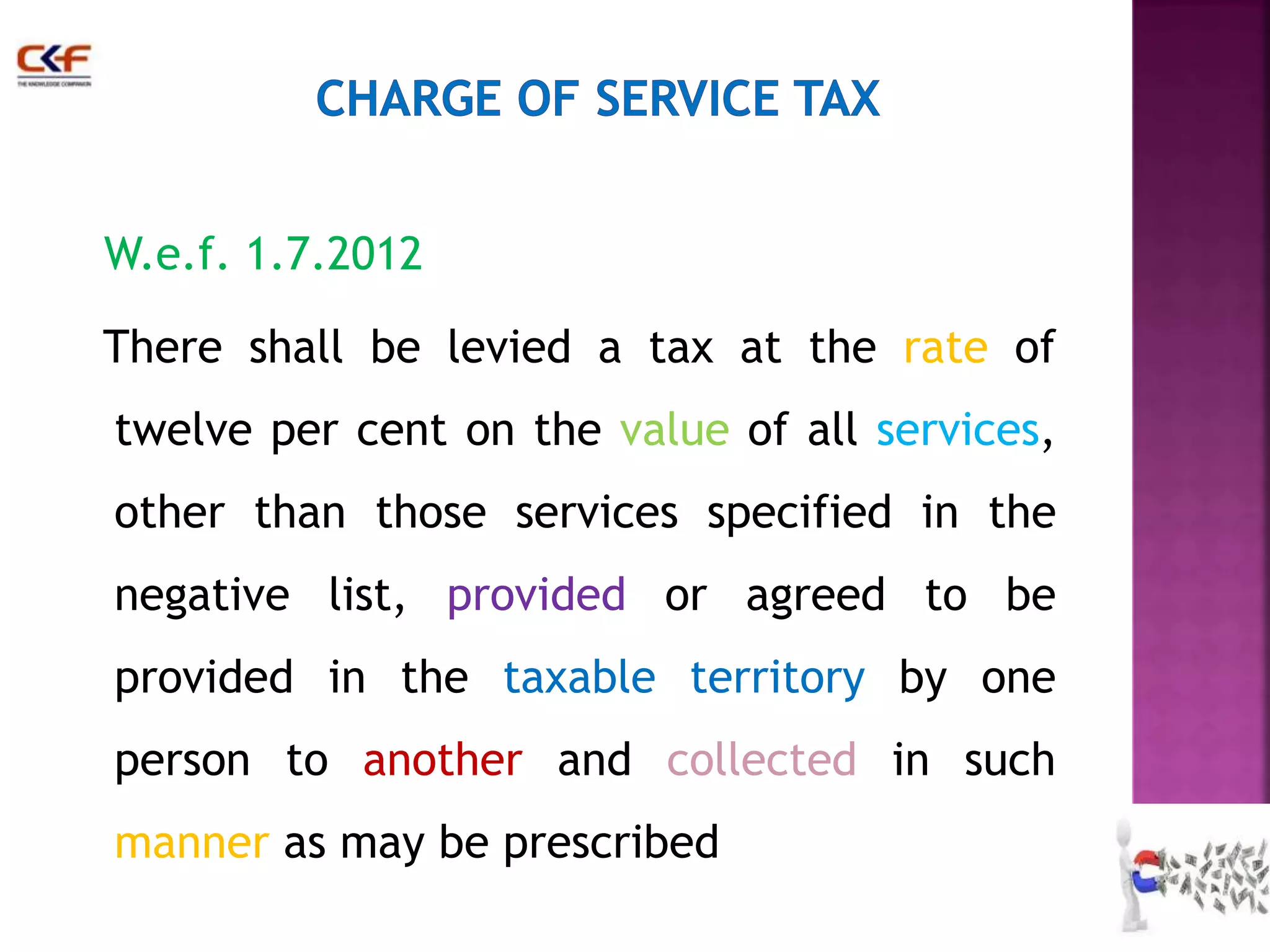

![Essential ingredients for charge of Service Tax (Section 66B)

• There should be a service involved.

• Such service should not be one included in the negative list as

defined in section 66D.

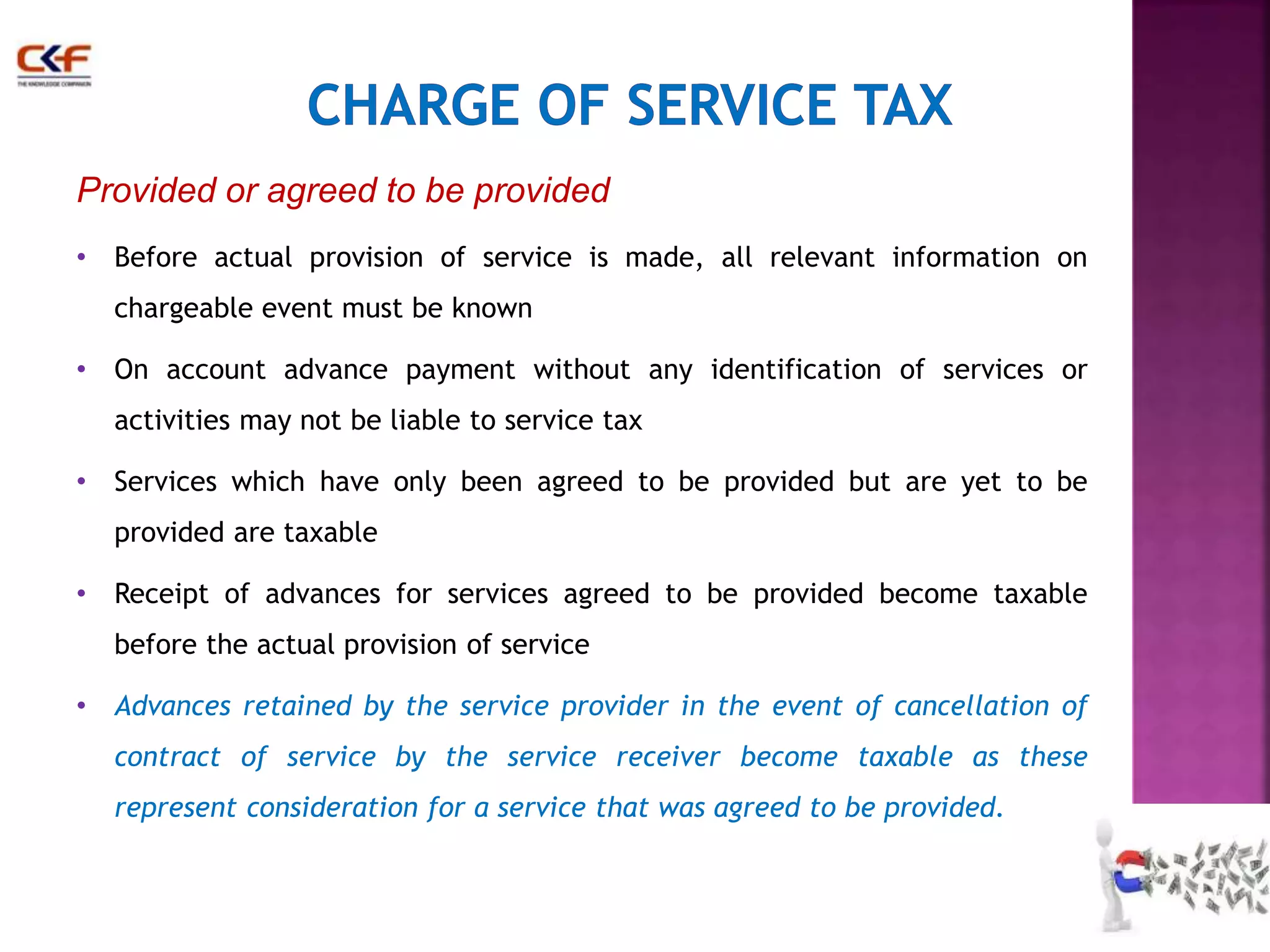

• Services should be provided or agreed to be provided.

• Services should be provided in the taxable territory only.

• Services should be provided by one person to another person.

• Tax shall be levied on value of services so provided or agreed to

be provided.

• Collection shall be in prescribed manner [section 68(1) or (2)].

29](https://image.slidesharecdn.com/session1-140904044412-phpapp02/75/Workshop-on-Understanding-the-Amended-law-of-Service-Tax-dated-29-08-2014-Session-1-29-2048.jpg)

![• Carrying out an intermediate production process as job work in relation

to -

a) agriculture, printing or textile processing;

b) cut and polished diamonds and gemstones; or plain and studded jewellery of gold

and other precious metals, falling under Chapter 71 of the Central Excise Tariff

Act, 1985

c) any goods on which appropriate duty is payable by the principal manufacturer;

d) processes of electroplating, zinc plating, anodizing, heat treatment, powder

coating, painting including spray painting or auto black, during the course of

manufacture of parts of cycles or sewing machines upto an aggregate value of

taxable service of the specified processes of one hundred and fifty lakh rupees in

a financial year subject to the condition that such aggregate value had not

exceeded one hundred and fifty lakh rupees during the preceding financial year;

• Services by an organizer to any person in respect of a business exhibition

held outside India

• Services by way of slaughtering of [bovine omitted by N. No. 44/2012- ST]

animals;](https://image.slidesharecdn.com/session1-140904044412-phpapp02/75/Workshop-on-Understanding-the-Amended-law-of-Service-Tax-dated-29-08-2014-Session-1-63-2048.jpg)