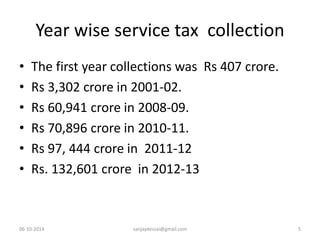

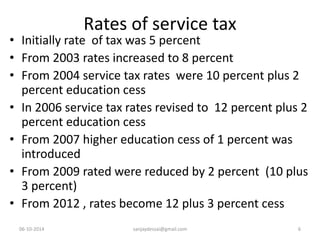

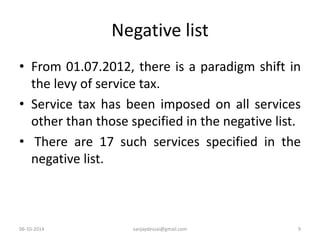

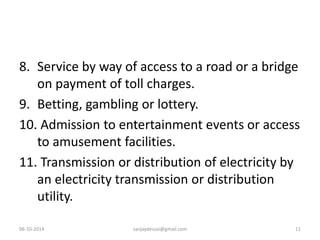

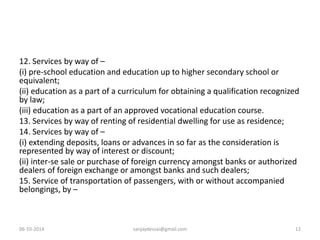

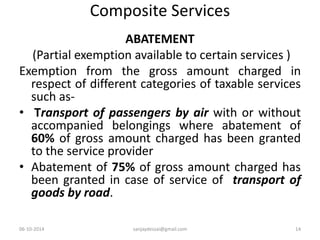

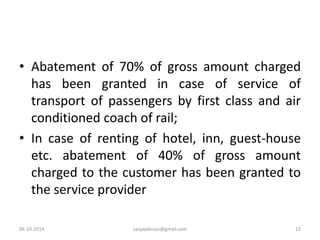

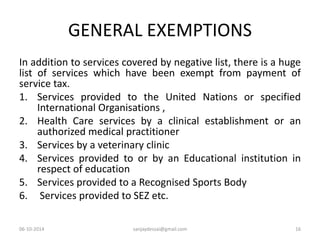

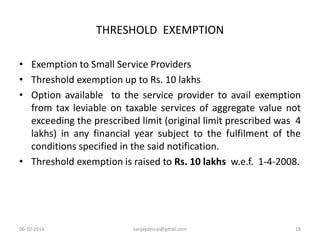

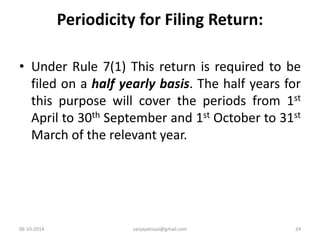

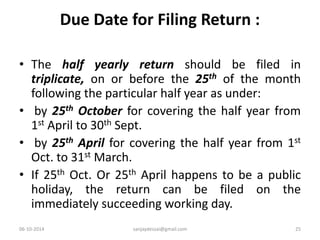

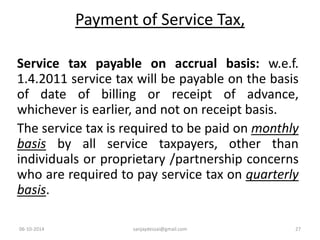

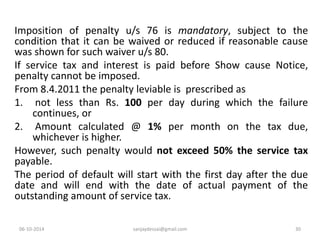

Dr. Sanjay P. Sawant Dessai's presentation on service tax for B.Com (Taxation) students at Goa University outlines the administration, structure, and exemptions related to service tax. The talk details the service tax history, including rates and collection over the years, alongside the negative list which specifies non-taxable services. Key points include registration requirements, filing returns, the payment schedule, and penalties for non-compliance.