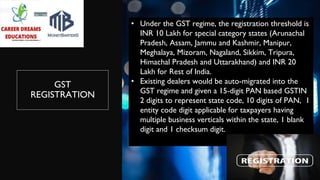

This document provides an overview and summary of the Goods and Services Tax (GST) system in India. It introduces GST as a comprehensive indirect tax levied on the supply of goods and services across India. It then describes the key components and classifications of GST, including CGST, SGST, IGST, and UT GST. It also lists the taxes that are subsumed under GST and those that are not. The document concludes by summarizing the registration process and key GST return forms that businesses must file, such as GSTR-1, GSTR-2, GSTR-3, and more.