This document discusses the taxation of cross-border services in India. It provides an overview of key concepts related to the export and import of services, including the definition of a "service", legislative background, and taxation rules. Some key points:

1) It outlines the definition of "service" under the new tax regime and exclusions from this definition.

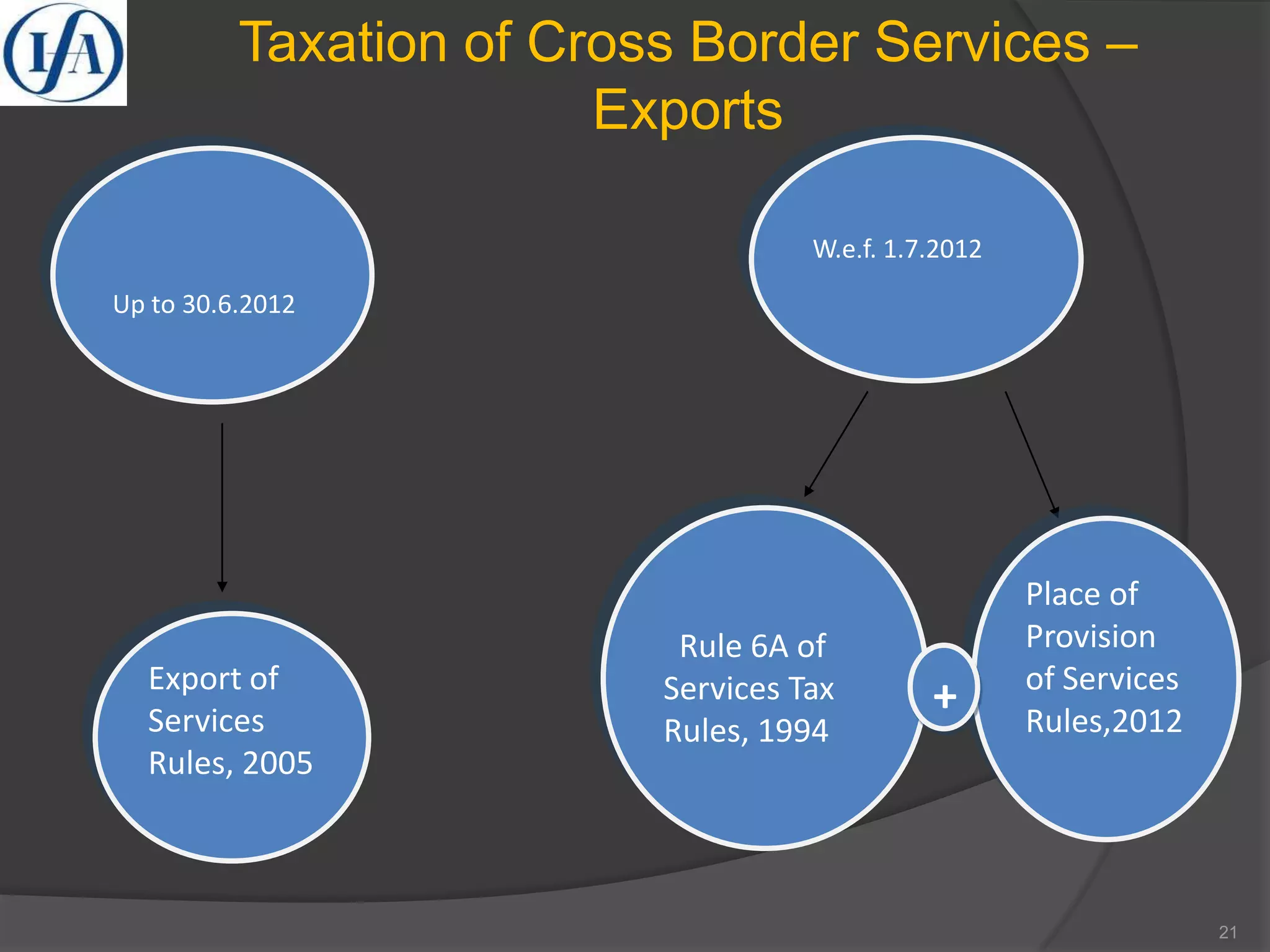

2) It discusses the previous legislative framework for export and import of services prior to 2012, including rules for determining whether a service is exported or imported.

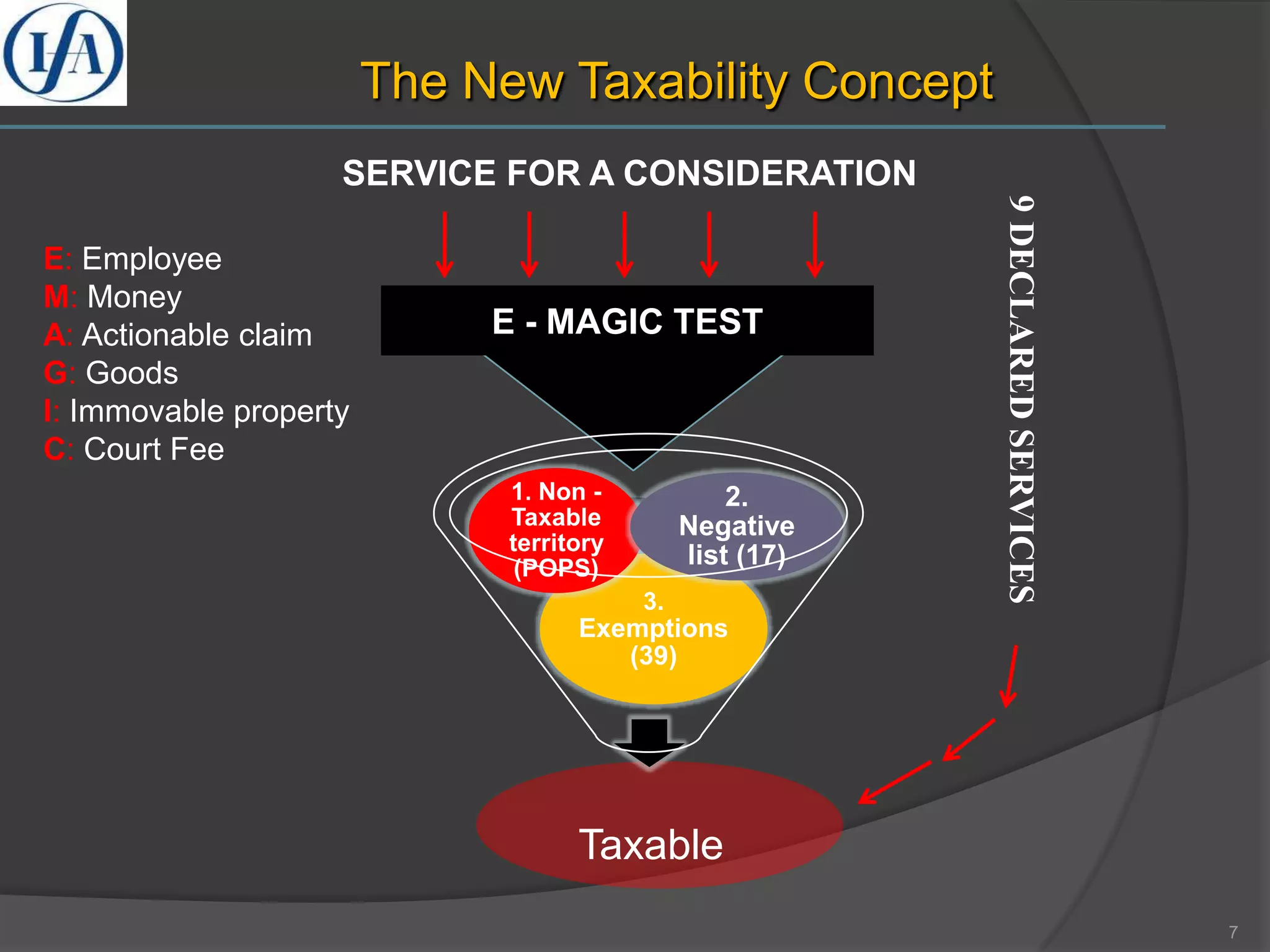

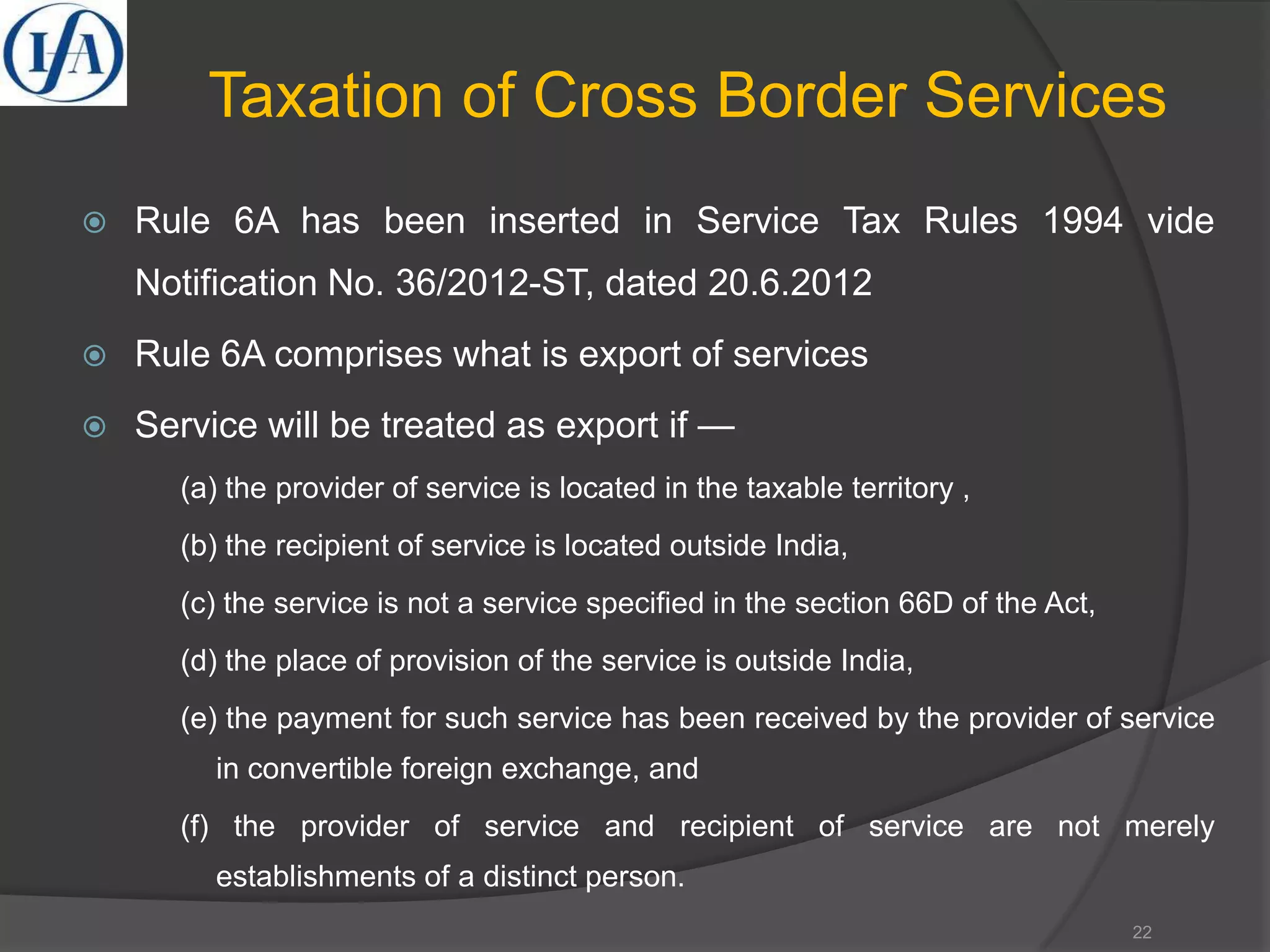

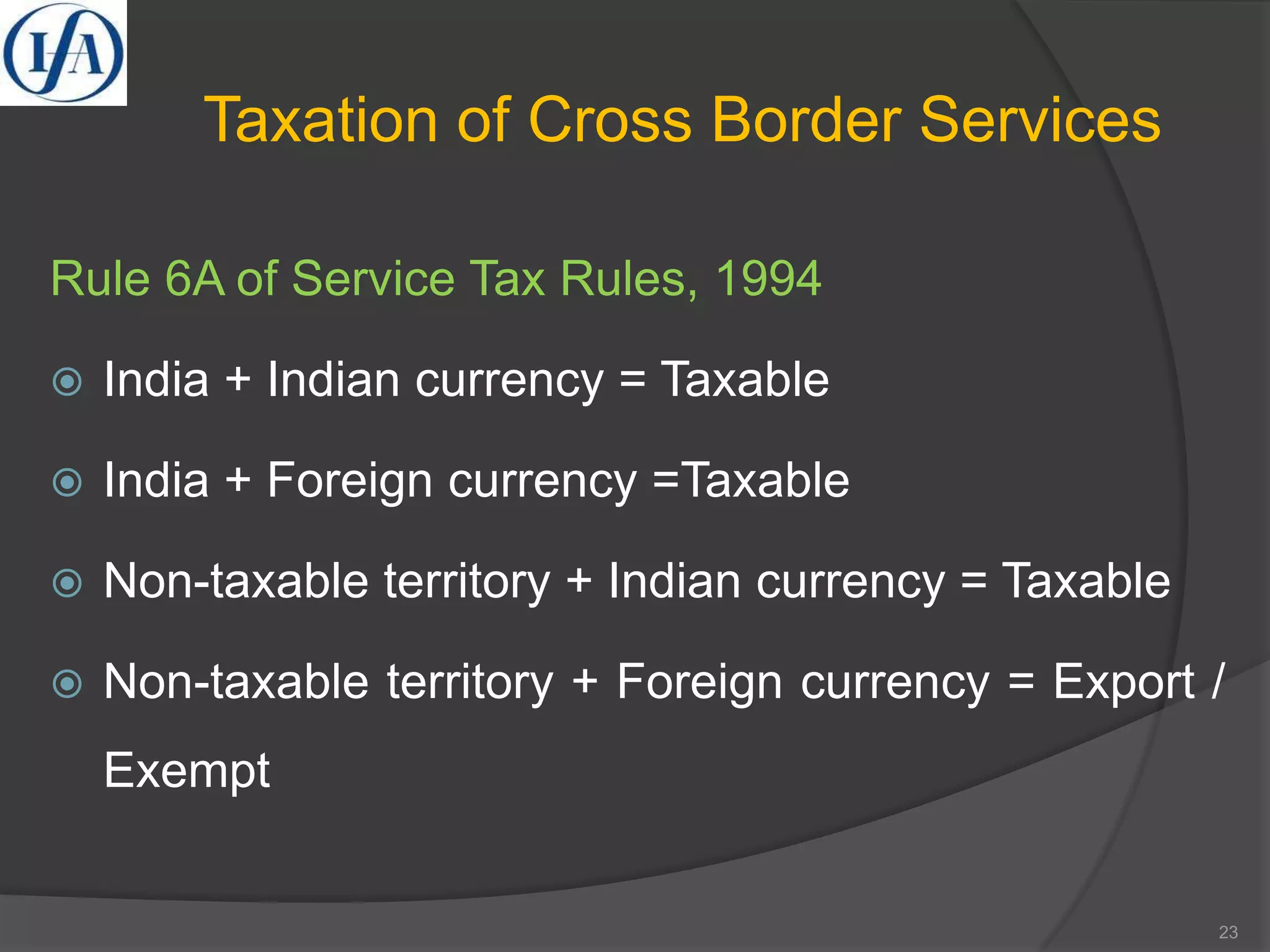

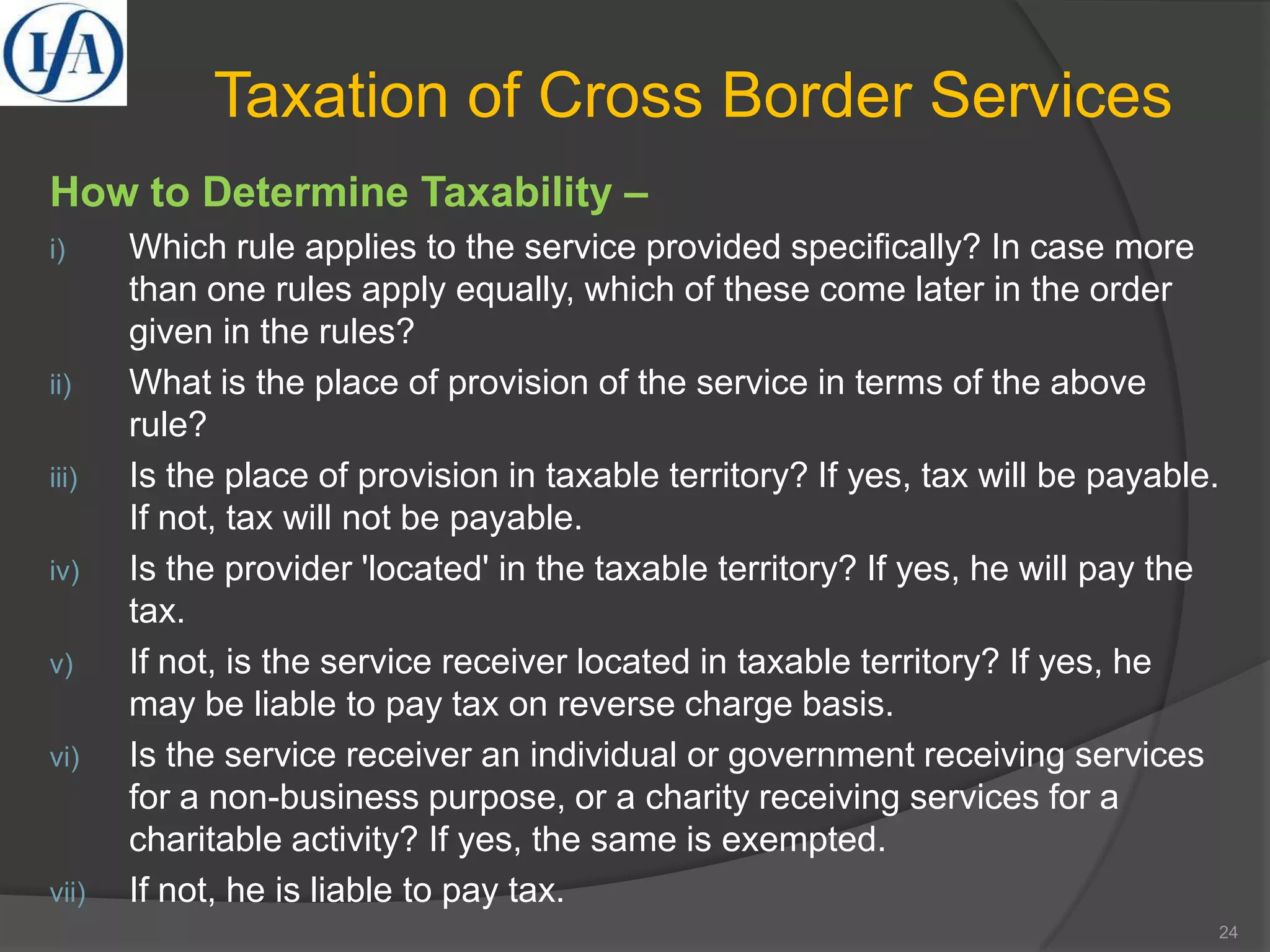

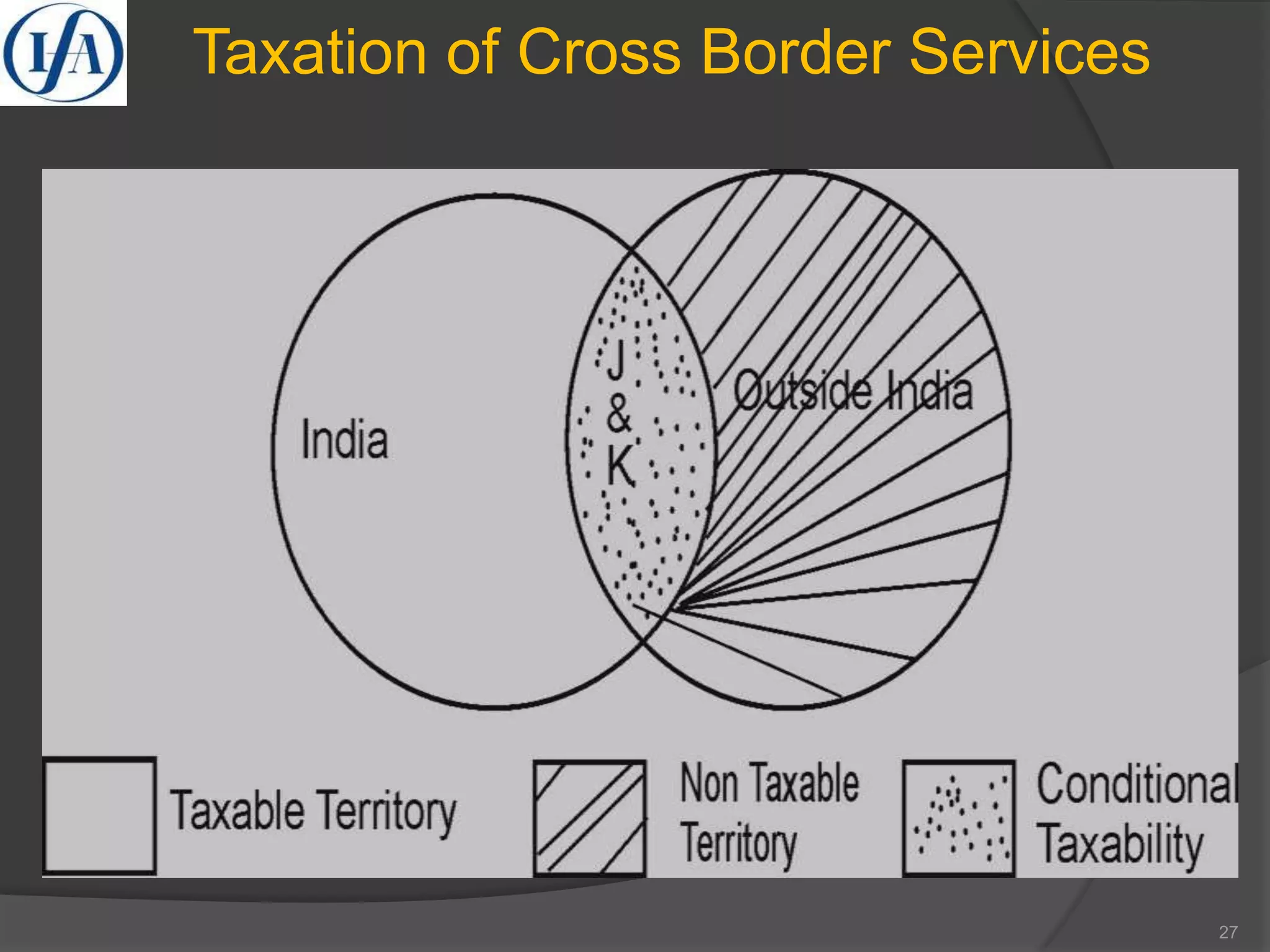

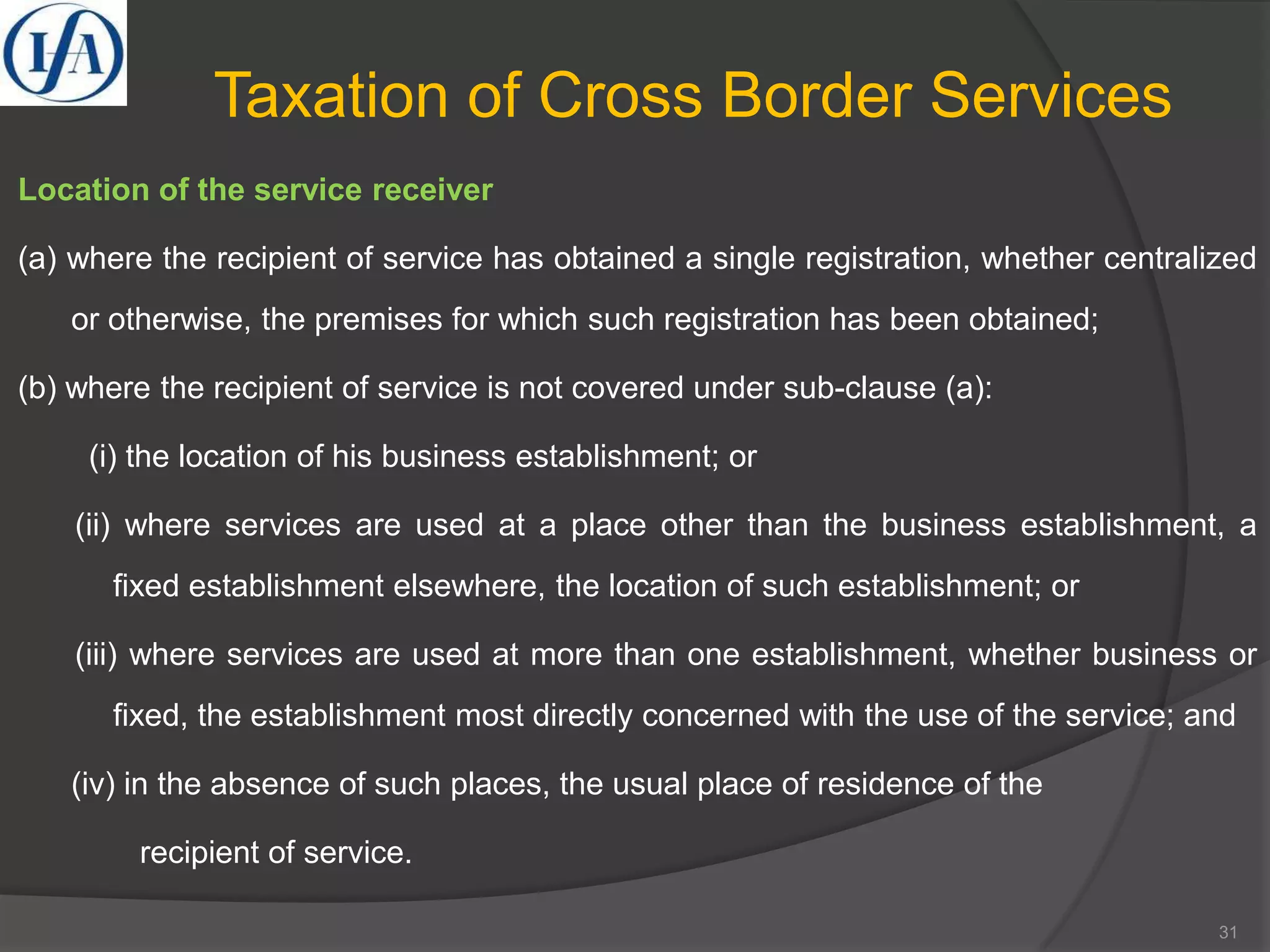

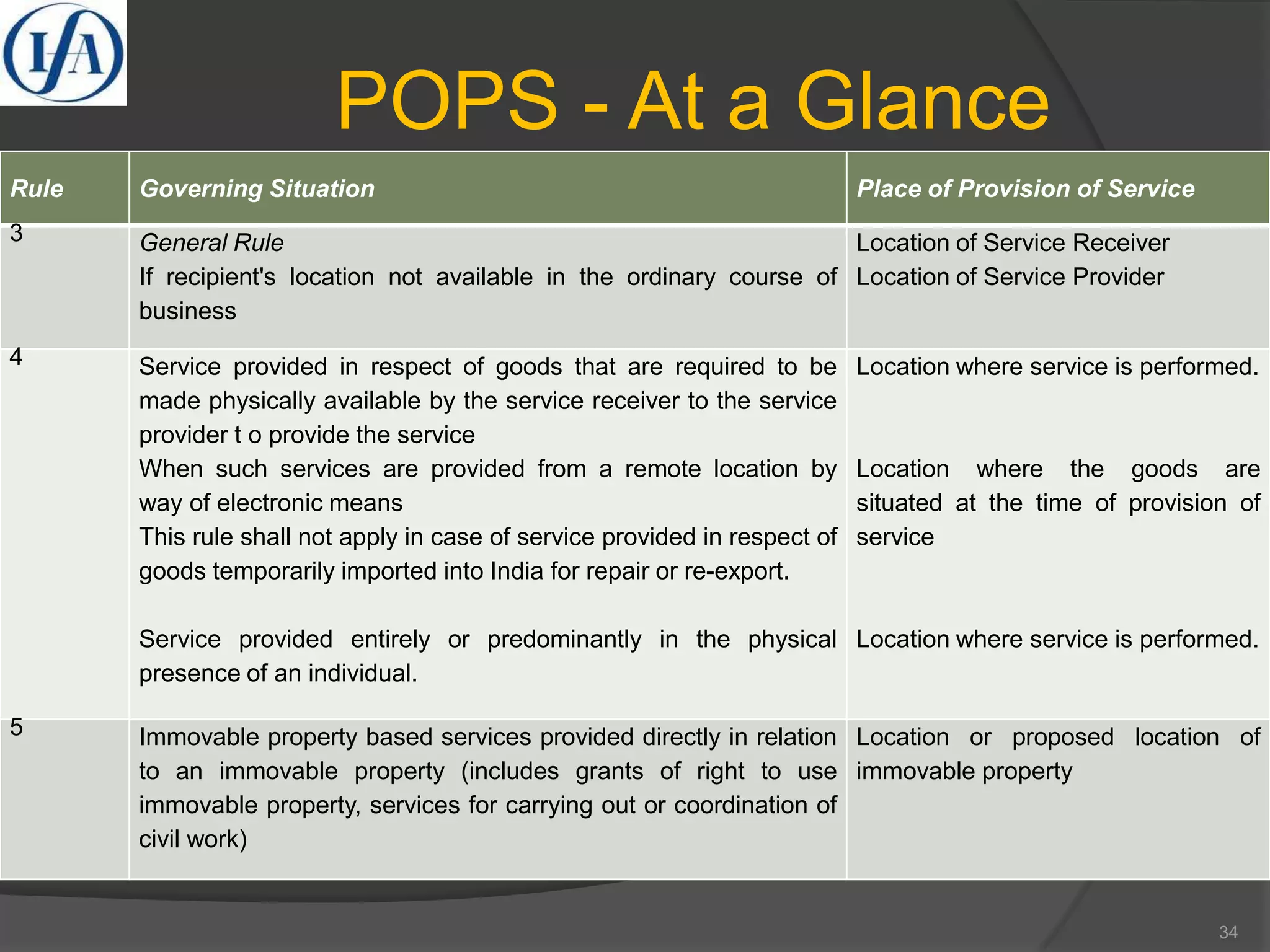

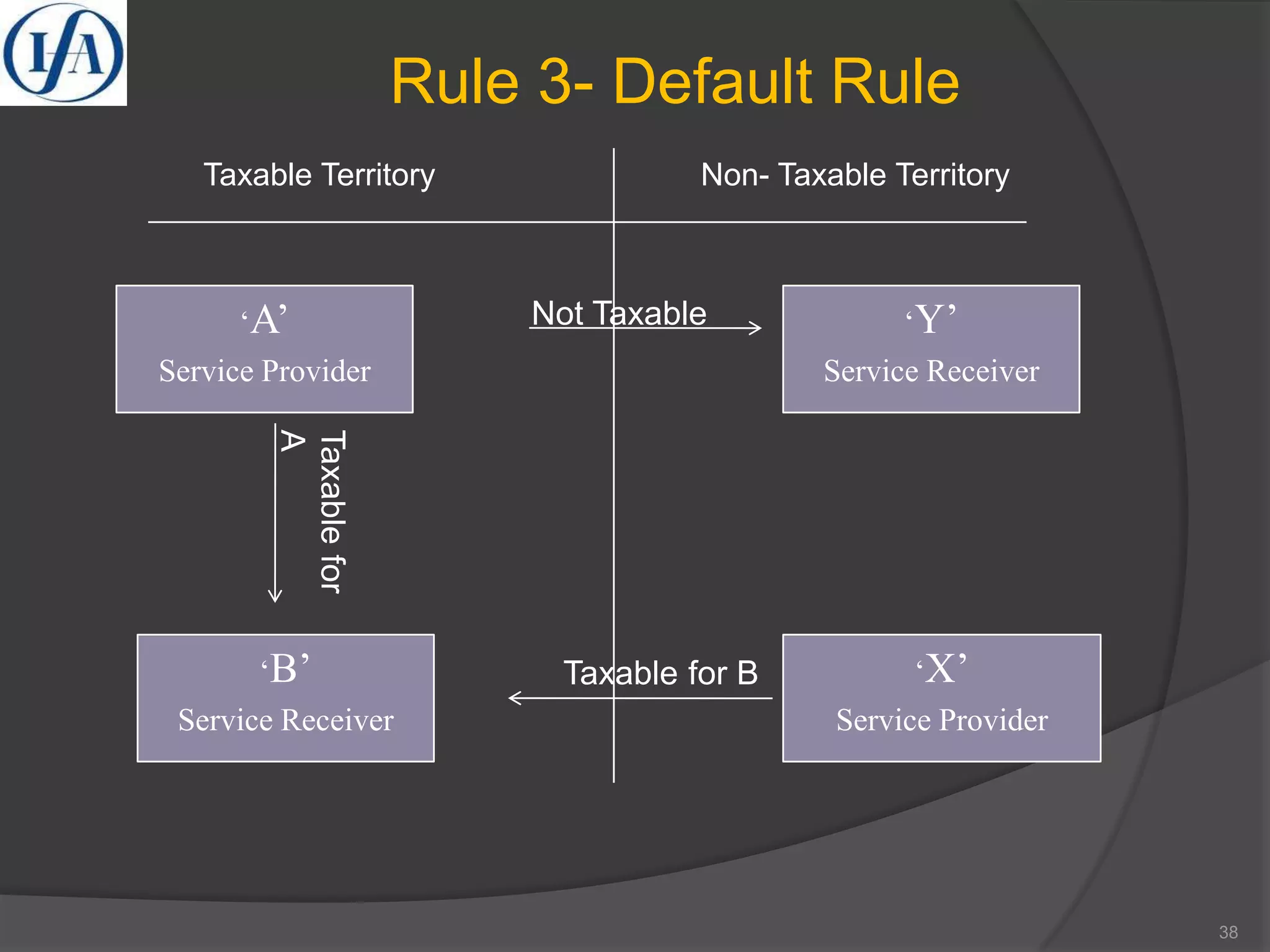

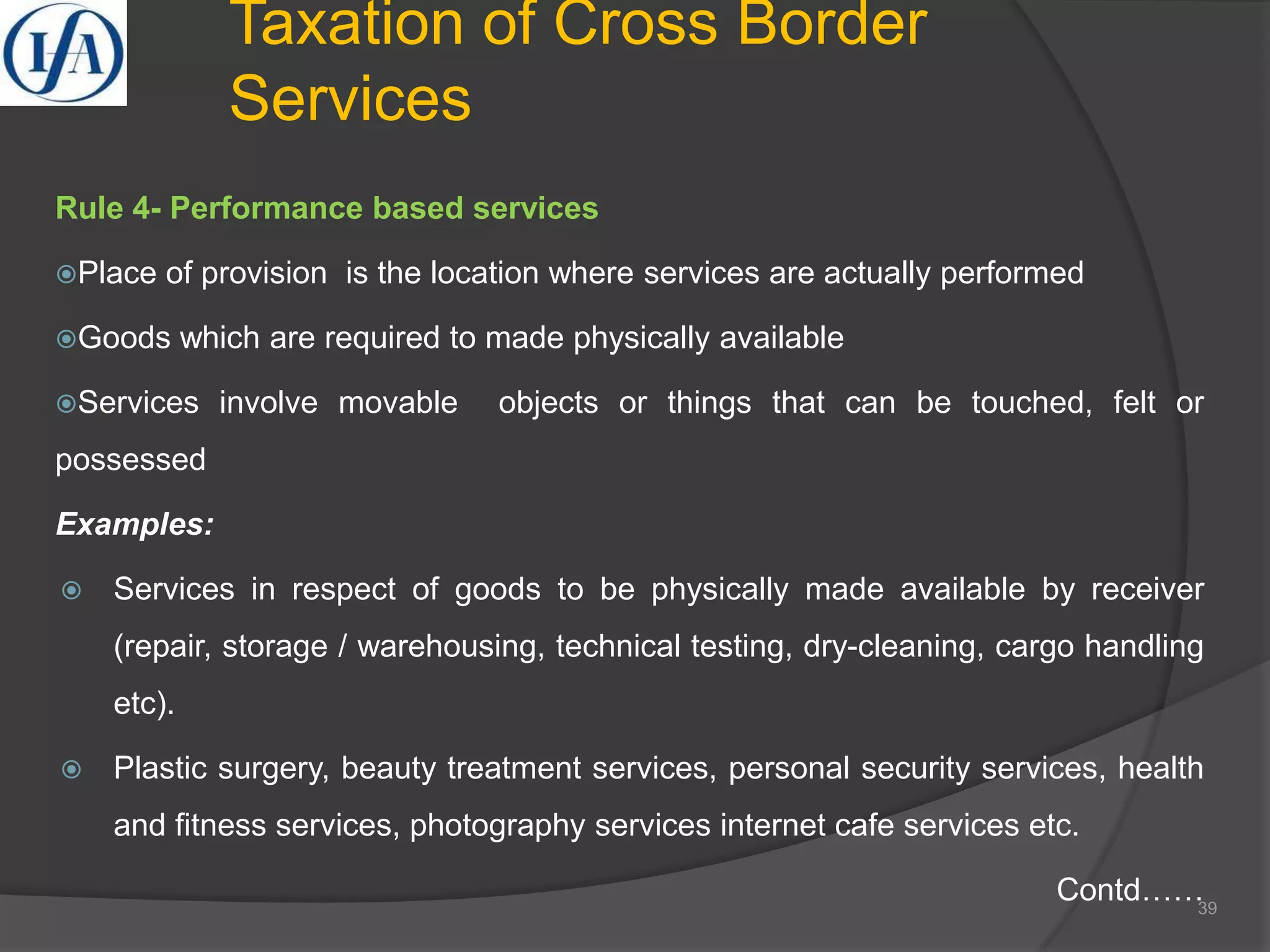

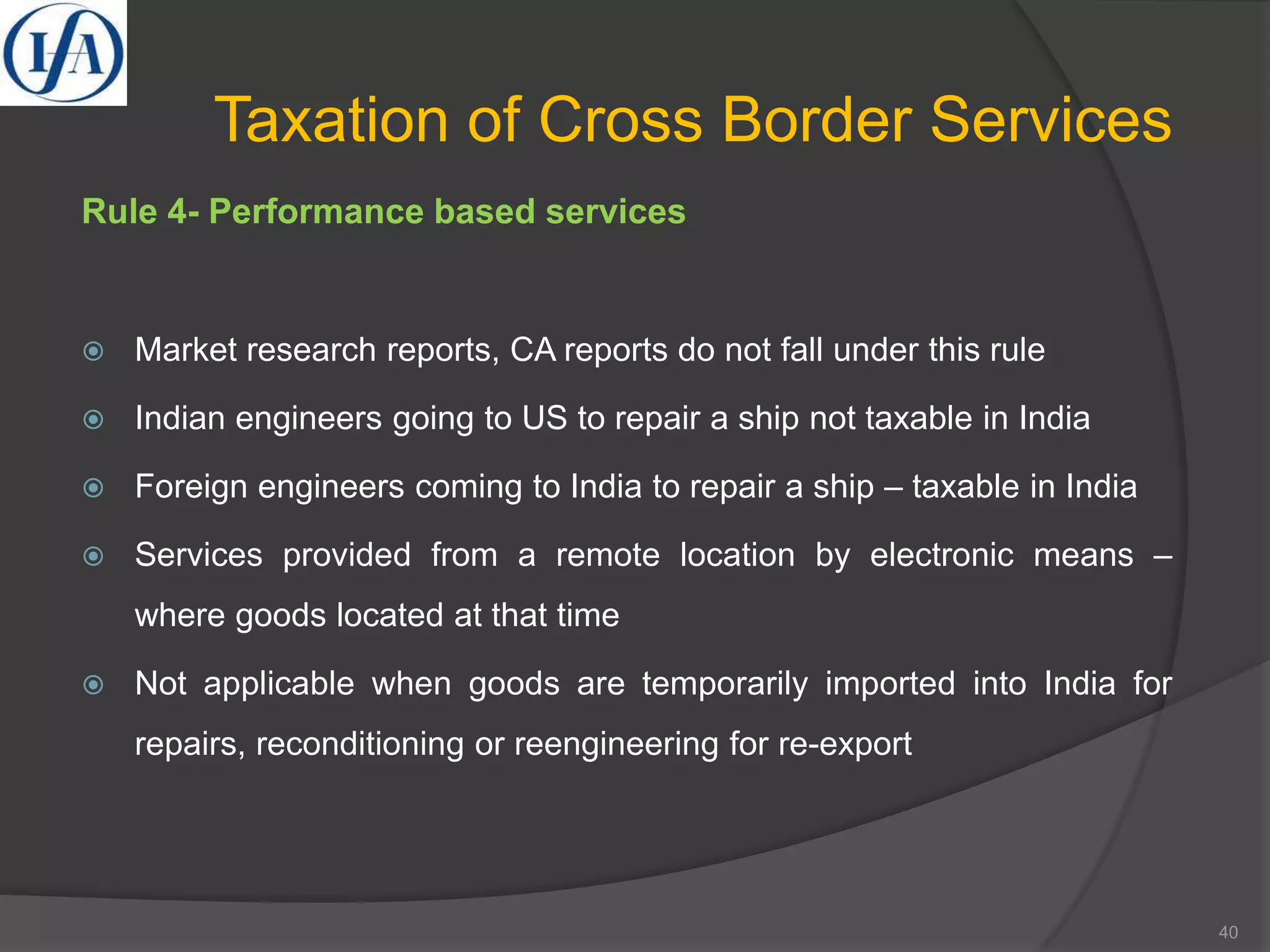

3) It introduces the new taxability framework introduced in 2012, including the concepts of taxable and non-taxable territory, and discusses how the place of provision of services is used to determine taxability

![Taxation of Cross Border Services

Immovable property criteria [Rule 3(1)(i)]

Immovable property should be located outside India

Services provided from India and used outside India

Payment received in convertible foreign exchange

E.g. Indian architect prepares a design sitting in India for a

property located in U.K and hands it over to the owner of

such property

14](https://image.slidesharecdn.com/hydrabad-130423011549-phpapp02/75/CONFERENCE-ON-INTERNATIONAL-TAXATION-14-2048.jpg)

![Taxation of Cross Border Services

Performance Based Criteria [Rule - 3(1)(ii)]

• Services performed outside India, either wholly or partly.

• Services provided from India and used outside India

• Payment in convertible foreign exchange

E.g. An Indian event manager arranges a seminar for an Indian company in

U.K.; the service has to be treated used outside India on the basis of

performance in U.K even though the benefit of such seminar may flow

back to the employees serving the company in India.

15](https://image.slidesharecdn.com/hydrabad-130423011549-phpapp02/75/CONFERENCE-ON-INTERNATIONAL-TAXATION-15-2048.jpg)

![Taxation of Cross Border Services

Recipient Based Criteria [Rule - 3(1)(iii)]

Services are provided in relation to business and commerce - recipient of service

should be located outside India;

Services are not provided in relation to business and commerce - recipient of

service should be located outside India at the time of provision of such service.

Services provided from India and used outside India (upto 28.2.2007)

Services delivered outside India and used outside India (W.e.f 1.3.2007)

Condition of used outside India deleted (W.e.f. 27.2.2010)

Payment received in convertible foreign exchange

E.g. A company taking orders from domestic buyers for its principal in UK &

US for export of goods by principal in India on commission basis received in

convertible foreign exchange from its principal 16](https://image.slidesharecdn.com/hydrabad-130423011549-phpapp02/75/CONFERENCE-ON-INTERNATIONAL-TAXATION-16-2048.jpg)

![Important Terms of POPS Rules, 2012

Taxable Territory [Section 65B(52)] –Taxable territory means

the territory to which the provisions of this chapter apply.

(Taxable territory = India – J & K State)

Non-taxable Territory [Section 65B(35)] – Non-taxable territory

means the territory which is outside the taxable territory.

Taxation of Cross Border Services

26](https://image.slidesharecdn.com/hydrabad-130423011549-phpapp02/75/CONFERENCE-ON-INTERNATIONAL-TAXATION-26-2048.jpg)

![Taxation of Cross Border Services

India [U/s 65B(27)]

(a) the territory of the Union according to Article 1 clauses (2) and (3) of the

Constitution;

(b) its territorial waters, continental shelf, exclusive economic zone or any other

maritime zone ;

(c) the sea-bed and the sub-soil underlying the territorial waters;

(d) the air space above its territory and territorial waters; and

(e) the installations, structures and vessels located in the continental shelf of India

and the exclusive economic zone of India, for the purposes of prospecting or

extraction or production of mineral oil and natural gas and supply thereof;

32](https://image.slidesharecdn.com/hydrabad-130423011549-phpapp02/75/CONFERENCE-ON-INTERNATIONAL-TAXATION-32-2048.jpg)

![Taxation of Cross Border Services

Rule 5-Services relating to Immovable Property

Place of provision is where immovable property is located

Applicable for services directly connected with immovable property.

Immovable property not defined in the Finance Act, 1994.

Immovable property shall include land, benefits to arise out of land, and

things attached to the earth, or permanently fastened to anything attached

to the earth. [ S. 3 (26) of the General Clauses Act, 1897]

Definition is inclusive

Properties such as buildings and fixed structures on land covered under

immovable property.

The property must be attached to some part of earth even if under water.

Contd……41](https://image.slidesharecdn.com/hydrabad-130423011549-phpapp02/75/CONFERENCE-ON-INTERNATIONAL-TAXATION-41-2048.jpg)