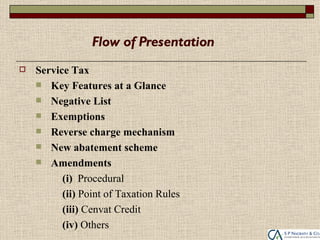

The document summarizes key changes to India's service tax laws effective July 1, 2012. Key points include:

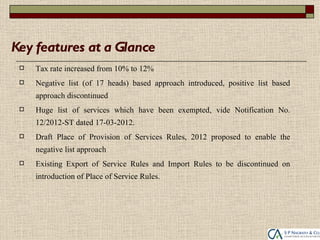

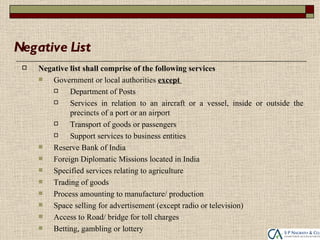

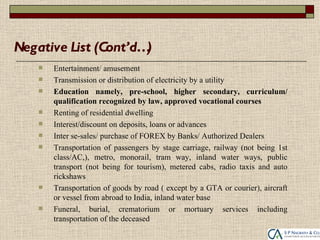

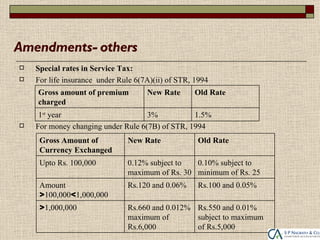

1) The service tax rate increased from 10% to 12% and the system shifted from a positive to a negative list.

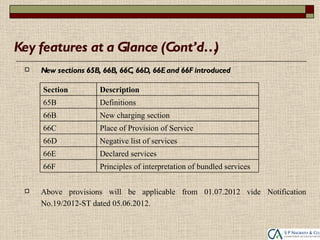

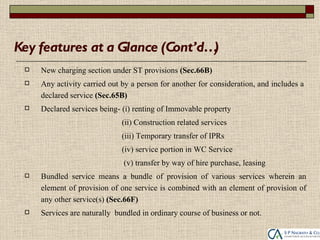

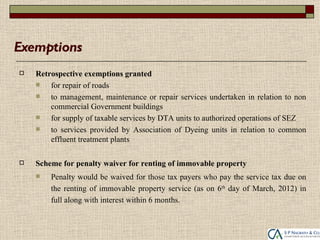

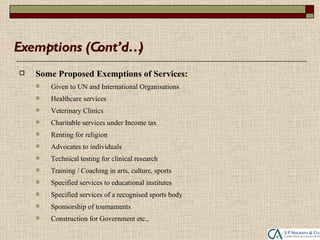

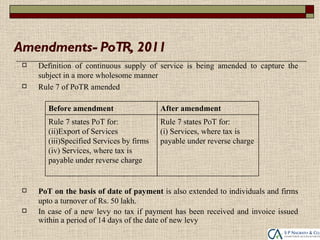

2) Many services were exempted from tax and new sections were introduced to define taxable services and the place of provision.

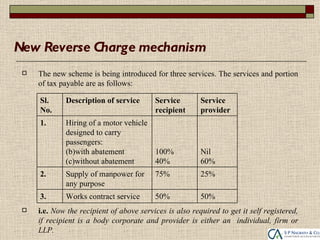

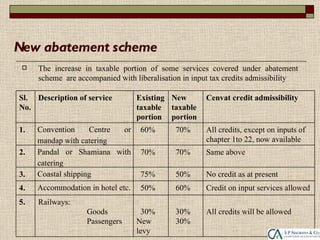

3) A reverse charge mechanism was introduced for three specified services and the abatement scheme was modified.

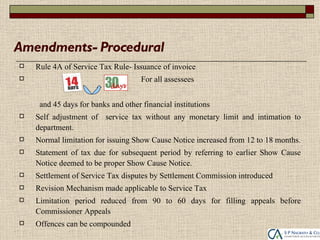

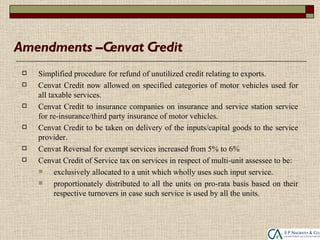

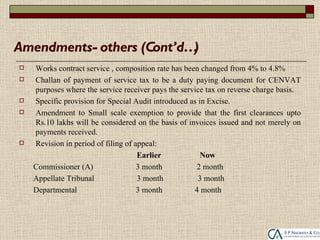

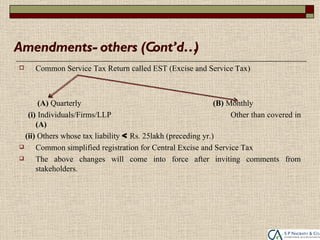

4) Procedural amendments included changes to invoicing rules, cenvat credit, and limitations periods.