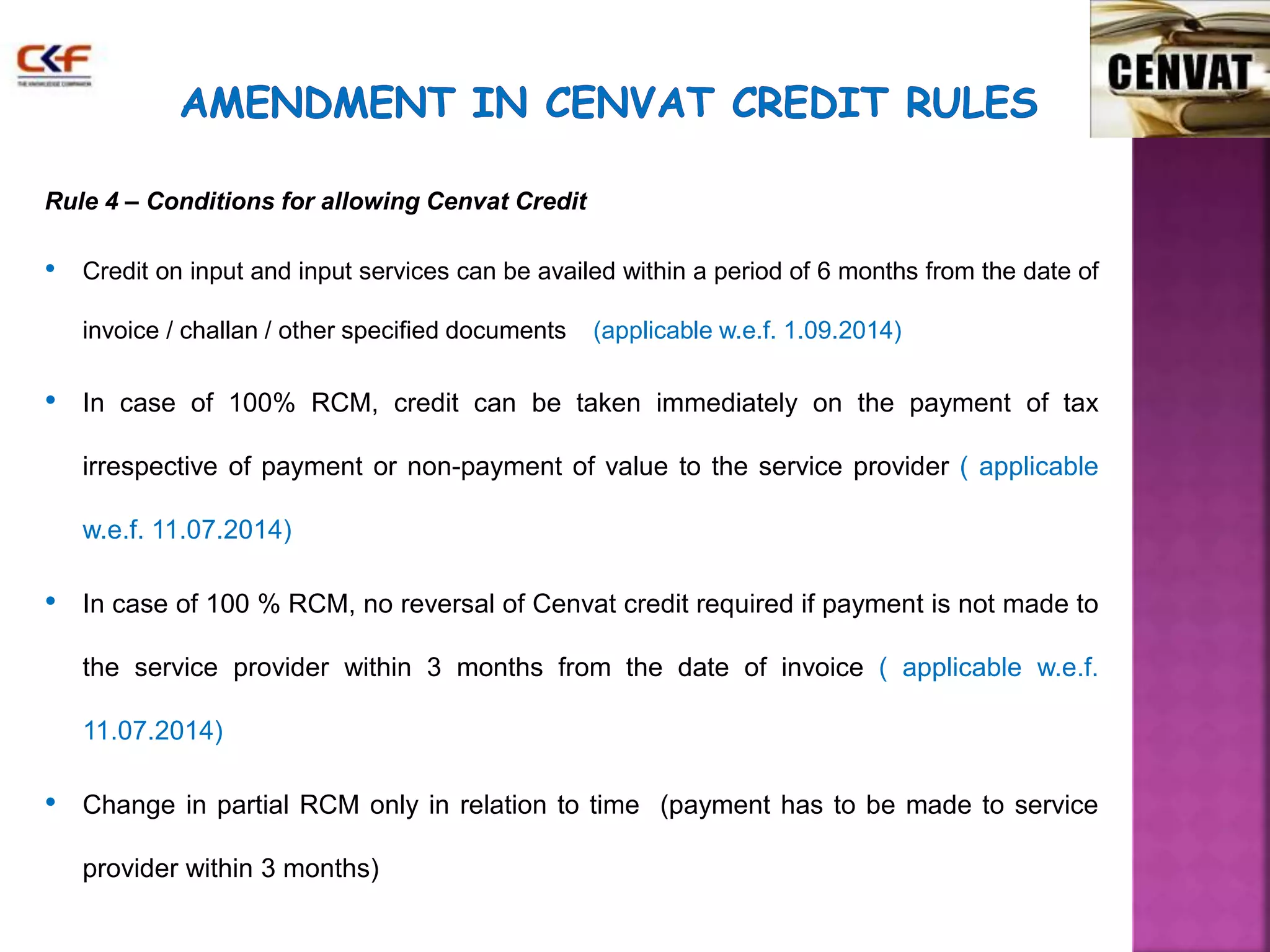

This document summarizes the key changes made to service tax law in India by the Finance Act of 2014. Some major changes include expanding the scope of taxable services by removing certain exemptions, changing rules related to point of taxation and place of provision of services, making e-payment of service tax mandatory, and amending provisions around CENVAT credit and valuation of works contracts. The presentation covers these changes in detail across various sectors such as advertising, transportation, healthcare, education, accommodation and others.

![Meaning of Advertisement [ Section 65B(2) ]

• Advertisement means -

any form of presentation for promotion of,

or bringing awareness about,

any event,

idea,

immovable property,

person, service,

goods or actionable claim through

newspaper, television, radio or any other means

but does not include any presentation made in person;

• Types /mode of advertisement which will be taxable now–

Internet (i.e. websites )

Theaters , out of home media

Film screens

Bill boards, conveyance

Building, hoardings,

Tickets, Automated Teller Machines (ATM), cell phones

Commercial publications (i.e. yellow pages/ business directories etc.)

Aerial advertisement etc.](https://image.slidesharecdn.com/session2-140904044607-phpapp02/75/Workshop-on-Understanding-the-Amended-law-of-Service-Tax-dated-29-08-2014-Session-2-5-2048.jpg)

![Print media [ Section 65B(39a) ]

• Print media means “Book” and “Newspaper” as defined in section 1(1) of the Press and

Registration of Books Act, 1867

• Books includes –

Every volume / part / division of book

Pamphlet in any languages

Every sheet of music

Chart / plan separately printed

but excludes –

Business directories,

Yellow pages

Trade catalogues meant for commercial purposes

• Newspaper means –

Printed periodical work (any frequency)

Containing public news /comments on public news](https://image.slidesharecdn.com/session2-140904044607-phpapp02/75/Workshop-on-Understanding-the-Amended-law-of-Service-Tax-dated-29-08-2014-Session-2-6-2048.jpg)

![Other changes

• LTUs are no longer eligible to transfer credit availed on or after 11.07.2014 to its units

• Manner for distribution of credit by input service distributor has been clarified

• Availment of Cenvat credit in relation to GTA service clarified and restriction (on not taking

credit on inputs, capital goods and input services) is applicable only to service provider

( applicable w.e.f 11.07.2014)

• Cenvat credit shall be available for rent-a-cab services received by the main contractor from a

sub-contractor. (applicable w.e.f. 1.10.2014)

• Power to impose restrictions in certain cases will now cover any service provider [ Rule 12AAA

w.e.f. 25.08.2014 ]

• A Service Tax Certificate for Transportation of goods by Rail (STTG certificate) issued by the

Indian Railway, alongwith photocopies of Railway Receipt (RR) mentioned in STTG certificate

is a document on which Cenvat credit shall be taken by the manufacturer or the provider of

output service [ vide N. No. 26/2014 –CE (NT) dated 27.08.2014](https://image.slidesharecdn.com/session2-140904044607-phpapp02/75/Workshop-on-Understanding-the-Amended-law-of-Service-Tax-dated-29-08-2014-Session-2-44-2048.jpg)