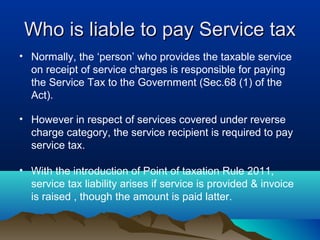

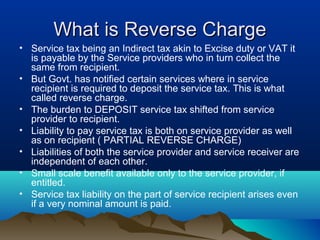

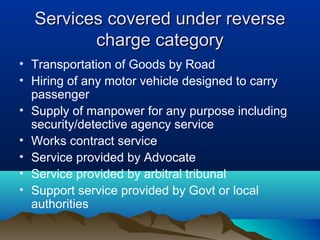

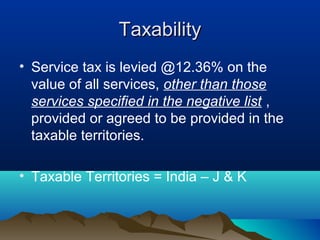

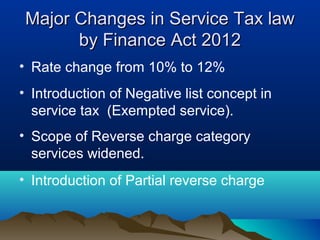

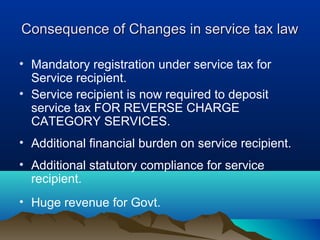

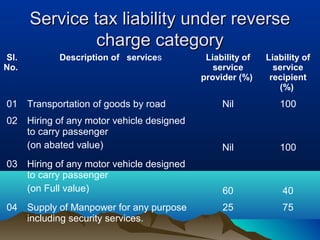

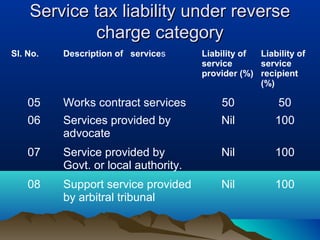

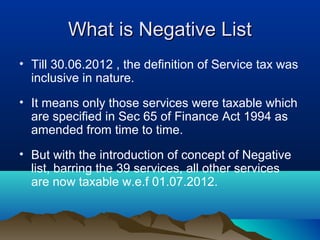

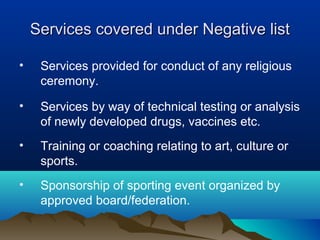

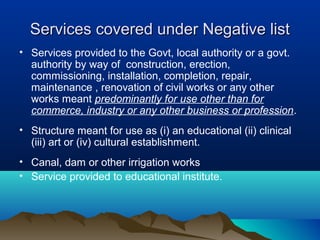

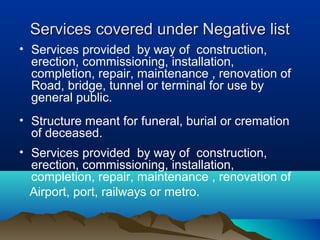

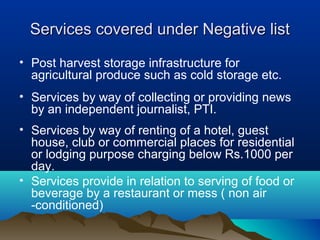

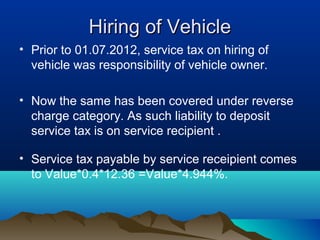

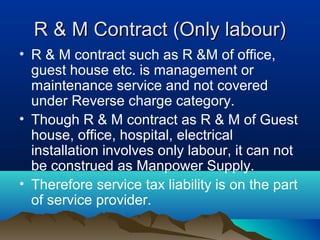

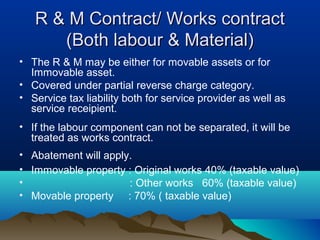

Service tax was introduced in India in 1994 and is a tax levied on the transaction of certain specified services. Initially only three services were taxable, but over time the scope has expanded significantly. Services now constitute over 60% of India's GDP. The rate of service tax has increased over time from 10% to the current 12% plus applicable cess. A key change in 2012 was the introduction of a "negative list" approach where all services are taxable unless specifically exempted, as opposed to the previous inclusive approach. Certain services are covered under "reverse charge" where the liability to pay the tax is on the service recipient rather than provider.