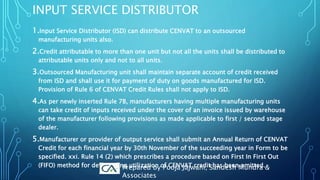

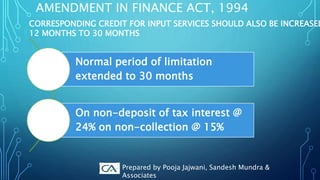

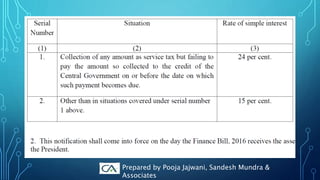

The document outlines recent changes in service tax regulations, including the introduction of a 'Krishi Kalyan Cess' to bring the effective service tax rate to 15%. It discusses amendments in negative lists, exemptions, and the expansion of service tax applicability, particularly in transport and construction sectors. Additionally, the document highlights new exemptions granted to certain educational programs and legal services, as well as restrictions on senior advocates regarding taxation.

![LEVY OF “KRISHI KALYAN CESS” [KKC] OF 0.5%

TO MAKE EFFECTIVE SERVICE TAX RATE @ 15%

• KKC paid eligible as CENVAT

Prepared by Pooja Jajwani, Sandesh

Mundra & Associates](https://image.slidesharecdn.com/servicetaxbudgetimpact2016-160321080000/85/Service-Tax-Budget-impact-2016-3-320.jpg)

![•KKC of 0.5% to make effective tax @ 15%.

•CENVAT against output liability of KKC.

ALLOWED

•Going near the GST target

•Shortly invoice will have more line items from

government than your actual bill

•Cess why – no fund sharing with the states

LEVY OF “KRISHI KALYAN CESS” [KKC] OF 0.5%

TO MAKE EFFECTIVE SERVICE TAX RATE @ 15%

W.E.F. 01-06-2016

Prepared by Pooja Jajwani, Sandesh

Mundra & Associates](https://image.slidesharecdn.com/servicetaxbudgetimpact2016-160321080000/85/Service-Tax-Budget-impact-2016-4-320.jpg)

![• This cess has no cascading effect as credit is available

• Changes are yet to be incorporated in Rule 3 of the Cenvat

Credit Rules, 2004 to provide requisite legal backing for

availment of Cenvat credit. Further as per the TRU letter the

credit seems to have been restricted for the service provider

• Event budget speech says – Input Tax credit of the cess will be

available for payment of cess

• Mallya cess ??

LEVY OF “KRISHI KALYAN CESS” [KKC] OF 0.5%

TO MAKE EFFECTIVE SERVICE TAX RATE @ 15%

W.E.F. 01-06-2016

Prepared by Pooja Jajwani, Sandesh

Mundra & Associates](https://image.slidesharecdn.com/servicetaxbudgetimpact2016-160321080000/85/Service-Tax-Budget-impact-2016-5-320.jpg)

![• Transportation of passenger by Ac Stage Carriage like GSRTC shall be liable

to Service Tax at an abated rate of 60% [with Swachh Bharat Cess (SBC) +

Krishi Kalyan Cess (KKC)]. w.e.f. 01-06-2016. without CENVAT

• Services of transportation of passengers with or without baggage by

Ropeway, Cable car or Aerial Tramway @ 14.5% [with SBC] w.e.f. 01-04-

2016.

• Contract carriage vs stage carriage

• Contract of carriage is a contract between goods/passenger carrier and

consignor, consignee or passenger. It typically define the rights, duties and

liabilities of parties, addressing topics such as acts of God and including

clauses such as force majeure.

• Stage carriage means a motor vehicle which can carry more than six

passengers excluding the driver for hire or reward at separate fares paid by

or for individual passengers, either for the whole journey or for stages of

2. TRANSPORTATION OF PASSENGERS

Prepared by Pooja Jajwani, Sandesh

Mundra & Associates](https://image.slidesharecdn.com/servicetaxbudgetimpact2016-160321080000/85/Service-Tax-Budget-impact-2016-10-320.jpg)

![TRANSPORTATION OF GOODS

• Services of transportation of goods from outside India up to

custom station of clearance in India is deleted from negative

list.

• Transportation of goods by aircraft exempted by amendment in

exemption notification.

• But Service tax at an abated rate of 4.5% [with SBC + KKC]

applicable on goods transportation by vessel under RCM. w.e.f.

01-06-2016

• Importation is taxable, exportation is exempt

Prepared by Pooja Jajwani, Sandesh

Mundra & Associates](https://image.slidesharecdn.com/servicetaxbudgetimpact2016-160321080000/85/Service-Tax-Budget-impact-2016-12-320.jpg)

![3. ARBITRAL TRIBUNAL

Services provided by Representor in Arbitral Tribunal to an Arbitral Trib

taxable @ 14.5% [with SBC]. w.e.f. 01-04-2016

Prepared by Pooja Jajwani, Sandesh

Mundra & Associates](https://image.slidesharecdn.com/servicetaxbudgetimpact2016-160321080000/85/Service-Tax-Budget-impact-2016-19-320.jpg)

![• 1. Threshold exemption to services provided by a performing artist in folk

or classical art form of (i) music, (ii) dance, or (iii) theater is increased from

Rs. 1,00,000/- per event to Rs. 1,50,000/- per event w.e.f. 01-04-2016

• 2. Service provided by Employees' Provident Fund Organisation [EPFO],

Insurance Regulatory and Development Authority of India [IRDA], Security

Exchange Board of India [SEBI] and National Centre for Cold Chain

Development [NCCCD] will be exempt from Service Tax w.e.f. 01-04-2016

• 3. Exemption from Service Tax provided to software recorded on media on

which affixation of Retail Sale Price [RSP] is required under Legal Metrology

Act, 2009 subject to following condition: -

Value of the package has been determined under Section 4A of the Central

Excise Act, 1944. - Appropriate duty of excise/CVD has been paid by

manufacturer / importer. - Declaration from service provider that no excess

amount over the RSP has been recovered. w.e.f. 01-03-2016

5 MISCELLANEOUS EXEMPTIONS

Prepared by Pooja Jajwani, Sandesh

Mundra & Associates](https://image.slidesharecdn.com/servicetaxbudgetimpact2016-160321080000/85/Service-Tax-Budget-impact-2016-31-320.jpg)

![INDIAN RAILWAY

• Services of transport of goods by Indian Railway shall be liable to Service

Tax @ 4.5% [with SBC + KKC] after abatement of 70% allowing CENVAT

credit of input services.

• However, transport of goods in container by rail by private sector shall be

liable to Service Tax @ 6% [with SBC + KKC] after abatement of 60% with

credit of input services.

• Services of transportation of passengers by rail service in A.C. Coach and

First Class shall be liable to Service Tax @ 4.5% [with SBC + KKC] after

abatement of 70% by additionally allowing CENVAT Credit of input services.

w.e.f. 01-04-2016 and effect of KKC from 01-06-2016

Prepared by Pooja Jajwani, Sandesh

Mundra & Associates](https://image.slidesharecdn.com/servicetaxbudgetimpact2016-160321080000/85/Service-Tax-Budget-impact-2016-35-320.jpg)

![TAX ON UNDER CONSTRUCTION PROPERTY

IN INDIA

Uniform abatement at the rate of 70% is

prescribed for Construction services. Hence, for

all commercial or residential construction

services abatement rate of 70% will be applicable

and effective rate of service tax shall be 4.50%

[with SBC + KKC] w.e.f. 01-04-2016 and effect

of KKC from 01-06-2016

Prepared by Pooja Jajwani, Sandesh

Mundra & Associates](https://image.slidesharecdn.com/servicetaxbudgetimpact2016-160321080000/85/Service-Tax-Budget-impact-2016-42-320.jpg)

![1. After deletion of ‘support Services’ from Rule 2(1)(d)(i)(E) of

Service Tax Rules, the Service Recipient under RCM shall be liable

to pay service tax on 'any services' provided by the Government

or local authorities to business entity.

2. RCM on Mutual Fund Agent / distributor is deleted hence he

shall be liable to pay Service Tax @15% [with SBC + KKC] subject

to benefit of Rs. 10 Lacs Basic Exemption Limit for services

provided to Mutual Fund / AMC.

3. For single premium annuity policies, an insurer carrying on life

insurance business shall be liable to pay service tax @ 1.40% of

the single premium charged from the policy holder.

AMENDMENT IN REVERSE CHARGE

MECHANISM

Prepared by Pooja Jajwani, Sandesh

Mundra & Associates](https://image.slidesharecdn.com/servicetaxbudgetimpact2016-160321080000/85/Service-Tax-Budget-impact-2016-46-320.jpg)

![[There is a big chance for disputes, as section

67(2) of Finance Act, 1994 says that Where the

gross amount charged by a service provider, for

the service provided or to be provided is

inclusive of service tax payable, the value of

such taxable service shall be such amount as,

with the addition of tax payable, is equal to the

gross amount charged. Hence, officers are likely

to impose 24% interest rate in most of cases by

saying that assessee has already collected

service tax but not paid to Govt.]

Prepared by Pooja Jajwani, Sandesh Mundra &

Associates](https://image.slidesharecdn.com/servicetaxbudgetimpact2016-160321080000/85/Service-Tax-Budget-impact-2016-61-320.jpg)