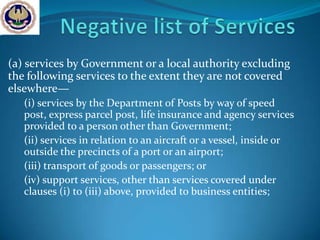

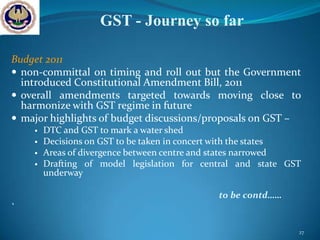

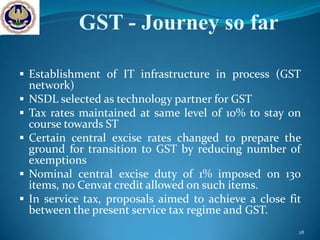

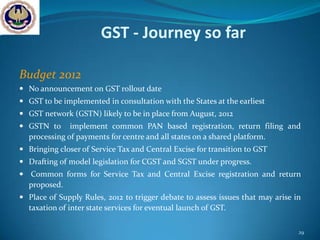

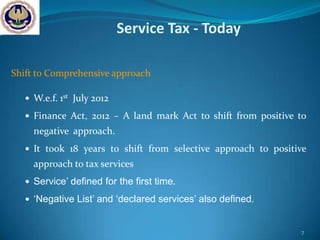

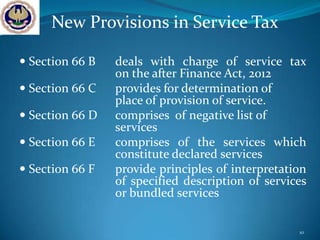

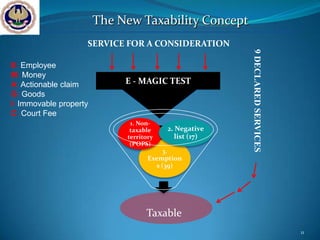

This document provides an overview of a regional conference for CA students in Jodhpur, India on November 30th, 2012 about indirect taxes. The presentation covers the negative list approach and Goods and Service Tax overview, as well as professional opportunities. It discusses India's economy and the contributions of different sectors. It then provides details on the past and present of service tax in India, including the shift to a comprehensive negative list approach. The new provisions and concepts of taxable services are explained. Finally, the 17 services specified in the negative list are listed.

![Service Tax in India (The Past)

Selective Approach to Service Tax

Selective v. Comprehensive approach

Taxation by choice

Service not defined but taxable service defined.

> 120 taxable services [section 65(105)]

Untapped tax potential

Economically justified

6](https://image.slidesharecdn.com/30-11-2012jodhpur-121212020718-phpapp01/85/30-11-2012-jodhpur-6-320.jpg)

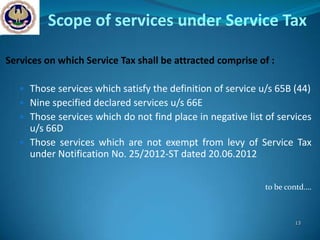

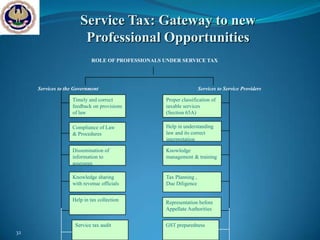

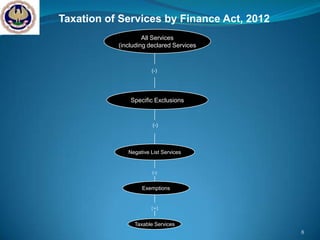

![Taxable of Services w.e.f. 1.7.2012

All services Taxable

[section 65B (44)]

Declared services Taxable

(section 66E)

Services covered under Not Taxable

negative list of services

(section 66D)

Services exempt under Mega Exempted

Notification No. 25/2012-ST

dated 20.6.2012

Other specified Exemptions Exempted

12](https://image.slidesharecdn.com/30-11-2012jodhpur-121212020718-phpapp01/85/30-11-2012-jodhpur-12-320.jpg)