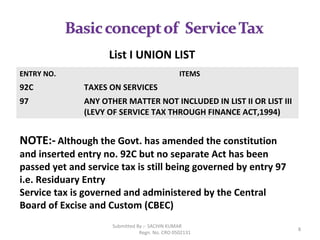

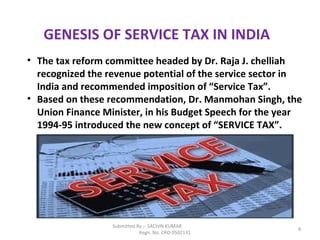

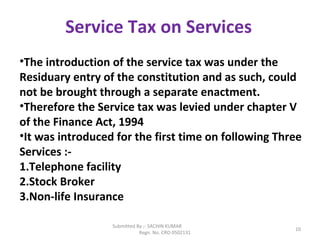

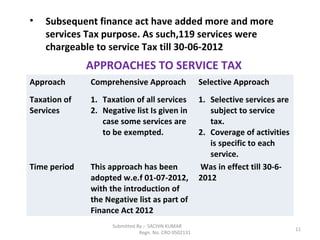

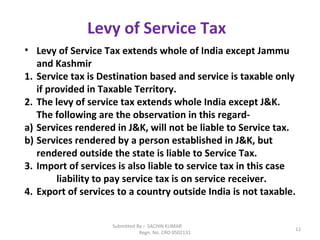

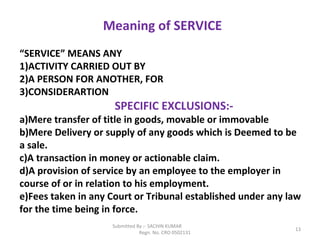

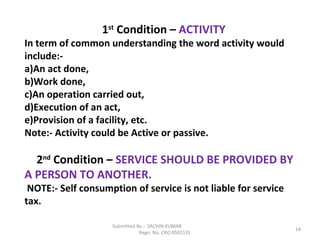

1) The document discusses the topic of service tax in India. It provides details on the basic concept of service tax, its genesis in India, approaches to service taxation, and the meaning of key terms like "service" and "consideration".

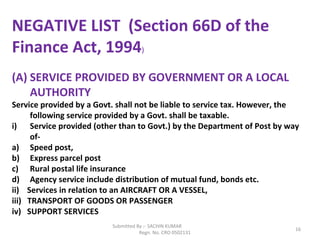

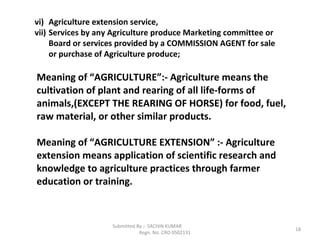

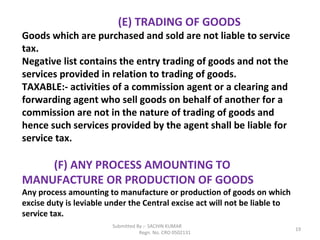

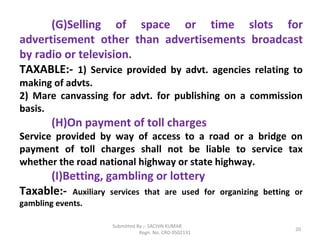

2) It examines the negative list of services exempted from service tax under section 66D of the Finance Act, including services provided by the government, Reserve Bank of India, foreign diplomatic missions, and certain agriculture, trading, manufacturing, and transport-related services.

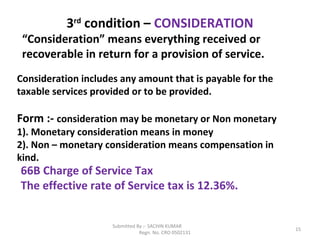

3) The effective rate of service tax in India is currently 12.36% as per section 66B of the Finance Act.