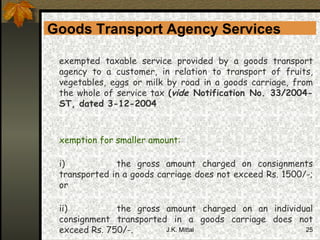

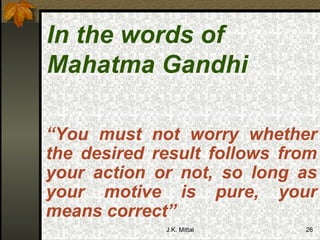

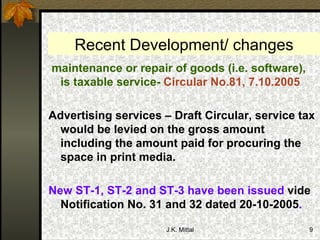

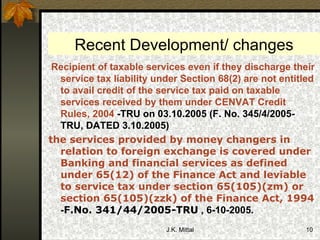

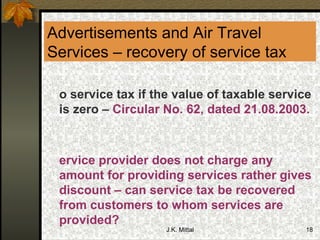

This document discusses various service tax issues and recent developments. It summarizes key points around exemption for small service providers, valuation and payment of service tax, export of services, and liability of service tax payment. It also touches on topics like advertisements, air travel services, and practicing company secretary services versus consulting services.

![Rule 6, w.e.f. 1-4-2005, prescribe that due date for service tax payment by all service tax assessees would be 5th of the following month or quarter, as the case may be However, tax for the month or the quarter ending is required to be paid by 31 st March w.e.f. 16.6.2005, provisions to provide self adjustment of excess payment of service tax by the assessee having centralized registration [Rule 4A]. Payment of Service tax………](https://image.slidesharecdn.com/outsidecpknowledgeservicetax1-120117020427-phpapp01/85/Outside-cp-knowledge-service-tax-1-5-320.jpg)

![Registration issues… * Single registration can be obtained, where assessee has centralize billing system or centralize accounting system, with the permission Rule4(2). W.e.f. 1-4-2005, power vested with the Chief Commissioner or Commission but In case offices are in the jurisdiction of more than one Chief Commissioner than DG (Service Tax) has been empowered to grand centralize registration – Letter No. F. No. 341/20/2005-TRU, dated 12 th May 2002]. [Rule4(3)(a)(b)] .](https://image.slidesharecdn.com/outsidecpknowledgeservicetax1-120117020427-phpapp01/85/Outside-cp-knowledge-service-tax-1-7-320.jpg)

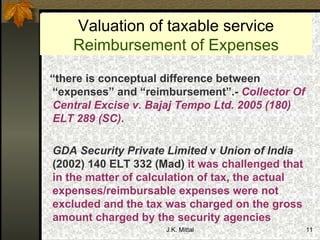

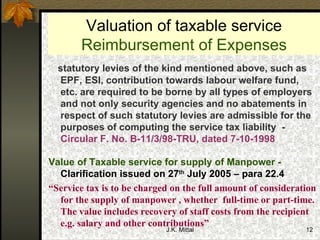

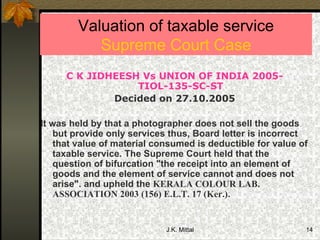

![Valuation of taxable service conflicting clarifications General exemption from service tax for part of value of taxable service which represent cost of goods and materials sold by the service provider to the recipient of service - Notification No. 12/2003, dated 20.06.2003 the value of paper and chemical used in the photo is reflected separately then such value shall be exempted from the service tax in terms of Notification No. 12/2003-ST, dated 20.06.2003 - Board in a letter dated 7 th April 2004 [File No. 233/2/2003.CX. 4] to Punjab Photo Colour Lab Association no other cost (other than the cost of unexposed photography film) such as photographic paper, chemicals, etc. is excluded from the taxable value - Circular F. No. B. 11/1/2001-TRU, dated 9th July, 2001](https://image.slidesharecdn.com/outsidecpknowledgeservicetax1-120117020427-phpapp01/85/Outside-cp-knowledge-service-tax-1-13-320.jpg)

![Who is liable to pay service tax “ every person providing taxable service to any person shall pay service tax at the rate specified in section 66 in such manner and within such period as may be prescribed” [Section 68(1)] for the notified services, service tax shall be paid by the person as prescribed by the Government, which may be recipient of taxable service and in such case, all the provisions shall apply to such person as if he is the person liable for paying the service tax in relation to such notified services [section 68(2)]. Rule 2(1)(d)(iv)- since 16-8-2002, person from outside India then recipient is liable to pay tax](https://image.slidesharecdn.com/outsidecpknowledgeservicetax1-120117020427-phpapp01/85/Outside-cp-knowledge-service-tax-1-16-320.jpg)

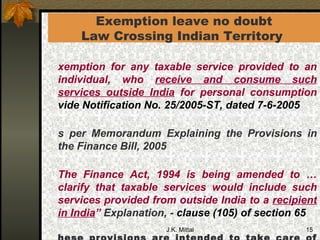

![Export of Services w.e.f. 15-3-2005 Export of taxable service (9 services) means, when services are in relation to immovable property, which is situated outside India [Rule 3(1)]. 48 taxable services are treated as export of services when such services are performed (partly or wholly) outside India [Rule 3(2)]. w.e.f. 16-6-2005, such services is treated as export of service only if delivered and used in business or for any other purpose outside India and payments is received by service provider in convertible foreign exchange .](https://image.slidesharecdn.com/outsidecpknowledgeservicetax1-120117020427-phpapp01/85/Outside-cp-knowledge-service-tax-1-17-320.jpg)

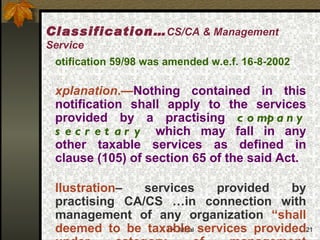

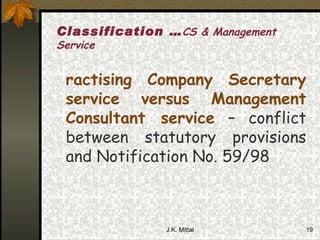

![Taxable service means any service provided or to be provided, “ to a client, by a practising company secretary in his professional capacity, in any manner .” [section 65(105)(u)]. Notification No. 59/98, 16.10.98 exempts the taxable services provided by a practising company secretary in his professional capacity to a client, other than the taxable services relating to - accounting, auditing, certifications etc.. Classification… CS & Management Service](https://image.slidesharecdn.com/outsidecpknowledgeservicetax1-120117020427-phpapp01/85/Outside-cp-knowledge-service-tax-1-20-320.jpg)