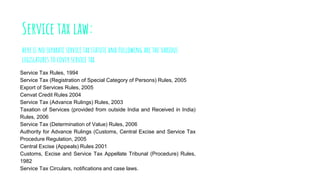

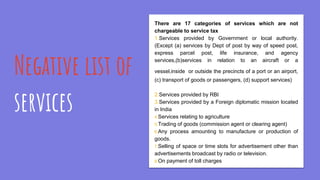

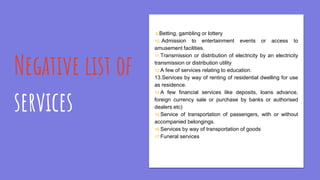

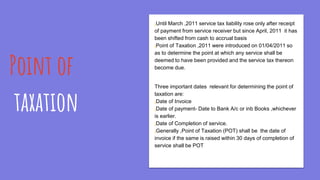

Service tax is an indirect tax paid to the government for consuming taxable services provided by service providers. The tax is included in bills for services such as restaurants, travel, and cable providers. Service tax was introduced in 1994 at a rate of 5% and now stands at 15% including additional cess taxes. Service tax applies throughout India except Jammu and Kashmir. Certain services such as agriculture, betting, and transportation of passengers are excluded from service tax through a negative list. The point of taxation, or when the tax liability arises, is determined based on the invoice date, payment date, or completion of service date - whichever comes first.