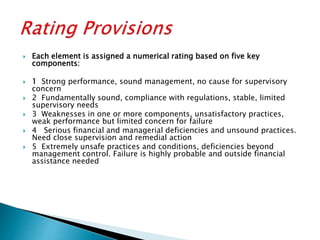

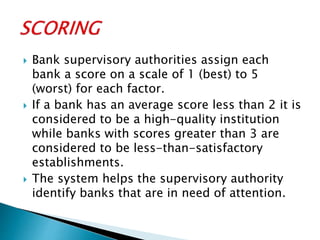

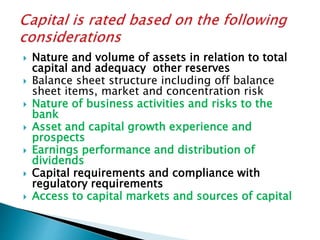

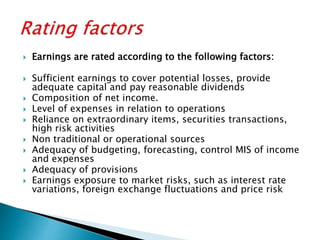

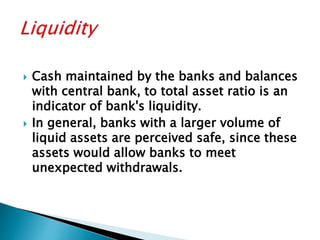

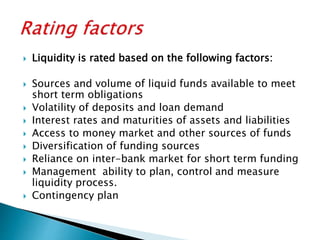

The document introduces the CAMELS rating system used by bank supervisory authorities to evaluate domestic and foreign banks. CAMELS ratings assess banks on capital adequacy, asset quality, management, earnings, liquidity, and sensitivity to market risk. Banks are given scores from 1 to 5 on each factor, with lower scores indicating stronger performance. An average score less than 2 signifies a high-quality institution, while scores above 3 require supervisory attention.