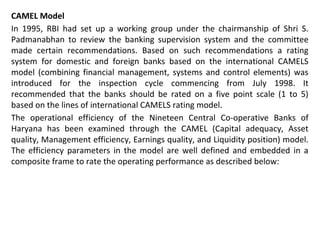

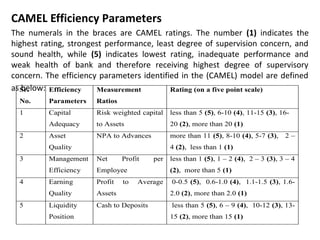

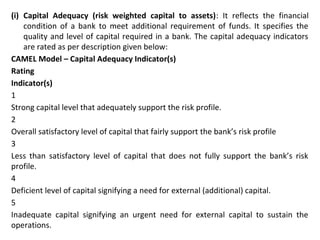

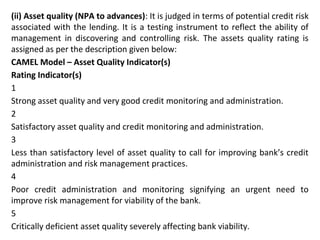

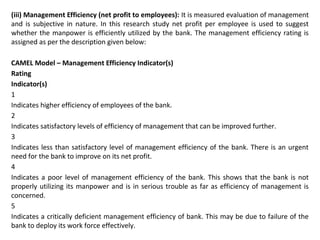

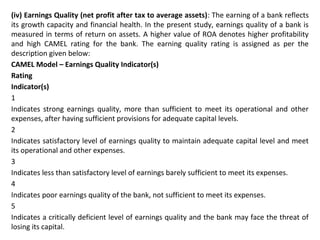

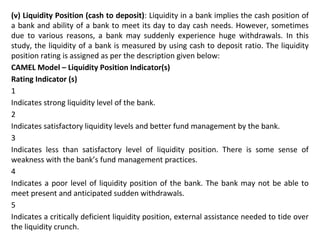

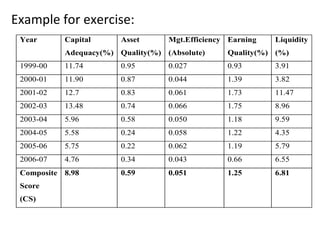

The document discusses the CAMEL model for evaluating the operational efficiency of banks. CAMEL stands for Capital Adequacy, Asset Quality, Management Efficiency, Earnings Quality, and Liquidity Position. Each component is measured using specific ratios and assigned a rating from 1 to 5, with 1 being the highest rating. The document provides detailed descriptions and thresholds for rating each CAMEL component. It also includes an example of how the ratings would be applied to calculate a composite score for a bank's performance evaluation.