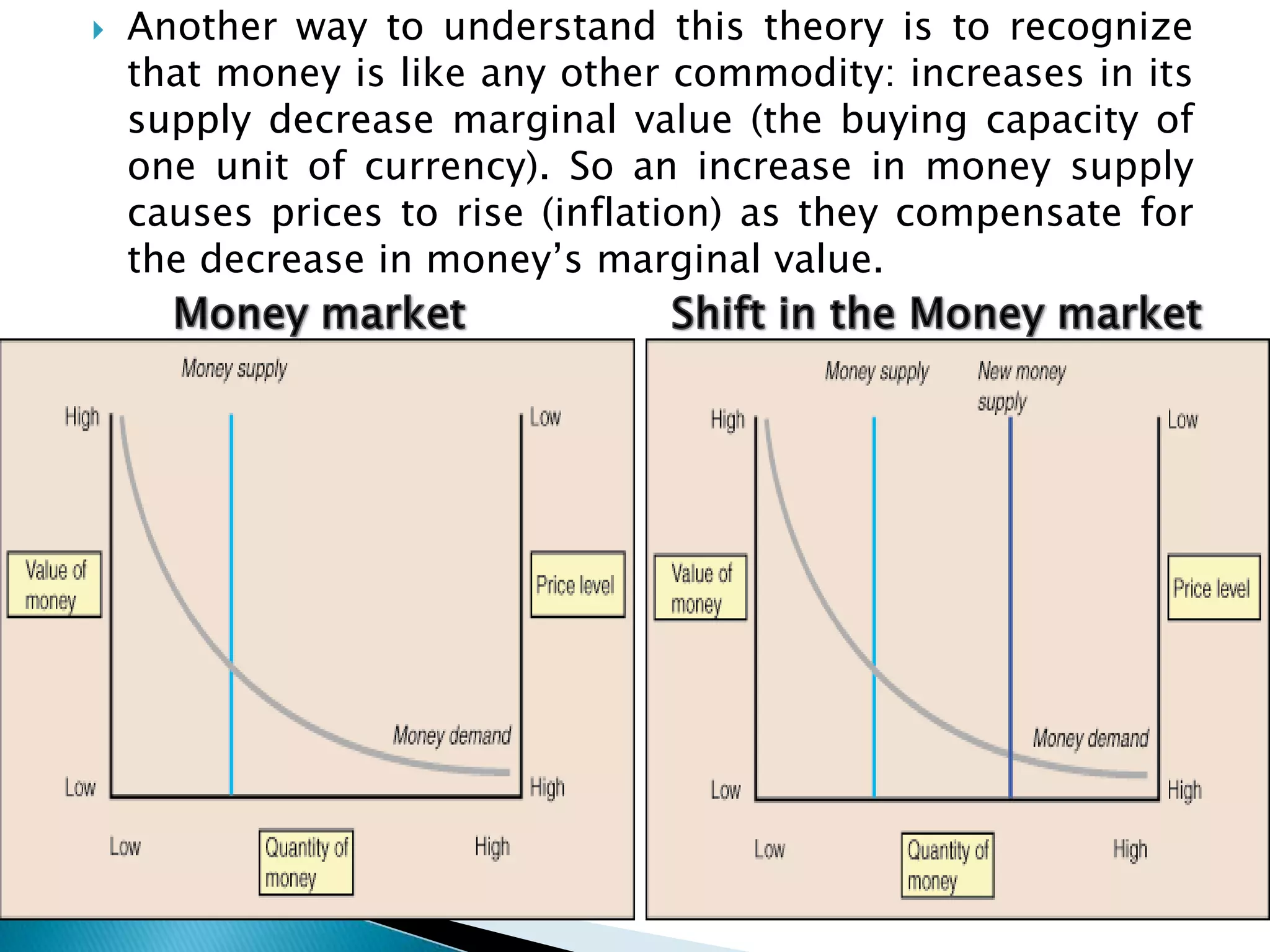

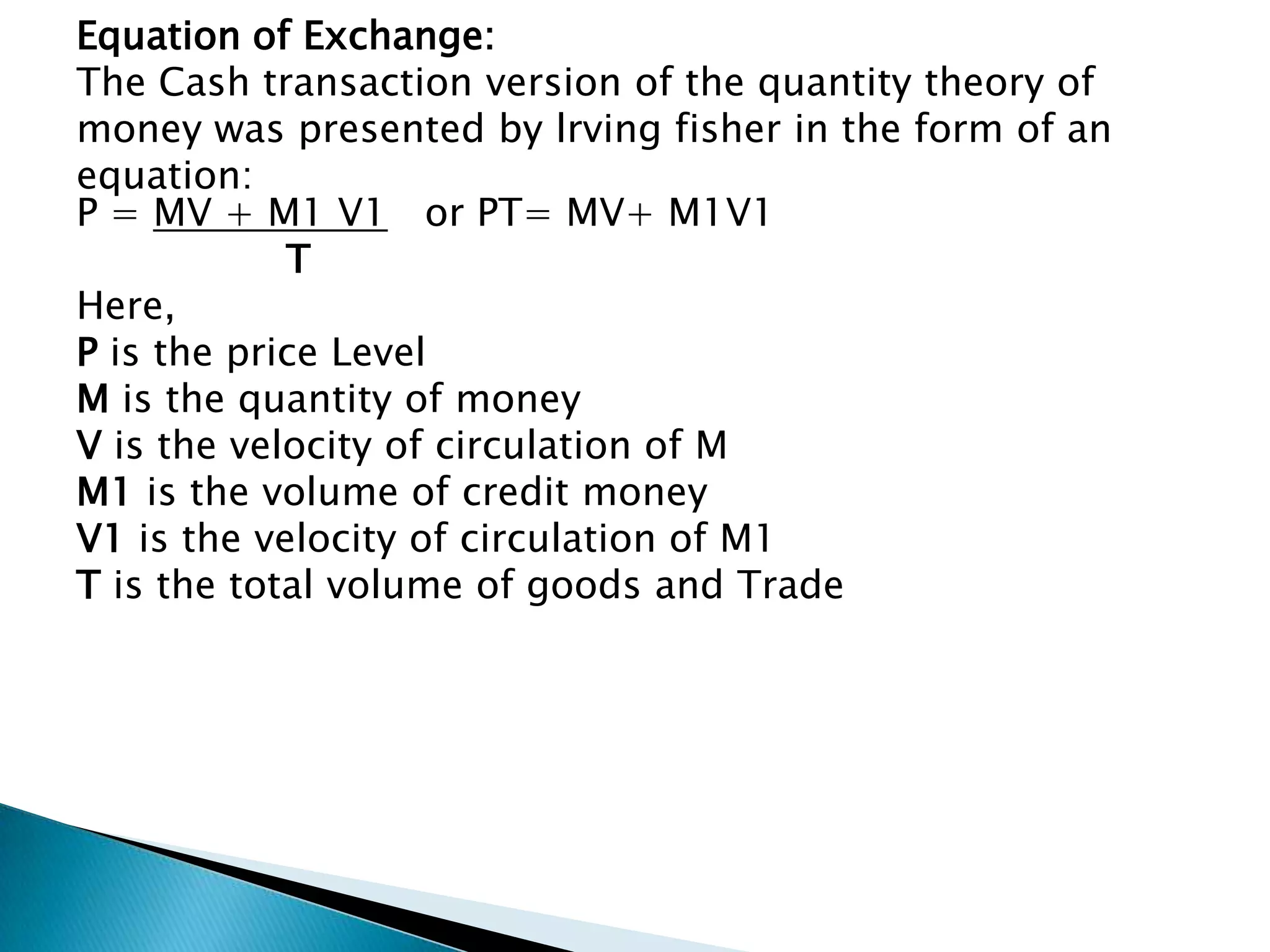

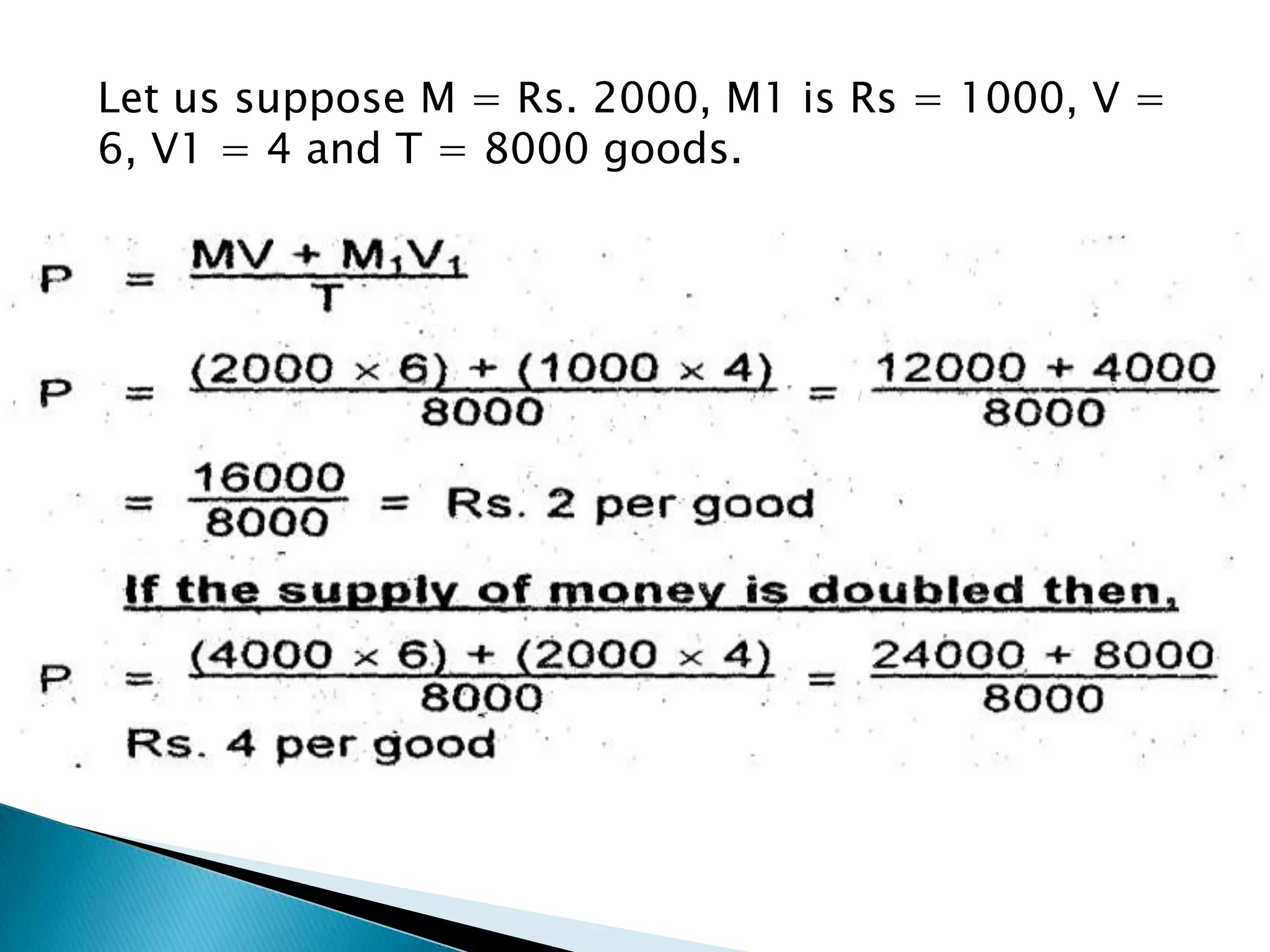

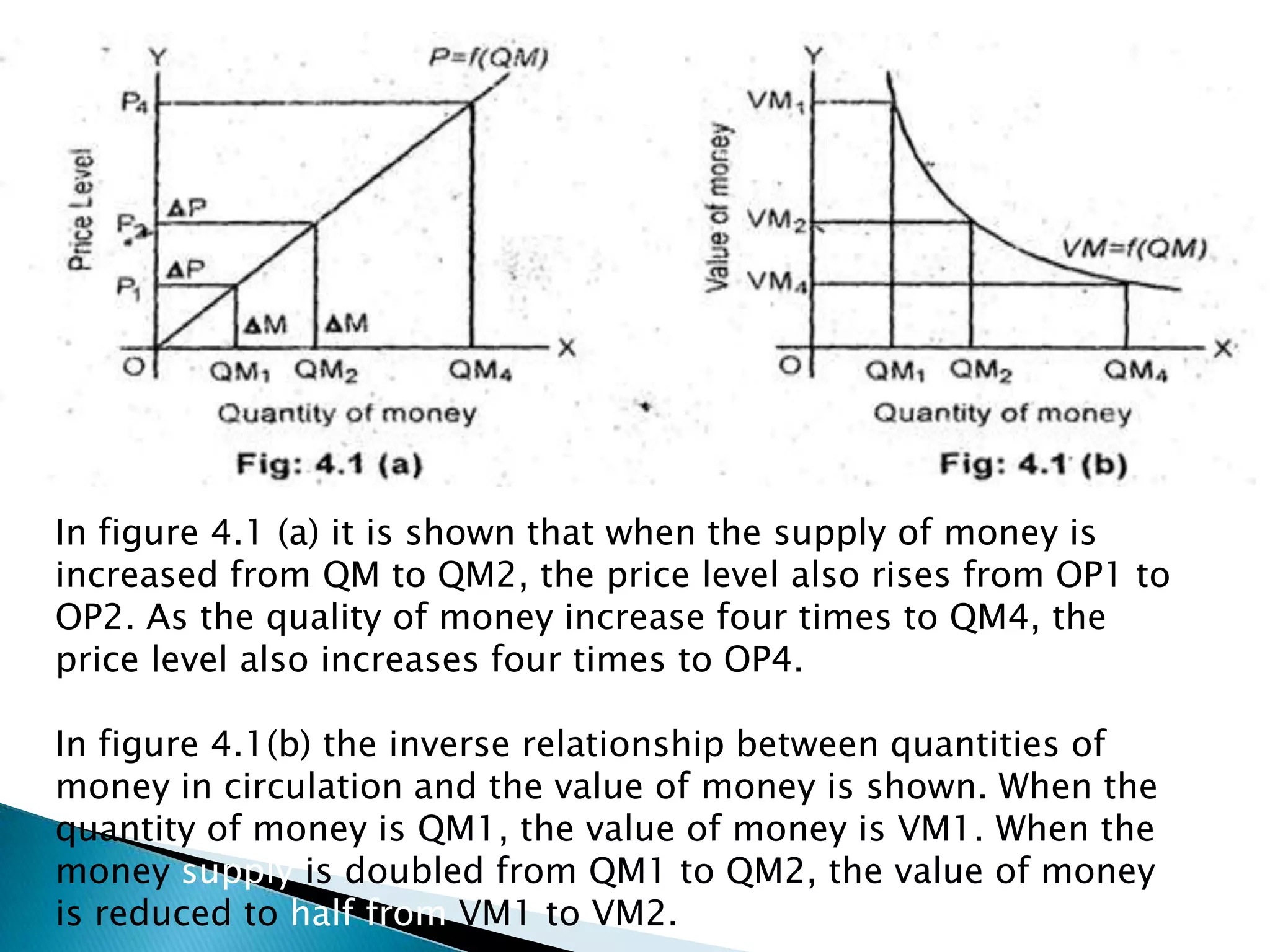

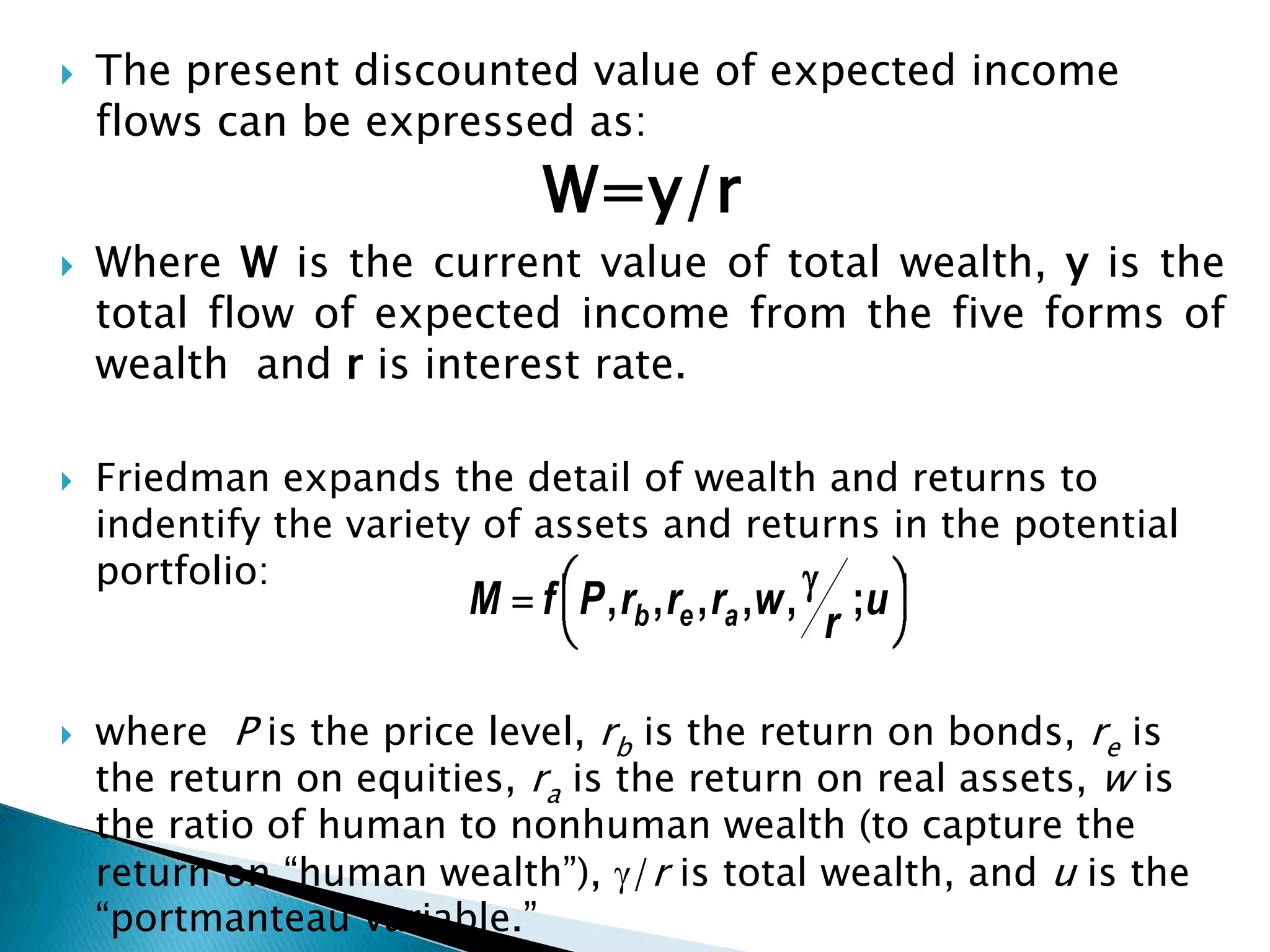

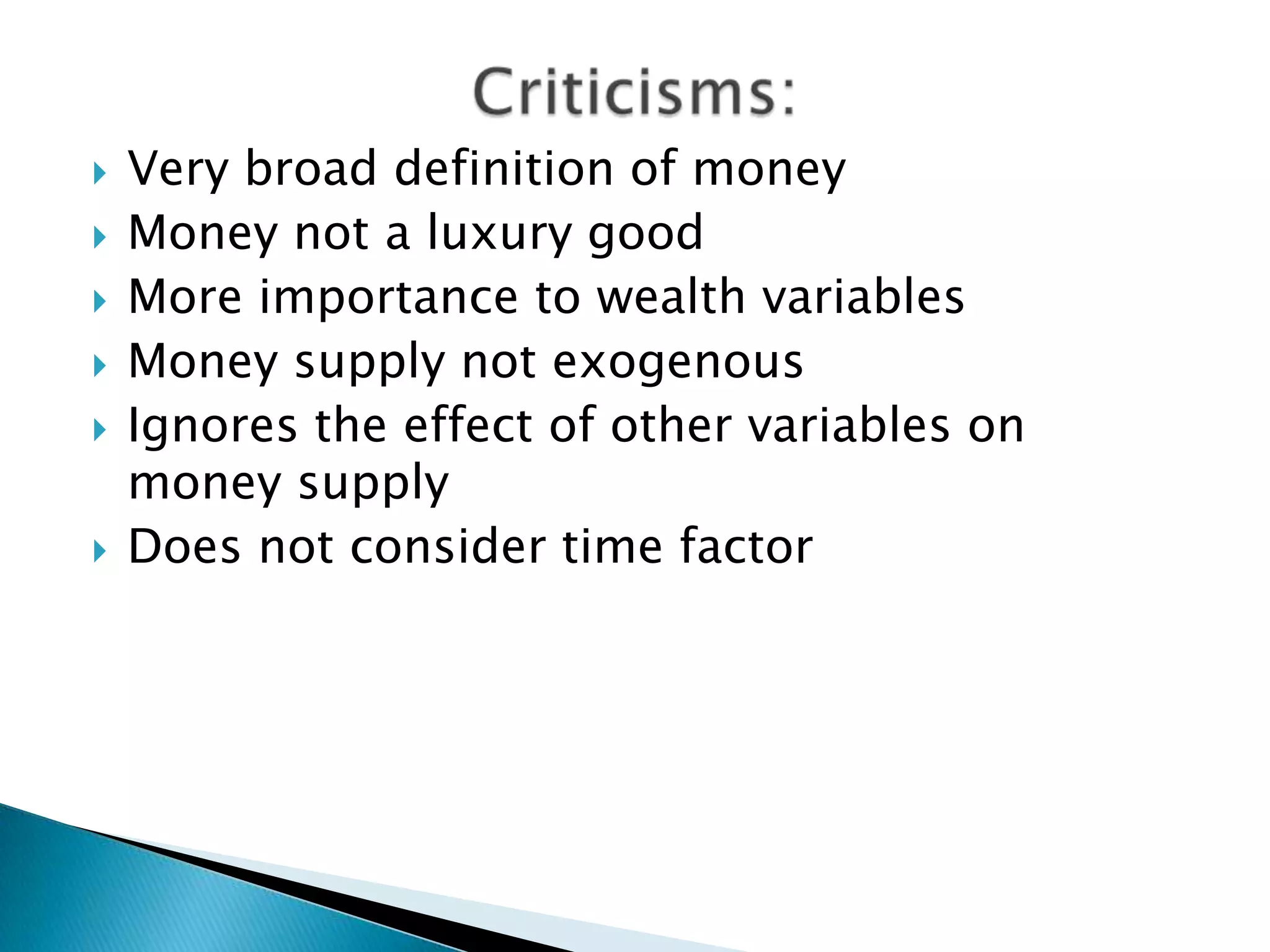

The document discusses the quantity theory of money. It begins by explaining the basic concept that there is a direct relationship between the quantity of money in an economy and the price level. It then discusses Irving Fisher's formulation of the quantity theory through his equation of exchange. Finally, it discusses Milton Friedman's reformulation, which views the quantity theory as a theory of demand for money and emphasizes the role of wealth and asset prices in determining demand for money.