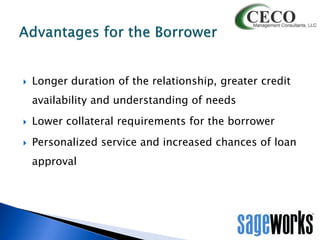

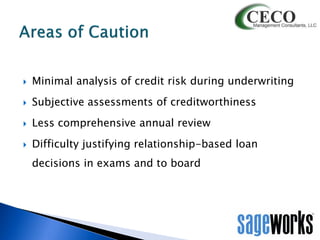

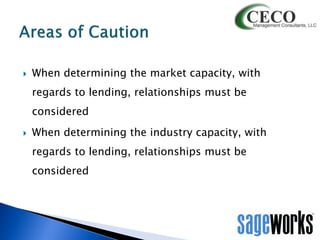

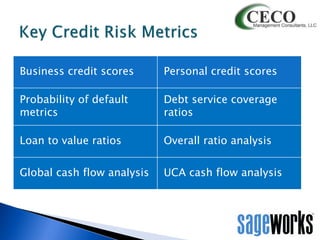

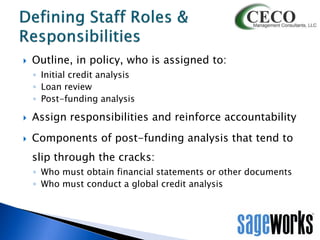

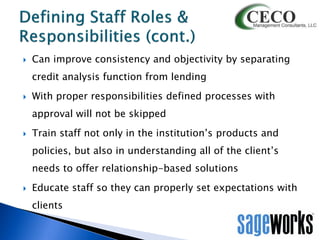

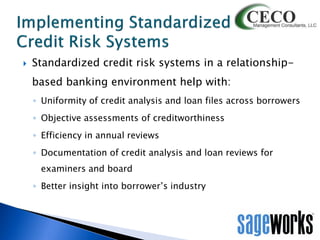

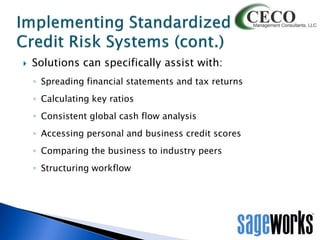

This webinar presentation was given by Jay Borkowski of Sageworks and Joe Waites of CECO Management Consultants. Sageworks provides credit risk management solutions and data to financial institutions. CECO provides consulting services in areas like strategy, credit, and operations to financial services companies. The webinar discussed relationship-based banking and lending, balancing relationships with risk management, and examples of effective strategies like outlining credit metrics and defining staff roles. Questions from attendees could be entered in the chat box.