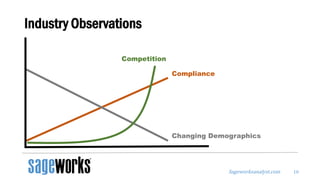

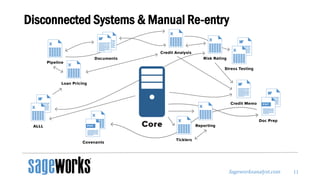

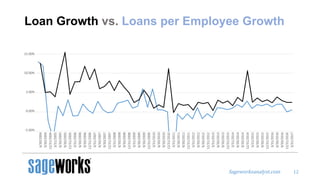

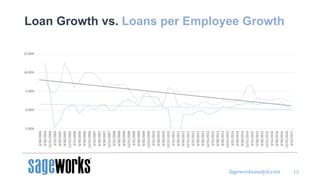

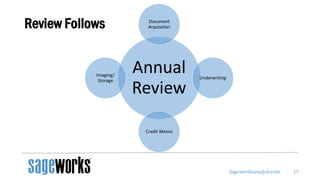

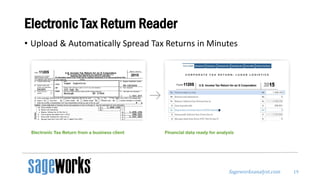

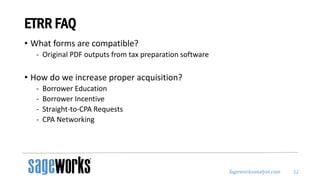

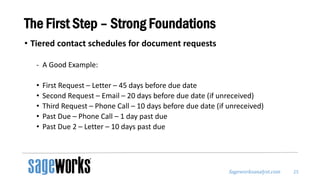

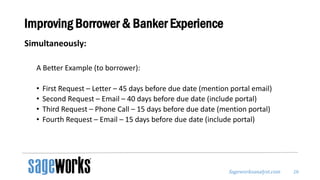

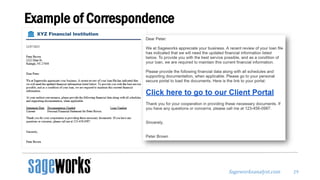

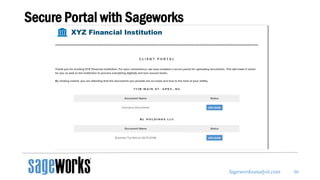

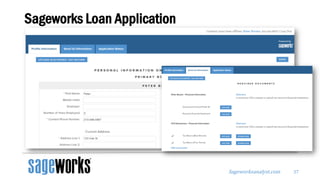

The document discusses best practices in document management to eliminate manual data entry, enhance the borrower and banker experience, and increase profitability. It highlights the importance of using technology, such as electronic tax return readers and digital portals, to streamline processes and reduce errors in lending. Additionally, the document outlines strategies for effectively collecting documents and improving communication between bankers and borrowers.