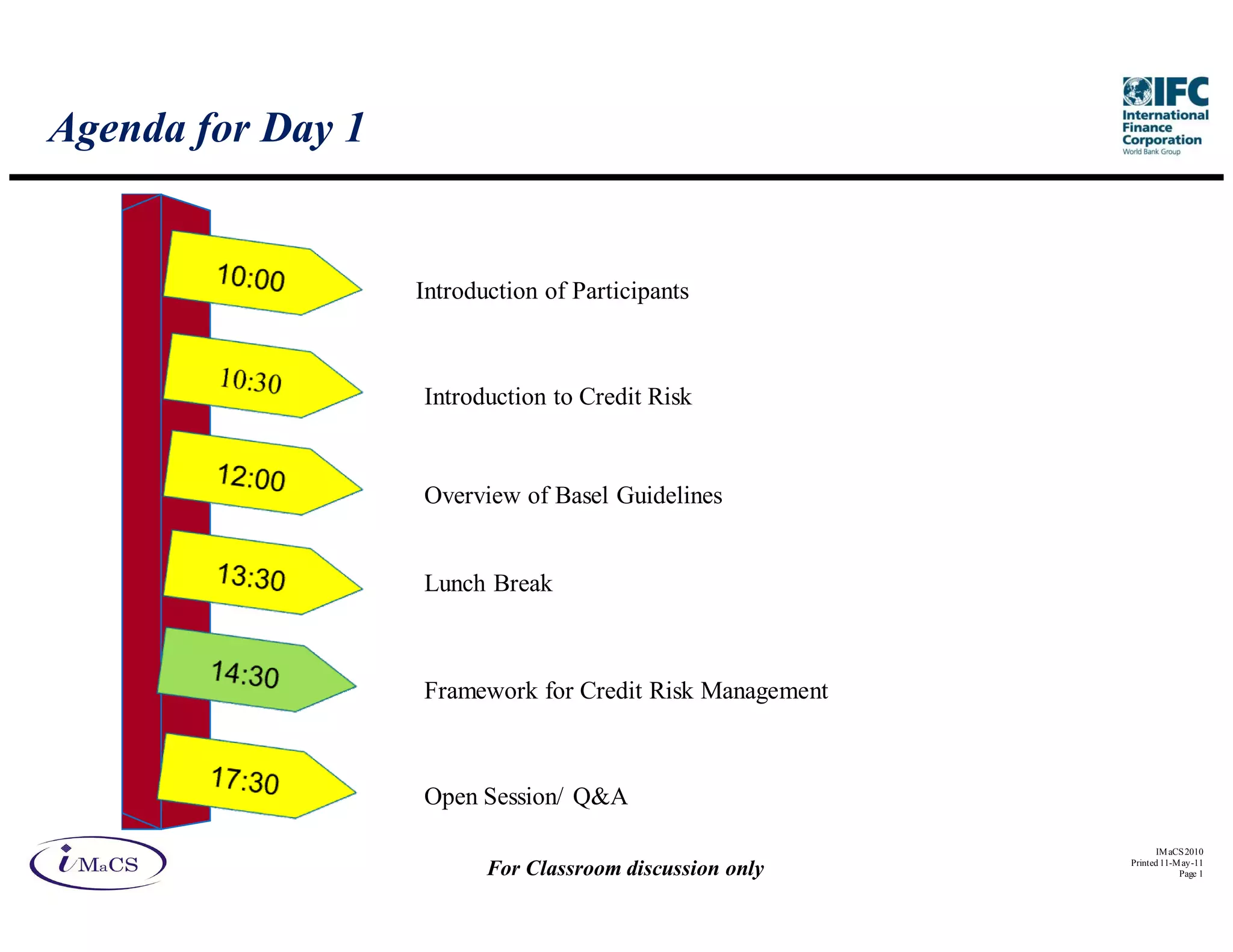

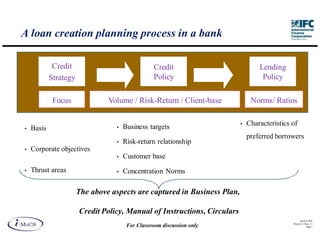

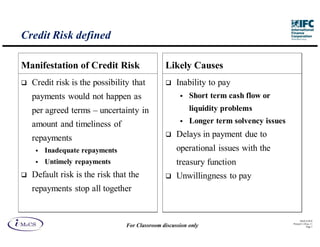

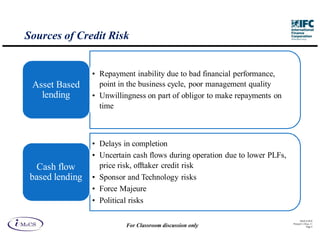

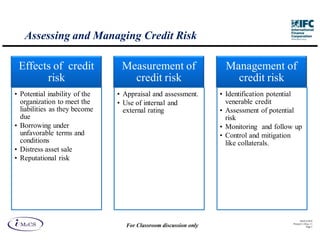

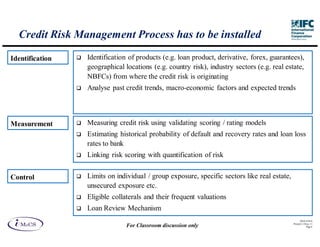

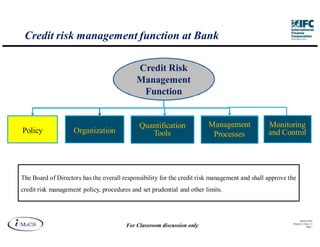

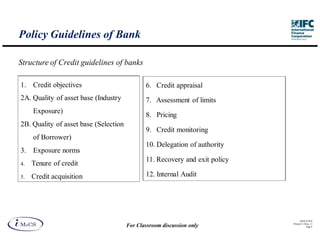

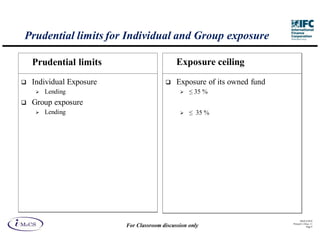

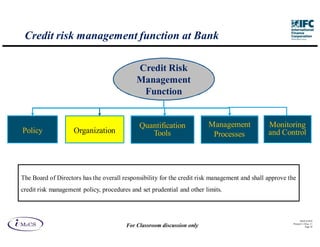

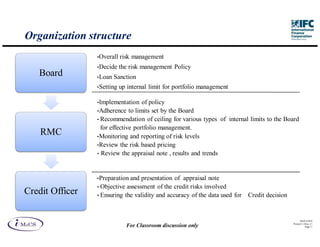

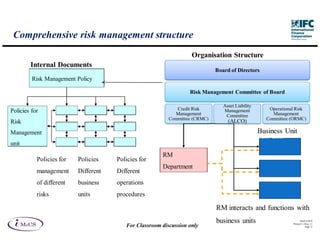

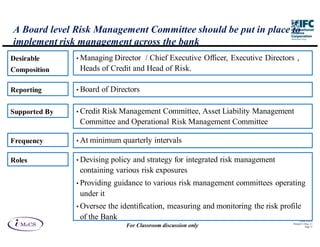

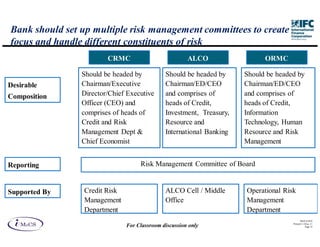

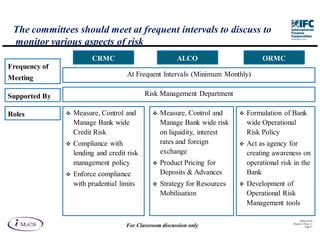

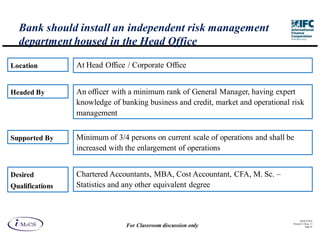

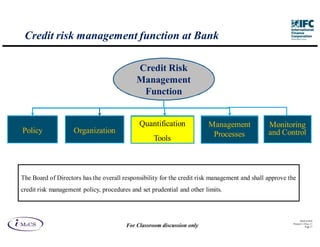

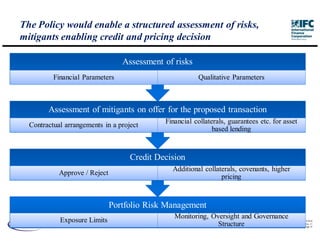

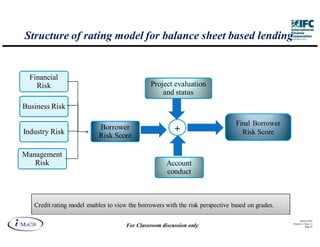

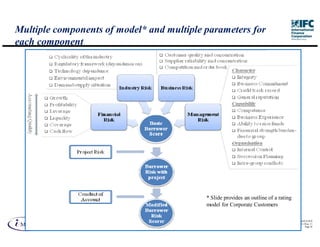

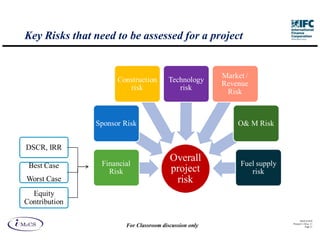

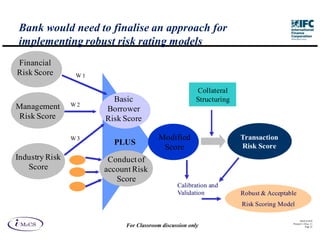

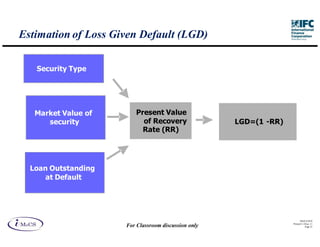

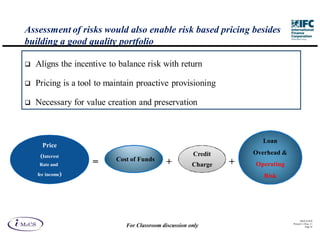

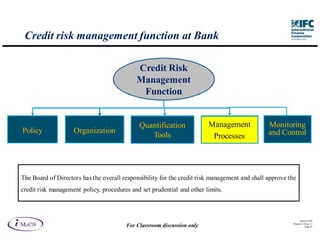

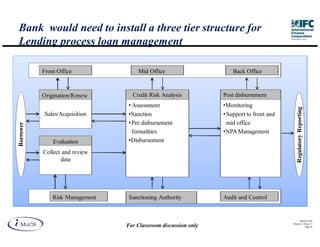

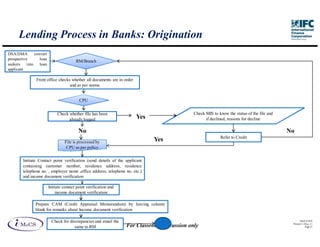

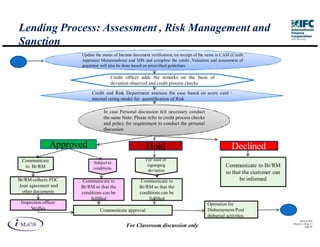

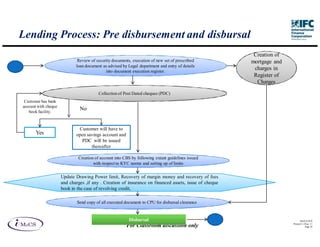

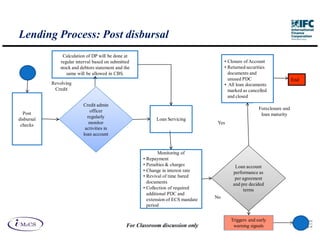

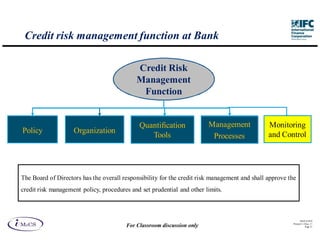

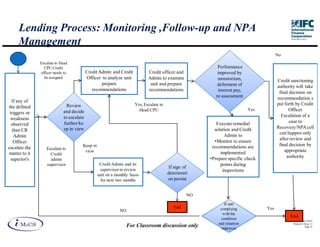

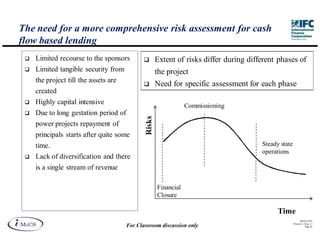

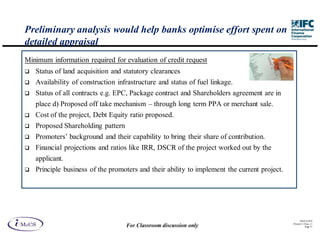

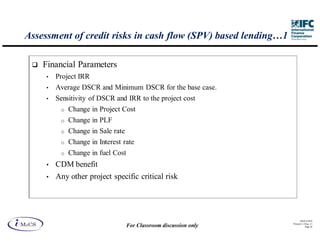

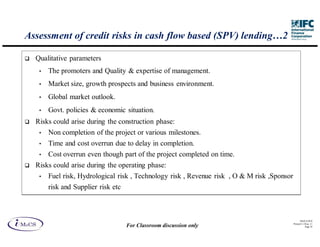

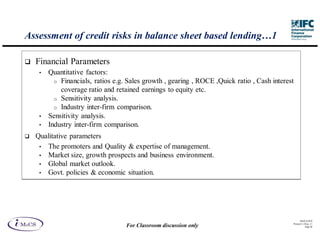

The document outlines the framework for credit risk management in banking, detailing processes for assessing and managing credit risk, including identification, measurement, and monitoring. It emphasizes the need for a structured approach with clear guidelines on loan creation, risk assessment, and portfolio management to minimize potential losses. Additionally, it discusses the roles of various committees and organizational structures in overseeing credit risk management policies and compliance.