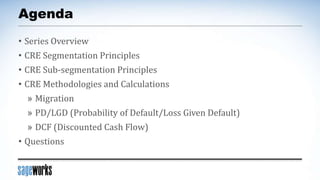

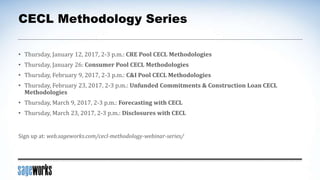

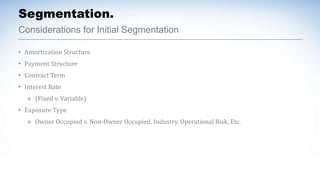

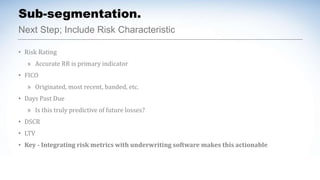

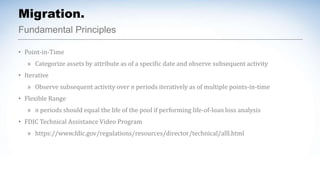

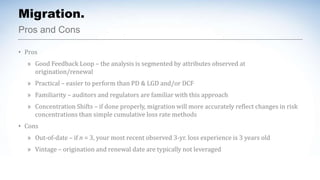

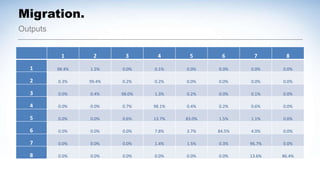

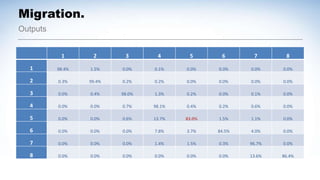

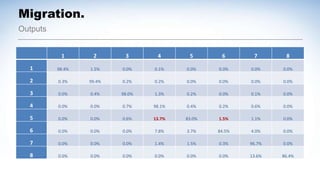

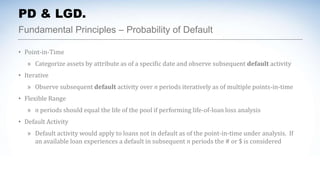

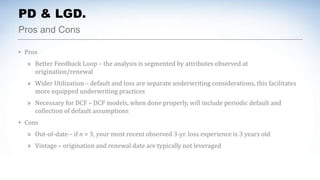

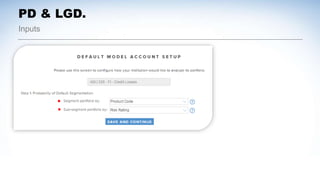

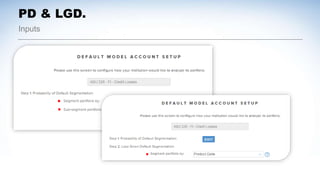

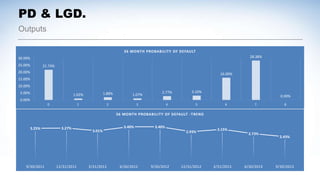

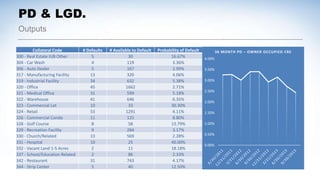

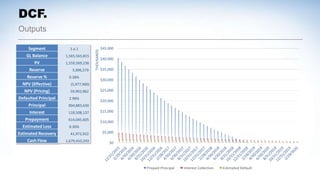

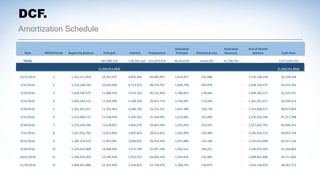

The document is a presentation on the CECL methodology series covering commercial real estate (CRE) and its risk management strategies. It includes information about segmentation principles, probability of default, and discounted cash flow calculations, along with pros and cons of various methodologies. The webinar series is designed to inform financial institutions and auditors about best practices and risks associated with loan portfolio management.