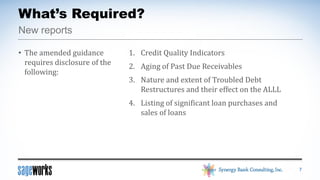

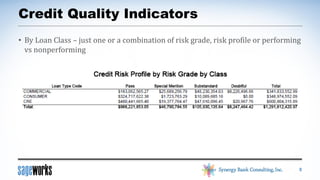

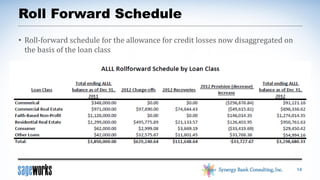

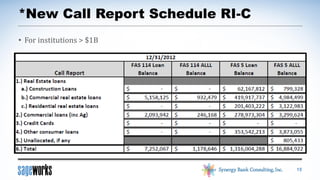

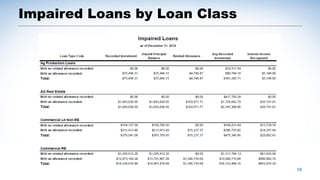

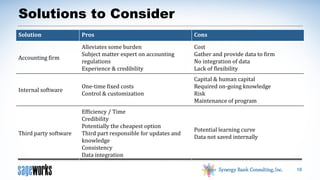

The document presents a financial information company and its key personnel, including Ed Bayer from Sageworks and Ancin Cooley from Synergy Bank Consulting. It discusses the importance of the Accounting Standards Update (ASU) 2010-20, mandating enhanced credit quality disclosures to improve transparency for financial institutions. There is also a comparison of solutions for managing accounting requirements, discussing the pros and cons of using accounting firms, internal software, and third-party software.