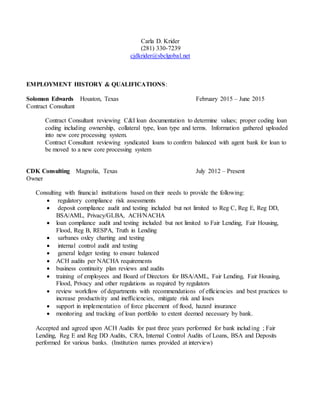

Carla D. Krider has over 30 years of experience in banking and financial consulting. She has held positions such as Loan Operations Manager and Vice President, where she oversaw loan departments and ensured compliance with regulations. Currently, as the owner of CDK Consulting, she provides regulatory compliance audits and risk assessments, internal control reviews, and training to financial institutions. Her qualifications include various banking certifications and extensive experience in loan and deposit compliance, auditing, and operations management.