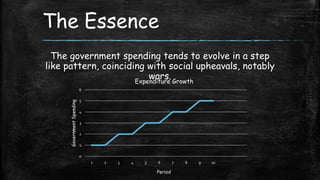

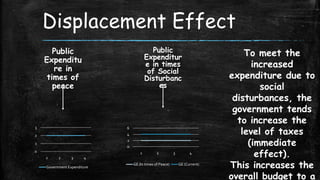

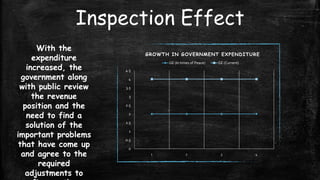

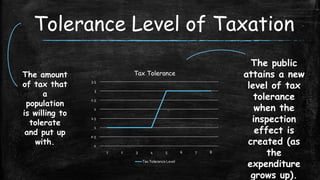

The Peacock-Wiseman Hypothesis proposes that government spending evolves in a step-like pattern coinciding with social upheavals like wars. It involves three related elements: 1) The displacement effect, where spending increases during disturbances, raising taxes and the budget. 2) The inspection effect, where increased spending leads to reviewing revenue needs. 3) The concentration effect, where spending and revenue stabilize at a new higher level until the next disturbance causes another displacement effect. Along with these effects, it explains the concept of a tolerance level of taxation that a population is willing to tolerate.

![History

ALAN T. PEACOCK,

University of Edinburgh

JACK WISEMAN,

London School of

Economics

and Political Science

The Growth of

Public Expenditure

in the United

Kingdom (1961)

[A study of behavior of

British government

expenditures from 1890 to

1955]](https://image.slidesharecdn.com/thepeacock-wisemanhypothesis-131021114826-phpapp01/85/The-Peacock-Wiseman-hypothesis-2-320.jpg)