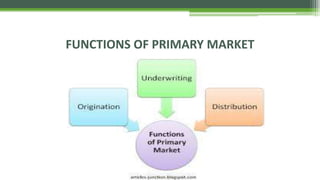

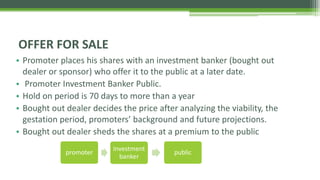

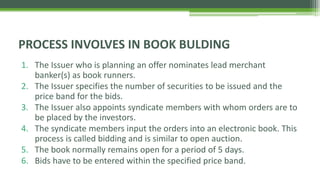

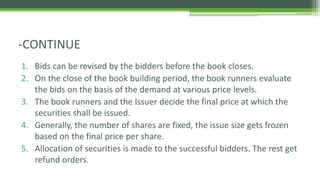

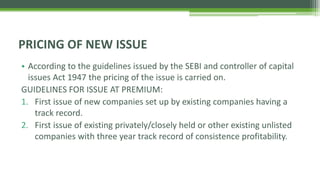

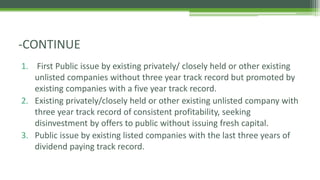

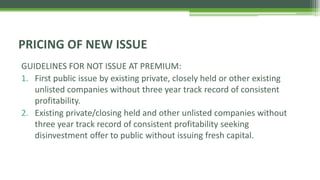

The document discusses the capital market, focusing on the primary market where new securities are issued. It outlines the roles of various players, including underwriters and lead managers, and describes methods of issuing shares such as Initial Public Offerings (IPOs) and rights issues. Additionally, it covers processes like book building and pricing guidelines for new issues, highlighting the significance of underwriting and marketing in facilitating public offerings.