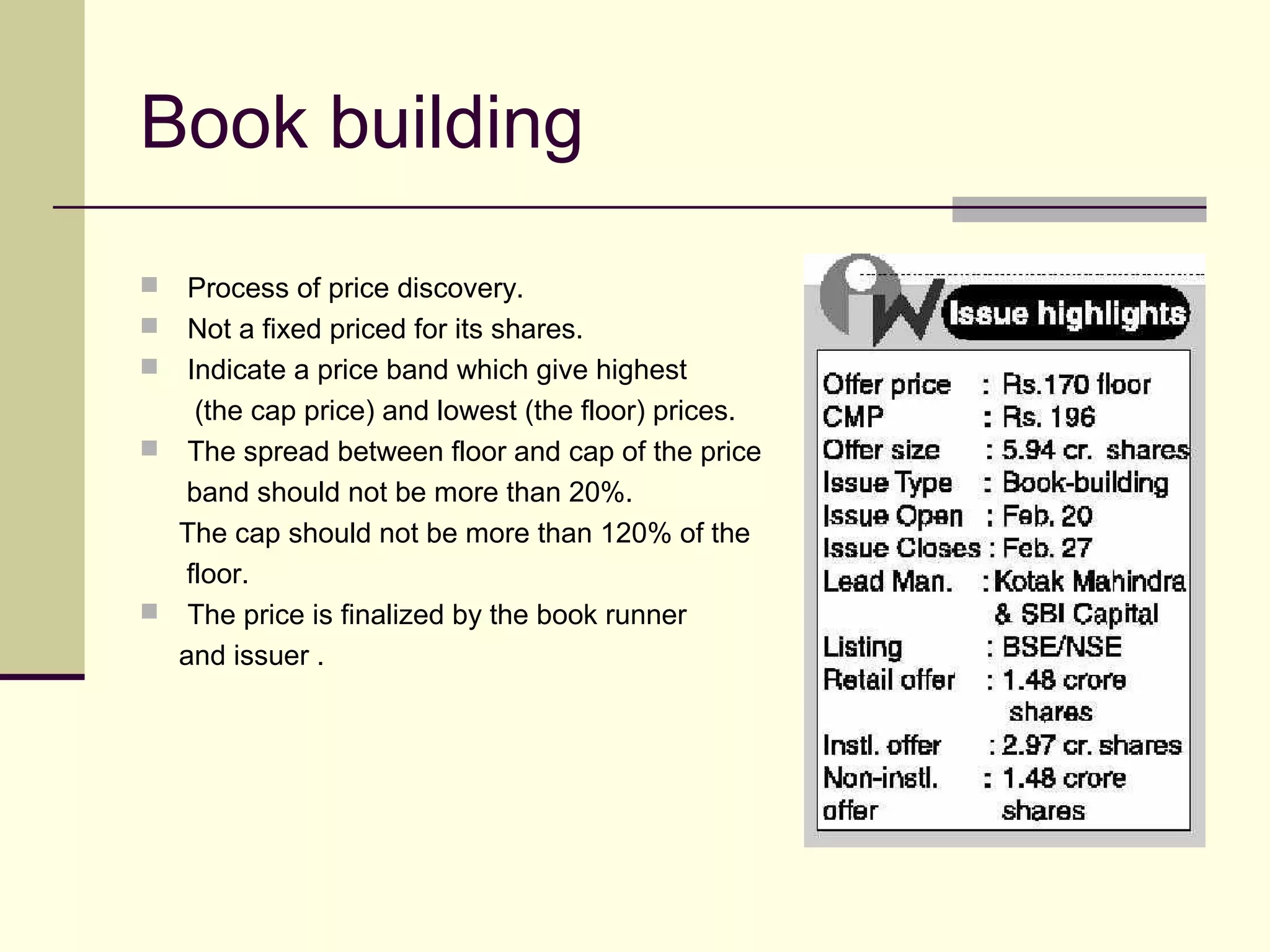

This document discusses equity shares and how they are issued in the primary market. It begins by defining the primary and secondary markets. In the primary market, companies issue new securities to raise capital. The document then discusses features of equity shares like maturity, income rights, and limited liability. It explains various methods of primary issuance like prospectus offers, private placements, right issues, and book building. It also outlines the roles of intermediaries in the issuance process like lead managers, registrars, bankers and underwriters.