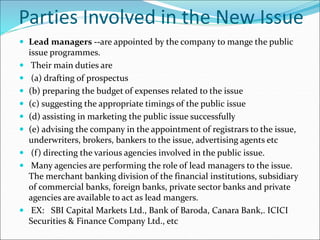

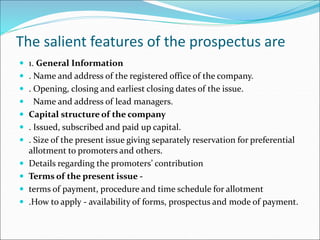

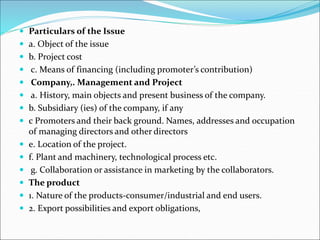

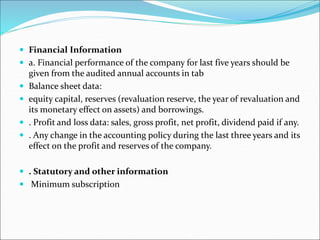

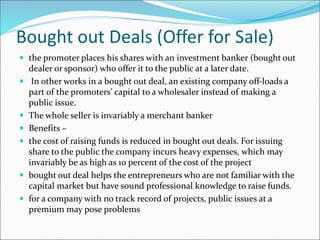

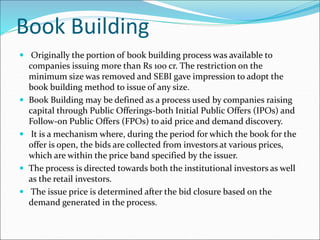

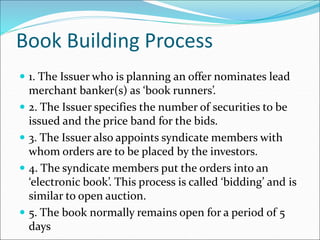

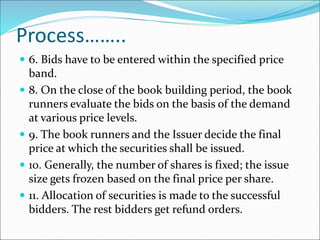

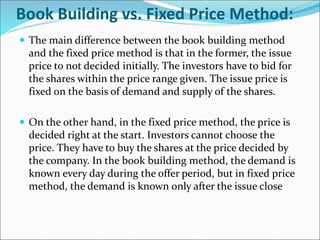

This document summarizes the key aspects of raising capital through a primary market public offering in India. It discusses the various methods companies use to raise funds, such as issuing shares, debentures, or global depository receipts. It then describes the functions of the primary market and the parties involved, including lead managers, registrars, underwriters, bankers, and advertising agents. It provides details on the prospectus, book building process, and other placement methods such as rights issues, private placements, bought deals and fixed price offerings. Overall, the document offers an overview of the Indian primary market and the process for companies conducting a public securities offering.