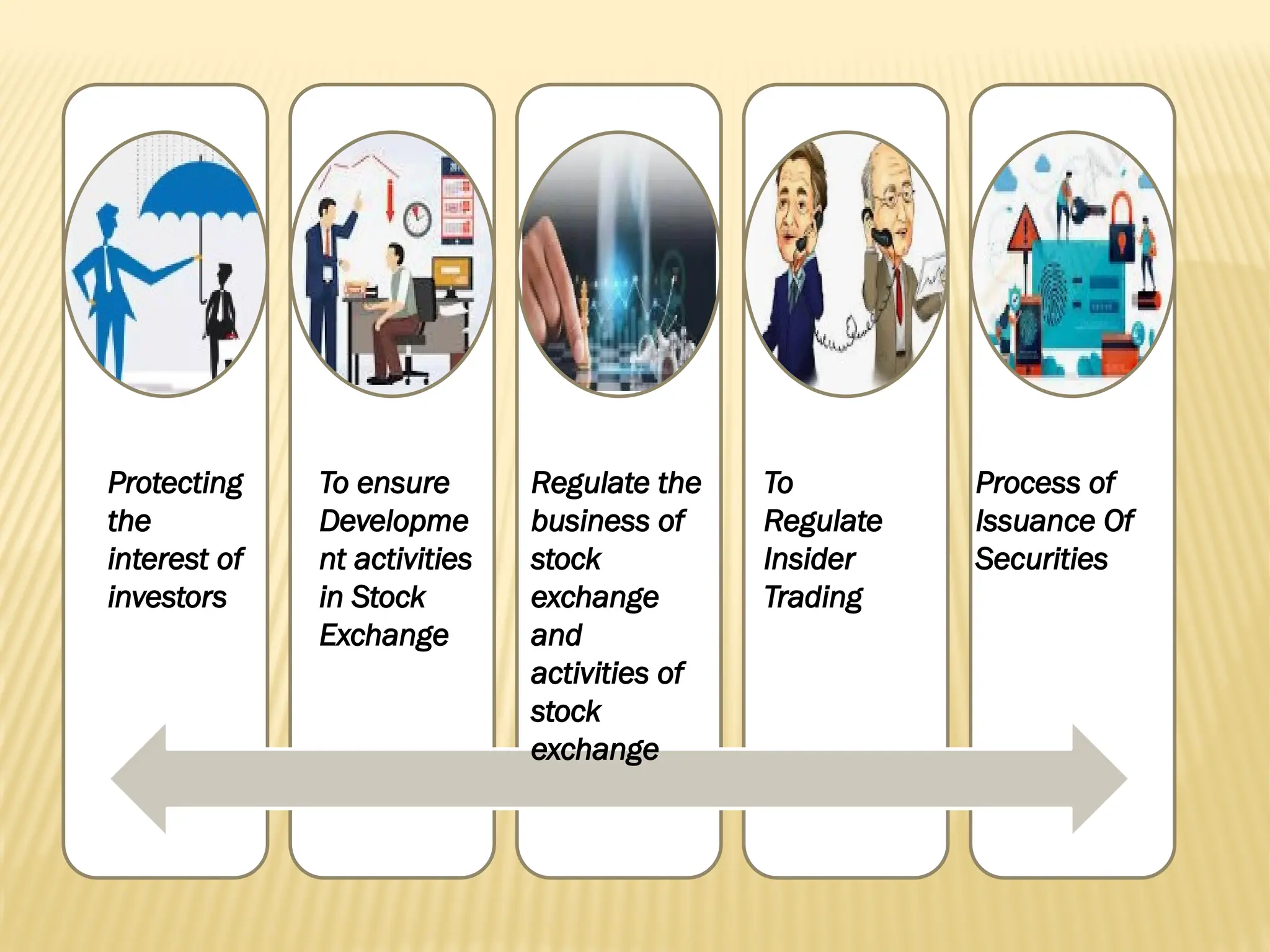

The document discusses the new issue market, also known as the primary market, where new securities are issued to the public for the first time, primarily through initial public offerings (IPOs) and seasoned equity offerings (SEOs). It outlines the roles of various participants such as merchant bankers, underwriters, and brokers, as well as methods for floating new issues, including public issues, offers for sale, placement, and rights issues. Additionally, it highlights the role of regulatory bodies like SEBI in protecting investor interests and ensuring market development.