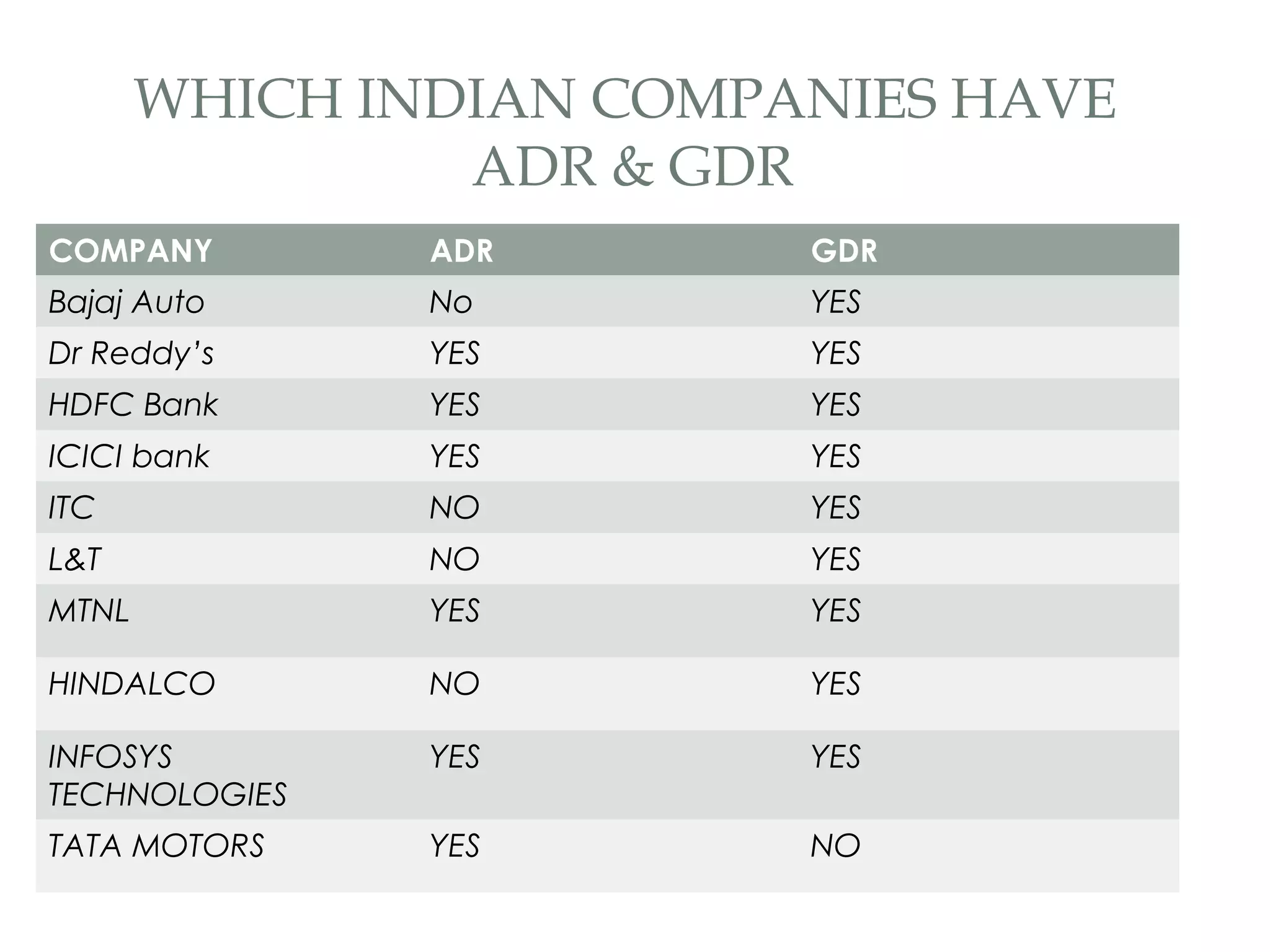

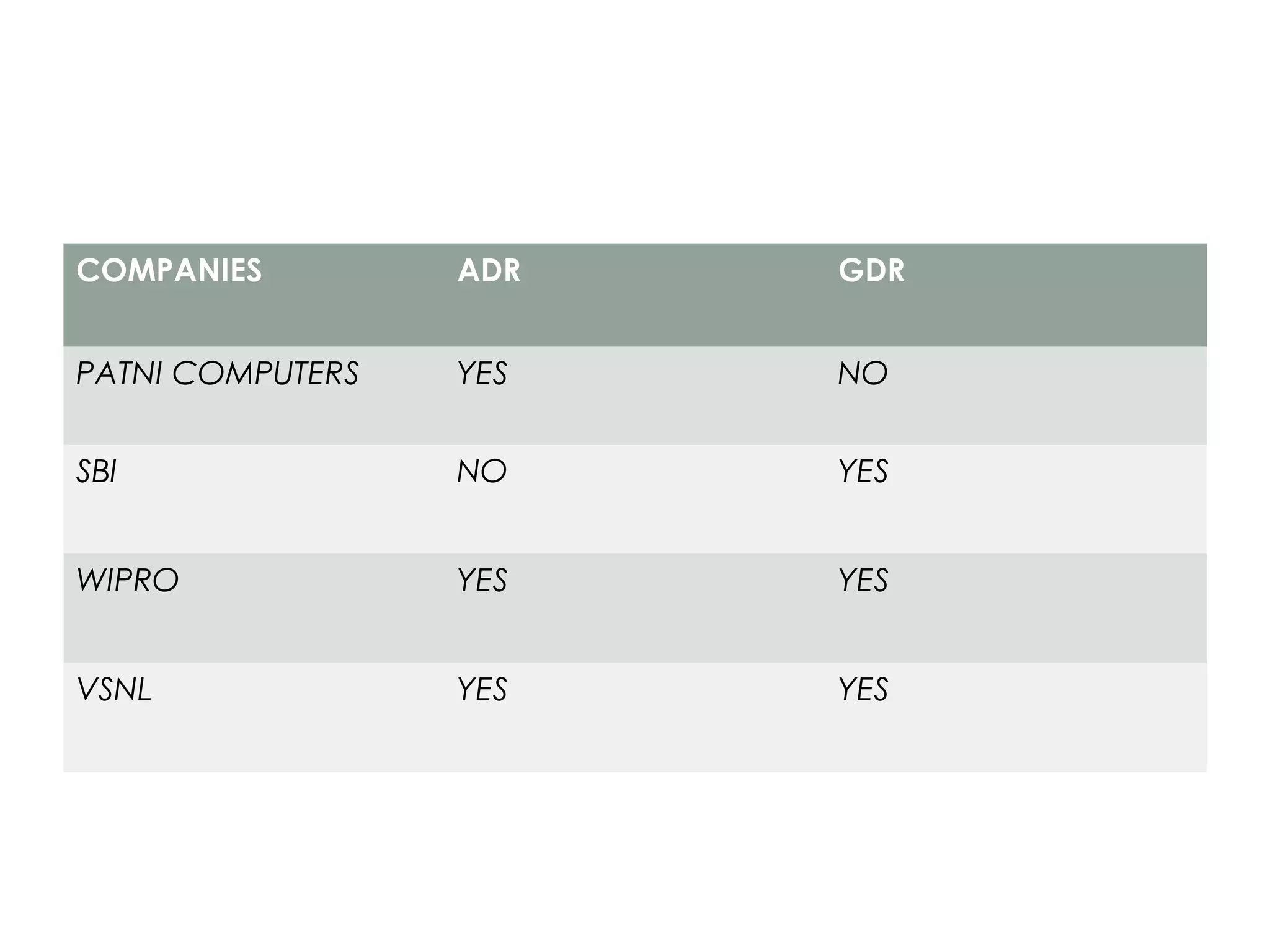

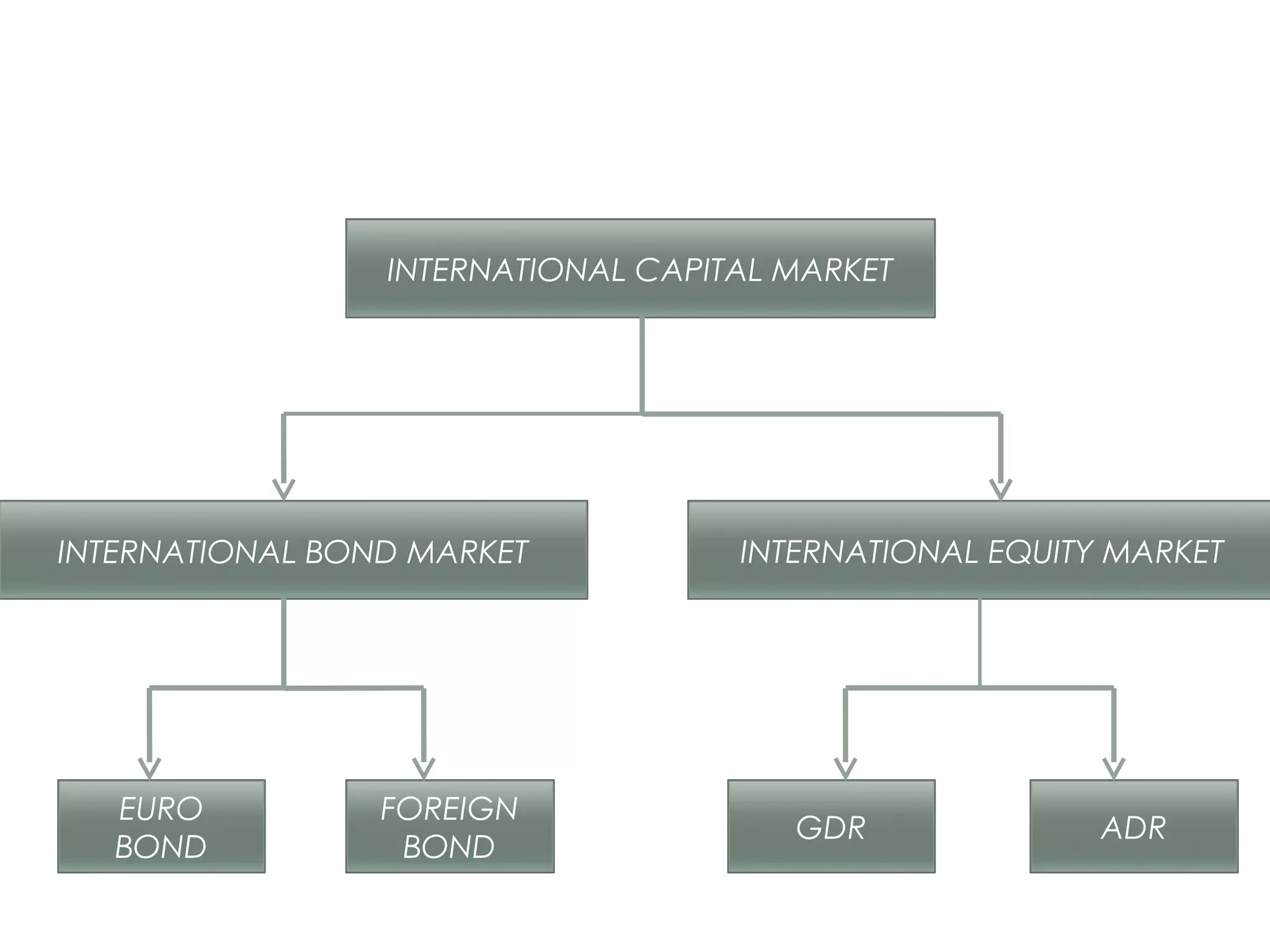

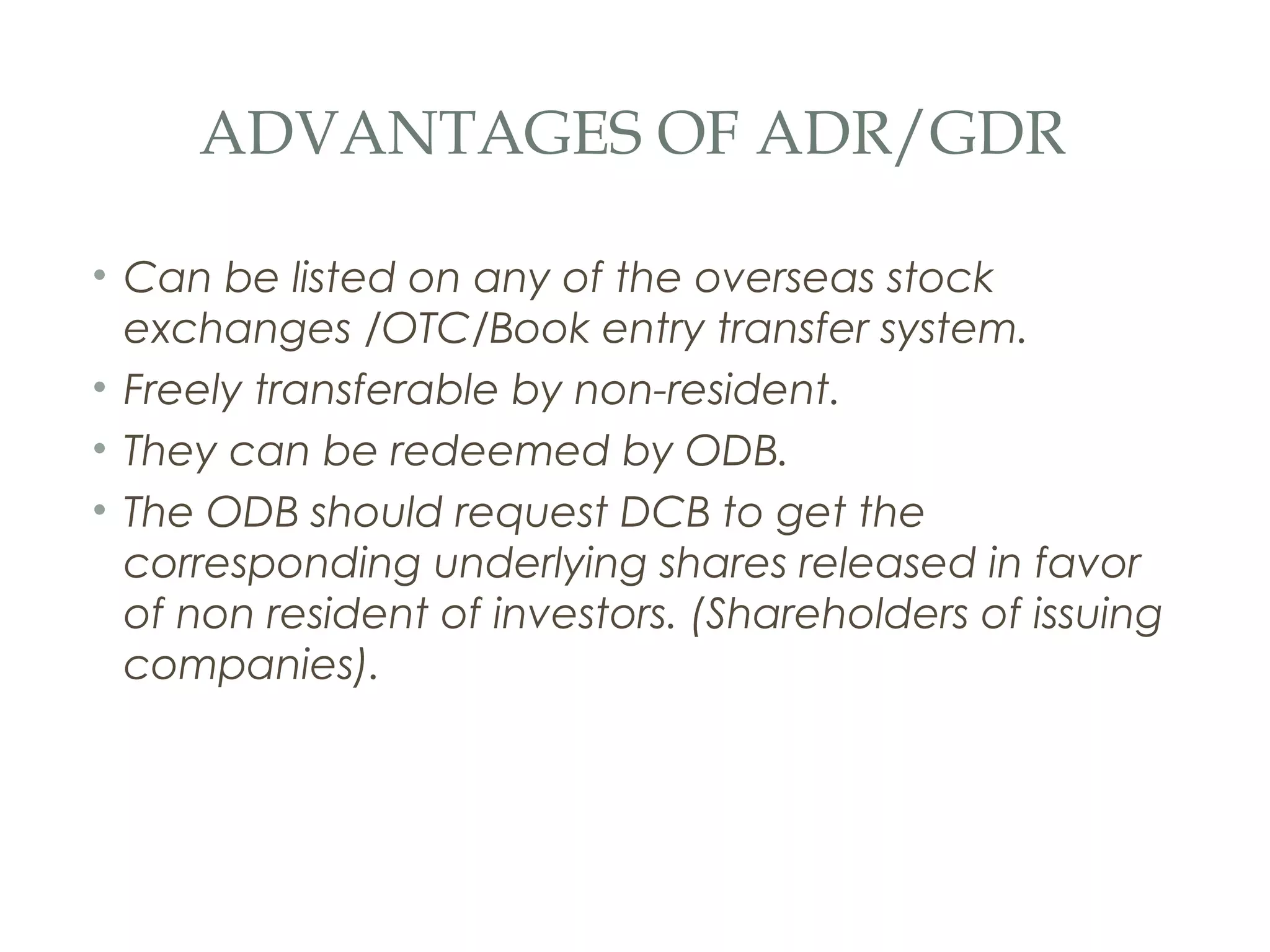

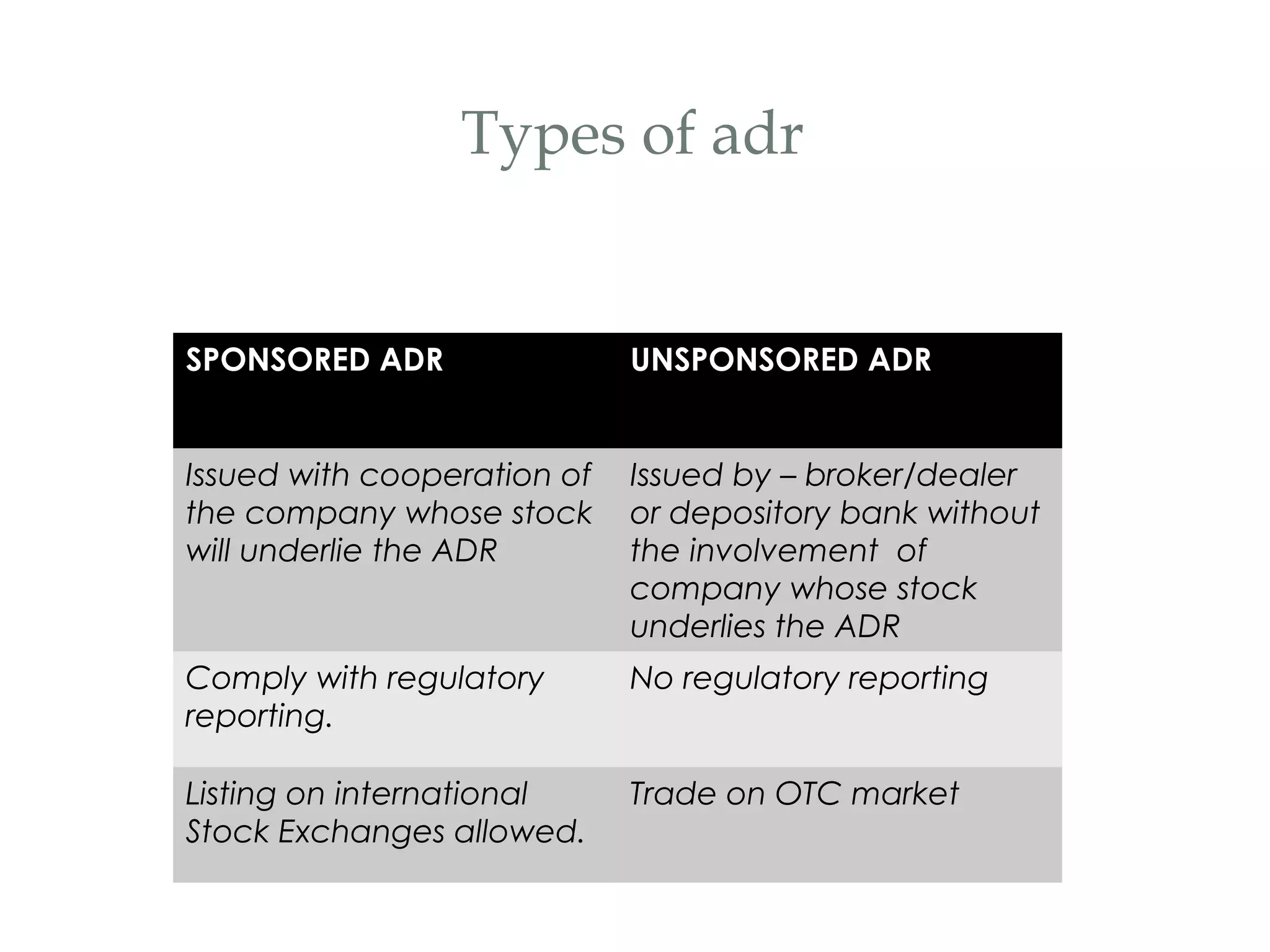

This document provides an overview of American Depository Receipts (ADRs) and Global Depository Receipts (GDRs). It defines ADRs and GDRs, describes the process for issuing them, and outlines their key advantages. It also differentiates between types of ADRs/GDRs, levels of ADR programs, and provides examples of Indian companies that have issued ADRs and GDRs.

![Levels of adr

• Level 1- Level 1 depositary receipts are the lowest level of

sponsored ADRs that can be issued. When a company issues

sponsored ADRs, it has one designated depositary who also

acts as its transfer agent.

• Level 1 shares can only be traded on the OTC market and the

company has minimal reporting requirements with the U.S.

Securities and Exchange Commission [SEC].

• Level 2- Level 2 depositary receipt programs are more

complicated for a foreign company. When a foreign company

wants to set up a Level 2 program, it must file a registration

statement with the U.S. SEC and is under SEC regulation.](https://image.slidesharecdn.com/adrandgdr-121001032911-phpapp02/75/ADR-and-GDR-10-2048.jpg)