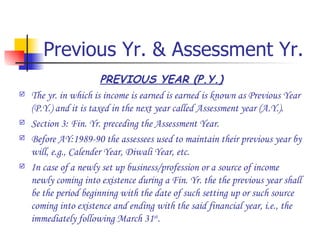

The document provides an overview of key concepts in India's Income Tax Act of 1961, including that it extends to all of India and sets tax rates annually. It defines income broadly to include various sources like salary, business profits, capital gains, and more. An assessee is anyone liable to pay tax, including individuals, HUFs, companies, and firms. The previous year refers to the year income is earned and taxed the following assessment year. Exceptions apply for some incomes taxed in the year before the normal assessment year. Returns must be filed by certain categories and assessments include reassessments.

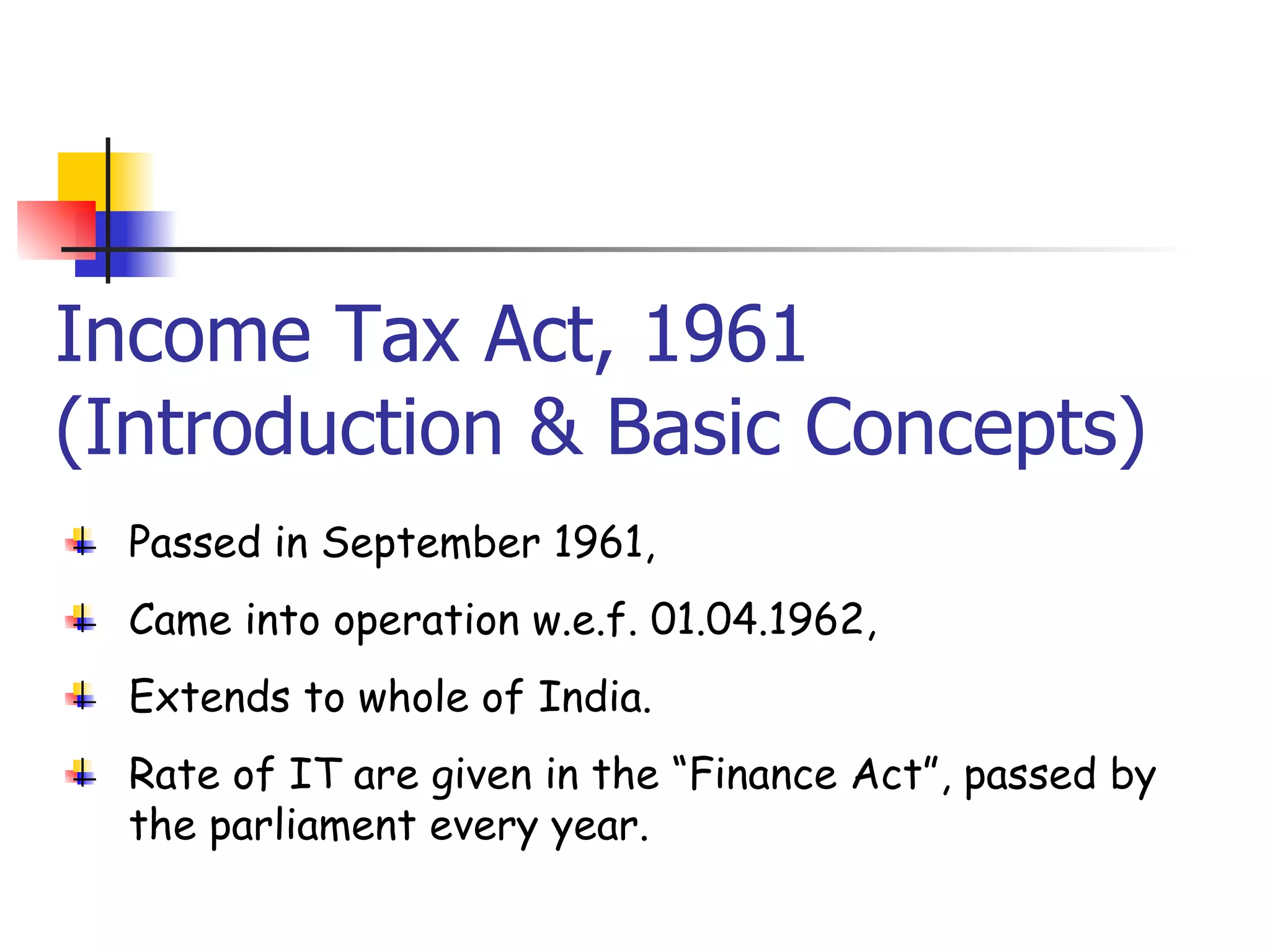

![Computation of Income 1.) Income from Salary XXXX 2.) Income from House Property XXX 3.) Income from Business/Profession XX 4.) Income from Capital Gains X 5.) Income from Other Sources XXXXX GROSS TOTAL INCOME (Sec. 14) XXXX Less:Deductions u/chap-VI-A (Sec.80CCC to 80U) XXX TOTAL INCOME [Sec.2(45)] XXXX Tax Due XXX Less:Rebates and Reliefs u/Chap-VIII XX Tax Payable XXXX](https://image.slidesharecdn.com/incometaxintroduction-091025051833-phpapp01/85/Income-Tax-Introduction-8-320.jpg)