This document discusses key aspects of the Goods and Services Tax (GST) in India, including:

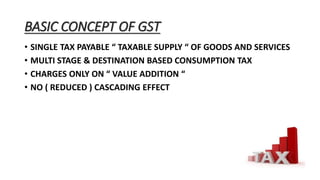

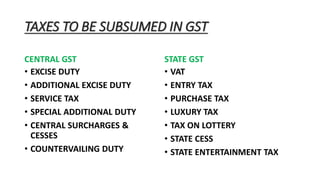

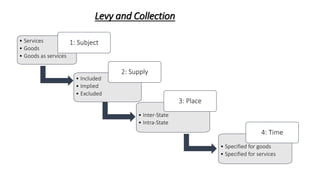

- GST is a single, destination-based tax levied on the supply of goods and services. It subsumes several taxes into a single tax.

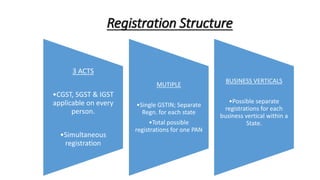

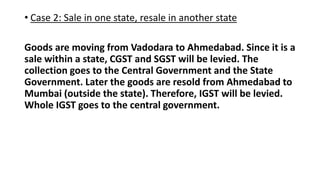

- GST is levied as Central GST (CGST), State GST (SGST), Integrated GST (IGST), and Union Territory GST (UTGST) depending on the nature of the supply.

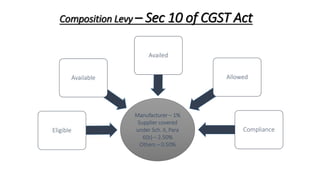

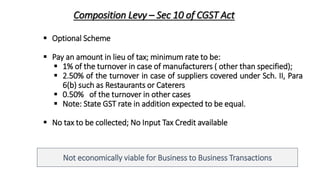

- There are four GST tax slabs of 0%, 5%, 12%, and 18% for goods and 5% and 18% for services. Composition scheme is available for small businesses with turnover less than Rs