SN Panigrahi is a seasoned professional with 29 years of experience in project management and related fields, having conducted over 150 workshops and published extensively. The document outlines the implementation of e-invoicing in India under the Goods and Services Tax (GST) framework, which aims to streamline compliance and reduce burdens for small and medium enterprises starting from January 1, 2020. It also details various notifications regarding e-invoicing regulations and advancements in e-way bill processing to improve tax compliance.

![6

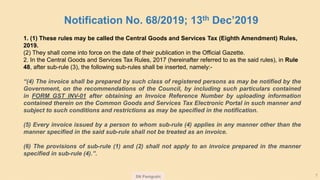

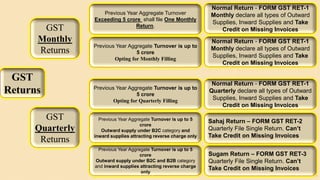

The Gist of the Notifications is as under:

1.A new sub-rule has been inserted to mandate issuance of electronic invoices by registered persons having an aggregate annual turnover in

excess of INR100 crores. The requirement is for supplies made to a Registered Person only ie B2B Transactions only

2.The aforementioned electronic invoice should mandatorily contain the following:

•Particulars as contained in Form GST INV-01 after obtaining Invoice Reference Number (IRN)

•The tax invoice shall also contain Quick Response (QR) code

3.Further, where registered persons have a turnover in excess of INR 500 crore and make a supply to an unregistered person (B2C

supplies), invoices shall contain the QR code

4.The changes shall come into effect from 1 April 2020

Notification nos. 68/2019-Central Tax, 70/2019-Central Tax, 71/2019-Central tax and 72/2019-Central Tax dated 13 December 2019]

It may be noted that for the purpose of e-invoice, Ten Invoice Registration Portal (IRP) have been notified. The same shall be effective from 1

January 2020.

[Notification no 69/2019-Central Tax dated 13 December 2019]

Our comments

During the last few months, there were several news articles on this subject. Vide the above notifications, the Government has shown its intent to

implement e-invoicing from the coming financial year. Also, ten IRPs have been notified from 1 Jan 2020 itself, which means the industry can initiate

e-invoicing from 1 Jan 2020.

The industry should now gear up and use the voluntary three-month e-invoice generation

period effective 1 January 2020 and identify challenges/suggestions which can be represented before the Government.](https://image.slidesharecdn.com/recentchangesingst-191216080424/85/Recent-Changes-in-GST-By-SN-Panigrahi-6-320.jpg)

![SN Panigrahi 17

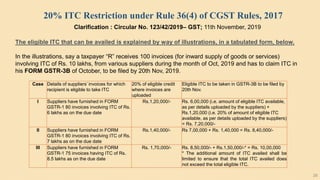

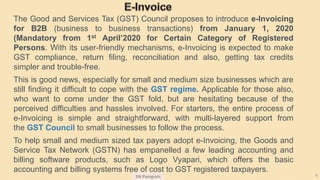

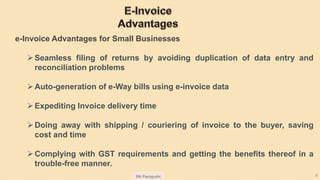

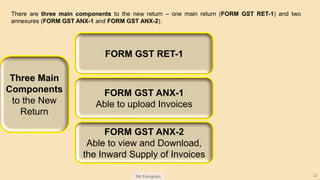

1. As per Rule 138E, non furnishing of CMP-08 for 2 consecutive quarters shall result in blocking of

E way bill for Composition Dealers. CMP-08 for April to June 2019 was required to be filed till 31-

08-2019 (N/N 35/2019-CT dated 29-7-2019) and CMP-08 for July to Sep 2019 is required to be filed

till 22nd October 2019[ N/N 50/2019 dtd 24-10-19]. For subsequent quarters due date for CMP-08 is

18th of month suceeding quarter. Hence blocking shall be from 19th.

2. Non furnishing of GSTR 3B for 2 consecutive months for normal taxpayers shall result in blocking

of e way bill for normal dealers. GSTR 3B is required to be filed till 20th of next month. Hence blocking

shall be from 21st. No filing of GSTR-1 shall not result in blocking of e way bill.

3. Effective Date: Blocking of E way bill has been made effective from 01-12-2019 on portal. Earlier

blocking was proposed w.e.f. 21-06-19 but extended to 21-8-19 by N/N 25/2019-CT and further

extended to 21-11-2019 by N/N 36/2019. Cautionary messages during November were conveyed while

generating E way bill, however blocking has been put into operation only w.e.f. 01-12-2019.

4. State of J&K: Due to poor Internet connectivity in state of J&K, number of people have not

able to file GSTR 3B. Now effective from 01-12-2019, e way bill for goods consigned to/from J&K

have been blocked.

5. Transporters registered with GSTIN shall also be blocked if they fail to file GSTR-3B for 2

consecutive months. Consignors and consignees transporting through such transporters can generate E

way bill. However, Transporters only enrolled for e way bill and not registered shall not be affected

Blocking of E way Bill w.e.f. 01-12-2019](https://image.slidesharecdn.com/recentchangesingst-191216080424/85/Recent-Changes-in-GST-By-SN-Panigrahi-17-320.jpg)

![SN Panigrahi 18

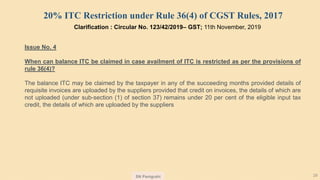

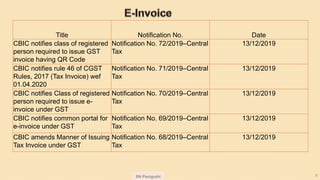

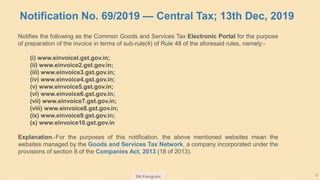

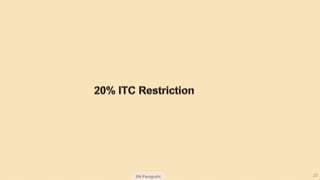

6. If blocking is done for consignor then consignee also cannot generate E way bill for inward supplies. Similarly

if consignee is blocked, then consignor also can’t generate e way bill for goods to be dispatched to consignee.

Transporter also can not generate e way bill for blocked consignor and consignee

7. Unblocking of E way Bill can be done by:

a) Filing GSTR 3B/CMP-08 and reducing default to lesser than 2 consecutive periods. E way bill shall

be unblocked automatically next day. If status is still not updated, then log in e way bill portal and click on

option Search > Update Block status. Enter GSTIN followed by captcha. Then click on Update Unblock status

from GST Common Portal

b) Unblocking can also be done by jurisdictional officer online on GST portal upon considering manual

representation from taxpayer [FAQ 2 and 9]. At present this functionality is not available with jurisdictional

officers also.

c) Online application for unblocking in EWB-05 can also be filed where representing sufficient cause for non

filing of GSTR 3B. Jurisdictional Commissioner may by reasoned order in EWB-06 unblock the E way bill.

Rejection of request shall not be made without providing opportunity of being heard. Facility of online application

is not available for the time being.

8. Blocking of e way bill shall result in assessee falling into clutches of section 129 entailing penalty and tax.

9. Blocking of E way bill implies blocking of delivery of goods. In such case, tax should also not be collected

from the taxpayer because the supply of the goods has been hampered.

10. While suppliers of goods have been penalized the services providers shall not be affected by non filing of

returns which appears to be discriminatory for suppliers of goods. Further suppliers of goods might resort

to splitting of bills to obviate the rigours of Rule 138E.

Blocking of E way Bill w.e.f. 01-12-2019](https://image.slidesharecdn.com/recentchangesingst-191216080424/85/Recent-Changes-in-GST-By-SN-Panigrahi-18-320.jpg)

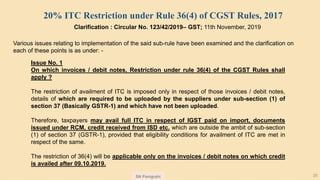

![SN Panigrahi 26

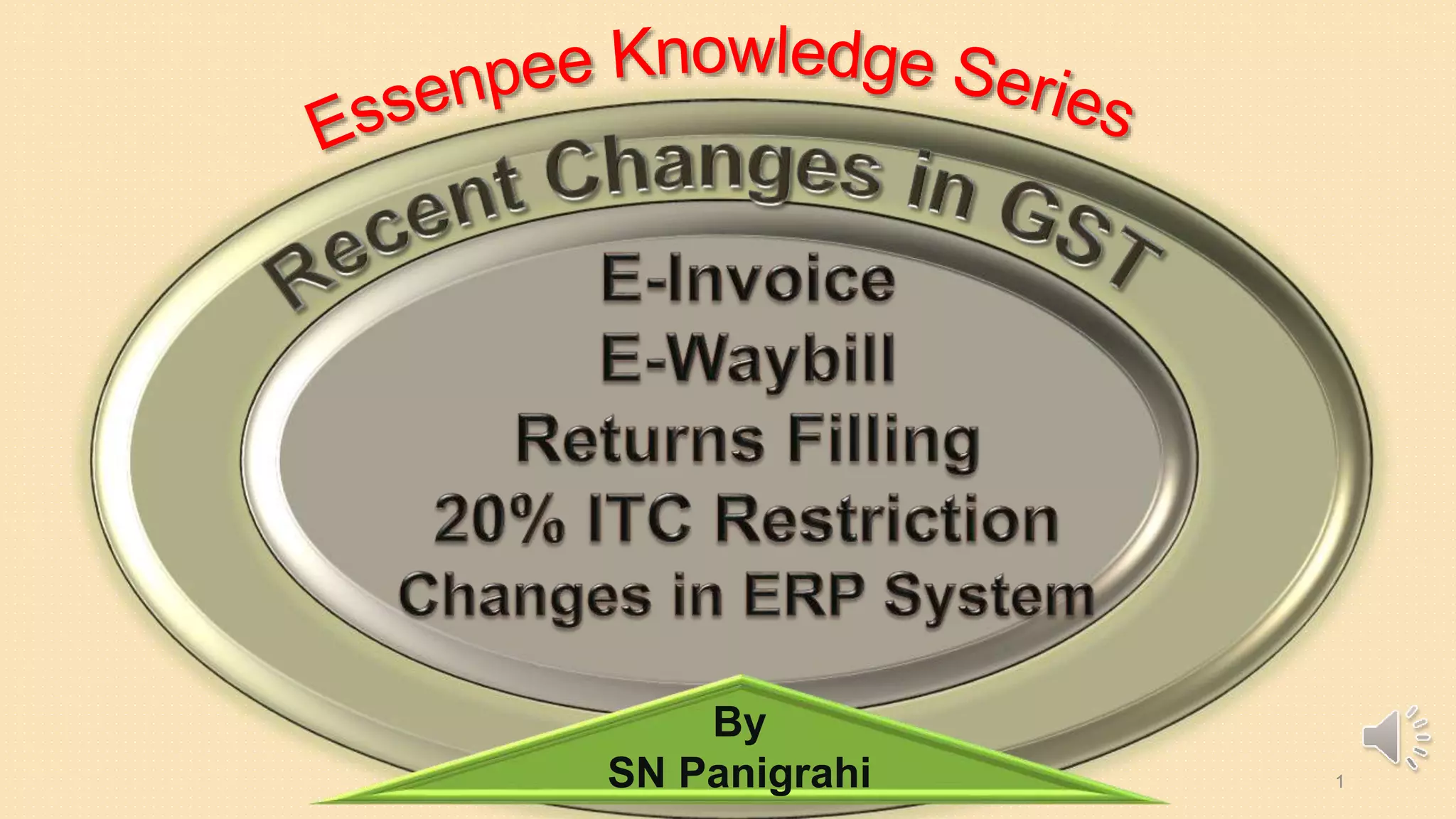

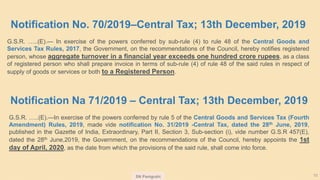

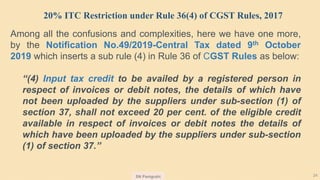

Issue No. 2

Whether the said restriction is to be calculated supplier wise or on consolidated

basis?

The restriction imposed is not supplier wise, It is on consolidated basis; total eligible ITC

from all suppliers against all supplies whose details have been uploaded by the suppliers in

GSTR-1.

Further, the calculation would be based on only those invoices which are otherwise eligible

for ITC.

Accordingly, those invoices on which ITC is not available under any of the provision

[say under section 17 (5)] would not be considered for calculating 20% of the eligible

credit available

Clarification : Circular No. 123/42/2019– GST; 11th November, 2019

20% ITC Restriction under Rule 36(4) of CGST Rules, 2017](https://image.slidesharecdn.com/recentchangesingst-191216080424/85/Recent-Changes-in-GST-By-SN-Panigrahi-26-320.jpg)