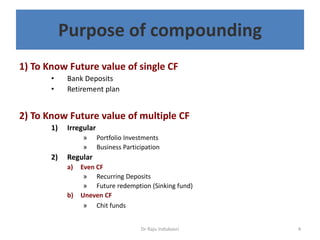

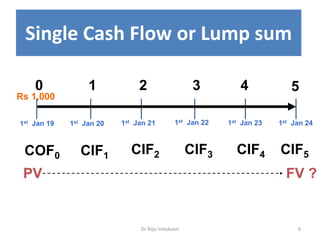

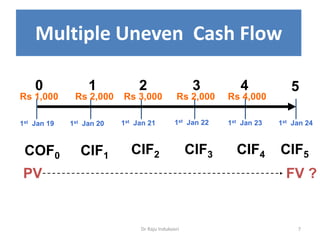

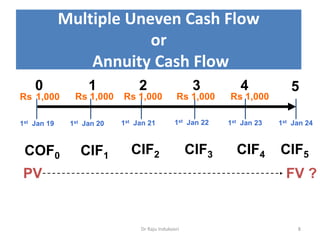

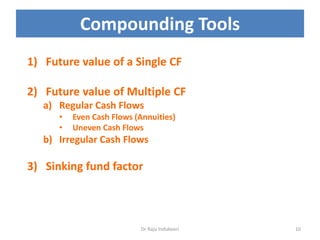

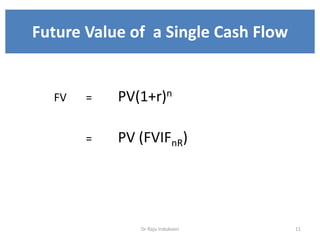

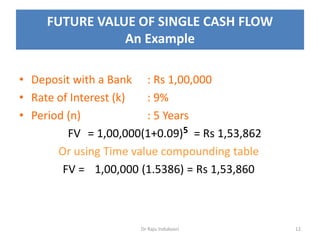

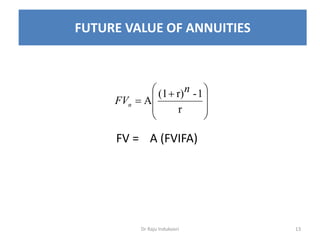

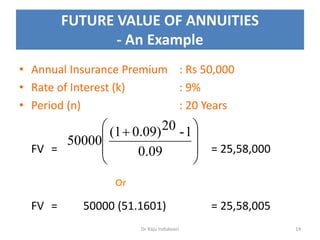

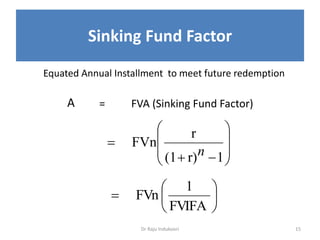

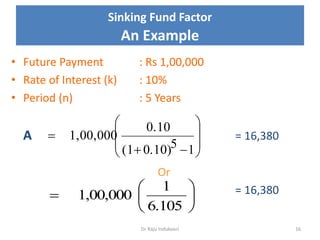

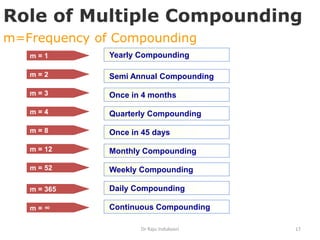

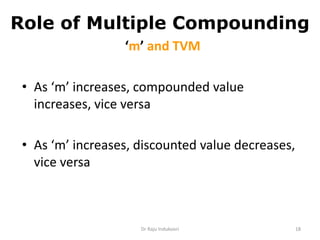

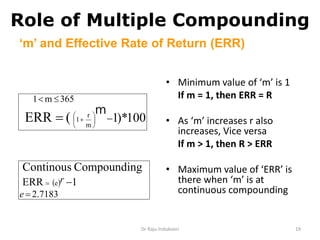

This document discusses the concept of compounding in finance. It defines compounding as the process of earning interest on interest over multiple periods of time. The document outlines tools for calculating the future value of single and multiple cash flows using compound interest formulas. These include formulas for determining the future value of a lump sum, annuities with regular payments, and sinking funds. The document also explores how the frequency of compounding affects interest earned, with more frequent compounding resulting in higher returns.