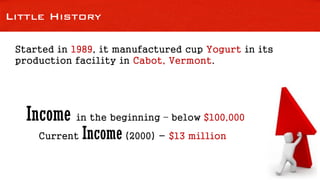

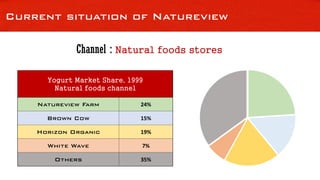

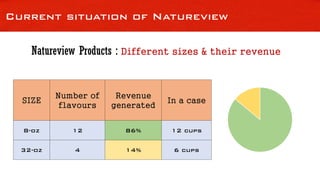

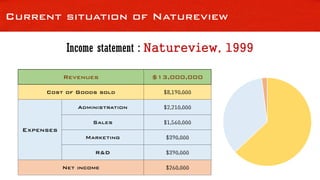

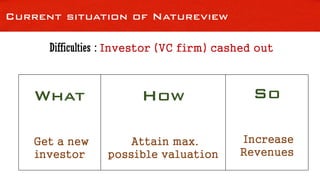

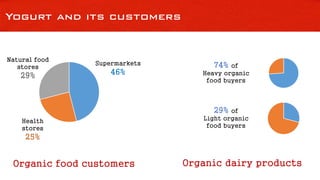

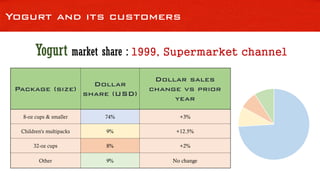

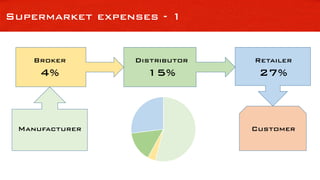

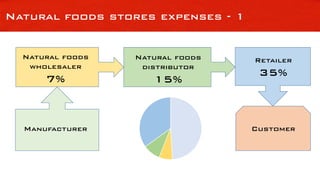

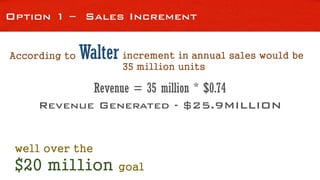

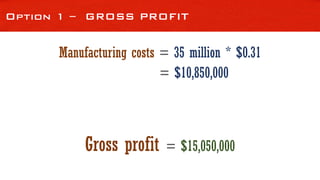

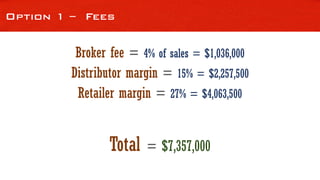

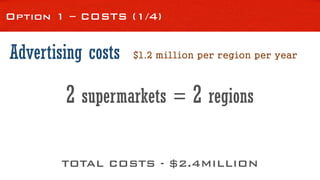

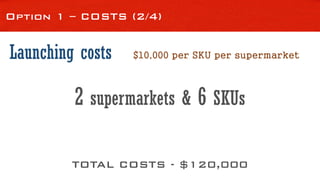

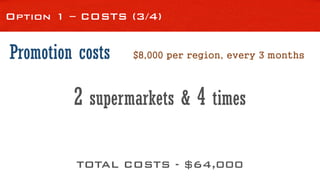

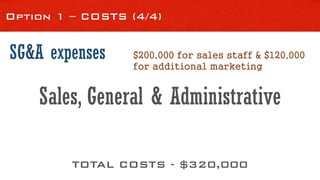

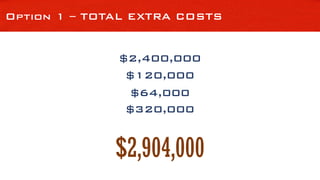

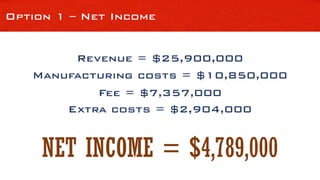

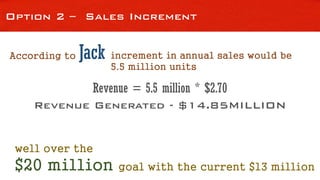

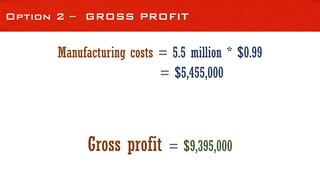

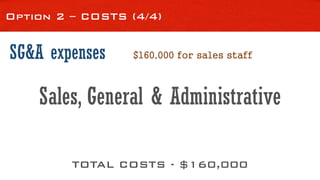

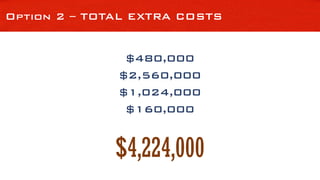

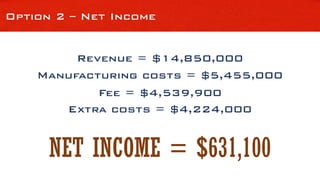

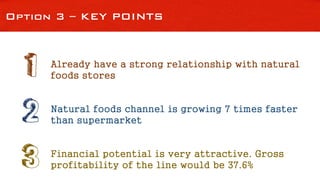

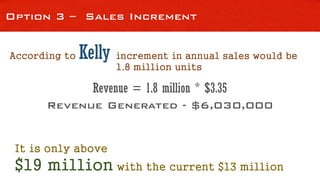

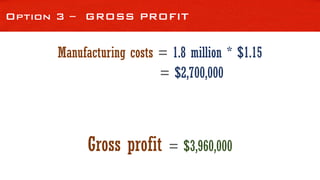

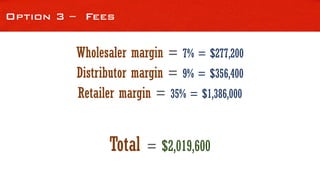

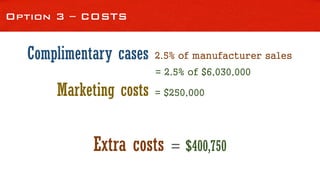

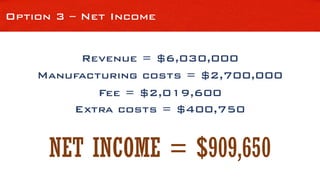

Natureview Farm manufactures and markets refrigerated yogurt cups. It started in 1989 and currently generates $13 million in annual revenue. To increase revenue to $20 million by 2001, three options were proposed: 1) Expand into supermarkets, 2) Expand distribution of larger 32oz cups to more supermarkets, or 3) Introduce new multipack children's yogurt products to natural food stores. Analyzing sales projections and costs, option 3 to expand in natural food stores was determined to have the lowest risks and best chance of achieving the revenue goal, while continuing to leverage Natureview's strong relationships in that channel.