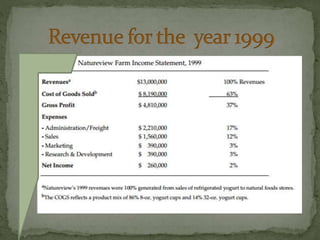

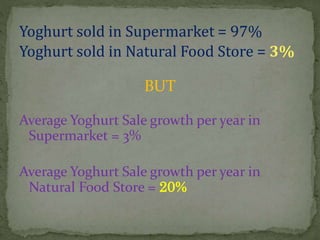

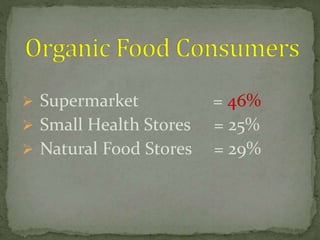

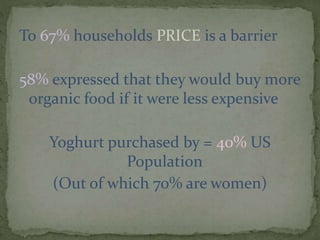

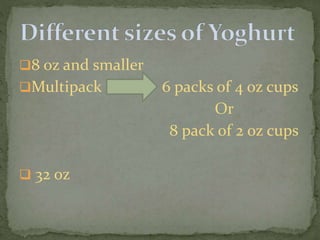

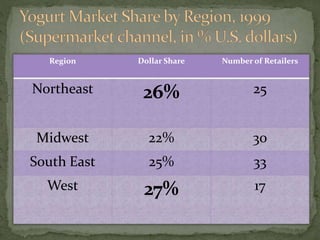

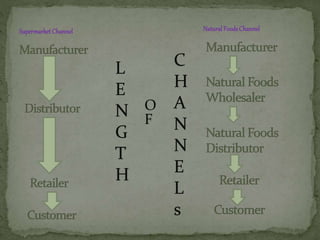

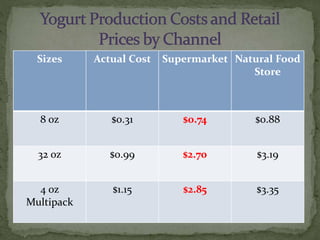

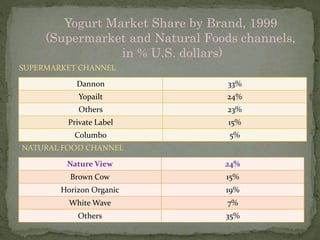

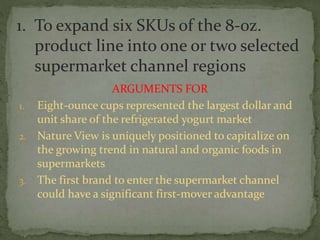

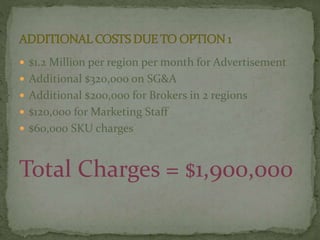

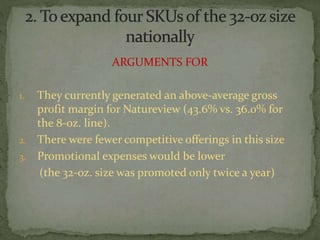

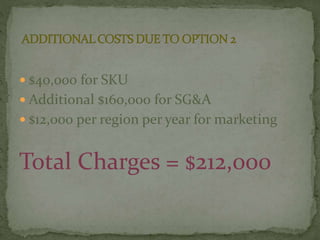

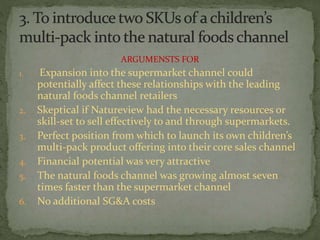

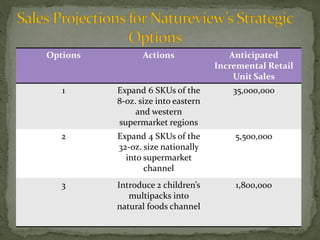

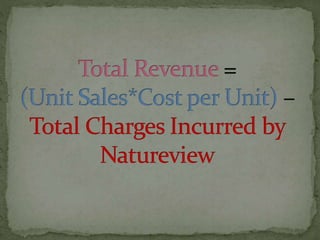

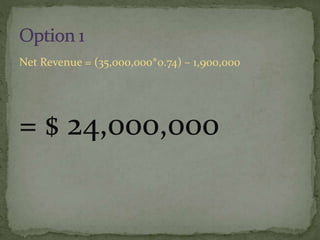

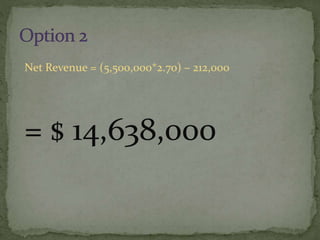

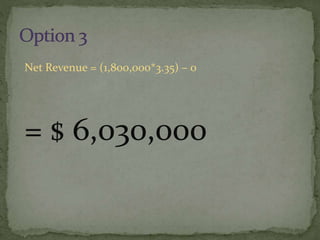

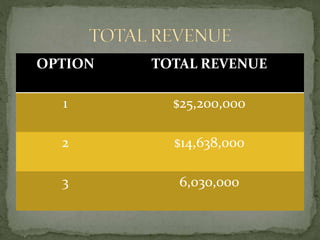

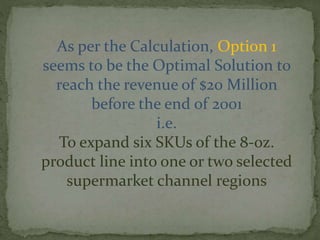

Natureview Farm is a small yogurt manufacturer that has grown from $100,000 to $13 million in revenue from 1989 to 1999 through natural food stores. It now aims to reach $20 million by 2001. It considers three options: 1) Expanding its 8oz yogurt line into supermarket regions, 2) Expanding its 32oz line nationally in supermarkets, or 3) Launching multipacks in natural food stores. Option 1 is estimated to generate the most incremental revenue of $25.2 million, allowing it to achieve its goal.