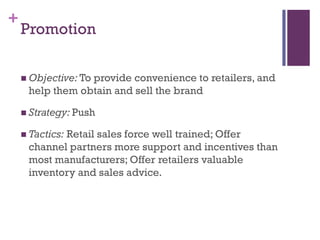

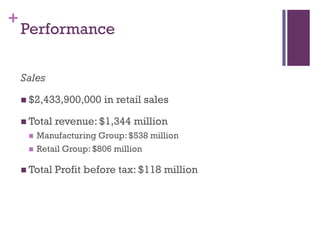

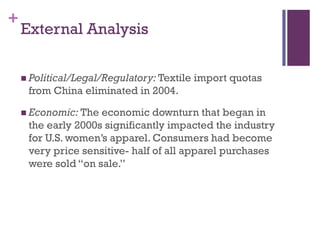

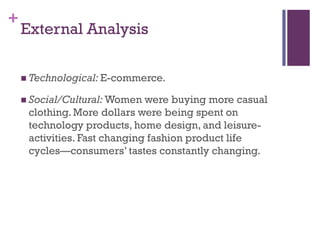

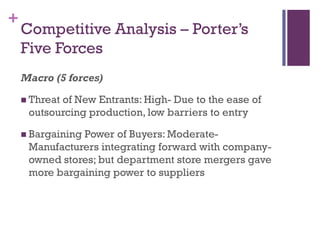

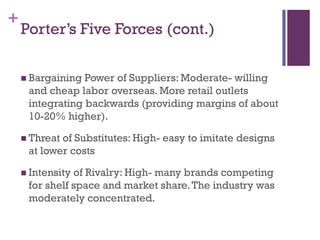

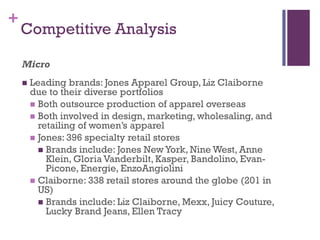

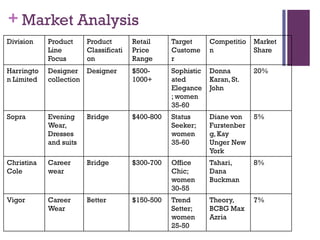

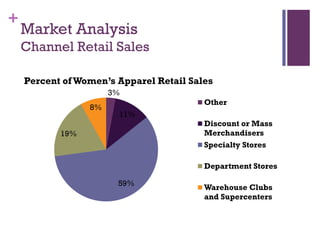

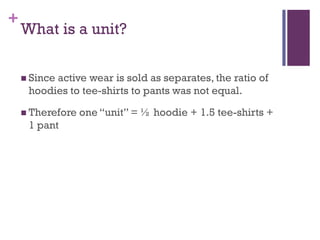

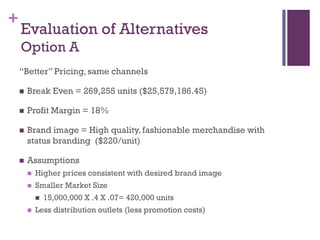

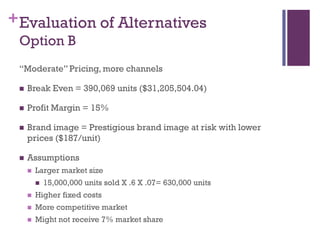

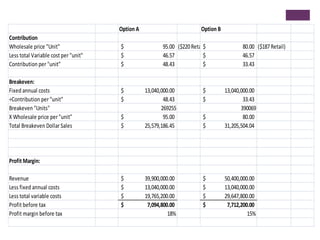

The document provides an analysis of the Harrington Collection company, which offers high-end fashion brands for women. It details the company's internal analysis including its target market, product lines, pricing strategy, promotion, and channels. It also analyzes the company's performance, external environment, competitors, and market segments. The case brief poses the problem of how to launch a new active wear line and evaluates two alternatives - offering "Better" pricing through current channels or "Moderate" pricing with expanded channels. It recommends the first option to maintain the brand's sophisticated image while achieving an 18% profit margin and breaking even in the first year.